Gold Strong in All Currencies, a Whisker from New Intra Day Record Dollar High

Commodities / Gold and Silver 2010 Sep 08, 2010 - 05:40 AM GMTBy: GoldCore

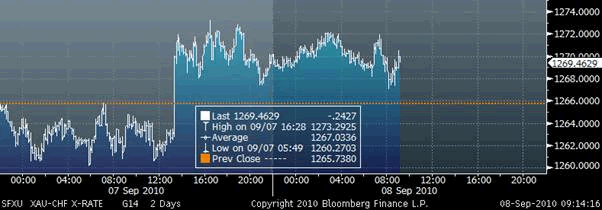

Gold rose again yesterday and had a new record daily high close (nominal) as renewed concerns about European banks and sovereigns led to a flight to the relative safety of US Treasuries, German bunds, the yen and the Swiss franc. Gold also rose in yen and Swiss franc terms yesterday showing that it is increasingly trading as a currency rather than a commodity. Gold surged in the euro and is again challenging the €1,000/oz level.

Gold rose again yesterday and had a new record daily high close (nominal) as renewed concerns about European banks and sovereigns led to a flight to the relative safety of US Treasuries, German bunds, the yen and the Swiss franc. Gold also rose in yen and Swiss franc terms yesterday showing that it is increasingly trading as a currency rather than a commodity. Gold surged in the euro and is again challenging the €1,000/oz level.

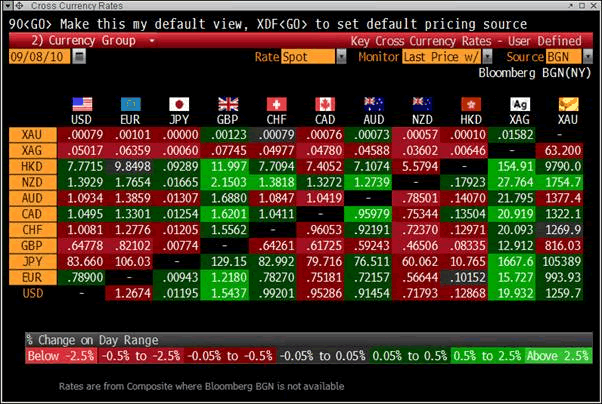

Gold is currently trading at $1,258.10/oz, €991.64/oz, £814.73/oz.

Gold in Swiss Francs - 2 Day (Tick)

Gold in Yen - 2 Day (Tick)

Gold for December delivery added $8.20 to settle at $1,259.30 an ounce after reaching $1,261.60/oz earlier in the day. Its record high settlement price was $1,258.30 an ounce, although it has reached an intraday high of $1,266.50 an ounce on June 21st. Gold could continue to rally in the traditionally strong September and autumn months and should it breach new record intraday highs, gold will likely target the $1,300/oz level, especially as demand in India and Asia continues to be robust. This is especially the case in India as we enter the festival season as seen in Indian premiums overnight.

Investors are continuing to use gold as a hedge against financial and economic risk which has again increased as seen in widening spreads between 10-year German bond yields and those of Irish and Portuguese debt which climbed to all-time highs yesterday, while the German-Greek yield spread increased to the widest since May.

Cross Currency Rates at 1000 GMT

This morning the Portugal German 10 year yield spread has widened to a new EMU record, as has Ireland's 10-year spread which is 7bps wider at +395bps. Italy and Spain's debt markets have also come under pressure again this morning - Italy's 10-year spread is 4bps wider at +155bps and Spain's 10-year spread is 3bps wider at +176bps.

Greece's 10-year spread is 4bps wider at +946bps after the worrying news that four months after the 110 billion-euro ($140 billion) bailout for Greece, the nation still hasn't disclosed the full details of secret financial transactions it used to conceal debt.

Silver

Silver peaked over the $20/oz level briefly before giving up the early gains and closed marginally higher. The COT data for silver is bullish as it shows that open interest levels remain below the levels seen in March 2008 when silver reached its record high of $20.81/oz. Silver has broken resistance and a close above $20/oz could lead to further sharp moves up and a challenge of the March 2008 highs.

Silver is currently trading at $19.90/oz, €15.68/oz and £12.88/oz.

Platinum Group Metals

Platinum is trading at $1,550.75/oz, palladium is at $522/oz and rhodium is at $2,050/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.