Tightening Money - US Interest Rate Cut Not a Done Deal

Interest-Rates / US Interest Rates Sep 15, 2007 - 03:24 AM GMTBy: Brian_Bloom

Its one thing for the Central Bank to “liquefy” the commercial banks, it's another for the commercial banks to on-lend their cash.

Right now, the commercial banks are so nervous about what is unknown regarding the depth of the sub-prime mortgage debacle that they are not even lending to each other. That's why the Libor rate (London Interbank Offer Rate) has spiked.

For the moment that's not really a problem, because banks which are short of cash can turn to the Central Bank and, paradoxically, borrow at a lower rate. But this places a huge strain on the system from an administrative perspective. It can't continue indefinitely.

The problem is that it's been three weeks, and no one really knows how deep the sub-prime mortgage problems reach. The core issue is the extent of the derivatives which hang off this particular (sub-prime mortgage) market.

The following chart was reproduced from the internet – courtesy theFinancials.com

Libor Rate (GBP) - 18-August 2006 – 18 th August 2007

(Source: http://www.thefinancials.com/syndicated/demo/DEM_LIBOR_Majors_3m.html# )

© theFinancials.com

But dislocation within the sub-prime market did not only cause a spike in interbank lending rates. It also caused a spike in volatility in the markets in general, as can be seen from the following two charts – courtesy Bigcharts.com

Whilst the high volatility in the Industrial market has waned the price has not yet recovered to where it was prior to the volatility.

By contrast, the $XAU is now back to where it was.

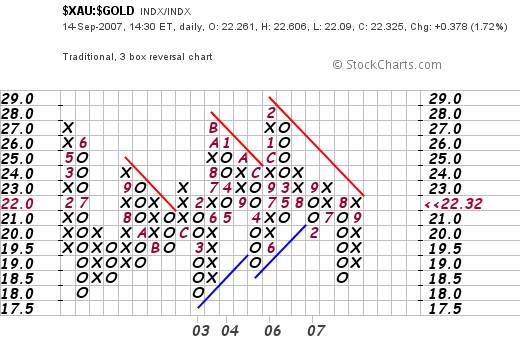

Perhaps more importantly, even though the $XAU has recovered, it is not yet in a bull market relative to Bullion – as can be seen from the following chart, courtesy stockcharts.com

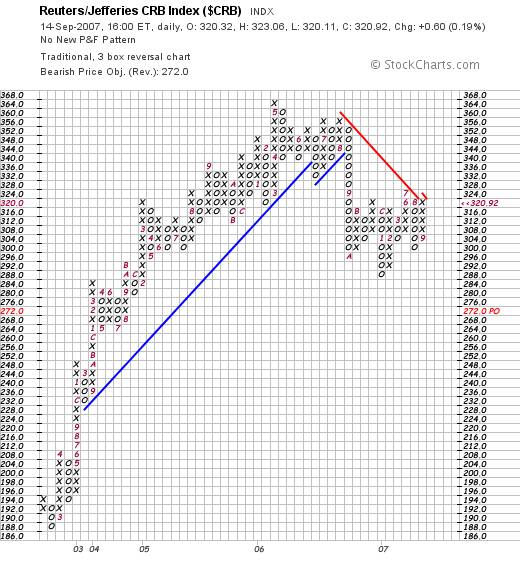

Also of relevance is the fact that the Commodities Index seems to be struggling to break up, as can be seen from the chart below:

To those who think in terms of the various relationships between “dependent” variables and “independent” variables, some questions are being begged:

- If gold shares are leveraged relative to gold (ie every additional one dollar in gold price falls straight to the bottom line of the gold mine's P&L), and the market is expecting the gold price to rise, why is the $XAU not outperforming the gold price?

- If the interbank market is placing a risk premium on cash, what do we think will happen if the US Federal Reserve Board flies in the face of this “demand for financial discipline” and it proceeds to drop the rate that it is prepared to lend to commercial banks?

- If the market is expecting a cut in US interest rates – which will very likely lead to a softening US Dollar, (which will likely lead to inflation in US$ denominated commodity prices) why is the commodities index struggling to break up?

Let's have a closer look at the US Dollar chart (courtesy stockcharts.com)

Hmm. The US Dollar is very weak, but there are technical indications that the breaks below the falling wedge may have been false breaks.

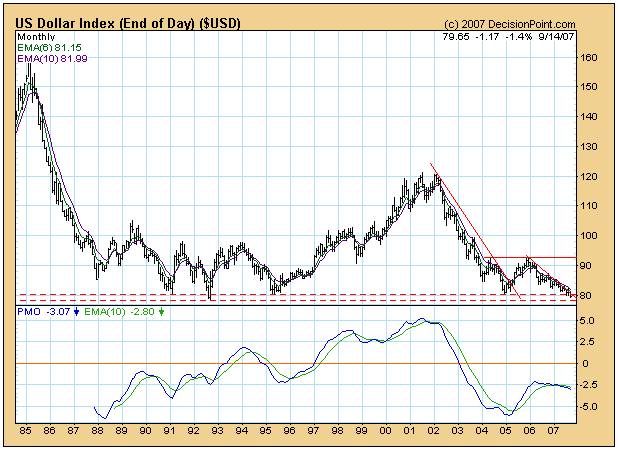

From a distance, we see the US Dollar is resting on 14 year support (chart courtesy Decisionpoint.com)

The primary problem with a falling US Dollar – which enthusiastic amateurs are calling for – is that it has the capacity to destroy the US economy, because:

- The US is the highest consumer (per capita) of oil in the world

- Oil is priced in US Dollars. If the Dollar falls, the price of oil in dollars will rise

- 60% of all transport within the US is oil dependent

- 66% of the US 's GDP is consumer driven

- The US Consumer is already bending under the strain of mortgages – many of which are low entry variable rate mortgages which are coming up for renewal at higher rates. If, on top of higher mortgage payments, the US consumer has to pay significantly higher prices for gasoline, the probability of a recession is high.

Conclusion

The US Federal Reserve is facing a serious dilemma. If it cuts rates, it will be flying in the face of the discipline which the professional market is now demanding, and this is likely to put serious pressure on the US Dollar.

If it raises rates, it may cause a dislocation in the “core” mortgage markets.

The “safest” course of action will be to hold rates where they are.

Unfortunately, the markets seem to be expecting a rate cut of between 0.25% and 0.5%, as can be seen from the chart of the 30 year bond yield below which has fallen from roughly 5.25% to 4.75% (the five and ten year yields have fallen by greater amounts).

Overall Conclusion

We appear to have reached a point in history where the Fed has to show who is boss, or lose control.

This analyst finds it very difficult to accept that the Fed will just roll over and bail out Private Enterprise from the consequences of its stupid decisions. That is why I sold out of my gold and silver shares (For the time being. I am still a long term bull).

However there is always the possibility that Chairman Bernanke is just a figurehead puppet – clay in the hands of the politicians and lobby groups. If this turns out to be the case, then the Fed will cut interest rates as per the general markets expectation, and the gold price will skyrocket upwards.

The relative strength chart of the gold shares:gold price is telling us that the Fed will not cut interest rates this time around.

Can this RS chart be wrong? Of course it could. No one has a monopoly on brains. If it was that easy to call the direction of the markets, we would all be rich. If you want “certainty” then investing in the markets is not for you.

By Brian Bloom

www.beyondneanderthal.com

Since 1987, when Brian Bloom became involved in the Venture Capital Industry, he has been constantly on the lookout for alternative energy technologies to replace fossil fuels. He has recently completed the manuscript of a novel entitled Beyond Neanderthal which he is targeting to publish within six to nine months.

The novel has been drafted on three levels: As a vehicle for communication it tells the light hearted, romantic story of four heroes in search of alternative energy technologies which can fully replace Neanderthal Fire. On that level, its storyline and language have been crafted to be understood and enjoyed by everyone with a high school education. The second level of the novel explores the intricacies of the processes involved and stimulates thinking about their development. None of the three new energy technologies which it introduces is yet on commercial radar. Gold, the element , (Au) will power one of them. On the third level, it examines why these technologies have not yet been commercialized. The answer: We've got our priorities wrong.

Beyond Neanderthal also provides a roughly quantified strategic plan to commercialise at least two of these technologies within a decade – across the planet. In context of our incorrect priorities, this cannot be achieved by Private Enterprise. Tragically, Governments will not act unless there is pressure from voters. It is therefore necessary to generate a juggernaut tidal wave of that pressure. The cost will be ‘peppercorn' relative to what is being currently considered by some Governments. Together, these three technologies have the power to lift humanity to a new level of evolution. Within a decade, Carbon emissions will plummet but, as you will discover, they are an irrelevancy. Please register your interest to acquire a copy of this novel at www.beyondneanderthal.com . Please also inform all your friends and associates. The more people who read the novel, the greater will be the pressure for Governments to act.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.