Stock Market May be Ready to Break Out of its Short-term Downtrend

Stock-Markets / Stock Markets 2010 Aug 29, 2010 - 07:59 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

Very Long-term trend - Down! The very-long-term cycles are down and if they make their lows when expected, the bear market which started in October 2007 should continue until about 2014-2015.

SPX: Intermediate trend.The index made an intermediate top at 1220 and is now in an intermediate downtrend which should come to an end in October 2010.

Analysis of the short-term trend is done on a daily basis with the help of hourly charts. It is an important adjunct to the analysis of daily and weekly charts which discusses the course of longer market trends.

Overview:

As stated above, the SPX is in a downtrend which, if the 4-year cycle obliges with its traditional pattern, should come to an end in October. Reinforcing this view is the fact that another cycle which has been very dominant in the past couple of years, the 17-wk cycle, is also due to make its low in October. "And (as they say in the TV commercials which advertise the $19.99 bargains) that's not all!" The 9-month cycle is also due to bottom in October. With this trio pointing to a bottom in the week of October 18, we'd better pay attention! There are already some indications that -- if this scenario prevails -- the final low on the SPX could be around 960-965.

If this is when (and where) the intermediate decline will end, the rally which started last week is only a rally in a downtrend and is not expected to be the beginning of a strong advance. We'll give it the benefit of the doubt. Friday's action was characterized by strong intra-day positive divergence in the A/D when the market sold off in the first hour, and this is normally a sign that the sharp downtrend is probably some sort of terminal climax marking the end of a trend -- in this case, the downtrend from 1099 or, most likely, from 1129.

On the Point & Figure chart, there was an area of distribution mostly between 1116 and 1129 which gave a phase count to about 1070, and a total count of 1045. We did find temporary support at the 1070 level, tested it again a few days later, but eventually continued the decline to the lower target where we have now made a double bottom.

Because we have now exhausted the full count from the 1116-1129 level, it is likely that we will spend some time above 1040 before moving lower. The re-accumulation level that was made as a result of the double bottom at 1040 has a potential count to about 1085 which would also happen to be a 50% retracement of the decline from 1129 to 1040. We should pay some attention to that level as a potential target for our interim rally.

Let's see if we find some justifications in the charts for this analysis.

Analysis

Chart Pattern and Momentum

Let's start with the Weekly SPX Chart so that we can refresh our perspective on the long term trend. My contention is that, in October of 2007, we started a secular bear market that should consist of three major legs. The first one was the bear leg which ended in March 2009 at 667. We are now in the bull leg which could continue into 2011 -- unless it already came to an end at 1220, on April 26. We should get a confirmation of the correct scenario after the 4-year cycle has made its low, ostensibly in October, depending on the amount of strength it can generate during its up-phase. Perhaps all it will do is provide a test of the 1220 high.

On the weekly chart, I have drawn several rising channels. The blue one represents the intermediate trend from March 2009 to April 2010. The green and purple channels are representative of the bull market phase. The lower trend line of the green channel could be penetrated by October. However, the purple one should hold until the entire bull phase has been spent.

The purple trend lines are parallels to the long-term channel from 2003 to 2007 which are drawn across the tops and bottom of the intermediate trend from March 2009 to April 2010. Similarly, the blue parallels which encompasses the recent consolidation were drawn as parallels to the intermediate blue channel. You can see how well they delimit the recent mid-point correction of the current intermediate downtrend.

I expect the bull-phase of the secular bull market to continue until prices come out of the wider channel. As for the top of the bull phase, the descending heavy red line may provide the resistance which will put a limit on the uptrend. If we should go through it, there is another one quite a bit higher which we will explore later, if necessary.

Now, let's look at the Daily Chart. The red channel encompasses the intermediate downtrend. On the bottom right, I have noted the expected time and price of the cycle lows. Depending on the action of the next few weeks, I may have to revise both time and price.

The steeper and smaller brown channel defines the short-term trend from 1129. Notice that on Friday, the index closed right on its downtrend line in a strong reversal which was supported by a very positive A/D. It would not be surprising if it traded higher and outside of it on Monday.

All the indices began to flatten out or turn up a few days ago, with the A/D (at the bottom) leading the way. This was a signal that we were coming into a low, and when the P&F projection was reached, the index reversed. As of Friday, only the A/D -- usually the first to do so -- has given a buy signal, but the others should not be far behind. We'll discuss potential targets under "Projections".

Please note that the decline stopped in the vicinity of the 1040 level which provided strong support at the end of May and early June. Because we seem to be reversing from this level, it gives the chart the appearance of a reverse Head and Shoulder pattern, with the neck line at 1130. I have considered the possibility that the 4- yr cycle might have bottomed in July in conjunction with the 2-yr cycle, as it did in 2006. If it has, we have made a reversal which is starting a very strong uptrend, and the H&S pattern will turn out to be valid. However, for the time being, I will only consider this possibility as a second choice to an October low. We should find out over the next couple of weeks which of the two scenarios is the right one.

We'll now move on to the Hourly Chart for a close look at Friday's action. A number of factors called our attention to an impending low point and reversal.

First, there was the P&F projection from the distribution level between 1116 and 1129 which had a target of about 1045.

Next, there was deceleration taking place in the index price. The low of 1040 fell way short of the bottom line of the descending channel.

Third, an important confirmation that the P&F target would cause a reversal: the A/D figures were improving rapidly and causing a number of higher lows in the raw hourly data going back to 8/19.

Now, all that was needed for a reversal to take place was a confirmation that we had found support at 1040 -- which came in the form of a double bottom on Friday -- and the breaking of the (blue) trend line which connects 1129 and 1099. We fell short of doing this on Friday, but it could come first thing on Monday morning.

After making a new recovery high above 1061 and instead of surging ahead, the SPX appeared hesitant, and although it kept pushing higher, there did not seem to be conviction in the move. For that reason, I held off giving a confirmed buy signal to my subscribers.

On the chart, you can see that 1085 is a 50% retracement of the move from 1129 to 1040. This is probably a good target, although there is a potential higher count. If we go higher, some more thought should be given to the H&S pattern. If we turn down before getting to that level, the October low will be a cinch.

Cycles

In 2006, the 4-yr cycle bottomed in July instead of October. This year, we had a low in July which was attributed to the 2-yr cycle. The weakness of the past two weeks is not yet a conclusive sign that the 4-yr cycle low is still ahead of us. If we start getting protracted market strength instead of weakness, we will have to consider the possibility that the 4-yr cycle made its low early, once again.

We are in the vicinity of a 26-td low. It may have bottomed on Friday. If not, Monday is the most likely alternate time frame.

A 39-td cycle is due about 9/10.

Projections

As stated earlier, the distribution level between 1116 and 1129 created a projection which has been satisfied. It is now normal to have a reaction in the opposite direction.

The amount of accumulation around 1040 is not substantial enough to cause the SPX to challenge its intermediate downtrend. At an extreme, it could sustain a move back up to the 1100 level.

The best scenario appears to be a 50% retracement to about 1085.

Breadth

The NYSE Summation index (courtesy of StockCharts.com) has shown an obvious reluctance to confirm the recent downtrend. This is a sign of internal strength .

The daily A/D indicators did not confirm the apparent market weakness in the decline from 1100.

This non-confirmation of the recent weakness is a sign that the short-term trend, at least, could be reversed.

Market Leaders and Sentiment

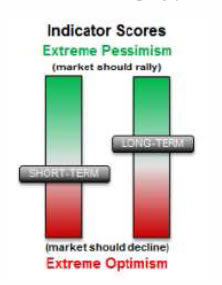

The SentimenTrader (courtesy of same) is giving us a similar picture. The long-term indicator has improved from neutral to slightly positive.

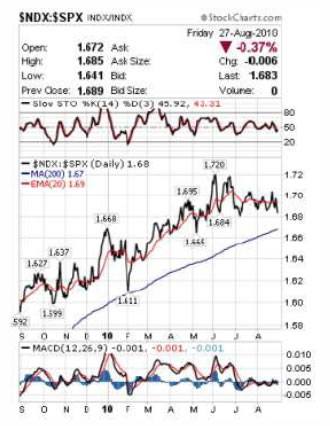

The NDX/SPX ratio (courtesy of SockCharts.com) continues to be neutral. Look at the MACD. It has been stuck at the "0" line since early July.

Gold

GLD has made a good recovery from its recent weakness. The rally has almost taken it back to the previous high. But look at the indicators. They show an overbought condition with negative divergence. This does not give us a picture of a rally which is ready to make new highs, but is more representative of the ETF being either in a long-term distribution pattern, or an extended sideways re-accumulation process which will eventually lead to new highs.

The next leg down will clarify which of the above two scenarios is the correct one. The entire move up to 123.50 had suggested that either a consolidation or a correction was due. This is what is happening.

Summary

The current market action suggests that the SPX may be ready to break out of its short-term downtrend. Although this could develop into something more as we go forward, the chart pattern does not point to an immediate challenge of the intermediate downtrend.

This presents a dilemma about whether or not the 4-yr cycle has already made its low, and how much weakness it will bring if it has not. We are eagerly waiting for some clarification which should come as a result of the market action over the next 2 or 3 weeks.

If precision in market timing is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate the claims made by the following subscribers:

Thanks for all your help. You have done a superb job in what is obviously a difficult market to gauge. J.D.

Unbelievable call. U nailed it, and never backed off. C.S.

I hope you can teach me about the market and the cycles. I want to be like you and be the best at it. F.J.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.