Emerging Stock Markets Thrive as U.S. Shares Tumble

Stock-Markets / Stock Markets 2010 Aug 16, 2010 - 05:42 AM GMTBy: Money_Morning

Jon D. Markman writes: As the U.S. stock markets struggle in the midst of slowing economic growth, emerging stock markets are thriving as their surging economies provide cover for savvy investors.

Jon D. Markman writes: As the U.S. stock markets struggle in the midst of slowing economic growth, emerging stock markets are thriving as their surging economies provide cover for savvy investors.

Stocks tripped over the past week after a weak jobless claims report and a lukewarm revenue outlook from Cisco Systems Inc. (NASDAQ: CSCO) on Thursday put an exclamation point on worries about a muddled Federal Reserve Bank policy. U.S. markets lost more than 4% in one of their weakest five-day spans of the year, including a 90% Downside Day on Wednesday that featured a rare event: All 30 stocks in the Dow Jones Industrials Average closed lower.

Small stocks had their throat slit, as the Russell 2000 plummeted below its 50-day and 200-day averages. It was the largest one-week loss for the index since early June when a Hungarian official compared his nation's debt woes to those of Greece. The index is back to early July, wiping out a month of gains. I'm not one to say "I told you so" but let me just note that we have strenuously recommended avoidance of the smalls in an effort to de-risk your portfolios.

Yet there were surprising bright spots: The emerging markets that I have been recommending were positively buoyant, with Thailand, Chile and India markets recording gains for the week, copper retaining its uptrend, and even in the United States underlying demand was not as weak under the surface as it appeared in the headline indexes.

It's weeks like this -- where the U.S. markets are down and Asian emerging markets are up -- that create the relative strength record we keep showing you. There's a great big world of economic growth out there that is manifesting itself in share prices much more buoyant than is being recorded in the United States.

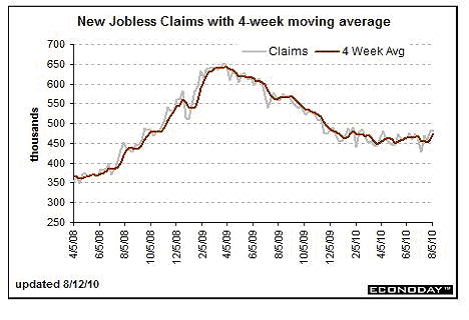

To be sure, investors have had plenty to worry about. The Fed downgraded its outlook for the economy earlier in the week and felt the situation was vulnerable enough to embark on another round of long-term bond purchases -- affectionately dubbed "quantitative easing" or more simply, money printing. And on Thursday, initial weekly jobless claims increased to the highest levels since February. The job market absolutely refuses to heal despite the fact economic output has been improving for more than a year.

There's also been plenty of bad news from Asia. In Japan, machine orders grew less than expected as a strong yen dampens the fortunes of the export-led economy there. Over in China, last month saw a slowdown in the growth rates of industrial production, fixed asset investment, retail sales, new bank loans, and money supply growth.

As a result, economists are recalibrating their expectations of economic growth in coming quarters. . Here in the United States, Deutsche Bank AG (NYSE: DB) economists now expect a sharp downward revision to Q2 GDP growth from 2.4% to just 1.1% as a result of reduced construction, inventories, and net exports. That's a huge change. They are also marking down their second half growth forecast as well: Q3 GDP grown declines to 3% from 4.6% and Q4 falls to 3.3% from 3.8%.

What's worse is that all of this comes after the Commerce Department downwardly revised economic growth data going back to 2007 -- showing that the recession was deeper than previously believed. So not only has the future dimmed, but we're in a deeper hole than previously thought. No wonder investors are acting as if they are confused: pushing stocks up by 200 Dow points one day, and down by 200 points the next day.

But not all hope is lost. Deutsche Bank analyst Joseph LaVorgna, who we think is on the ball, reported this week that his team believes the second half will put up stronger growth than the first half, and that the momentum will carry over to 2011. Key positives, in his mind: lower interest rates and a weaker dollar. In short: The Fed is on investors' side.

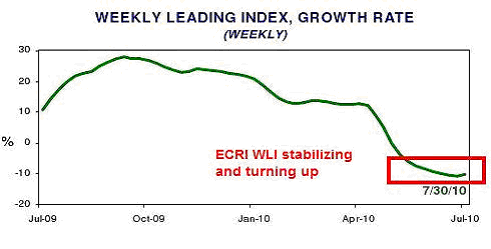

Eventually, this situation could very well push stocks higher, assuming the still vulnerable economy does not tip back into a new recession. Although recent data points have weakened, they are really telling us what the economy was doing back in June and July. A more real-time outlook is provided by leading indicators such as the ECRI's weekly leading index, or WLI. And as you can see in the chart above, it's starting, ever so slowly, to stabilize and inch higher again. This is a very sensitive measure, however, and could tip back over.

Remember that an ultra-low interest rate/slow growth environment is the best of all worlds for institutional investors. The economy is strong enough for companies to earn great profits, raise cash in the bond market, and return wealth to shareholders via M&A activity, share buybacks, or dividend hikes. But a lack of job creation and general weakness keeps central banks on hold, ensuring that investable capital is plentiful and available at low cost.

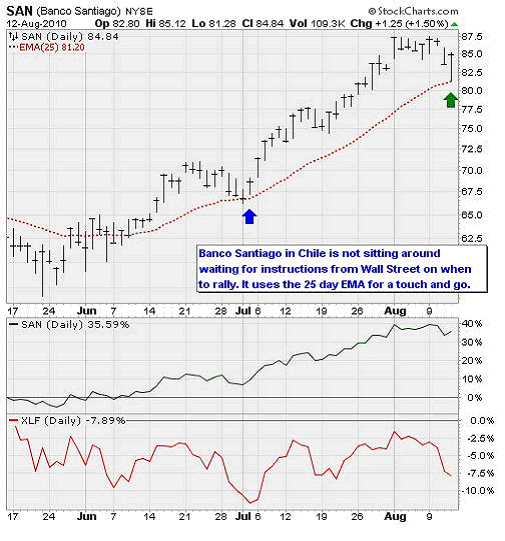

.Now of course that is just the United States, where we don't have a ton of exposure. Most of the equity guidance in my Strategic Advantage advisory service is toward emerging markets, and they have not been sitting around waiting for a green light from Wall Street. Banco Santander - Chile (NYSE ADR: SAN), shown in the chart above, has been one of the top bank stocks in the world for the past year, and it has kept up its leadership in the recent downturn.

In the top panel you can see how the Chilean bank's price has traded since mid-May; in the bottom two panels you can see it has posted a 35% gain during a time when the U.S. banks in the Financial Select Sector SPDR (NYSE: XLF) are down 7.6%. Santiago is not expensive, either, with a forward price/earnings multiple of 11, vs. 15% annual growth. That's value leadership, not pure momentum.

In short, for your risk capital the overseas markets are still the place to invest. The U.S. story may not be as horrible as the bears make it out to be, but it's still not the powerhouse that the emerging markets have a chance to be over the rest of the decade.

If you are looking for one positive in the data this week, here's one: The disparity between declining issues and advancing issues pushed the venerable Arms Index on Wednesday to levels typically associated with short-term bottoms. Also, the percentage of stocks above their 10-day moving average has fallen under 9%, which is super low.

The last time the Arms Index closed at these levels was back on June 4. Stocks posted another day of losses before reversing and slinging into the mid-June high. A similar scenario could well play out next week, since Wednesday was followed by two days of milder losses.

The bottom line though is that every day that clicks by we are more than likely getting closer to the end of the summer rally. So while the evidence suggests that bulls can have one last hurrah, my expectation is that they will get exactly one before it's time to blow out the candles on this party.

FED WATCHING

The Fed, in its statement on Tuesday, noted that the "pace of recovery in output and employment has slowed in recent months" but still expects the economy to grow in the months to come at a "more modest" rate than previously anticipated. This really wasn't news to anyone. We've seen a pullback in various leading indicators, from the new orders component of the Institute for Supply Management's indexes to the Conference Board's Leading Economic Index.

The Fed's move was politically expedient, as suggested on Monday, and largely meaningless. Failing to acknowledge the recent weakening of the economy would've weakened the central bank's credibility. Acknowledging the problem without loosening policy would've been seen as irresponsible. This was a middle ground that saved face and bought another month of deliberation.

In reality, nothing much changed. The repurchases will only amount to around $100 billion a year compared to the Fed's $2.3 trillion balance sheet. Thus, Paul Ashworth of Capital Economics in London dubbed the move a "largely symbolic gesture, designed to reassure the markets rather than boost the economy."

Let's keep it simple: The U.S. central bank remains on the side of investors, providing low interest rates and tons of liquidity and is prepared to provide more. What the economy does with that is dependent on a lot of other factors, but the main takeaway is that the Fed is on the case.

I continue to think that if necessary the Fed will whip out all the tactics that it tried during 2008-2009, and if those don't work it will try some new ones. The central bank has had virtually unlimited power for decades, but after the financial reform bill recently passed by Congress it has even more power. Call the Fed evil, misguided or inept if you will, but never, ever underestimate its creativity, resolve and stubbornness.

CHINA SYNDROME

Developed market investors were shaken this week by new evidence of a banking crisis in Ireland, second thoughts about the Fed's handwringing over the U.S. economy and a worrisome outlook from the Bank of England. But mainly the focus was on Asia.

Japanese machine orders rose less than expected in June -- 1.6% off of the 9.1% drop seen in May. Economists were expecting a 5.4% gain. Producer prices also posted an unexpected drop -- reviving worries over deflation in the land of the rising sun. Despite signs of a slowdown, on the pressures of a still climbing yen, the Bank of Japan has yet to take action.

Over in China, there was a litany of bad news to add to Tuesday's disappointing report on imports. Growth rates for industrial production, fixed asset investment, and retail sales slowed last month. In addition, new bank loans and money supply growth also slowed.

To be fair, the magnitudes of the changes were small: Industrial output fell from 13.7% in June to 13.4% in July, for instance. But it was enough to give a shock to sentiment since Chinese authorities are actively trying to pull back on the reigns of an economy that was beginning to overheat.

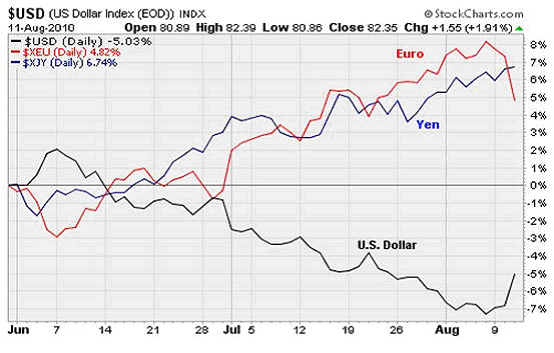

Here in the United States, there wasn't much to be happy about either. The trade gapped worsened more than expected as export fell 1.3% -- likely due to the reduced competitiveness of American goods due to a strong dollar and weak euro during the month of June. Unfortunately, according to Action Economics, the increase in the trade deficit could result in a significant downgrade to the government's initial Q2 GDP growth estimate of 2.4% to as low as 1%.

The good news is that the dollar has slipped significantly against both the euro and the yen since June -- which will provide a boost to U.S. competitiveness and help increase exports for July and August. The dollar is down nearly 18% against the euro from its June high and is down 15% against the yen -- a move that will provide a big boost to Q3 GDP growth.

The bottom line is that the global economy is slogging through a soft patch as the reverberations from the spring's European debt crisis and the withdrawal of fiscal stimulus slows things down. But a slowdown is not the same as a contraction. That may come later, but until evidence grows more undeniable the markets are going to trade in this herky-jerky, "I love you, I hate you, I love you," style. Get used to it.

Week in review

Monday: No major economic releases.

Tuesday: In Japan, the Bank of Japan decided to not take action to quell the recent rise in the yen -- threatening the profitability of Japanese exporters. Over in China, there was a larger than expected drop in imports, which led to questions about the vitality of Chinese shoppers.

But then the Federal Reserve, after downgrading its outlook for the economy, announced that it would reinvest the proceeds from its mortgage holdings into Treasury bonds. Effectively, this will stem the withdrawal of money from the capital markets we've seen lately, which will help keep interest rates low.

Wednesday: The U.S. trade balance worsened more than expected as export fell 1.3% -- likely due to the reduced competitiveness of American goods due to a strong dollar and weak euro during the month of June. Unfortunately, according to Action Economics, the increase in the trade deficit could result in a significant downgrade to the government's initial Q2 GDP growth estimate of 2.4% to as low as 1%.

Thursday: Initial weekly jobless claims increased to the highest levels since February -- increasing to 484,000 from 479,000 the previous week. This was well over expectations of 460,000. The job market absolutely refuses to heal despite the fact economic output has been improving for more than a year.

There's also been plenty of bad news from Asia. In Japan, machine orders grew less than expected as a strong yen dampens the fortunes of the export-led economy there. Over in China last month saw a slowdown in the growth rates of industrial production, fixed asset investment, retail sales, new bank loans, and money supply growth.

Friday: The latest read on the U.S. economy came this morning in the retail sales for July. On the surface, it was good: a little rebound after three down months. But the rebound was so small, at 0.4% month-over-month, that it's almost inconsequential.

And if you look deeper, you'll find that if you take out the 1.6% month-over-month gain in motor vehicle sales goosed by low interest rates and huge incentives, the number looks a lot worse: Furniture and clothing sales contracted for the fourth straight month; building materials sales fell for the third straight month; and food sales have fallen five straight months. And if you strip out the 0.3% increase in consumer prices in July, real sales only rose by 0.1%. So really, this was not a great report so early in a recovery.

The week ahead

Monday: The Empire State Manufacturing Survey will provide an update on factory output in the state of New York.

Tuesday: A read on inflation from the Producer Price Index and an update on industrial production.

Wednesday: The Energy Information Administration will provide an update on crude oil inventories.

Thursday: The Conference Board releases its Leading Economic Index for the month of July.

Friday: No major economic releases.

[Editor's Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source : http://moneymorning.com/2010/08/16/stock-markets/

Money Morning/The Money Map Report

©2010 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.