Stocks Search for Direction Post Bank Stress Tests

Stock-Markets / Stock Markets 2010 Jul 26, 2010 - 09:20 AM GMTBy: PaddyPowerTrader

U.S. stocks rallied Friday, sending benchmark indexes to one month highs, after Genzyme, the largest maker of medicines for genetic diseases received a takeover approach from Sanofi Aventis boosting optimism for renewed surge in M&A activity given corporates are sitting on record piles of cash. General Electric also boosted its dividend by 20%. The euro appreciated after 84 of 91 European banks passed stress tests. Treasuries dropped. The Standard & Poor’s 500 Index climbed 0.8% to finish at 1,102.66 its first gain above 1,100 since June 22.

U.S. stocks rallied Friday, sending benchmark indexes to one month highs, after Genzyme, the largest maker of medicines for genetic diseases received a takeover approach from Sanofi Aventis boosting optimism for renewed surge in M&A activity given corporates are sitting on record piles of cash. General Electric also boosted its dividend by 20%. The euro appreciated after 84 of 91 European banks passed stress tests. Treasuries dropped. The Standard & Poor’s 500 Index climbed 0.8% to finish at 1,102.66 its first gain above 1,100 since June 22.

In a surprisingly muted session to begin the week stocks on the move this post stress test Monday in Europe include Glaxo, the U.K.’s largest drugmaker, lost 2% as health care stocks performed the worst of any industry in Europe. The company declined to comment on a report in the Wall Street Journal that it recently made a “very casual” overture to Genzyme asking the biotechnology company to keep Glaxo in mind if Genzyme considered selling itself.

The big loser today is facilities management company Connaught Plc which tumbled 80%to just 20 pence after saying net debt will be “significantly in excess” of the £120 million it forecast for Aug. 31, its year end, and said it needs “urgent” funding to meet the needs of the business. The company has started negotiations with its lenders.

But Pace has rallied 7.2% today after the U.K. supplier of those television set-top boxes to British Sky Broadcasting said H1 pretax profit rose 46% and announced it plans to acquire 2Wire Inc. for $475 million.

In Milan Fiat is off 1.5% after a broker downgrade from Credit Suisse who cut the automaker from “outperform” to “neutral”.

Stateside before the bell Enterprise Products Partners said that its second quarter net profit rose 91% to $357.2 million, or 46c per unit, from $186.6 million, or 32c per unit, a year earlier. Revenue for the quarter rose 39% to $7.54 billion. The natural gas transportation and storage firm said its midstream systems in the quarter were operating at or near record levels, with natural gas pipelines volumes at a record 12.7 trillion British thermal units per day. Analysts polled by FactSet had been expecting earnings of 44c per unit on sales of $7.56 billion.

Today’s Market Moving News

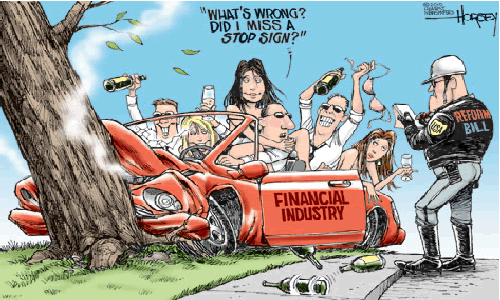

•The Spoof, sorry Stress test results proved to be a total anti climax never has so much been written on so little, it seems. The result was a stress test where far fewer institutions failed than was widely anticipated, whilst the additional amount of capital required to be injected was less than one tenth of what the market was expecting. So is this just the worst cover up since Bobby Charlton’s comb over ? The market will now do its own analysis, aided by the higher level of detail provided, and apply more severe stresses to the various institutions. From here, we would anticipate credit markets to trade neutral to weaker for European financials. Even before applying more severe stresses, we note that an additional 17 banks would have failed if the minimum Tier 1 ratio had been lifted to 7% (which is far from demanding). The balance of press comment is certainly tilted to the sceptical over the stress test methodology and results. Although not quite falling in with the Armageddon bloggers and conspiracy theorists, the FT has wholeheartedly thrown its hat in with the cynics.

•It is obviously easy to be sceptical, tests only applied to 65% of banks, sovereign haircuts too mild (and constructed relative to end 2009 yields, so milder still relative to current market) and only applied to trading books, etc, etc. And the modest €3.5bn capital shortfall of the seven small banks that failed has irritated a market wanting more and bigger scalps. It’s hard not to juxtapose two stories: 7 small banks failed the stress tests in EU, while across the pond the Fed quietly shut down 7 small US banks on Friday.

•The Secretary General of the Committee of European Banking Supervisors said he would be speaking with German authorities to discuss why 6 of 14 German banks didn’t release detailed breakdowns of sovereign debt holdings as part the continent’s bank stress tests, The Financial Times reported on its website Sunday. Arnoud Vossen told the FT, “We agreed with all supervisory authorities and with the banks in the exercise that there would be a bank by bank disclosure of sovereign risks.” However, according to the report, 6 German institutions Deutsche Bank, Postbank, Hypo Real Estate , Landesbank Berlin, and mutual groups DZ and WGZ didn’t release all the information expected. German regulatory officials said local laws prohibited them from compelling the banks to release the information, the FT reported.

•The Bank of England won’t need to raise its benchmark interest rate for at least 18 months as the aftermath of the recession defuses price pressures, the Centre for Economics and Business Research said. U.K. inflation will slow “sharply” from a pace of 2.9% this September to 2.2%in February next year, the London based research group said in a report today. The rate of annual consumer-price gains will then slow to 1.6% by February 2012, the CEBR said.

UK House Prices

And U.K. house prices fell in July for the first time in 15 months as the government’s budget squeeze curbed demand and more people tried to sell their properties, Hometrack said. The average price in England and Wales fell 0. % from June to 158,700 pounds, the London-based property researcher said in an e-mailed report today, citing a survey of surveyors and real-estate agents. Home values in the capital led the decline, dropping 0.2%. On the year, prices rose 2%. “The fall in prices marks a turning point for the housing market,” Richard Donnell, director of research at Hometrack, said in the report. “Further modest price falls are inevitable over the second half of the year as the volume of homes for sale continues to rise and demand remains weak on the back of concerns over the wider economic outlook and uncertainty over the impact of recently announced cuts in government spending.”

Company / Equity News

•Tullow Oil this morning announced a significant oil discovery that had been eagerly awaited by the market. The Owo 1 exploration well in the Deepwater Tano licence offshore Ghana has intersected a significant column of excellent quality light oil. Results of drilling, wireline logs and samples of reservoir fluids have established Owo as a major new oil field requiring further appraisal. This significant discovery is critical as its end Tullow’s recent relatively disappointing drilling updates over the past 12 months. The market may again price Tullow Oil at a premium to the sector to price in substantial exploration potential in the West Africa. Separately BofA Merrill Lynch have raised their price on the stock to 1,785 from 1,725 and kept their “buy” rating.

•According to Nielsen, Magners significantly outperformed the GB off trade cider category in the four weeks to July 10th. Magners volume growth was up 90%yoy, and value growth increased 53%yoy. The cider category improved with both volumes and value sales up 8% yoy. Beer category volumes rose 16% in the period with beer value sales increasing 8%.

•Publisher Pearson’s results today show organic growth in continuing operations (i.e.

Europe’s biggest bank by market value and Standard Chartered Plc are in talks to buy Old Mutual’s 52% holding in South Africa’s Nedbank, the Financial Times reported. HSBC shares dropped 1.3% on the story.

•Apple has delayed the release of the white iPhone 4 for the second time, saying

the model is still harder to manufacture than expected. The white model will be available later this year, the Cupertino, California based company said today in a statement. The black models are not affected, it said. Apple sold 1.7 million of the black model iPhone 4, which features video calling, in the first three days after its June debut. That month, the company postponed releasing the white model until the second half of July, citing unexpected manufacturing challenges.

•Sony may post first quarter operating profit of between 10 billion yen and 30 billion yen, compared with a year earlier loss, Nikkei English News said, without citing anyone. Earnings were helped by increased sales of digital cameras and personal computers in emerging countries, the report said. The company’s game and mobile phone divisions returned to profit after cost savings, the Nikkei said.

•Dow Jones has a good summary of the EU Steelmakers upcoming earnings. “European steel producers are set to post a profit in the second quarter of 2010 compared with a losing the same period a year ago due to improved orders and prices on the year. However, caution will still prevail with the second half widely expected to show a slowdown in demand and output cuts, analysts said Friday. Earnings to watch are second quarter results for ArcelorMittal on July 28, Salzgitter AG on Aug. 12 and third quarter earnings for ThyssenKrupp AG on Aug. 13. Analysts forecast Salzgitter to post the worst results of the three given the company is more exposed to the construction industry, which is lagging other sectors’ recovery, whereas ThyssenKrupp will benefit from improved German auto exports, said Hermann Reith, a steel analyst at BHF Bank in Frankfurt. Steel prices averaged $776 a metric ton in the second quarter of this year, up 36% from the same period last year, U.K.-based consultancy MEPS International Ltd. said. However, global average prices have been slipping in recent months and are now down around 8% from the year’s peak in May of $798/ton. MEPS analyst Kaye Ayub said she expects steel prices to trend lower through the remainder of the year and that mills may have to cut output due to ebbing demand, particularly during the traditionally quiet summer period in Europe. ArcelorMittal previously said it will lower output in Europe in the third quarter by 10% due to the seasonal summer slowdown. Steel mills in Europe will also continue to struggle with higher raw material costs.”

•Teva Pharmaceutical, the world’s biggest maker of generic drugs, fell the most in 21 months on concern sales of its Copaxone multiple sclerosis drug may decline if U.S. regulators approve rival medications. The U.S. Food and Drug Administration on July 23 approved the marketing of generic versions of Sanofi-Aventis SA’s Lovenox anti clotting drug from Novartis AG and Momenta Pharmaceuticals Inc. The decision may affect Copaxone because both drugs have a complex molecular structure, Natali Gotlieb, a Tel Aviv-based analyst at IBI, said today in an e-mailed report.

•Nomura, Japan’s largest brokerage, cut its recommendation on Japanese shares to “neutral,” citing a weaker profit outlook and slower economic- growth prospects. “The recovery in Japanese earnings is already beginning to lose momentum,” Nomura analysts including Ian Scott wrote in an e-mailed report dated July 23. The brokerage also today downgraded its forecast for growth in the country as a strengthening yen threatens the export-fueled rebound.

•The Force was with a man when he robbed a bank wearing a Darth Vader mask and a cape. Armed with a gun instead of a light saber, the man entered a Chase bank branch in Setauket, New York, about 50 miles east of New York City, on Thursday and demanded cash from a teller, police said. He fled through a parking lot with an undisclosed amount of money.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.