Gold Prices Holding Up Well

Commodities / Gold and Silver 2010 Jul 18, 2010 - 03:28 AM GMTBy: Bob_Kirtley

Despite Portugal’s sovereign debt being down graded the eurocrats have managed to calm the waters and keep the euro reasonably steady. Austerity is the word for the Europeans, real or imagined, whereas stimulus is the word for the United States. Interestingly the euro is steady but the dollar has lost 6.8% of its value in just over a month as the spot light once again is focused on the fundamentals of the dollar. Throw in a down grade from the Chinese and things don’t look to bright for the US sovereign debt.

Despite Portugal’s sovereign debt being down graded the eurocrats have managed to calm the waters and keep the euro reasonably steady. Austerity is the word for the Europeans, real or imagined, whereas stimulus is the word for the United States. Interestingly the euro is steady but the dollar has lost 6.8% of its value in just over a month as the spot light once again is focused on the fundamentals of the dollar. Throw in a down grade from the Chinese and things don’t look to bright for the US sovereign debt.

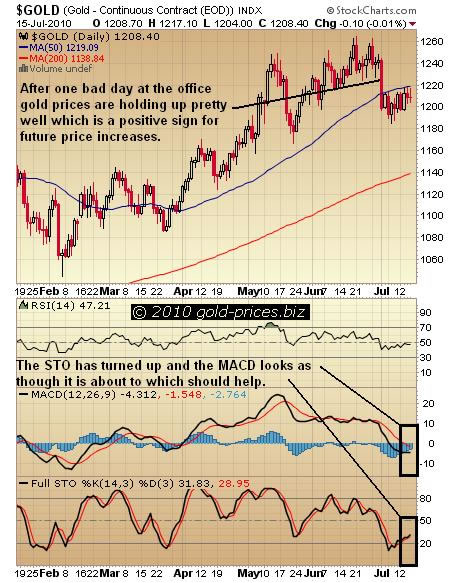

Taking a quick look at the above chart we can see that apart from one bad day at the office, when gold was sold down about $40.00/oz, gold prices are holding up pretty well especially for this time of the year when the summer doldrums usually kick in and volumes drop off significantly. We can also see that the STO is heading north and the MACD looks as though it is also ending its downward slide, which all bodes well for gold prices. If gold can maintain these levels through until September then the stage will be set for a major advance and the forming of a few new all time highs.

Turning to the chart for the USD we can see that it has resumed its trek south, all as we suggested on 09 June 2010 when the USD looked a tad overbought and has since lost about 6.8% in little over a month. The technical indicators have been floored so some consolidation may be on the cards, however we expect it be short lived as the economic recovery in the United States continues to fade and the general mistrust of paper currencies compels investors to re-think their strategies.

The days of a rating agency duopoly in the United States whereby Moody’s and Standard and Poors could issue triple A status to companies on the verge of bankruptcy are now over. Making their debut is this area is the world’s first “non-Western” sovereign credit rating agency, a Chinese company named Dagone (means Big Justice in Chinese) who have down graded the US to AA with a negative outlook. This agency would appear to concentrate more on the ability to pay than the ability to borrow. The dragon has stirred from its slumbers and its influence on world affairs will be felt in every corner of the planet. However, a no nonsense, practical assessment of the state of play will be welcomed by many, especially gold bugs who are contrarian by nature and tire of big government influence in these matters.

Below is the chart we posted of USD which we posted on 09 June 2010 accompanied with a snippet of our commentary.

We could well be too early in making this call but it appears to us that the dollar may now have run its course and will now look to take a breather. As we can glean from the chart, over the last two months the Euro has been under the gun, resulting in a rally for the USD as the preferred currency. Also note the gap that is opening up between the dollar at ‘88′ and the 200dma, which stands at ‘79′. The RSI, MACD and the STO are bouncing along at the top of their respective ranges and sooner or later they will return to somewhere more in the middle of their ranges. So the dollar now appears to be a tad overbought, in our humble opinion.

For now we will be keeping a tight grip on our precious metals but will be taking a serious look at our portfolio of stocks with the view to pruning some of the poorer performers and reinvesting in quality stocks which look to have a brighter future and have responded to the movements in gold prices.

Stay on your toes and have a good one.

Got a comment then please add it to this article, all opinions are welcome and very much appreciated by both our readership and the team here.

Recently our premium options trading service OPTIONTRADER has been putting in a great performance, the last 16 trades with an average gain of 42.73% per trade, in an average of just under 38 days per trade. Click here to sign up or find out more.

Silver-prices.net have been rather fortunate to close both the $15.00 and the$16.00 options trade on Silver Wheaton Corporation, with both returning a little over 100% profit.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.