Option Expiry Bear Raid on SP500 Futures and Gold Close Charts

Stock-Markets / Financial Markets 2010 Jul 17, 2010 - 06:12 AM GMTBy: Jesse

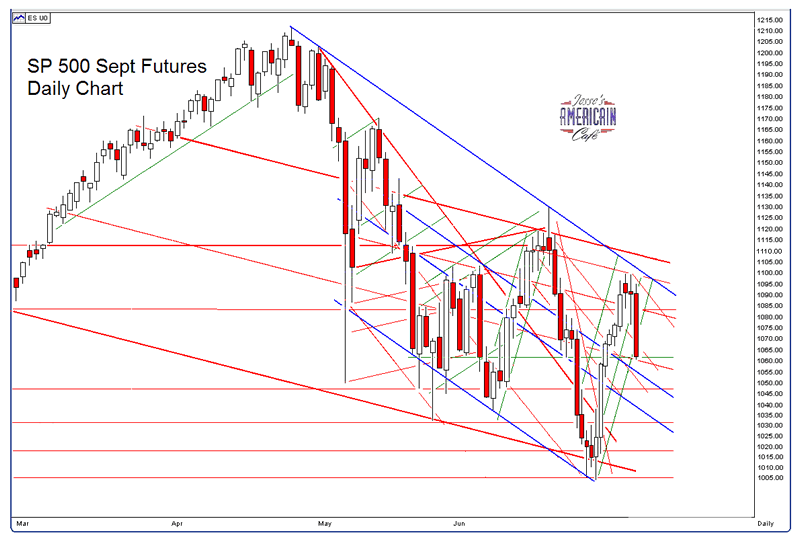

I had thought that the SP 500 would fail at a slightly higher level, the blue resistance trendline, but apparently that is not the case, at least for now.

Earnings misses in the banks and key tech bellwethers is driving the selling, and not coincidentally on the option expiration Friday for July. Michigan sentiment came in at a very low 66.5 which was well below expectations. At least for now belief in the recovery is off the table.

I beefed up my short positions in the financials as part of the short stocks / long gold & silver paired trade the other day, and this appears to be working reasonably well, giving me some room to play behind the shorts to add selectively at throwaway prices in the better miners and in bullion.

I am looking for a move down to the 1050-1060 area before the SP tries to back and fill itself on support. If it breaks down from there then the 1000 level looks possible. Keep in mind that this is a trader's market, and fundamentally it isn't telling us much of anything, except that a lack of financial reform has made the US a nation dominated by frivolous speculators who add no value and tax real GDP through price distortion.

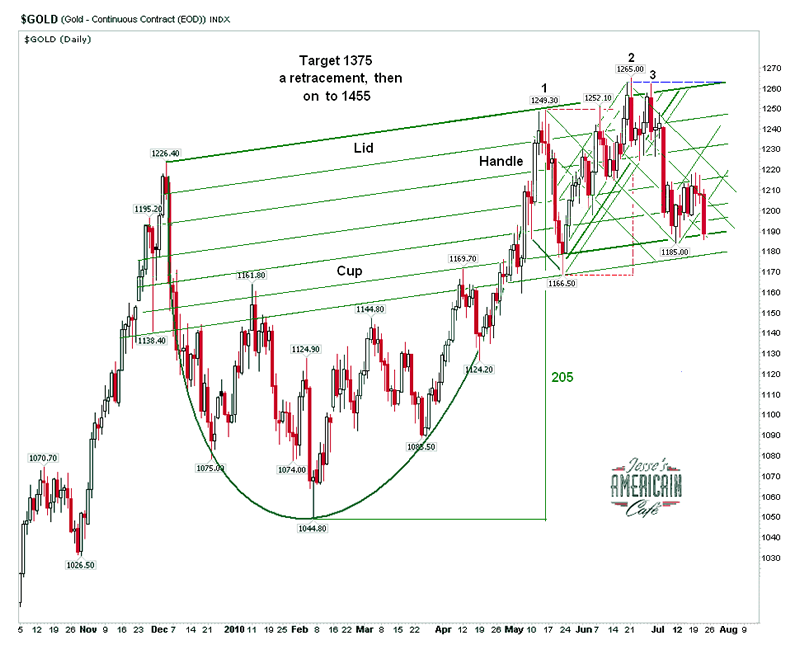

Gold and silver were hit very hard with yet another bear raid, with the paper crowd trying to trigger selling by smashing prices with program selling at key moments and price points, running the stops and scaring the weak hands out. This is how the game is played, and particularly so in this environment of big players and lax regulations.

I don't think this precious metals selling will last much longer, but we have to keep one eye on stocks to see if there is a great move to a general sell off and act accordingly. That means little or no leverage, conservative positions, and hedging against loss. Or better yet, don't bother with the market at all except in long time frames.

Despite the rumours and rationales spread by hedge funds and trading desks like this commentary here, this was obviously a bear raid tied to today's stock options expiration. No profit motivated professional trader dumps positions like this and sells against themselves unless the motive is to drive down the price and run the stops, clearing out the weak hands and taking profits from short positions in related trades. Now that 'sales by the IMF' has gotten tired through repetition it looks like 'liquidation by John Paulson' (JP) is the new bear trade precious metals boogeyman. More likely "JP" is in reality "JPM."

A Modest Proposal

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2010 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.