U.S. Labor Day Insanity from Clinton's Secretary of Labor

Politics / US Politics Sep 06, 2010 - 02:30 PM GMTBy: Mike_Shedlock

It's Labor Day. The markets are closed. Those working for government, banks, schools etc have the day off. All totaled, 17.3 million citizens do not have a job today nor a job they can return to on Tuesday. Another 8.9 million will not work as many hours as they would like, this week, next week, or the week after that.

How NOT to End the Great Recession

In a New York Times Op-Ed, Robert B. Reich, a secretary of labor in the Clinton administration, and professor of public policy at the University of California, Berkeley comes to all the wrong conclusions about where we are, how we got here, and what to do about it.

Please consider How to End the Great Recession

Reich: THIS promises to be the worst Labor Day in the memory of most Americans. Organized labor is down to about 7 percent of the private work force. Members of non-organized labor — most of the rest of us — are unemployed, underemployed or underwater.

Mish Comment: When organized labor is at 0%, both public and private, we will be on our way to prosperity. Organized labor in conjunction with piss poor management bankrupted GM and countless other manufacturing companies. Now, public unions, in cooperation with corrupt politicians have bankrupted countless cities and states.

Reich: The Labor Department reported on Friday that just 67,000 new private-sector jobs were created in August, while at least 125,000 are needed to keep up with the growth of the potential work force.

The national economy isn’t escaping the gravitational pull of the Great Recession. None of the standard booster rockets are working: near-zero short-term interest rates from the Fed, almost record-low borrowing costs in the bond market, a giant stimulus package and tax credits for small businesses that hire the long-term unemployed have all failed to do enough.

That’s because the real problem has to do with the structure of the economy, not the business cycle. No booster rocket can work unless consumers are able, at some point, to keep the economy moving on their own. But consumers no longer have the purchasing power to buy the goods and services they produce as workers; for some time now, their means haven’t kept up with what the growing economy could and should have been able to provide them.Mish Comment: Consumers no longer have the purchasing power because of a number of factors.

1. Loose monetary policies at the Fed that encouraged asset speculation, including housing.

2. Rampant property price escalation (until the crash) and rampant property tax increases even though wages did not keep up.

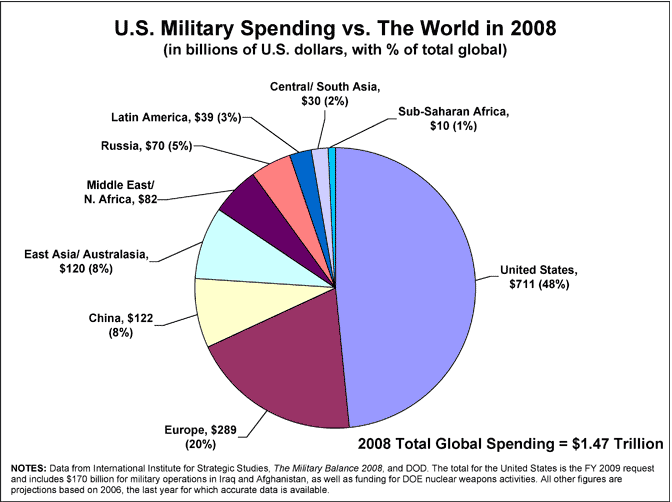

3. A sinking dollar because of inane amounts of government spending. The US has troops in 140 countries around the globe, and a military budget as nearly big as the rest of the world combined.

Quite literally we are spending ourselves to death, with absolutely nothing to show for it.

The above chart from The FY 2009 Pentagon Spending Request - Global Military Spending

It's not what one makes that matters, it's how far the dollar goes. Our policies ensure the dollar does not go very far.

Reich: This crisis began decades ago when a new wave of technology — things like satellite communications, container ships, computers and eventually the Internet — made it cheaper for American employers to use low-wage labor abroad or labor-replacing software here at home than to continue paying the typical worker a middle-class wage. Even though the American economy kept growing, hourly wages flattened. The median male worker earns less today, adjusted for inflation, than he did 30 years ago.

Mish Comment: The crisis started when Congress perpetually spent more money than it took in, when social engineering and regulation made it undesirable to do business in the United States, when tax policy encouraged flight of jobs and capital. The internet was an enabler, it is not to blame.

Reich: Eventually, of course, the debt bubble burst — and with it, the last coping mechanism. Now we’re left to deal with the underlying problem that we’ve avoided for decades. Even if nearly everyone was employed, the vast middle class still wouldn’t have enough money to buy what the economy is capable of producing.

Mish Comment: The underlying problems still remain. Unfortunately Robert Reich is clueless about what the underlying problems are.

Reich: THE Great Depression and its aftermath demonstrate that there is only one way back to full recovery: through more widely shared prosperity. In the 1930s, the American economy was completely restructured. New Deal measures — Social Security, a 40-hour work week with time-and-a-half overtime, unemployment insurance, the right to form unions and bargain collectively, the minimum wage — leveled the playing field.

Mish Comment: Payment for the absurd policies of FDR are now coming due. Social Security is broke, there is no "lock box" demographics are unfavorable, and acts like Davis Bacon and collective bargaining have wrecked many cities and states.

When it comes to jobs creation, we need to get the most done for the cheapest amount and the way to do that is scrap the Davis-Bacon act. Please see Thoughts on the Davis Bacon Act for details.

Socialists like Robert Reich point out alleged benefits of FDR's policies. The Fact of the matter is FDR's policies were extremely destructive.

The baby boom following WWII is what got the economy humming, not inept policies or unions. We recovered in spite of piss poor policies, not because of them. Indeed unions sewed the seeds of their own destruction which is exactly why only 7 percent of the private work force is unionized. We need to celebrate this fact, not bemoan it.

In the decades after World War II, legislation like the G.I. Bill, a vast expansion of public higher education and civil rights and voting rights laws further reduced economic inequality. Much of this was paid for with a 70 percent to 90 percent marginal income tax on the highest incomes. And as America’s middle class shared more of the economy’s gains, it was able to buy more of the goods and services the economy could provide. The result: rapid growth and more jobs.

By contrast, little has been done since 2008 to widen the circle of prosperity. Health-care reform is an important step forward but it’s not nearly enough.Mish Comment: Once again Reich does not understand what it takes to create jobs in the real world. Reich lives in academia, insulated in his womb of academic theory, theories that anyone living in the real world can easily see are fatally flawed in today's world.

It would behoove Reich to read Small Business Trends - Yet Another Disaster

From the NFIB ...

The expiration of the Bush tax program and the implementation of the health care bill represent the two largest tax increases in modern history. Add to that serious talk of a VAT and passing cap and trade. Nothing here to create optimism about the future for business owners or consumers. Top that off with government borrowing of $1.8 trillion last year and $1.5 trillion this year and on into the future, it is no surprise that owners are fearful and pessimistic.

What’s missing from the “debate” is logic. Policies should not violate common sense and logic, if they do, they are misleading and disguising a hidden agenda. Arguing that more government spending and taxes are needed to re-establish optimism, confidence and growth doesn’t meet the common sense test. Saving bankrupt companies to preserve union jobs doesn’t make sense either. The list of these “policy inconsistencies” is long.

Bottom line, owners remain pessimistic and nothing is happening in Washington to provide encouragement. Confidence is lost.

Plight of Small Businesses

I have written extensively about the plight of small businesses. Here are some examples Reich needs to consider.

- August 03, 2010: Wells Fargo/Gallup Small Business Index Hits Record Low, Future Expectations Dip Below Zero First Time Ever

- August 20, 2010: Small Businesses are Not Hiring - Why Should They?

- August 24, 2010: Another Atlas Shrugs - Small Business Owners Chime In

Reich: What else could be done to raise wages and thereby spur the economy? We might consider, for example, extending the earned income tax credit all the way up through the middle class, and paying for it with a tax on carbon. Or exempting the first $20,000 of income from payroll taxes and paying for it with a payroll tax on incomes over $250,000.

In the longer term, Americans must be better prepared to succeed in the global, high-tech economy. Early childhood education should be more widely available, paid for by a small 0.5 percent fee on all financial transactions. Public universities should be free; in return, graduates would then be required to pay back 10 percent of their first 10 years of full-time income.Mish Comment: Small business owners and entrepreneurs are scared to death of the lunacy of Cap-and-Trade. It gives existing businesses the right to sell energy credits they "earned" because they are currently a polluter. New businesses will pay the price.

Cap-and-Trade also opens up ridiculous financial trading of these credits and their derivatives for the benefit of Goldman Sachs and the other broker-dealers.

Cap-and-Trade is preposterous, not only in theory but actual practice. For example, please consider Cap-and-Trade Carbon Credit Extortion Scam In Full Swing.

Here is another example of the stupidity of Cap-and-Trade: Walmart, Costco, US Bank Profit From Energy Credits in US; Carbon Tax Thrown Out By French Court

Reich: Another step: workers who lose their jobs and have to settle for positions that pay less could qualify for “earnings insurance” that would pay half the salary difference for two years; such a program would probably prove less expensive than extended unemployment benefits.

These measures would not enlarge the budget deficit because they would be paid for. In fact, such moves would help reduce the long-term deficits by getting more Americans back to work and the economy growing again.

Policies that generate more widely shared prosperity lead to stronger and more sustainable economic growth — and that’s good for everyone. The rich are better off with a smaller percentage of a fast-growing economy than a larger share of an economy that’s barely moving. That’s the Labor Day lesson we learned decades ago; until we remember it again, we’ll be stuck in the Great Recession.Conclusion

Reich, is blinded by academic theory. He does not understand business in the real word. He cannot distinguish between the problem and the solution. He never once discusses how the "haves" (overpaid unionized public workers), are destroying private ordinary taxpayers.

Reich wants socialistic policies that will provide further incentives for businesses to move overseas.

The one book Reich desperately needs to read is "Plunder" by Steve Greenhut. For a book review, please see Five Thumbs Up for Steve Greenhut's Plunder!

There can be, nor will there be any recovery until the wage discrepancies and pension benefits of the public sector are brought in line with those of the private sector, not by increasing private sector wages but by reducing insane benefits of the public sector. In addition we need better tax policies and we need to rein in absurd military spending.

Finally I would be remiss if I failed to point out the self-serving educational proposals of Reich. Education costs are soaring right now and there are cries for more to do it "for the kids".

We are not doing it for kids, we do it for teachers and administrators. Wages and benefits are preposterous enough already. The irony is most professors seldom teach. Instead students are taught by substitutes while the professors entertain self-serving research projects to justify their inflated salaries and egos.

Thus, Reich cannot possibly be further off in his solutions to the crisis. Such is to be expected from socialist academics living in self-serving academia instead of the real world.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.