Hoping the Weekend Brings Market Perspective

Stock-Markets / Financial Markets 2010 Aug 14, 2010 - 04:32 AM GMTBy: PhilStockWorld

David Rosenberg is the special guest on CNBC this morning.

David Rosenberg is the special guest on CNBC this morning.

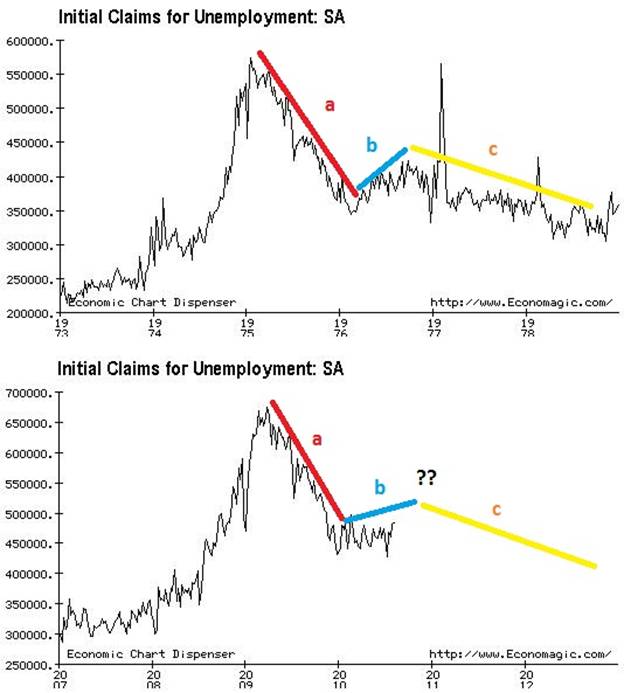

Sometimes I get the impression they intentionally counter-program any bullish point I bring up (we talked about Rosenberg in yesterday’s post). As I did say yesterday - fear sells and CNBC is in the business of selling fear, driven by their own fear of declining ratings (new lows in the last book) and irrelevance. I think one of the problems with CNBC is that they forget they are on television. On the right, I am SHOWING you a chart of weekly unemployment - TV is supposed to be all about showing you things but the only things they show you are gigantic talking heads and the dreaded "octo-box" where the loudest guy with the best one-liner wins (I guess).

It’s sad that anyone gets their information this way and I am relieved to see people once again picking up newspapers to get their news (or even the occasional financial blog). The chart above is from Calafia Beach Pundit on Seeking Alpha and he’s trying to point out, as I am, that we have a tremendous amount of negativity that can take this MASSIVE improvement in weekly job losses and spin it as a negative. I’m not saying it’s great - we need to put people back to work - but expecting job losses to fall from 650,000 per week down to 300,000 per week without so much as a bump along the way would not only be unprecedented but ridiculous.

Another thing I like about blogs is the commentary and another SA Writer (who I happen to follow), John Lounsbury and a reader called Oil Finder, go back and forth on the merits of Pundit’s observation. You can learn more about unemployment following this exchange than you will if you had watched CNBC 24/7 for the entire past decade! Oil Finder makes the excellent observation that the track of the unemployment claims through the current recession is virtually identical to the track of our last major recession in the 70s (the one they blame on Carter, who took office in January of 1977).

So if we take into account the overall expansion of the labor force since 1975, then it’s not terribly surprising that our Unemployment numbers are also higher this time around. Back in the 70’s we had the oil crisis, the hostage crisis, Watergate the end of a pointless war that put the country in debt and government interference with the markets and the dollar (Nixon removed the gold standard). In short - they were just as screwed up as we were…

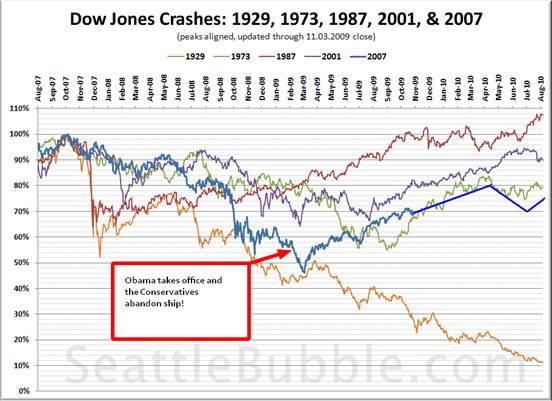

The Dow had peaked out right around Nixon’s re-election in late 1972 (and top tax rates were 70% back then!) at 1,050 but by late August of 1975, the Dow had plunged to 580 and then went even lower, to about 560 in December of 1975. We recovered from there all the way back to 1,000 in early 1976 but then dipped back to 750 in the Spring of 1978 and we flopped along between 800 and 1,000 all the way through the Fall of 1982, when Reagan famously said "Don’t worry about the deficit, it‘s big enough to take care of itself" and lowered taxes and spent record amounts of money and managed to send the markets into orbit - even though his "Star Wars" initiative never really panned out.

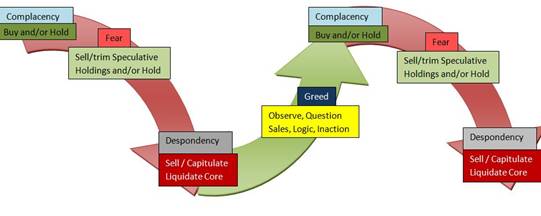

Other than the over-stimulated bubble top of 2007 - our market has fallen about the same and recovered about the same and is now pulling back about the same as it did in the last recession. The real difference in the economy of 2010 and the economy of 1975 is the LACK OF STIMULUS as the born-again deficit hawks in Congress have done their best to prevent any actual aid from reaching the people they supposedly represent. There is no point to the Fed engaging in Quantitative Easing, to put money into the economy, if that money isn’t spent. There is absolutely no point to the Fed buying Treasuries to keep rates low if the banks aren’t lending and the government isn’t spending, is there?

Government spending in a recession is an INVESTMENT in our (the people’s) future. We pay out Unemployment and Food Stamps to avoid catastrophe but that does nothing to CREATE jobs. When business spending is lacking and people aren’t being hired then it’s up to the Government of the United States to invest in America. China invested and continues to invest in China and they have to cool their economy down! German invests in Germany and their GDP has now been revised to DOUBLE what the initial projections were. The UK and the US, on the other hand, have 2 warring parties and the Conservatives of each nation have hamstrung the Government and both countries are stuck in the muck with their sleezeball politicians and special interest groups.

The only special interest this country should have is putting 10M Americans back to work so they won’t need Unemployment Insurance or Food Stamps or loan bailouts. Even if those 10M people only make the $30,000 a year paid to the bottom 90%, rather than the $300,000 a year that the top 10% averages, that’s still $3Tn in new wages and that generates $1Tn in new tax revenues, which pays back whatever we invest in putting America back to work - not to mention all the Unemployment Insurance and Food Stamps etc that we are spending anyway. And then that $3Tn flows back through the economy and Consumer Spending picks up and we once again have a strong economy - it’s not difficult - we just need the political will and vision to do what this country has successfully done many times before.

As Gordon Long points out this morning, Big Business no longer invests in America, Big Business does nothing more than suck money out of America to pay their employees overseas and hide their profits in offshore accounts and you drones just keep voting for it to continue over and over again and actually rally to protect the interests of these wealthy corporations and their wealthy CEOs and stockholders as they repeatedly rape and pillage your neighbors (as long as it’s not you, right). And why do you let it happen? Because you want to be one of "THEM"? Because sometimes when they trickle, a little bit of their wealth trickles on you?

The CPI was actually UP 0.3% this morning, not deflationary at all and Retail Sales were UP 0.4% vs -0.3% last month, when that report, among others sent us to back to 10,100 on the Dow and the S&P hit 1,056. If you listen to the MSM, you would think we should be far lower than that today and has one single person on TV mentioned Germany’s revised GDP was up 2.2%, from up 1.2% expected and is their fastest growth in 4 years?

No, you won’t hear any good news because good news won’t give tax breaks to the wealthy. Only fear of a catastrophe like 9/11 or this deficit-laden economic collapse can have people who make no money voting for cutting jobs and humanitarian programs in order for the people who have all the money to keep more of it in their banks (where they refuse to lend it or use it to invest in America or hire American workers). Welcome to the USS Ship of Fools!

Our friends at Goldman Sachs say there is a 25-30% chance of the US falling back into a recession and maybe an optimist would say there is a 70-75% chance that we won’t double dip but the official quote is: "As signs of slower U.S. growth has multiplied, market participants have become worried about the possibility of a double-dip recession. The probability is unusually high — between 25 percent and 30 percent - but we do not see double dip at the base case." Notice that in Bloomberg, the "but we do not see double dip at the base case" has been omitted. What a difference it makes where you get your news from!

Our levels are holding so far and our bets are still leaning bullish until we see 3 of 5 broken.

Have a great weekend,

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.