U.S. CPI Negative 3rd Consecutive Month, Consumers Have a Selective Memory

Economics / Inflation Jul 16, 2010 - 04:34 PM GMTBy: Mike_Shedlock

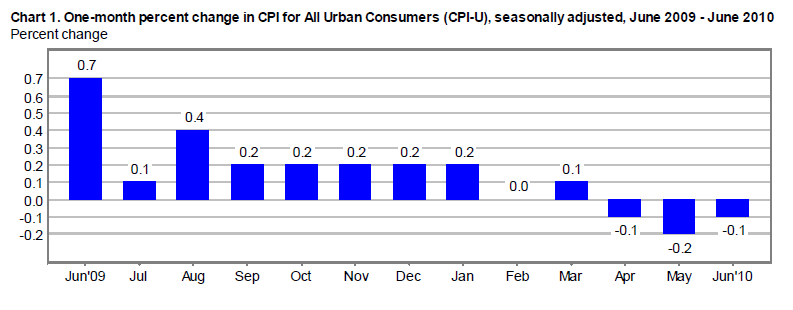

As expected, as least as I expected, the Consumer Price Index for June shows the seasonally adjusted CPI was Negative 3rd Consecutive Month.

As expected, as least as I expected, the Consumer Price Index for June shows the seasonally adjusted CPI was Negative 3rd Consecutive Month.

The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.1 percent in June on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the index increased 1.1 percent before seasonal adjustment.

Similarly to April and May, a decline in the energy index caused the seasonally adjusted all items decrease in June. The index for energy decreased 2.9 percent in June, the same decline as in May, with a decline in the gasoline index accounting for most of the decrease. This more than offset an increase in the index for all items less food and energy, while the food index was unchanged for the second month in a row.

The index for all items less food and energy rose 0.2 percent in June after increasing 0.1 percent in May. A broad array of indexes posted increases, including shelter, apparel, used cars, medical care, tobacco, and recreation. These increases more than offset declines in the indexes for household furnishings and operations and for airline fares. The 12-month change in the index for all items less food and energy remained at 0.9 percent for the third month in a row.

One Month Change in CPI-U

12-Month CPI-U Change vs. Year Ago

Oil and the CPI

For, now the CPI (less food and energy) has been hovering near +1% for about a year. However, it is not really valid to exclude food or energy but the Fed does it to justify their inflationary policies (policies that clearly are not working now).

The jump in "all items" in the second chart reflects the rebound in oil prices in Spring-Summer of 2009 when crude soared from $35 a barrel to close to $80 a barrel.

Of course hyperinflationists were screaming every step of the way, conveniently ignoring the plunge from $140 to $35.

Selective Memories

When it comes to prices, people have selective memories. They remember every penny uptick in gasoline prices, but forget the times they drop. The same applies to most everything else, but energy is very noticeable because people are constantly filling up their tanks.

On average, prices have been going up over time, but not as fast as memory suggests.

Another factor is rising taxes. That is money out of your pocket and mine, siphoned off by government and wasted on needless or even mindless things like the wars in Iraq and Afghanistan, but rising taxes are not the same as rising prices.

Medical and Used Car Increases

Here is an interesting BLS statement from the report that bears a closer look: "A broad array of indexes posted increases, including shelter, apparel, used cars, medical care, tobacco, and recreation."

One of the reasons used car prices rose was the inane cash-for clunkers policy that destroyed productive assets. This is similar to FDR destroying crops in the great depression, on a much smaller scale of course.

Without a doubt, medical prices are rising as a result of inept government policy. The recently passed medical reform bill will not help any.

My point is one must distinguish between why prices are rising, not just note that prices are rising. For example, prices rising as a result of an expansion of money supply or credit are a true effect of inflation (inflation itself being the rise in money supply or credit). Prices rising because of inept government policy (or because of supply constraints like peak oil) do not constitute "inflation" nor can they be considered a result of "inflation".

Perverse State of Affairs with Housing and Owners' Equivalent Rent

Finally, in regards to housing, note that rental prices, specifically "owners' equivalent rent" is the single largest component of the CPI. Thus, the BLS does not include actual prices in their analysis but rather imputed rents.

Although rents have been falling the BLS reports rents are rising. Here is one possible explanation.

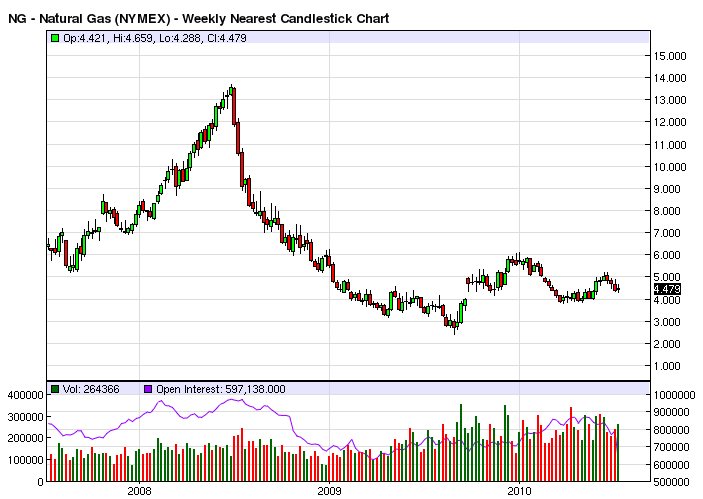

When natural gas and heating oil prices drop, imputed rents rise and when natural gas and heating oil prices rise, imputed rents fall. The reason for this apparent anomaly is the BLS assumes heating is part of rent and one is getting more value for constant rental dollars when energy prices rise.

Here is a chart of natural gas.

Natural gas prices are down in 2010 and that puts upward pressure on imputed rents.

I think the whole thing is silly, and the BLS needs to plug in home prices directly, using the Case-Shiller housing index as a guide.

Regardless, if gasoline prices continue to drop as I expect they will, the CPI will soon enough be in negative territory anyway.

As I said in Are we "Trending Towards Deflation" or in It? ....

Bernanke has failed. "It" has happened.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.