U.S. 3rd Quarter GDP Likely Negative, Recession Never Ended

Economics / Recession 2008 - 2010 Aug 23, 2010 - 05:07 AM GMTBy: Mike_Shedlock

While some people still think the odds of a double dip recession are close to zero, ironically, the only reason they may be right is if the first dip never ended.

Please consider last Friday's Breakfast With Dave, wherein Rosenberg stated U.S. RECESSION NEVER ENDED; GDP TO CONTRACT IN Q3

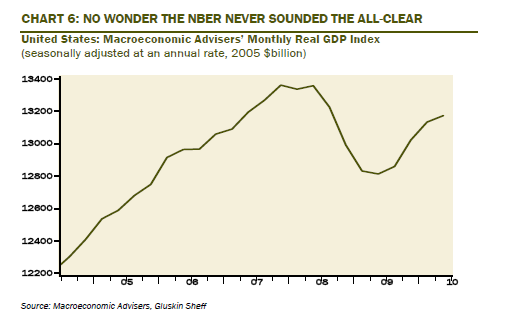

How Likely is a Double Dip?Our suspicions have been confirmed — the recession never ended. Macroeconomic Advisers produces a monthly U.S. real GDP series and it shows that the peak was in April, as we expected, with both May and June down 0.4% in the worst back-to-back performance since the economy was crying Uncle! back in the depths of despair in September-October 2008.

The quarterly data show that Q2 stands at a +1.1% annual rate (so look for a steep downward revision for last quarter) and the “build in” for Q3 is -1.5% at an annual rate. Depending on the data flow through the July-September period, it looks like we could see a -0.5% to -1% annualized pace for the current quarter. Most economists have cut their forecasts but are still in a +2.5% to +3.5% range. What is truly amazing is that despite all the fiscal, monetary, and bailout stimulus, the level of real economy activity, as per the M.A. monthly data, is still 2.5% below the prior peak. To put this fact into context, the entire peak to trough contraction in the 2001 recession was 1.3%! That is incredible.

Interestingly, and dovetailing nicely with our deflation theme, nominal GDP fell 0.3% in May and by 0.4% in June. This is a key reason why Treasury yields are melting.

Flashback June 25, 2010: ECRI Weekly Leading Indicators at Negative 6.9; How Likely is a Double Dip?

Inventory restocking contributed 1.88 of the reported 2.7 [first quarter annualized GDP].

Second quarter GDP may very well be flat or even negative and it is increasingly likely third quarter GDP will be negative.

Meanwhile the ECRI is still spouting "With coincident indicators, ranging from GDP, employment, income and sales, all showing simultaneous improvement, the U.S. economy is undoubtedly in a recovery".Flashback August 15, 2010: ECRI WLI "Flattens Out" at -9.8% - ECRI says "Gage is Fine"

I actually have the odds of a double-dip recession falling quite rapidly. Why? Because it is increasingly likely the recession that started in 2007 never ended.

Second quarter GDP will likely be revised way lower to 1.1% or so. Unless things improve, 3rd quarter GDP will contract. Amazingly, economists are still clinging to estimates of 2.5% and up.

So expect to discover the vast majority of economists will be surprised at the forthcoming downward revisions, even after we point these things out well in advance and repeat them.

Recent Surprises

- 58 out of 58 Economists Overoptimistic on Philly Fed Manufacturing Estimate; Median Forecast +7 Actual Result -7.7, a "Veritable Disaster"

- Weekly Unemployment Claims Hit 500,000, Exceed Every Economist's Estimate; No Lasting Improvement for 9 Months

The ECRI is still touting the "flattening" of the Weekly Leading Indicators (WLI) at -10. With the collapse in treasury yields, a print of -500,000 on weekly claims, and a god-awful Philly Fed report, let's watch the next few weeks. I suspect this "flattening" period will soon be over.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.