Stock Market Take-Off Tuesday Already?

Stock-Markets / Stock Markets 2010 Jul 27, 2010 - 11:10 AM GMTBy: PhilStockWorld

Wow, this market goes from zero to sixty in record time, doesn’t it?

Wow, this market goes from zero to sixty in record time, doesn’t it?

Our 1,013 mark (see yesterday’s post for charts) was tested and broken on the S&P yesterday (see David Fry’s chart) on a silly stick save into the close but, seeing that, it was very obvious that "they" are looking to paint some impressive moves on the charts this week so strap yourselves in - it’s going to be a wild one.

1,020 is our next big test on the S&P along with the satanic 666 on the Russell and 10,700 is the next big test for the Dow (as 10,500 seems well in hand). Advancers led decliners 20:1 on the Nasdaq, which shows you what a total farce the market is because we had the same ratios going down so stocks are either ALL good or ALL bad on a random daily basis. Human beings do not trade this way my friends, this market has been totally taken over by machines and the affect of your individual trading is about the same as shooting a water gun into a wave to slow it down.

1,020 is our next big test on the S&P along with the satanic 666 on the Russell and 10,700 is the next big test for the Dow (as 10,500 seems well in hand). Advancers led decliners 20:1 on the Nasdaq, which shows you what a total farce the market is because we had the same ratios going down so stocks are either ALL good or ALL bad on a random daily basis. Human beings do not trade this way my friends, this market has been totally taken over by machines and the affect of your individual trading is about the same as shooting a water gun into a wave to slow it down.As long as you accept this fact and "go with the flow" you can be a very happy channel surfer but fight the tide at your own peril! We stuck to hedged plays in yesterday’s Member Chat with our bearish play on FSLR in the Morning Alert and then earnings spreads on MEE and VECO along with long-term bullish plays on LYG, GS, CHK and our beloved TBT, who are finally showing signs of life. We also keep selling GENZ calls to overly enthusiastic buyers who think someone is going to pay more than $70 for the company - even though it was at $50 before the rumors started. Aside from the lack of logic that a buyer with a p/e of under 10 will pay a p/e of over 20 for GENZ, it just isn’t really the right credit environment for buyers to be bidding +40% for a company. We aren’t buying puts but we’ll certainly sell Jan $70 calls for $4 as that’s just silly!

The markets are back in "Soar and Ignore" mode this morning as bad news is now like water off a duck’s back to the market, much the same way good news was ignored just 2 weeks ago. The moon is full this week so I’m going to start charting that against the market as we’re still trying to find some sort of early predictor of this moody behavior. ICSC Retail Store Sales were up 0.6% vs 1.4% last week and 3.8% for the year (down from 4.2% last week) in a very quickly eroding outlook for retailers. We’ll get Redbook Chain Store Sales at 9 and Consumer Confidence at 10 and tomorrow’s the Fed’s Beige Book through about July 15th and if anything is going to tank the markets, it will be that so we shall remain cautious until tomorrow afternoon. Of course, we did all our buying almost 1,000 points ago so it’s hard for us to get motivated to buy more at these prices anyway…

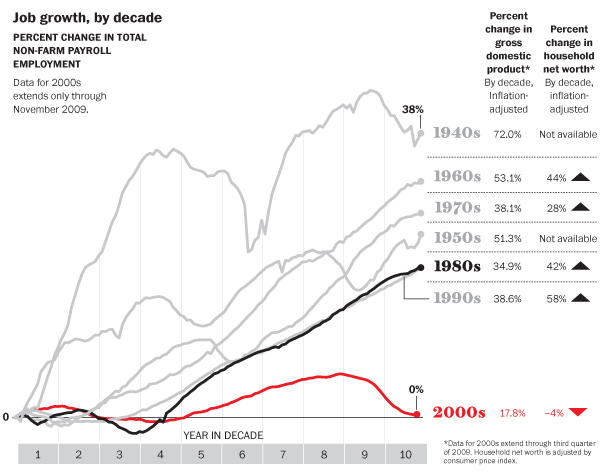

It’s also hard to get motivated to buy at 10,700 when you look at the above chart and realize how dangerous the jobs situation still is in this country. American corporations may be doing well as they sell 50% of their goods overseas (and make 80% of them overseas) so the United States in itself plays a smaller and smaller role in their overall planning. As long as overseas markets grow and labor costs keep going down - Big Business can shake off a little slowing demand from the hometown consumers.

No company is more American than Harley-Davidson and HOG is a perfect example of the death of the American worker as the company reported $71M in profits, TRIPLE what they made last year - on LESS SALES. That’s right, Harley laid off 2,000 Americans last year, 20% of their US work-force and will dump another 1,500 this year. Harley is transitioning from "Made in America" to "Assembled in America" and we’re lucky the remaining 5,000 employees are still allowed to do that!

No company is more American than Harley-Davidson and HOG is a perfect example of the death of the American worker as the company reported $71M in profits, TRIPLE what they made last year - on LESS SALES. That’s right, Harley laid off 2,000 Americans last year, 20% of their US work-force and will dump another 1,500 this year. Harley is transitioning from "Made in America" to "Assembled in America" and we’re lucky the remaining 5,000 employees are still allowed to do that!

“Because of high unemployment, management is using its leverage to get more hours out of workers,” said Robert C. Pozen, a senior lecturer at Harvard Business School and the former president of Fidelity Investments. “What’s worrisome is that American business has gotten used to being a lot leaner, and it could take a while before they start hiring again.” And some of those businesses, including Harley-Davidson, are preparing for a future where they can prosper even if sales do not recover. Harley’s goal is to permanently be in a position to generate strong profits on a lower revenue base.

Despite all the hiring we’re doing over there, our little rally yesterday failed to get a reaction out of Asia, which pretty much flatlined this morning. The Hang Seng finished the day up 133 on a mighty stick into their close so I don’t count that and we should be very concerned that the Nikkei continues to gap 1,000 points away from the Dow - even with the Dollar climbing to 87.5 Yen in last nights FOREXmanipulation trading. The Dow and the Nikkei are now 12% apart for the year, with the Nikkei down 10% and the Dow up 2% so one of them is out of their minds:

If we’re going to be pushing up to our 5% lines at Dow 10,700, S&P 1,155, Nas 2,300, NYSE 7,350 and Russell 666, then we could look at EWJ Sept $9 calls at .70 as that’s just .10 in premium on the Nikkei index, currently $9.59. Even a 50% catch-up by the Nikkei would be 6% and that would take EWJ to $10.16 so $1.16 for the calls at least and a very nice 65% profit so that’s my bullish play on global markets if this party keeps going.

Europe is doing a better job of keeping up with us and EU indexes are up about 1% ahead of the US open (9am). All the EU indexes are in their safe zone - if it’s a dull day we can look at the charts tomorrow. We had good profit news from DB and UBS this morning as all the global Banksters are having a nice quarter (hence our LYG play yesterday). SAP raised their sales outlook and had a 16% jump in profits and Daimler continues to show Americans how to run a car company (and they have universal health care and 6-weeks paid vacation!) with a nice profit AND raised guidance.

Europe is doing a better job of keeping up with us and EU indexes are up about 1% ahead of the US open (9am). All the EU indexes are in their safe zone - if it’s a dull day we can look at the charts tomorrow. We had good profit news from DB and UBS this morning as all the global Banksters are having a nice quarter (hence our LYG play yesterday). SAP raised their sales outlook and had a 16% jump in profits and Daimler continues to show Americans how to run a car company (and they have universal health care and 6-weeks paid vacation!) with a nice profit AND raised guidance.

Redbook Sales came in +2.7%, in-line with expectations andCase Shiller was up 1.3%, a bit better than expected so still showing signs of life in the economy. We get a preview of the Beige Book with Richmond Manufacturing at 10 and the Chicago Fed at noon - if those are not pretty good we’ll be taking some speculative shorts into tomorrow’s Fed report as it would be a shame to blow our lovely profits on a "flash crash," wouldn’t it?

Other than that, get ready to ride the waves and have some fun as the market approaches ramming speed!

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.