Gold Get Ready, Set, the Best Months Are Just Ahead

Commodities / Gold and Silver 2010 Aug 09, 2010 - 09:56 AM GMTBy: Frank_Holmes

Global economic conditions are now favorable for gold as a safe-haven investment. The U.S., Western Europe and Japan are close to buckling under the weight of their sovereign debt loads, government budget deficits remain large and persistent and, as a result, faith in major paper currencies is low.

Global economic conditions are now favorable for gold as a safe-haven investment. The U.S., Western Europe and Japan are close to buckling under the weight of their sovereign debt loads, government budget deficits remain large and persistent and, as a result, faith in major paper currencies is low.

On top of this, China – the world’s No. 1 gold producer and No. 2 gold consumer – is encouraging gold investing by its rapidly growing middle class, and will likely have to increase imports to meet this new demand.

If history is any guide, gold is about to get even more attractive because we are heading into the fall and winter gift-giving season. This is the time of year that gold jewelers typically do their biggest business. The kickoff is the Muslim holy month of Ramadan, which starts next week and ends with generous gift-giving in early September.

After Ramadan comes India’s post-monsoon wedding season, and in November there’s Diwali, one of India’s most important festivals. During the fall, jewelry makers in the U.S. and Europe stock up in advance of the Christmas shopping season. And in China, there are two big gold opportunities: the week-long National Day celebration starting October 1, and the Chinese New Year in early 2011.

Looking at more than four decades of seasonality, September has been the best month of the year for gold and gold stocks.

The clear trend can be seen on the seasonality chart for spot gold. In a typical year, the September price rises 2.5 percent above the August price. And to make the case even more compelling, the gold price has risen in 17 of the 21 Septembers since 1989, by far the best success ratio of any month of the year.

In September 2009, the gold price jumped nearly 6 percent, well above the long-term average.

September is historically an even better month for gold stocks as measured by the NYSE Arca Gold Miners Index (GDM).

After the typically weak months of June and July, the gold miners start moving up in August and make an 8.3 percent leap in September. In September 2009, the jump was 14.5 percent. Since 1993, the GDM has been up 12 times in September and down just five times.

The strong correlation between the gold price and gold-mining stocks explains much of the average September jump for gold stocks, which have historically offered leverage to the gold price. In up markets, earnings growth has tended to exceed the increase in gold price. In down markets, the leverage works in the opposite direction — gold stocks also tend to decline more when the price of bullion is falling.

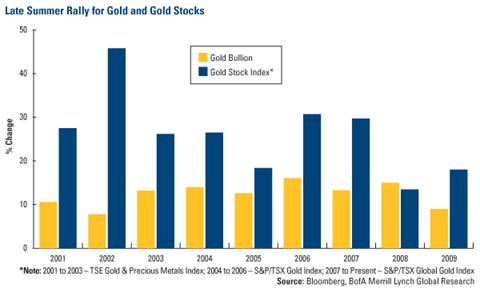

This leverage is shown on the chart of how bullion and the miners have fared in late-summer and fall rallies during the gold bull market that began in 2001. These uptrends have generally occurred between mid-July and early October, though in 2004 it extended into late November.

The gold price has climbed an average of 12.4 percent during the 2001-09 seasonal rallies even as the price steadily moved into four digits. As good as that result was, the impact on gold stocks was even stronger – their annual jump averaged more than 26 percent.

In 2010 the trend could be shaping up right on schedule. From a recent bottom of $1,157 per ounce in late July, spot gold had risen more than 4 percent through mid-afternoon on August 6 and the TSX/S&P Global Gold Index had gained more than 6 percent.

Bank of America-Merrill Lynch recently called for $1,300 gold by October-November 2010 as a result of the seasonal demand, and the gold watchers at CIBC World Markets in Toronto see $1,400 gold next year due to strong investment demand and inadequate supply response.

Given the current economic weakness, CIBC pointed out that during the Great Recession, “gold was one of the only investment classes that provided positive returns. This fact will not be forgotten if the next recession materializes.”

Its analysts also say that gold equities look relatively cheap compared to bullion, adding that, for the first time ever, some of the big producers are trading at price-earnings ratios below the S&P 500 Index average.

Going back to 1971, when President Nixon ended dollar convertibility into gold and deregulated the price of gold, gold stocks have tended to outperform the S&P 500 when the federal government runs budget deficits. Through 2019, the annual federal deficit is projected to average around $1 trillion, creating the potential for gold stocks to remain an attractive investment relative to the broader market for years to come.

Based on the long-term record, this may be a good time for investors to consider establishing or adding to a gold or gold-stock position in advance of seasonal demand growth. Historical patterns may be a useful guide and improve the chances for investment success, but of course, there are no guarantees that the fall of 2010 will follow the well-established trend.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.