Fearful Stock Market Thursday, Manic Over, Depression Sets In

Stock-Markets / Stock Markets 2010 Aug 12, 2010 - 01:22 PM GMTBy: PhilStockWorld

The markets are clearly insane.

The markets are clearly insane.

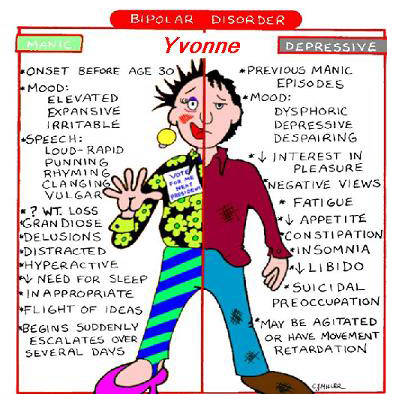

I diagnosed manic depression in the markets years ago but it’s been getting worse and worse to the point where we now have mood swings from week to week and sometimes even day to day. Much of this is politically driven with the Conservatives currently in overdrive - looking to "prove" that every single thing the Democratically controlled Government does is nothing short of a disaster. Nothing works, nothing will work and nothing proposed will work other than more tax cuts and "throwing the bums out" (the Democratic bums, not the Republican bums).

There is a 24-hour television network that is slightly conservative and, if you look on the Fox website, you will find out that 8% of the children in the US are born to "illegals," that cutting the World’s largest defense budget will make U.S. less safe (YOU DECIDE - they say), Democrats IGNORE ethics cloud by attending Charlie Rangle’s 80th birthday party, Democrats are using the Tea Party against the GOP (but don’t worry because "the tide is turning at the polls"), the drilling ban is crippling the Gulf, we’re "wasting" Billions of dollars by sending aid to other countries and, best of all, the page is sponsored by BipolarDepression.com!

There is a 24-hour television network that is slightly conservative and, if you look on the Fox website, you will find out that 8% of the children in the US are born to "illegals," that cutting the World’s largest defense budget will make U.S. less safe (YOU DECIDE - they say), Democrats IGNORE ethics cloud by attending Charlie Rangle’s 80th birthday party, Democrats are using the Tea Party against the GOP (but don’t worry because "the tide is turning at the polls"), the drilling ban is crippling the Gulf, we’re "wasting" Billions of dollars by sending aid to other countries and, best of all, the page is sponsored by BipolarDepression.com!Heck, after reading that page I’m ready for a few Xanex myself!

The front page of the WSJ is not much better with the headline: "ECB Warns on Economic Recovery" along with their very accurate Page 1 print headline: "Markets Swoon on Fears." Of course, if you actually read the ECB article, you’ll find what they actually said is "The sustainability of the recovery in global and euro-area trade will depend critically not only on a further strengthening of private demand, but also on the robustness and health of the global financial system" IN THE CONTEXT of an article analyzing the collapse of global trade in the wake of the 2008 financial crisis. But that doesn’t make a great headline does it? That doesn’t make you pick up the paper or stay tuned through the commercial so it’s ALTERED, spun to maximize the FEAR reaction in the readers - the one that is most likely to lead to a purchase decision.

The European Union’s Eurostat statistics office, meanwhile, said industrial output dropped 0.1% from May and was 8.2% stronger than last June. Economists surveyed by Dow Jones Newswires last week had expected increases of 0.5% on a month-to-month basis and 9.1% on the year. However, May’s figures were revised higher to show that industrial output rose 1.1% on the month and 9.9% on the year—the strongest annual increase since comparable records began in 1991. This data is in THE SAME ARTICLE that is "warning" us about the recovery.

The European Union’s Eurostat statistics office, meanwhile, said industrial output dropped 0.1% from May and was 8.2% stronger than last June. Economists surveyed by Dow Jones Newswires last week had expected increases of 0.5% on a month-to-month basis and 9.1% on the year. However, May’s figures were revised higher to show that industrial output rose 1.1% on the month and 9.9% on the year—the strongest annual increase since comparable records began in 1991. This data is in THE SAME ARTICLE that is "warning" us about the recovery.

In Member Chat last night, we were discussing the latest "warnings" from uber-bear David Rosenberg, who asks "What Caused Bernanke to Shift His View?" which refers to the 11-word difference between the prior Fed statement and the one we got on Tuesday because Bernanke hasn’t said an actual word since then. My commentary on the article was as follows:

The Rosenberg is great but it is just the last straw as I see everyone (in my opinion) leaning way too bearish so that triggered my rant (an earlier post for members) on perspective. My job (as I see it) is to be the captain of the ship and to steer us clear of the icebergs as we navigate choppy market waters - whenever we tilt the ship too far in either direction, I do my best to get everyone rowing on a better path. What I don’t like to see is panic and hysteria - that doesn’t do anyone any good.

If I thought the global GDP or even the US GDP was going to grow at 3.5%, then I would be way more bullish. "Discovering" that the economy is rough and that having 25M people out of work is not a good thing really doesn’t shock my Socialist ass and it shouldn’t surprise you either. As I pointed out in the last jobs report, ALL of the layoffs were in the government sector as the Conservative strategy of "starving the beast" is paying off in spades so why aren’t they partying in the streets? This is what I mean when I call Republican policies insane - they are not well thought out. Cut 4M people off unemployment - what happens next to the economy? Cut 144,000 teachers - won’t that make unemployment go up and freak out investors yet again? Let the states go bankrupt - won’t that cause a melt-down in the bond markets and freeze up credit again?

Busting the unions and pulling benefits leads to lower labor compensation, unemployed people (shockingly) can’t afford to shop, especially in a July when oil prices shot back over $80 because oil is an instant tax on the poor. Small business people have no access to credit because banks don’t lend. Banks don’t lend because the Fed lends them money at 0.25% and they can put it in TBills and get 3% rather than risk lending it to small businesses or homeowners who might not pay them back. Of course the NFIB survey reflects this - how many times have I said that small business is getting totally screwed over by Big Business, who are the same top 0.01% as the rest of the crooks that are destroying this country so they can add to their money piles?

None of this is news. I knew this was going to be a disaster the day Bush got re-elected for pretty much all of the same reason. The only shock I had was how long it took this house of cards to collapse BUT - just because a house of cards collapses doesn’t mean I then extrapolate that the table it was built on is going to collapse or the building the table is resting on or the planet the building is on or the Universe that planet is in. The World will keep spinning and this too shall pass and the fact that a new bunch of prognosticators suddenly realize the economy is in bad shape every time we dip negative in the market (where was this insightful stuff for the last 4 weeks?) us to get stampeded in and out of positions like a bunch of clueless sheep.

On June 17th I wrote "Productivity and Prices are Peaking" and it took a month but now we got the Productivity report that confirms that. Should I be FREAKING OUT because something I said was happening at 10,400, which made me bet against 10,700 being broken, was finally, officially reported? Maybe my frustration is that no one seems to read my articles! Or maybe they, like everything else, are simply forgotten the next day as this market environment turns everyone into day traders.

I will close this by urging new members, and maybe current members who forgot, to read my "Worst-Case Scenario: Getting Real with Global GDP!" I wrote that one 2 panics ago (June 6th), when we were bottoming out at 9,800 and (surprise) everyone was freaking out and calling for the end of the World, which made me decide it was a great time to start our Q2 Buy List (June 7th).

I will close this by urging new members, and maybe current members who forgot, to read my "Worst-Case Scenario: Getting Real with Global GDP!" I wrote that one 2 panics ago (June 6th), when we were bottoming out at 9,800 and (surprise) everyone was freaking out and calling for the end of the World, which made me decide it was a great time to start our Q2 Buy List (June 7th).

Maybe I’m wrong, maybe the World IS ending and it’s always good to get everyone’s diverse opinions on the subject but the problem is I sometimes just get tired of making the same points over and over again but, if I don’t - then the tone of the site gets ridiculously bearish - perhaps at the worst possible time.

We are still in the middle of our trading range (9,700-10,700) so we could easily go in either direction and a real market panic could take us down to 9,000, which is why we are still 65% cash but my overview is that we’re at the point where the government (whether for election purposes or for some crazy notion of actually wanting to help people) needs to do something and that something is not going to be giving tax breaks to 13M people. So the Conservative pundits are having a little hissy-fit and you will continue to get bombarded with negative news for the duration but, in the end, the people with money and researchers see the same thing as I do - putting money into equities is safer than bonds and there is plenty of money sloshing around out there. The World is not ending and, while the economy may not be snapping back quickly - we certainly aren’t going back to the stone age — unless Palin gets elected.

As I mentioned on Monday, Japan is going on vacation next week and today the Nikkei clawed it’s way back to 9,212 on a huge Yen dump that took it back to 85.79 to the dollar but the manipulation didn’t hold and we got our usual rise in the Yen from 3am as the Yen jumped back to 85.2 to the dollar. These are huge moves for FOREX trading but they now happen EVERY DAY! We have also had more than 1% swings in the Pound and the Euro both generally down today against our bouncing dollar (our trade ideas in Friday Morning’s Alert to Members was selling the UUP Aug $24 puts for $1 (now .20 - up 80%) and buying the Aug $23 calls for .40 (now .95, up 137%).

As I mentioned on Monday, Japan is going on vacation next week and today the Nikkei clawed it’s way back to 9,212 on a huge Yen dump that took it back to 85.79 to the dollar but the manipulation didn’t hold and we got our usual rise in the Yen from 3am as the Yen jumped back to 85.2 to the dollar. These are huge moves for FOREX trading but they now happen EVERY DAY! We have also had more than 1% swings in the Pound and the Euro both generally down today against our bouncing dollar (our trade ideas in Friday Morning’s Alert to Members was selling the UUP Aug $24 puts for $1 (now .20 - up 80%) and buying the Aug $23 calls for .40 (now .95, up 137%).

The Shanghai fell 1.25% (2,575) and the Hang Seng gave up 0.9% (21,105) but India continues to hold that 18,000 line at 18,073. I’m sure some stuff happened in Asia but it’s 9:15 and it’s all about us now. Same goes for Europe where they dropped from a nice open and are now down about half a point after another bad round of Unemployment Data from us (484,000 Americans lost their jobs last week) and both Import (-0.3%) and Export (-0.2%) Prices were deflationary. Tomorrow is the real excitement with CPI and Retail Sales for July along with Michigan Sentiment and Business Inventories.

We expected to test our levels at Dow 10,200, S&P 1,070, Nas 2,200, NYSE 6,800, and Russell 635 and the Russell already blew it yesterday (but we expected that after last week’s horrific small business data we discussed). Our QID spread from Tuesday morning’s post has already been rolled (up 369% in 48 hours) to the DXD spread I mentioned we’d flip to in yesterday’s post so congrats to all who played along at home!

We had a few bullish trade ideas (and a CSCO spread that needs to be dumped right away!), trying to get ahead on some bottom fishing yesterday but so far, so bad on those! Today we may actually be forced to join the bears if we blow 3 of our 5 bottom levels but I am hoping that this holds as it would be very nice to begin to establish what has been the mid-point of our trading range as more of a base.

Is that too optimistic? We’ll see…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.