Stock Markets React to Goldmans Numbers and Housing Data

Stock-Markets / Stock Markets 2010 Jul 20, 2010 - 11:13 AM GMTBy: PaddyPowerTrader

U.S. stocks rebounded Monday from the market’s biggest drop this month, as optimism about earnings from technology and energy companies overshadowed a drop in financial shares and worse than expected NAHB homebuilder confidence numbers. Microsoft climbed 1.4% after UBS raised its earnings estimate, citing signs of stronger demand. Halliburton jumped 6% after topping analysts’ earnings and revenue estimates.

U.S. stocks rebounded Monday from the market’s biggest drop this month, as optimism about earnings from technology and energy companies overshadowed a drop in financial shares and worse than expected NAHB homebuilder confidence numbers. Microsoft climbed 1.4% after UBS raised its earnings estimate, citing signs of stronger demand. Halliburton jumped 6% after topping analysts’ earnings and revenue estimates.

But Bank of America shed a further 2.7% as Goldman Sachs took the shares off its “conviction buy” list, saying low rates may hurt interest income. IBM. rose 1.4% in the regular session Monday but then turned tail and fell 3.7% in trading after the official close of markets after the world’s largest computer-services provider reported second quarter sales that missed analysts’ estimates as the falling euro weighed on revenue. Anadarko Petroleum Corp. fell the most in the S&P 500, losing 4.1% as Kenneth Feinberg, who is overseeing a $20 billion fund to pay damage claims from the Gulf of Mexico oil spill, said the BP’s partner could still be sued by victims even if they had been paid from BP’s fund.

This week is light on economic data as the market digests corporate earnings. Investors are also awaiting commentary from Bernanke’s monetary policy testimony Wednesday and Thursday, and the release of the European bank stress test results on Friday. As I mentioned some days ago the rumours concerning Nationalized Germany’s Hypo Real Estate flunking the European banking stress test seem to have been well founded.

Today in Europe its been a bad hair day for the telecoms sector with Cable & Wireless sinking 18% today to make it the worst performer on the FTSE 100. The company blamed government spending cuts as it warned that full year earnings will be at the lower end of forecasts. “Non contracted spending in the U.K. public sector has slowed very significantly,” C&W said in a statement. “Given the nature of our public sector business, this reduction will adversely impact trading.” A broker downgrade from JPMorgan who lowered its recommendation for the shares to “underweight” from “neutral added to the selling pressure. BT shed 4.1% in sympathy while Vodafone , which was downgraded to “hold” from “buy” at ING , slid 1.5%.

International Power gained a further 1.4% Tuesday, extending yesterday’s 10% advance after a UBS analysts said in a report today that GDF Suez SA’s bid to gain control of the U.K. company may be worth more than 400 pence a share and may include a cash payment. GDF may offer 350 pence a share plus 100 pence cash, analysts said. Separately, French newspaper Les Echos reported the French government is backing GDF Suez’s plan to gain control of International Power.

Platinum spread betting’>Aquarius Platinum , the world’s fourth-largest producer of the metal, jumped 9.5% after the South African government said a mine safety order wasn’t intended to halt mining operations. Luxury goods maker Hermes International has raised its 2010 sales growth target to between 10% and 12% from a previous forecast of at least 5%. The shares climbed 2.3% Tuesday on the news.

Stateside it looks like being another ugly opening for this yoyo market as we’ve just had a double whammy of much weaker the expected housing starts numbers (at -5% to an 8 month low versus the expected -2.7% with nasty negative revisions to the previous months data) and the giant vampire squid, Goldman Sachs coming in light on the revenues side ($8.84bn versus $8.99bn the Street was expecting). Other stocks reporting before the NY opening included Biogen who equalled expectations but raised full year guidance, health care giant J&J who beat the Street’s consensus EPS by 2c but on nearly flat revenues, UAL who beat on revenues & EPS. But Zions bank Corp continued the trend of disappointing results from financials slipping 9% pre market after reporting a loss of 84c per share versus the 53c expected . There were better tidings from iconic motor cycle maker Harley Daividson who reported a tripling of net income.

Today’s Market Moving Stories

•The were more signs that the Eurozone PIIGS sovereign debt crisis may be abating this morning with Ireland (6 and 10 year bonds), Spain and Greece with short dated T Bills managed to fund over 10 billion in fresh debt issuance with some ease between them. However Hungary was not as fortunate as investors choice to shun their 2 month T Bills auction forcing them to trim planned issuance and forcing up yields.

•UK July CBI survey shows that manufacturers expect a fall in export orders in Q3 Although the headline total orders balance of July’s CBI industrial trends survey showed a 7 point improvement to 16, its highest level since August 2008, the quarterly section of July’s survey indicated that Q3 could prove to be more challenging for manufacturers. The quarterly section that assesses manufacturers’ expectations for Q3 saw a net balance of 5% of respondents expecting total orders to rise over the quarter; this was the weakest outturn since Q4 2009. Additionally, the balance measuring expected export orders in the coming quarter fell by 21 points to -3, its first negative outturn since Q3 2009. On the whole, this survey has not proved to be the best guide during the recent recession, and we would not read too much into today’s outturn. We would, however, note that it follows a marked fall in the export orders balance of June’s manufacturing PMI and serves to emphasise that manufacturers expect exports to be weaker in Q3.

•The WSJ reports that the BoJ could act if USDJPY lingers around 85 for too long. WSJ cites “a person familiar with BOJ thinking”. I’d be very sceptical about this story. Anyone who reads BoJ minutes instantly becomes familiar with BoJ thinking. Sounds like someone at the WSJ was asked to investigate the Nikkei headline and phoned a few IB strategists for their views. “If the yen comes to stay around 85 against the dollar for one or two months, that could have an adverse effect on the economy,” said the person. If that happens, the BOJ “may do something.” Article says when USDJPY fell to 84.82 on Nov 27, BOJ conducted a rate check, by phoning around. Yep, sounds like a market contact is the source alright. Also, article makes no mention of MoF, and it is the MoF who decides on intervention policy not the BoJ.

Ryanair Flying Higher

Ryanair has reported a strong set of Q1 results this morning. Net profit, excluding the exceptional volcanic ash impact, rose 1.5% to €138m, up from €136m in 2009. This was ahead of management’s guidance for a result slightly lower year on year and ahead of consensus estimates of €125m. The airline carried 18m passengers over the period from April to June at an average fare of €39. This passenger yield was over 5% higher year on year and represents a resilient result considering the airline had to lower fares to stimulate demand post the volcanic ash disruptions. The most impressive aspect of the airlines results were a 23% increase in ancillary revenues and just a 1% increase in ex fuel costs per passenger. The latter is ahead of managements full year guidance for full year ex fuel unit costs to rise by 4% and the former is a function of increased average flight length. Gross cash at the group increased by €259m and now totals €3.1bn. The group will pay a once off dividend of €500m on October 1st, subject to shareholder approval at its AGM on September 22nd. Conservative as ever with it statements about it finances and guidance Ryanair’s outlook remains “cautious and unchanged”. It expects full year net profits to rise by between 10% to 15% to eur 350m to eur 375m.

Company / Equity News

•In their H1 trading statement William Hill indicated that operating profit would be flat at GBP135m (GBP134.6m) despite a 3% rise in net revenue. Trading from online was up strongly revenue up 24% and profit up 43%. OTC (over the counter) Retail was more mixed however, with a strong World Cup and good machine performance were offset by poor horse racing results, including a weak Grand National and the “worst ever” Royal Ascot (profit wise). So a touch on the disappointing side.

•Texas Instruments’ shares slid 5.5% in post market trading after the company reported second-quarter revenue and profit just below Wall Street expectations. Although Texas Instruments‘ profit rose sharply–and its quarterly operating profit set a record–the results weren’t enough to impress investors, who had expected earnings surprises similar to those from Intel and Advanced Micro Devices. TI executives said demand had grown across all sectors, with enough momentum that the company also forecast third-quarter earnings of 64 cents to 74 cents a share on revenue of $3.55 billion to $3.85 billion. Those ranges were better than the expectation of Wall Street analysts, who estimated 64 cents a share on $3.59 billion in revenue, according to a poll by Thomson Reuters. Last month, TI raised the bottom end of its guidance, forecasting earnings of 60 cents to 64 cents on revenue of $3.45 billion to $3.59 billion. Gross margin rose to 54.2% from 45.7%, nearly up to its long term target of 55%. Sales of analog chips which provide more than two fifths of total revenue jumped 56% and earnings more than quadrupled. Total orders climbed 33% from a year earlier and 2% from the first quarter.

•Staying with all things tech, Dell has agreed to buy closely held Ocarina Networks, a maker of hardware and software for reducing information storage requirements, to bolster its growing corporate data-centre business. The price wasn’t disclosed. Ocarina, based in San Jose, California, makes technology that lets companies cut down on the amount of space they need to store data by reducing redundancies. The technology complements Dell’s EqualLogic storage systems, the company said in a statement.

•Nokia Oyj, losing ground to competitors such as Apple in the smartphone market, is looking to replace CEEO Olli-Pekka Kallasvuo, the Wall Street Journal reported. The company, which approached the heads of several U.S. technology companies for the post, will make a decision by the end of the month, according to the report yesterday, which cited unidentified people familiar with the situation. One of the candidates refused Nokia’s advances after meeting Chairman Jorma Ollila because the position requires moving to Finland, where the company is based, it said. “We don’t comment on market rumor and speculation,” spokeswoman Laurie Armstrong for the Espoo, Finland-based company, said by e-mail.

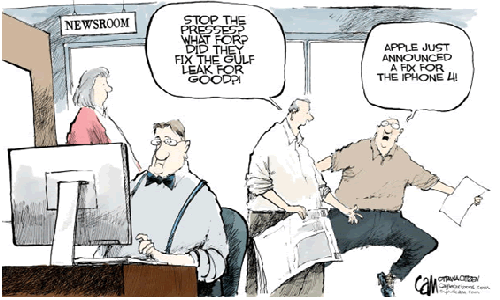

•Apple will report that profit more than doubled last quarter, analysts predict, reflecting demand for the iPad tablet and early sales of the iPhone 4. In a report later today, Apple may say net income in the fiscal third quarter surged to $2.87 billion, or $3.09 a share, according to the average estimate of analysts surveyed by Bloomberg. A year earlier, the company said profit rose to $1.23 billion, or $1.35 a share. Revenue likely surged 76 percent.

•Halliburton rose the most in the S&P 500, rallying 6% after the company reported an 83% increase in second-quarter profit to $480 million, or 53 cents share, as gains in onshore drilling made up for a halt to new wells in the Gulf of Mexico. Earnings from continuing operation were 52 cents a share, topping the average analyst estimate of 37 cents. Revenue was $4.39 billion, beating the average projection of $4.09 billion in a Bloomberg survey.

•The FT today notes a flurry of international deal activity raised the prospect of a rebound in global mergers and acquisition activity, even though economic data increased fears about the pace of the global recovery. Some 25 potential and agreed deals worth nearly $8bn were announced on Monday in sectors ranging from UK engineering to Italian frozen food, according to data from Dealogic. The potential deals included a $4.5bn bid approach for Tomkins, the UK car parts to building materials group, from a Canadian private-equity led consortium. Private equity groups were active elsewhere with deals including a $1.8bn buy-out of Healthscope in Australia by Carlyle and TPG and the €805m takeover of Unilever’s Italian frozen food business by Permira. The $8bn of deal activity excluded the preliminary talks between GDF Suez and International Power to create a London-listed power company as they have not yet been officially announced. If a deal went ahead, analysts said International Power would be worth up to $10bn. Bankers said the growing amount of cash on balance sheets was likely to put companies under pressure to utilise it. They added that private equity groups also were looking to spend a large overhang of capital raised before the financial crisis. But they cautioned that the recovery in acquisitions-explained/’ title=’Spread Bet M&A’>M&A would continue to be slow amid concerns over the eurozone debt crisis and disappointing US economic conditions. The volume of deals worldwide is still a fraction of the thousands of billions it reached at the peak of the debt boom in 2007.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.