Key Stock Market Index Re-Entry Price Minimums

Stock-Markets / Stock Markets 2010 Sep 06, 2010 - 04:42 AM GMTBy: Richard_Shaw

Stocks had a good week this week. They may follow through, or they may stall and reverse. Only time will tell, and that time is near.

Stocks had a good week this week. They may follow through, or they may stall and reverse. Only time will tell, and that time is near.

While we hold positions in some strong single country funds, and some conservative high yield US individual stocks, we have been mostly on the sidelines for a few months.

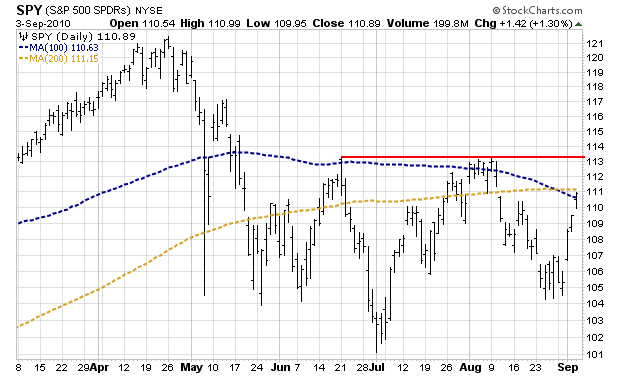

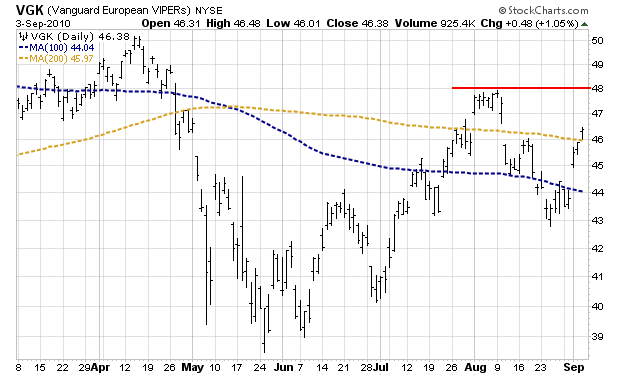

The April highs are some distance away for most broad equity indexes, but recent short-term highs are within close reach.

Here are minimum prices that we think should be exceeded before conservative investors consider adding to positions in broad indexes. Even then, the intermediate trend for most of the broad equity indexes is down, which means remaining nimble is important for those who are anxious to add to risk positions now.

If a new up trend is around the corner, there will be plenty of upside, even if you wait for a bit of proof. If a stall and reversal is ahead, waiting for more proof could avoid disappointing and painful losses.

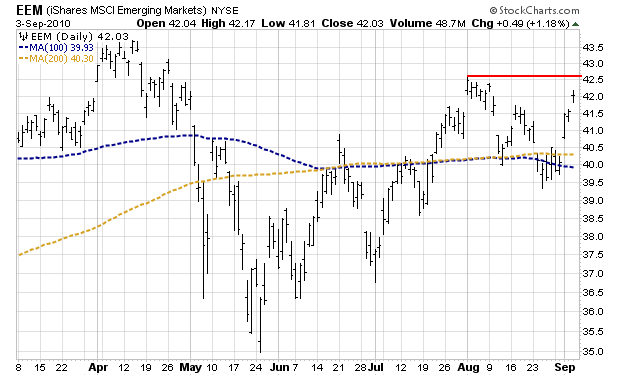

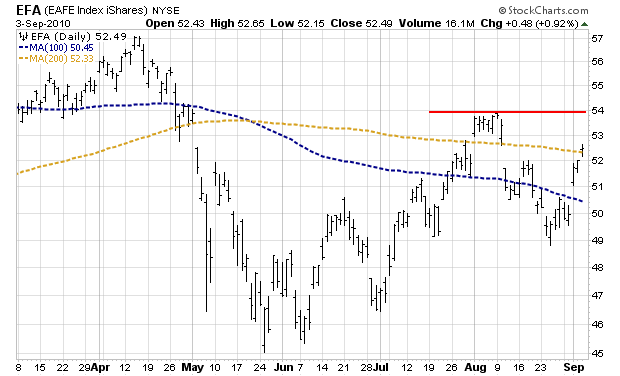

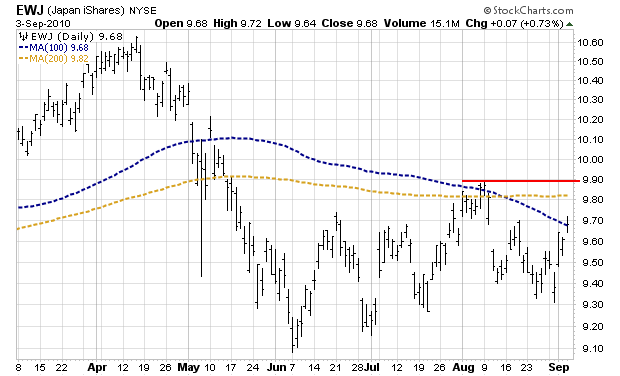

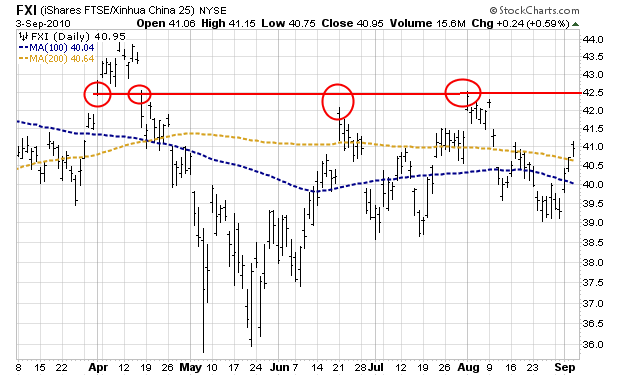

In each case, the minimum target is above the recent short-term highs, as shown by the red horizontal line on each chart below.

Securities Cited: SPY, EFA, EEM, VGK, EWJ, FXI.

Holdings Disclosure: As of September 3,2010, we do not own any mentioned security in any managed account.

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2010 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.