Gold and Markets Await Inflation Figures from Eurozone, UK, US and China

Commodities / Gold and Silver 2010 Jul 12, 2010 - 07:17 AM GMTBy: GoldCore

Gold is lower in Asian and early European trading on low volume as the dollar has risen and renewed risk appetite has resulted in tentative gains in equity markets. Gold's marginally higher weekly close last week was positive from a technical point of view and could lead to follow through this week as momentum following traders and funds "make the trend their friend".

Gold is lower in Asian and early European trading on low volume as the dollar has risen and renewed risk appetite has resulted in tentative gains in equity markets. Gold's marginally higher weekly close last week was positive from a technical point of view and could lead to follow through this week as momentum following traders and funds "make the trend their friend".

Gold is currently trading at $1,207/oz and in euro, GBP, CHF, and JPY terms, at €960/oz, £804/oz, CHF 1,284/oz, JPY 106,825/oz respectively.

Silver's price action was even more positive and silver rose 1.5% last week (see below) while gold and silver mining shares surged in value. Much of the speculative froth that had entered the market has been eliminated with speculative longs rushing for the exit in the recent sell off. There has also been significant short covering by the commercials which might indicate that higher prices are expected after this correction.

Gold in USD - 60 Days (60 Minutes)

The market awaits inflation data this week (in eurozone states, the UK, the US and China) which will indicate whether the extremely lose fiscal and monetary policies of recent months (and indeed years) are leading to inflation pressures. UK inflation figures will be closely studied tomorrow after worries from Bank of England rate setter Andrew Sentance that prices are rising despite the economic slack created by the recession. The very poor trade and current account deficit figures (see News below) may lead to sterling coming under pressure in the coming months.

Gold "Rush" or "Mania"?

There remains an unusual dichotomy in the precious metal markets between the sentiment of industry professionals and analysts and those of the "man in the street" and retail investors.

In the industry there is a growing consensus that gold will likely remain in a bull market for the foreseeable future. There are bears but even they acknowledge that gold merits an allocation in a portfolio given the degree of continuing macroeconomic risk. This is in contrast to retail investors most of whom have little if any allocation to gold whatsoever. Indeed, the financial services industry internationally continues to barely cover gold and most financial advisers internationally do not even advocate a tiny allocation to gold in a portfolio.

There is no mania or 'rush' for gold indeed the public's perception of gold is that it is at record highs and therefore it is a good time to sell gold and get cash as seen in the international "cash for gold" phenomenon. The public is selling gold while the buyers are a minority of more risk aware investors and savers and the smart money of certain hedge funds (see News below), high net worth individuals, pension funds and central banks. While allocation to gold has increased internationally, it is from an extremely low base suggesting that the price gains of recent years remain sustainable. The consensus view among the funds is that the price of gold - trading at around $1,200 an ounce - will rise to well above $1,500/oz before it suffers any sizeable correction.

This expectation of further prices rises (gold has increased four-fold since 2002) is based in part on the view that bullion provides a hedge against a rise in inflation. Some fund managers believe a sharp jump in inflation is unavoidable as a result of central banks' monetary easing policies, which have, in effect pumped more money into the economy. Historically, they say, the correlation between gold and inflation is hard to ignore. Over the past half century, the gold price has tracked the amount of money in the world - measured broadly in terms of "M2" monetary supply - fairly accurately, peaking at times of inflation, such as the mid-1970s and early 1980s. The hedge funds argue that the recent swelling of the monetary base will translate into a spike in monetary supply. When it does, gold prices will follow.

Silver

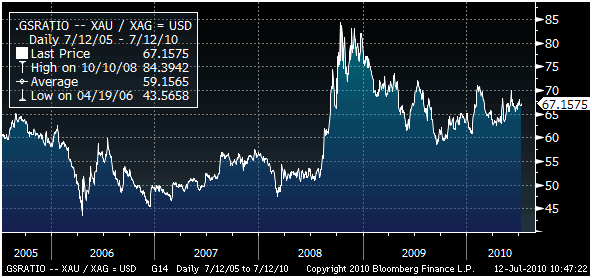

Silver rose 1.5% last week and closed above the $18/oz level at $18.04/oz. Silver's fundamentals remain very sound and arguably even stronger than goals and we continue to see the gold/silver ratio falling resulting in silver playing catch up with gold and outperforming gold. While gold at $1,200 per ounce is some 40% above its 1980 nominal high ($850/oz), silver remains less than 65% its nominal high of $50/oz in 1980.

Silver is currently trading at $18.00/oz, €14.30/oz and £11.99/oz.

Gold Silver Ratio - 5 Years (Daily)

Platinum Group Metals

Platinum is trading at $1,526/oz and palladium is currently trading at $459/oz. Rhodium is at $2,450/oz.

News

(Financial Times) - Hedge funds - the new gold believers

After years of ignoring gold, some major hedge funds now have enormous gold holdings to protect against what they see as a store of value in economic crises. Not so long ago, hedge funds would send their most junior analysts to the seminars that bullion bankers hosted. Gold, for much of the past two decades, was the ultimate dreary asset - of interest only to central bankers and miners. Now those same bankers are struggling to find time in their diaries to fit in many of the hedge fund industry's biggest players. In mid-town New York, funds that employ barely 100 staff are finding themselves with gold holdings larger than those of some developed nations. Paulson & Co, one of the world's most successful hedge fund managers, denominates a third of its $33bn of assets under management in a share class bolstered by huge positions in the gold market. In fact, gold is the firm's largest single position. The $3.4bn stake in the SPDR Gold Trust, a listed US instrument backed by physical gold, equates to a greater tonnage of the metal than Australia holds. The reason for this is simple. Amid fears that the global economy could be heading for a double-dip recession - and as financial markets continue to gyrate - some hedge managers are becoming increasingly bullish about the precious metal. They are drawn to gold's traditional status as a store of value in crises. Paulson & Co is the largest hedge fund to back gold, but others including Soros Fund Management, Tudor Investment Corp, Greenlight Capital and Third Point, are now converts. "I have never been a gold bug," Paul Tudor Jones, founder and chairman of Tudor Investment, wrote last year. "It is just an asset that, like everything else in life, has its time and place. And now is that time."

(Bloomberg) - Turkey imported 300 kilograms of gold last month, compared with none in May, the Istanbul Gold Exchange said in a report on its Web site. The country imported 91.72 kilograms of silver, from none in May.

(Bloomberg) - Deutsche Bank AG is starting 10 exchange-traded commodities on the London Stock Exchange, including db Physical Gold and db Physical Silver. The gold product has a 0.29 percent product fee and for silver it's 0.45 percent, Deutsche Bank said in a e-mailed statement today.

(Bloomberg) - Hedge-fund managers and other large speculators decreased their net-long position in New York silver futures in the week ended July 6, according to U.S. Commodity Futures Trading Commission data. Speculative long positions, or bets prices will rise, outnumbered short positions by 35,044 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions fell by 6,866 contracts, or 16 percent, from a week earlier.

(Sky News) Britain's Balance Of Payments Gap Widens

Britain's balance of payments gap has widened dramatically to £9.62bn in the first quarter of the year. The UK current account deficit with the rest of the world is the biggest since the third quarter of 2007. The balance of payments measures the differnce in value between the goods and sevices we buy from abroad against the value of goods and services we sell abroad. The latest deficit figure compares with a surplus of over £520m in the last quarter of 2009, and is the equivalent of 2.7% of Gross Domestic Product (GDP). Meanwhile, the latest GDP figures have confirmed that the economy grew by 0.3% between January and March. The figure, which had already been revised up from an initial 0.2%, had been delayed by what the Office for National Statistics (ONS) called a "potential error". Also, official figues show the UK economy's nosedive during the recession was even steeper than first feared. Output slumped 6.4% from its peak in the first three months of 2008 - bigger than the 6.2% slide previously estimated, revised data from the ONS showed. The economy began its pull-out from the record slump in the final quarter of 2009. And it grew by 0.3% in the opening three months of 2010 - in line with earlier estimates.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.