Corporate America’s $2 Trillion Cash Pile, Let’s Kick Some Corporate Ass

Stock-Markets / Financial Markets 2010 Jul 12, 2010 - 03:33 PM GMTBy: PhilStockWorld

$2,000,000,000,000 is a lot of cash.

$2,000,000,000,000 is a lot of cash.

That’s about how much America’s 500 largest NON-FINANCIAL companies have on their books. This is up about $500,000,000,000 from last year as 2010 has been very, very good for corporate profits, which are growing at a 36% pace this year and we’ll get a better insight into that this earnings season. Right now, our biggest problem is a lack of faith in the economy. As we noted last week, temp hiring is near records but real hiring is not there at all - companies are using what turnaround there is to save up for the next rainy day.

Sales are still weak but profit margins have expanded tremendously and Poor Sales is still listed as the single most important problem by 30% of the CEO’s surveyed, followed by Taxes (22%) and Regulations (13%). If poor sales to the consumer are the main problem, then what is the logic of laying off more workers and lobbying against more stimulus? As Brett Arends noted this weekend, we are hardly sliding into Socialism with Federal Spending at 25% of the economy this year vs. 23.5% under Reagan - and he didn’t have a $1Tn annual military budget (his was $200Bn and was considered out of control at the time) nor did he have a $400Bn annual interest payment on existing debt (Reagan pretty much invented modern debt--before him, we had the same debt since WWII).

Lack of consumer spending is the prime factor holding back the recovery at the moment and who can blame consumers for not spending. Unemployment has sidelined 22% (not a typo) of the men aged 25-65 in America. That does not count those who are working part-time or full-time at low-paying jobs--that is 18M men between 25 and 65 in the United States of America who have no jobs at all! And what does our government do about it? They cut off their unemployment benefits--as if there are 18M job openings and these guys are just lazy…

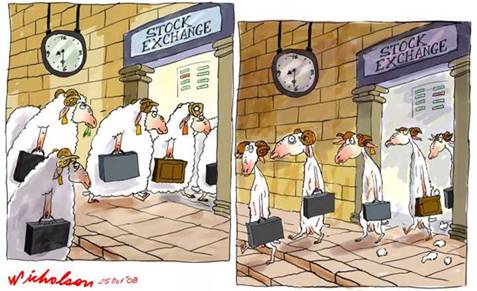

There were, in fact, 3.1M job openings in April and that was up 24% from last year so that means that "just" 14.9M American men of working age are structurally unemployed. Structural unemployment is joblessness caused not by lack of demand, but by changes in demand patterns or obsolescence of technology, and requiring retraining of workers and large investment in new capital equipment. We need to get real about this - ONLY Government involvement is going to be able to turn this around. Business is scared and sitting on cash and if the US Government isn’t willing to invest in America - why should businesses?

What does it cost to employ 15M people? Let’s say we pay them an average of $28,000 (National average) plus generous health care and benefits and call it $35,000 per man. That’s $525Bn to full employment in the United States. As it stands now, we are giving 6M of those people unemployment checks anyway, say $100Bn and, of course, if we hire those people for $525Bn they’ll pay about $150Bn in taxes so the net difference to the government between NOT helping 15M people get jobs and helping 15M get jobs is $275Bn a year.

I won’t get into the fancy math of how $525,000,000,000 paid out as fresh wages flows through our economy, the general rule of thumb is there is a 3x multiplier effect to net GDP so about $1.5Tn or +10% to our GDP for pushing through jobs programs that would cost us a net of $275Bn. Of course if some of those jobs end up creating other jobs along the supply chain, then so much the better and maybe we’ll have to spend less or maybe we’ll get some real, lasting economic growth. Why isn’t our Government doing this??? This is what the Chinese Government does to achieve huge economic growth - THEY INVEST IN INFRASTRUCTURE!

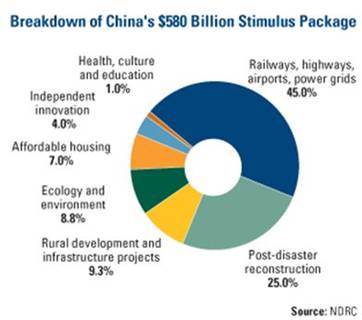

China invested the same $580Bn we should be investing and their economy came roaring back this year. Of course $580Bn in China’s $6Tn economy is like the US spending $1.5Tn on infrastructure but let’s not go crazy, I would be thrilled if we take 1/2 as much as we spent on TARP ($700Bn) and apply it to REAL stimulus that creates jobs for a change and leaves something of lasting benefit in it’s wake like roads, bridges, renewable energy, high-speed rail lines--you know, the kind of things real countries invest in as opposed to the Corporate Kleptocracy that has been sold to the masses as US Capitalism…

Charles Hugh Smith sums up our situation as this: "In "saving our financial system," the public borrowed trillions and transferred the money to private Power Elites, who then buy the public debt with the money swindled out of the taxpayer. Then the taxpayers transfer more wealth every year to the Power Elites/Plutocracy in the form of interest on the Treasury debt. The Power Elites will own the debt that was taken on to bail them out of bad private bets: this is the culmination of privatized gains, socialized risk. In effect, it’s a Third World/colonial scam on a gigantic scale: plunder the public treasury, then buy the debt which was borrowed and transferred to your pockets. You are buying the country with money you borrowed from its taxpayers. No despot could do better."

Charles Hugh Smith sums up our situation as this: "In "saving our financial system," the public borrowed trillions and transferred the money to private Power Elites, who then buy the public debt with the money swindled out of the taxpayer. Then the taxpayers transfer more wealth every year to the Power Elites/Plutocracy in the form of interest on the Treasury debt. The Power Elites will own the debt that was taken on to bail them out of bad private bets: this is the culmination of privatized gains, socialized risk. In effect, it’s a Third World/colonial scam on a gigantic scale: plunder the public treasury, then buy the debt which was borrowed and transferred to your pockets. You are buying the country with money you borrowed from its taxpayers. No despot could do better."

He goes on to say more interesting things in "The Con of the Decade, Part II" and I summed it up for Members this weekend, saying: "It’s a very sick game being played: The bottom 99.99% are left with national debt levels that work out to $200,000 per person but the top .01% aren’t worried about paying that debt since it’s a tiny part of their assets. So the game is to build the wealth of 30,000 people and corporations by $1Bn by putting 300M people $100,000 more in debt ($30Tn) and then saying "we’re all in this together" and telling the 299,970,000 people that they’d all better tighten their belts and start paying off the debt but, by the way, if they try to tax the Top 30,000 for it - they’ll leave the country--an option not available to the wider slave class. Unless the bottom 299,970,000 people wise up, there will be nothing left for them in this country but the bill."

How is it possible then, to remain bullish on the economy, given that things are so obviously out of control? For one thing, as I have to explain often lately - I’m not bullish, I’m RANGEISH. I think the fair value for the S&P is about 1,100 and 10,700 on the Dow and moves 10% above and below those lines are simply noise along the path to finding true value. There is certainly nothing wrong with our carpetbagger corporations. They are ravaging the land and screwing over the people in ways not seen since the roaring 20’s and, unlike the 20s, when this country crashes and burns they will happily relocate to the next hot market to exploit so why wouldn’t we bet on those guys?

As I indicated in our 2010 Outlook, there are two very different economies in America. The top 10% have 4.2% unemployment and our Corporate Citizens and our privileged class has been doing very, very well in 2010. The working class, on the other hand, has 25% unemployment, is deeply in debt and their assets (mainly through foreclosure) are diminishing at a rate of 10% per year, even as the top 0.01% of our population grew their assets by an average of $500,000,000 each in 2009. In 2007, Forbes hailed 2006 as "the Richest Year in Human History" as 178 people became Billionaires and $3.5Tn of wealth was added to the holdings of the "best" 946 people in the World. That’s $3.7Bn EACH!!! That’s 7% of the entire planet Earth’s GDP going to less than 1,000 people. And where do you think that money came from? EVERYONE ELSE!

And those are just the people. Corporations did even better at raking in the cash and, as I said above, 2010 is shaping up to be every bit as good as 2006 for the top 0.01% and until the other 6,851,254,041 people wake out of their stupor and do something about it. I think the smart money needs to be bet on the top 0.01%. Notice American Workers are soooooooooo stupid, that the Dock Worker’s Union pays for an ad that calls the President a Communist for pointing out that China invests in infrastructure and we don’t. That’s how deeply ingrained the corporate propaganda is in this country. The Tea Party rallies against big government as if unfettered big business is going to save them and now the Supreme Court has rewritten election laws so that the top 0.01% can now make unlimited corporate contributions to insure that the rest of the laws favor them as well. [See also The Supreme Court and Corporate Free Speech, and Citizens United Case.]

That makes it easy for us to place our bets. Financial regulation will be a joke, environmental laws are a joke, labor laws are a joke and there will be no serious attempt to raise corporate tax rates or close loopholes, even though they currently pay just 5% on average. In short, there has never been a better time to go with the flow and bet on the rich to get richer.

If you can’t be in the top 0.01% yourself, at least you can own your own piece of one of them and history is full of people who live very comfortable lives sucking up to the wealthy so pucker up America and kiss some corporate ass because I’ve certainly given up all hope that you will grow a spine and fight for your own self interest.

Anyway, happy Monday to you! Asia had a nice morning EXCEPT Japan, where voters handed PM Kan’s party a nasty defeat in the weekend elections (Japan, like many countries, has the strange custom of holding elections on weekends, when citizens are able to vote). This makes four consecutive Japanese governments that have been tossed out at the end of their first year and the Nikkei dropped 0.4% on the political uncertainty. The real fallout from this is that it makes it much more likely that Japan will get their AAA rating cut or, in the very least, put on watch! The Shangai didn’t care and tested 2,500 on a spike, settling at 2,490 (up 0.8%) and the Hang Seng added 0.44% but failed to hold 20,500, which they took in early trading. India is still going up - another 0.6% today to 17,937 and now we can watch for a test of 18,000 in the World’s best performing market as Industrial Output rises 11.5% in May.

Europe is finally back to work after a month of World Cup fever and markets there are up slightly ahead of the US open, which has recovered to flat as well after a poor overnight performance. International Credit Default Swaps continue to decline so somebody is betting Trillions that the global economy is improving but we cannot afford another "jobless recovery"--that was the BS they sold us after 9/11 and look where that led us. Do we want to go for round 3 of that? You can’t count on China to carry the ball for the whole World. Iron ore imports are falling there, as are copper imports and and that is causing the smart money to fly out of gold but don’t worry gold bugs, there is still a ton of dumb money left in that trade, despite hedge funds pulling 15% of the total futures last week. Just 6 more weeks like that and net shorts will outnumber the longs for the first time in a decade.

Nonetheless, Wall Street is hiring again (call me Lloyd!) as there is only so much raping and pillaging you can expect a bunch of rich men to do before they need some help and, with $61.4Bn in profits in 2009, someone has to carry the wallets. New York securities firms added 2,000 jobs since February but there’s still a long way to go to make up for the 28,000 layoffs since the 2008 peak - that’s when they can get really serious about taking the rest of America’s money! This is a nice break for New York as the AVERAGE Wall Street employee makes $392,000 so just 2,000 jobs puts $784,000,000 back into the economy. “It’s a big deal for both the city and the state,” said Robert D. Yaro, president of the Regional Plan Association, a leading independent planning group. “This is a significant turnaround.” Twenty percent of the state’s tax revenue comes from the financial sector, he said, while Wall Street accounts for about 12 percent of the city’s budget.

The hiring is not just a local phenomenon. Major investment banks are quietly rebuilding their global work forces. Goldman Sachs added 600 jobs worldwide in the first quarter, while JPMorgan’s investment bank has hired slightly more than 2,000 people globally since the beginning of the year. Closer to home, Credit Suisse’s investment bank, based in New York, filled 600 positions in the first quarter, with a significant portion in New York. Deutsche Bank has hired 414 people in New York, including 98 directors and managing directors since the start of the year. Nomura of Japan has been especially aggressive, recently hiring several top bankers from Deutsche Bank. Nomura’s New York-based securities unit has increased its staff to more than 1,700, from 1,000 in March 2009, and the bank says it will hire 300 more workers by March 2011.

So we’ll be back to normal in no time and that means I’ll be betting on the rich guys to get much, much richer and that’s just great for America, isn’t it?

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.