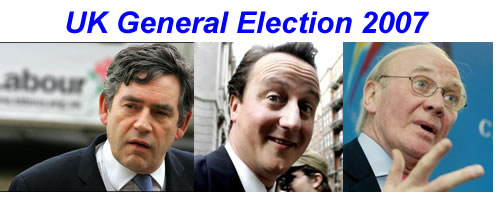

Labour Opinion Poll Boost - Over 80% of Voters Expect Labour to Win an October Election

ElectionOracle / UK General Election Sep 27, 2007 - 02:49 AM GMTBy: Nadeem_Walayat

A poll conducted by the Market Oracle gives labour a further boost which suggests that 83% of voters believe that Labour would win an October General Election. The Labour party conference draws to a close at mid-day today and despite election fever there is no sign that Gordon Brown is about to declare an imminent general election.

A poll conducted by the Market Oracle gives labour a further boost which suggests that 83% of voters believe that Labour would win an October General Election. The Labour party conference draws to a close at mid-day today and despite election fever there is no sign that Gordon Brown is about to declare an imminent general election.

The Poll conducted from Sunday 23rd Sept, right up to this morning asked the following question:

VOTE NOW - Should Gordon Brown go for an October General Election ?

- Yes - Because Labour would win (43%)

- Yes - Because Labour would lose (13%)

- No - Because Labour would lose (4%)

- No - Because Labour would win. (40%)

An analysis of the results clearly shows that the vast majority of Labour supporters and opponents both conclude that a Labour victory in an October Election is virtually guaranteed, [1) 43% plus 3) 40% = 83%]

The news is even better for Labour when analysing Labour opponents alone, which suggests 75% of Labour opponents expect labour to win an October election [4) Divided by (2) 43% plus 3) 40%) = 75%] . At the same time 17% of all voters and 15% of Labour only supporters think that Labour would lose an October election.

Labour's overall poll standing is at 47%, which compares against other polling results putting labour at 44%, therefore Labour retains the momentum going into October.

The Market Oracle poll confirms the view that Gordon Brown should seize the opportunity and go to the polls now whilst he is riding high, and especially as his opponents are in disarray.

If Gordon Brown delays then he may come to regret that decision as a deteriorating economy on the back of record debt, banking credit crunch and an anticipated UK housing bust that is already underway. Additionally postponing the election will allow the Tories to get their act together and present a credible alternative to the electorate.

Another negative factor in delaying, is that the British people may eventually come to the opinion that there is little difference between Tony Blair and Gordon Brown, and that they really do want a fresh start. The truth of the matter is that despite the speeches and avoidance of the mention of Tony Blair's name during the much of the conference, there is little difference between the polices of Gordon Brown and that of Tony Blair.

Notes:

* At the time of posting this article, a total of 171 votes have been cast between Sunday 23rd Sept and Thursday 27th September.

* The article Snap UK General Election Before the Economic Slump Hits? - Vote Now! , highlighted the reasons both for and against an Snap General Election this autumn.

* The Poll Remains Open

Click Here to Vote Now (registration not necessary)

Click Here for Results so far.

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

Nadeem Walayat is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.