All Major Banks Oppose Honest Reporting To Hide Huge Loan Losses

Economics / Credit Crisis 2010 Aug 30, 2010 - 01:41 PM GMTBy: Mike_Shedlock

Reader "Henry" has a question on the loan loss provision chart I posted in Former Fed Vice Chairman vs. Mish: Is the Fed Out of Ammo?

Reader "Henry" has a question on the loan loss provision chart I posted in Former Fed Vice Chairman vs. Mish: Is the Fed Out of Ammo?

Henry writes ...

Hello Mish,

Thanks for writing and sharing your wonderful column. It has been very informative and educational.

Could you please help us mere mortals decipher the ALLL/LLRNPT chart in a follow up post?

I have difficulty reconciling the units, and I suspect I'm not the only one. Exactly what does that chart depict?

Thanks.

HenryFrom my previous post ...

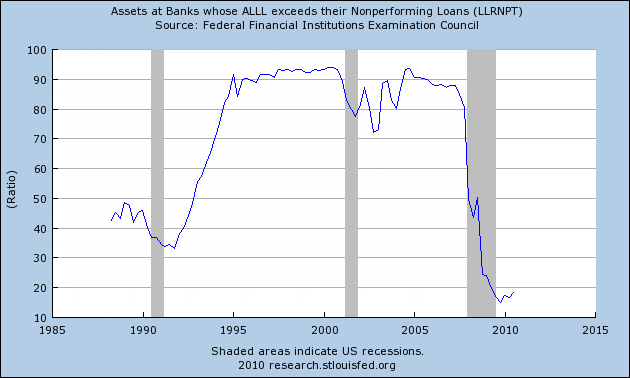

To further clarify, the chart depicts the ratio of loan loss provisions to nonperforming loans across the entire banking system (all banks). There are 33 ALLL charts by bank size and region for inquiring minds to consider. The above chart is the aggregate.Assets at Banks whose ALLL Exceeds their Nonperforming Loans

The ALLL is a bank’s best estimate of the amount it will not be able to collect on its loans and leases based on current information and events. To fund the ALLL, the bank takes a periodic charge against earnings. Such a charge is called a provision for loan and lease losses.

One look at the above chart in light of an economy headed back into recession and a housing market already back in the toilet should be enough to convince anyone that banks already have insufficient loan loss provisions.

That is one of the reasons banks are reluctant to lend. Lack of creditworthy customers is a second. Quite frankly would be idiotic to force more lending in such an environment.

The implication what the chart suggests is that banks believe nonperforming loans are NOT a problem (or alternatively they are simply ignoring expected losses to goose earnings).

The implication what I suggest is banks earnings have been overstated. Why? Because provisions for loan losses are a hit to earnings. I believe losses are coming for which there are no provisions.

The chart depicts a form of "extend and pretend" and overvaluation of assets on bank balance sheets. The Fed and the accounting board ignore this happening (encourage is probably a better word), hoping the problem will get better. With more foreclosures and bankruptcies on the horizon, I suggest it won't.

Magnitude of the Problem

The above analysis is only in percentage terms. Let's see if we can figure out in dollar terms how big the problem is. A few more charts that will help do just that.

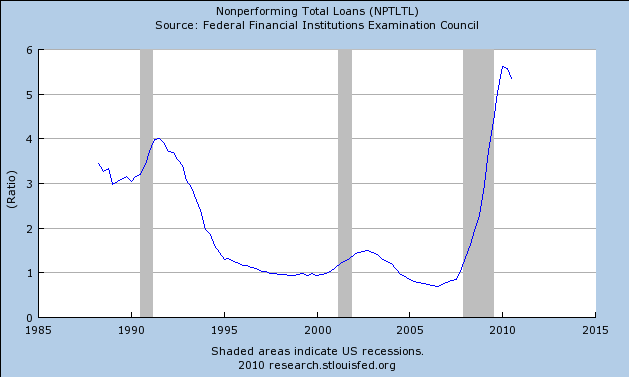

Nonperforming Total Loan Percentage

The above chart shows that 5.5% of loans are non-performing.

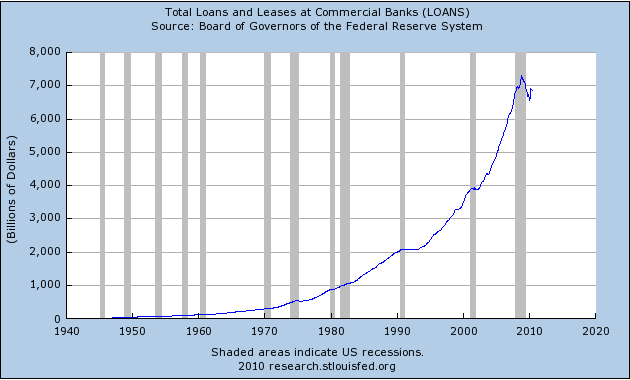

Total Loans and Leases

The above chart shows there are $7 trillion in total loans and leases. Of that 5.5% is nonperforming. Thus there are $385 billion of "admitted" nonperforming loans.

At the start of the recession, the first chart shows that banks had made a loan loss allowance for about 90% of non-performing loans. Now the figure is under 20%.

We are still not there yet, and this is where it gets fuzzy. Not all losses will be 100%, Some might be 10% others 80%. I cannot quantify the losses, I can just state there is a huge problem with insufficient loan loss provisions.

Charts Understate the Problem

The above charts understate the problem because there are hundreds of billions of dollars in nonperforming bank assets held off bank balance sheets.

We can add still more to the problem because of absurd mark-to-market valuations and the Fed and FDIC playing games with what constitutes a "nonperforming loan".

Banks Oppose Rule Changes

Inquiring minds note Wells Fargo “Strongly” Opposes FASB’s Rules on Loan Values

Wells Fargo & Co., the largest home lender in the U.S., said it disagrees with an accounting board’s plan that would require banks to report the fair value of loans on their books.

“We strongly oppose the expansion of fair value as the primary balance-sheet measurement attribute for virtually all financial instruments,” Wells Fargo Controller Richard Levy wrote in the Aug. 19 letter. “It will only serve to cement a short-term focus on fair-value measures.”

Wells Fargo, based in San Francisco, said the proposal would lead investors to put more emphasis on short-term results, eroding support for the banking system. The lender also said the new rule would mean deriving values for illiquid instruments like loans from subjective “Level 3” valuations such as models.All Major Banks Oppose Honest Reporting

Virtually all the banks are against honest reporting. Wells Fargo is leading the pack because of all the nonperforming Pay Option ARM and problem housing assets on its books.

The louder a bank screams, the more unprepared it is to deal with nonperforming loans and mark-to-market valuations of garbage held on its balance sheet.

Banks Recruit Investors To Kill Fair Value Proposals

Banks are so opposed to common sense rules that they have even recruited investors in a Campaign to Kill FASB Fair-Value Proposal

Banking lobbyists have launched an e- mail and Web campaign to mobilize investors against a proposed expansion of fair-value accounting rules that may force banks such as Citigroup Inc. and Wells Fargo & Co. to write down billions of dollars of assets.

The American Bankers Association opposes the Financial Accounting Standards Board’s plan to apply fair-value rules to all financial instruments, including loans, rather than just to securities. The group says the rule could make strong banks appear undercapitalized.

Fair-value, also known as mark-to-market accounting, forces companies to adjust the value of most securities they hold to market prices each quarter. It became one of the biggest flash points of the financial crisis when banks barraged lawmakers and the Securities and Exchange Commission with complaints that the rule exacerbated their problems because they had to record losses on mortgage bonds they had no intention of selling.

FASB in April 2009 relaxed that requirement after being pressured by lawmakers on a House Financial Services subcommittee. At the time, FASB Chairman Robert Herz said Congress stepped in because of complaints from banks and their trade groups.

The change raises the stakes for the 26 biggest U.S. banks, which currently value loans at $94.8 billion more than market prices, Barclays Capital analyst Jason Goldberg said.

San Francisco-based Wells Fargo said the fair value of its loans was $721.1 billion, or 3 percent less than the carrying value. Regions Financial Corp., based in Birmingham, Alabama, estimated loans were worth $70.2 billion, 15 percent less than the value reported on its balance sheet.Thus, the above charts and discussion only forms a framework of discussion for what losses banks are hiding on their balance sheets and off their balance sheets.

The starting point for discussion is not pretty, and beneath the surface the actual magnitude of the problem is worse than it looks.

Undercapitalized Banks

Banks are undercapitalized across the board because of these issues. Unfortunately, as noted above, it is purposely hard to accurately untangle this mess because of the lobbying effort by banks and the Fed's willingness to encourage extend-and-pretend games.

Those of you who keep asking "Why are banks reluctant to lend?" now have another solid reason.

Moreover, Obama administration policy errors compound the above problems. The result turns up in small business hiring trends.

Small Business Trends

- Small Business Trends - Yet Another Disaster

- Wells Fargo/Gallup Small Business Index Hits Record Low, Future Expectations Dip Below Zero First Time Ever

- Another Atlas Shrugs - Small Business Owners Chime In

- Small Businesses are Not Hiring - Why Should They?

The icing on the cake is that because of massive overcapacity and tapped out, deleveraging consumers, and misguided policies by the Obama administration, businesses do not want to borrow, expand, or hire.

The combined result is an amazingly toxic brew that will keep unemployment elevated for as long time.

Flashback August 18, 2009: Structurally High Unemployment For A Decade

Consumer demand is dead. That demand is not coming back anytime soon, and there is no driver for jobs if it doesn't.People manage to get hyperinflation out of this. The idea is laughable.

Harsh Reality From Bernanke

In the Incredible Shrinking Boomer Economy I noted a harsh reality quote of Bernanke:

"It takes GDP growth of about 2.5 percent to keep the jobless rate constant. But the Fed expects growth of only about 1 percent in the last six months of the year. So that's not enough to bring down the unemployment rate."

Pray tell what happens if GDP can't exceed 2.5% for a couple of years? What about a decade (or on and off for a decade)?

If you have come to the conclusion that we are going to have structurally high unemployment for a decade, you have come to the right conclusion. Ask yourself: Is that what the stock market is priced for?

Addendum

Off Balance Sheet Accounting at Citigroup and Wells Fargo

Inquiring minds may be interested in Wells Fargo's Balance Sheet: Scaring the Horses regarding off balance sheet exposure at Wells Fargo and Citigroup. The article is from February 2009, but the off balance sheet problem still exists.

Here is another Flashback, this one from April 16, 2009: Wells Fargo’s Profit Looks Too Good to Be True: Jonathan Weil

FDIC Allows Banks To Hide Insufficient Capital

Dateline December 15, 2009: FDIC Approves Giving Banks Reprieve From Capital Requirements

The Federal Deposit Insurance Corp. gave banks including Citigroup Inc., Bank of America Corp. and JPMorgan Chase & Co. a reprieve of at least six months from raising capital to support billions of dollars of securities the firms will be adding to their balance sheets.

Bank regulators including the FDIC and Federal Reserve want to permit a phase-in of capital requirements that rise starting next month under a change approved by the Financial Accounting Standards Board. The rule, passed in May, eliminates some off- balance-sheet trusts, forcing banks to put billions of dollars of assets and liabilities on their books.

Executives from Citigroup, JPMorgan, Bank of America, Wells Fargo & Co., Capital One Financial Corp. and the American Securitization Forum met FDIC officials Dec. 2 to discuss capital requirements related to the FASB measure.

The executives proposed that “the transition period should extend beyond 2010 to a point in the economy where unemployment is lower and issuers are less capital-restrained from growing their balance sheet and providing credit,” according to a paper the ASF presented the FDIC.

Citigroup suggested three years to offset assets and liabilities brought onto balance sheets, Chief Financial Officer John Gerspach said in an Oct. 15 letter to regulators. Requiring banks to “assume the risk-based capital effects immediately, or even over one year, is an undeniably severe penalty,” he wrote.Banks in general are sitting on assets, not marked-to-market, both on and off their balance sheets, for which they have made no loan loss provisions, while credit risk for new loans is exceptionally high.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.