Silver Stocks Offer Value

Commodities / Gold & Silver Stocks Aug 17, 2010 - 03:03 PM GMTBy: Jordan_Roy_Byrne

In our last editorial we showed a few charts of our junior gold and junior silver indices.

In our last editorial we showed a few charts of our junior gold and junior silver indices.

Gold has moved well past its 2008 high and the same has happened with our junior gold index. Silver, at its recovery peak was within 7% off its 2008 high while our junior silver index was 25% off its 2008 high. While the junior silvers have recovered, they have lagged both the junior golds and Silver.

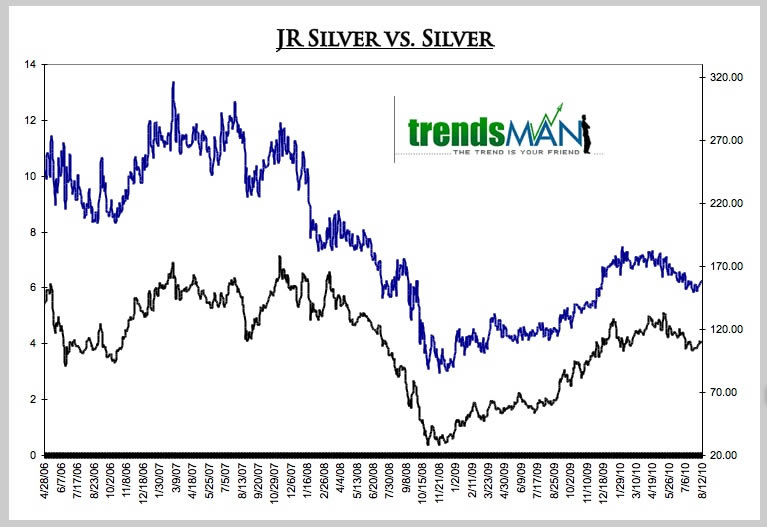

This chart shows our junior silver index (black) and our index versus Silver (blue).

The ratio fell from about 13.5 to 3.0 and now sits below 6.0. Much of the recovery in the junior silver stocks has come from the huge recovery in Silver rather than from a leveraged move in the shares. Is the market right about this? Are the silver stocks fairly valued here? Let’s take a look at some ratios, which can help explain the profitability of the silver stocks and answer those questions.

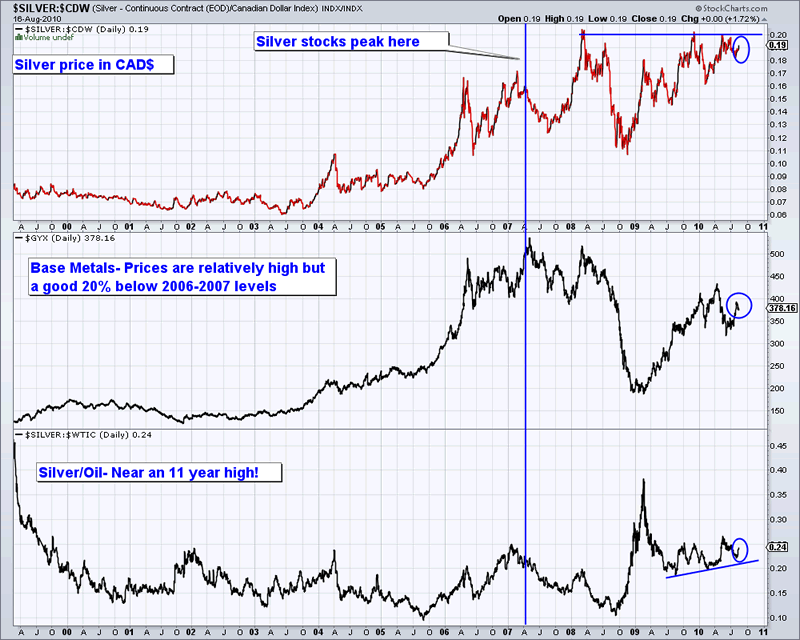

In the following chart we show three things: Silver in Canadian Dollars, Base Metals prices and Silver versus Oil. The vast majority of silver stocks are Canadian companies so the Canadian price of Silver is more important to them. We know that Oil comprises a large cost of mining and that many silver companies produce base metals in addition to Silver.

Since the peak in silver stocks, Silver in Canadian Dollars is almost 20% higher, Silver vs. Oil is marginally higher and base metals prices are a good 20% off their highs. This quick analysis indicates that silver producers, as a group, should have near record profits and perhaps even better profits than in 2007. This is the case as a handful of silver companies have recently reported excellent profits.

So why haven’t silver stocks gained more? First, the credit crunch and deflationary environment is initially most bullish for the gold sector. As we know, Gold always leads Silver. Second, the financial crisis has lead to more risk aversion. In such an environment Silver has difficulty escaping its partial status as an industrial metal.

Going forward, traders and investors should keep their eyes on the Silver sector. If the price of Silver can clear and hold above $20/oz, then most of the silver stocks can rise handsomely. Furthermore, the transition from a deflationary to inflationary environment should benefit the silver sector first and foremost.

Hence, in our premium service, we cover numerous silver companies and focus on our favorite juniors. We believe these stocks have more potential than junior golds and currently offer better value. You can try our service for free for 14 days.

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.