Gold Consolidates in the Summer Doldrums as Dollar Falls Sharply

Commodities / Gold and Silver 2010 Jul 16, 2010 - 07:19 AM GMTBy: GoldCore

Gold eked out small gains yesterday as the dollar fell sharply on concerns about the US economic outlook which the poor Google and JP Morgan results did not help. Gold continues to consolidate around the $1,200/oz level and since the start of July gold (in USD terms) remains in a tight range between $1,185 and $1,218/oz where there is a determined seller. Gold is currently trading at $1,206/oz, €930/oz and £785/oz.

Gold eked out small gains yesterday as the dollar fell sharply on concerns about the US economic outlook which the poor Google and JP Morgan results did not help. Gold continues to consolidate around the $1,200/oz level and since the start of July gold (in USD terms) remains in a tight range between $1,185 and $1,218/oz where there is a determined seller. Gold is currently trading at $1,206/oz, €930/oz and £785/oz.

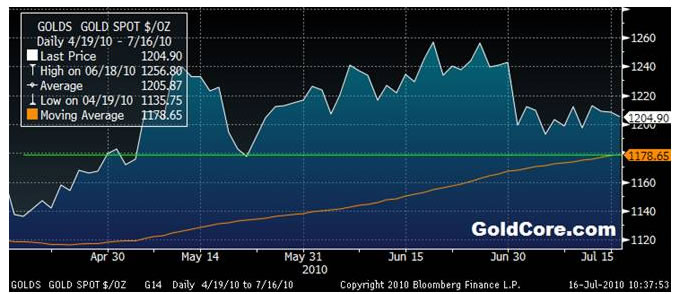

Gold in USD – 3 Months (Daily) – Support at 100 DMA

A higher weekly close, above $1,211/oz would be bullish and might lead to a challenge of resistance at $1,218/oz next week. A lower weekly close could see us dip below the $1,200 level and test technical support at the 100 day moving average at $1,178/oz. Strong physical demand below the $1,200/oz level, particularly in Asia, is supporting gold in the traditionally weak “summer doldrums” period.

The summer months normally see seasonal weakness and it is thus a good time to buy on the seasonal dip. This has been the case in recent years and was seen again last year when gold fell in June, rose marginally in July, was flat in August and then rose strongly in gold’s traditional period of strength from September into the autumn and early winter.

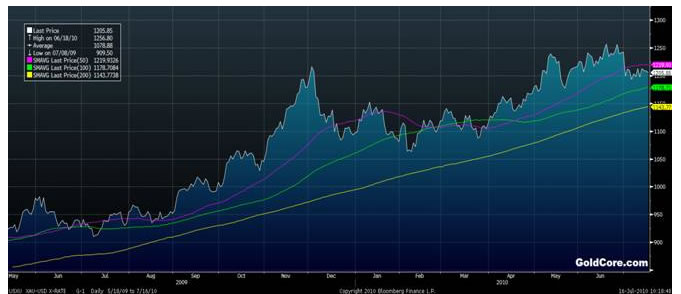

Last year (see Chart below), from the end of July to the high in early December gold rose 25% (from $950/oz to over $1,200/oz). Should the performance be replicated this year (and there is no reason why it could not be replicated given the strong fundamentals) than gold could again rise some 25%. This would take gold from the $1,200/oz levels of today to as high as $1,500/oz, prior to another period of falling prices, correction and consolidation.

Gold in USD – 14 Months (Daily) – 50, 100 and 200 Day Moving Averages

SILVER

Silver is currently trading at $18.30/oz, €14.09/oz and £11.91/oz.

PGM’s

Platinum is trading at $1,521/oz and palladium is currently trading at $464/oz. While rhodium is at $2,400/oz.

NEWS

(Reuters)

European stocks inched higher late on Friday morning, in cautious trading ahead of more U.S. bellwethers reporting second-quarter earnings, including Bank of America (BAC.N) and Citigroup (C.N). Oil major BP (BP.L) rose 4.3 percent after saying it has capped its leaking well in the Gulf of Mexico.

(AFP)

The 16-nation eurozone slipped back into a trade deficit with the rest of the world in May, posting a shortfall of 3.4 billion euros (4.4 billion dollars), official statistics showed on Friday. The single currency area had posted a surplus for three months in a row, thanks to a fall in the euro which boosts exports through lower prices. The trade surplus was 300 million euros in April, much lower than a previous estimate of 1.8 billion euros, the Eurostat data agency said. This followed surpluses of 1.9 billion euros in February and 3.8 billion euros in March.

(Bloomberg) -- Assets held in Japan’s first exchange-traded funds backed by gold and other precious metals may increase eight-fold in a year as investors seek to protect their wealth in the country with the world’s biggest public debt, its largest publicly traded bank said. ETFs backed by gold, silver, platinum and palladium stored in Japan may hold as much as 30 billion yen ($337 million) in July next year, from the initial 3.5 billion yen, said Osamu Hoshi, deputy general manager at Mitsubishi UFJ Trust and Banking Corp., a member of Mitsubishi UFJ Financial Group Inc.

(Bloomberg) -- The Shanghai Stock Exchange has submitted a proposal to China’s central bank for introduction of a gold exchange certificate developed with the Shanghai Gold Exchange, said Liu Ti, an official with the stock exchange. The gold exchange certificates, designed for institutional investors such as insurers and mutual funds, would be traded on the Shanghai exchange, Liu, director of the Shanghai Stock Exchange’s innovation department, said at a Guosen Securities Co. conference in the city of Qingdao today. They would be sponsored by the gold exchange instead of a fund as China prohibits mutual funds from investing in gold, Liu said.

(AP) -- Wheat prices soared Thursday as traders questioned how much of the global crop has been damaged by poor weather. Wheat rose 6.7 percent, its fifth consecutive day of gains. Corn and soybeans prices also rose. Two of the world's top wheat-exporting countries are coping with weather problems. Rains hampered the Canadian planting season, while a drought is expected to cut wheat production in Russia and Kazakhstan by 14 percent. Dry weather is now spreading into Germany, which has left traders with questions about this year's global production, Northstar Commodity analyst Jason Ward said. Also, traders who earlier bet wheat prices would fall are buying contracts to try to limit potential losses, he said. Meanwhile the U.S., the world's biggest wheat exporter, is wrapping up a robust winter wheat harvest while spring wheat appears to be in "phenomenal" shape, Ward said.

(Bloomberg) -- Billionaire Carlos Slim is digging for gold in Mexico, taking advantage of bullion prices that touched a record last month while awaiting a broader economic rebound. Slim’s mining outfit Grupo Frisco, a division of holding company Grupo Carso SAB, plans to open more mines this year and acquired one this month after ramping up gold production more than ninefold in 2009. That increase helped boost Carso’s profits as gold spot prices leaped 24 percent for the year.

(Irish Times)

Oil prices slip towards $76. Oil slid for a third day today towards $76 as stock markets in Asia fell after disappointing US economic indicators, while a potential Atlantic storm provided some support to prices. Japan's Nikkei average shed almost 3 per cent today, after reports showing US industrial production slowed sharply last month and manufacturing output snapped a three-month streak of increases capped Wall Street gains yesterday.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.