Bulls Are About to Move the Stock Markets Higher

Stock-Markets / Stock Markets 2010 Sep 08, 2010 - 07:45 AM GMTBy: David_Banister

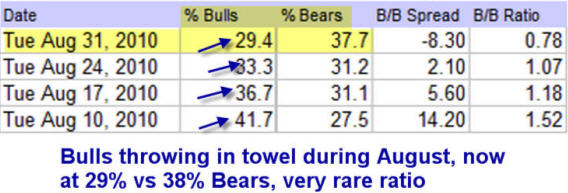

I’ve been busy counting the months of correction since Mid-April this year when I forecasted a top in the U.S. Markets following a massive 13 month rally off the March 2009 lows. The theory I had at the time was that the % of bulls in sentiment surveys was running at nearly 3 to 1 over Bears. 57% of those surveyed were Bullish in Mid-April and only 20% were Bearish. In addition, we had completed a clear 5 wave bullish pattern up from the March 2009 lows, and the time period of the rally was also a Fibonacci ratio.

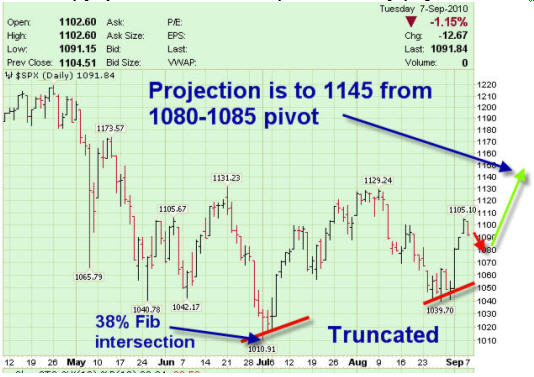

Since that time, we have dropped to as low as 1011 on the SP 500, which is a 38% Fibonacci intersection of the 2007 highs to 2009 lows, and also the 2009 lows to 2010 highs. This created a platform for a calendar year bottom, and since then we have marked some time rallying up to Fibonacci pivots and back down again.

The most recent action is what really caught my eye and my subscribers were made aware a few weeks ago to prepare for a rally. The drop from 1130 to 1040 on the SP 500 was a “corrective pattern”, meaning it was in a three wave formation. 60 points down to 1070, 30 points up to 1100, and another 60 points down to 1040. This also lined up with the May 25th bottom and is yet another Fibonacci intersection. The rally up last week was extremely strong off the lows, and admittedly probably caught some bears off guard and caused short covering as well. What really woke me up as I did my research over the weekend was the sentiment surveys through last Tuesday.

The percentage of Bulls in the survey had dropped to 29% whilst the Bears had roared ahead to just over 37%. This is the first time that the Bears had been this high in the surveys in a very long time, and in addition, the last time the Bulls percentile readings were nearly this low was back in March of 2009, at 26%. Typically these types of readings when coupled with what I believe to be bottoming or “corrective” wave patterns often lead to big rallies and catch people off guard. Conversely, overly bullish readings as in Mid April concomittant with certain Elliott Wave patterns I identify often lead to tops as well.

What I expect now is a pullback to 1080, possibly 1070-1074 on the SP 500, and then a large rally to roughly 1145. This will encounter some resistance there as it also is a 61.8% Fibonacci pivot of the 2010 highs and the 2010 lows. The pendulum appears to be swinging back to the Bulls, and I expect that following the first full week of October we will be rallying up past 1160 on the SP 500 and then challenging the 1220 highs of April of this year.

A side note on Gold and Silver as well: I wrote a forecast on silver last week with silver at $18.73 an ounce predicting an imminent move above $19.50 with a breakout leading to $26-$29 per ounce over several months. At this time I favor Silver over Gold performance wise for the foreseeable future, and I still like Gold moving to the $1300-$1325 per ounce level in the coming months.

Below is my projected SP 500 chart recently released to our paying subscribers at TMTF.

Please considering subscribing or enjoying our free weekly reports at www.MarketTrendForecast.com

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2010 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.