Yen Intervention: Impact on U.S. Dollar, Copper, Oil, Silver, and Gold

Stock-Markets / Financial Markets 2010 Sep 16, 2010 - 11:36 AM GMTBy: Chris_Ciovacco

In today’s global environment of slower growth and high debt levels, no country wants a strong currency. Japan has seen the yen rise more than 10% since May, which has exporters very uneasy in the Land of the Rising Sun.

In today’s global environment of slower growth and high debt levels, no country wants a strong currency. Japan has seen the yen rise more than 10% since May, which has exporters very uneasy in the Land of the Rising Sun.

Japan’s estimated $20 billion foreign exchange intervention on Wednesday leads to a logical question of the potential longer-term impact on the U.S. dollar and commodities. While intervention can play a role in the currency markets in the short-to-intermediate term, market forces that were in place prior to the intervention will most likely continue to impact the U.S. dollar, copper, oil, silver, and gold.

According to the Wall Street Journal:

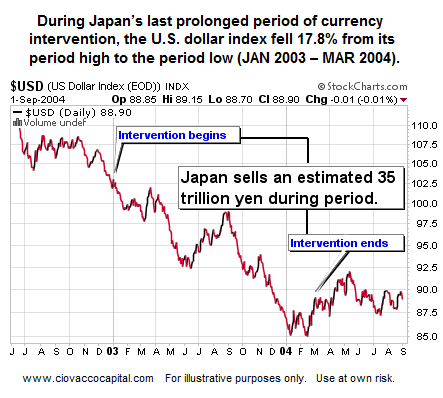

If history is any guide, Wednesday’s intervention was just the opening salvo. When Japan last intervened in the market to push the yen down, it sold an estimated 35 trillion yen ($421 billion) from January 2003 to March 2004.

The chart below shows the performance of the U.S. dollar index during the last period of yen (FXY) intervention by Japan.

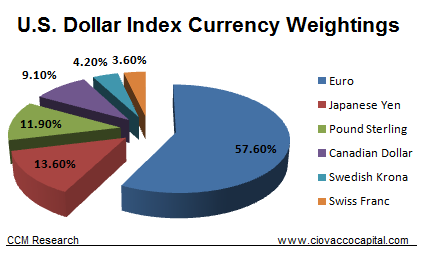

Since the yen makes up only 13.6% of the U.S. dollar index (UUP), it is understandable intervention by Japan may have a somewhat muted effect relative to the dollar’s longer-term path.

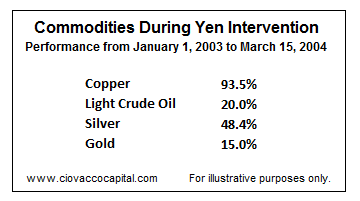

Since commodities are often used as a way to hedge against a weak dollar, we also looked at the commodities markets during the last prolonged yen intervention period. Like the U.S. dollar, the commodity markets were most likely driven by the fundamentals of the day more so than any actions by Japan.

Therefore, based on this one anecdotal piece of evidence, our longer-term outlook relative to the dollar and the commodities markets may not need a significant adjustment due to Wednesday’s episode of yen intervention. Shorter-term, there may be a reluctance to butt heads with policymakers in Japan while taking the other side of the trade. With a meeting coming next week, you can bet the Fed is keeping a close eye on developments in Japan. More comments and a chart of longer-term trends in the U.S. dollar (or lack thereof) can be found in a recent post, Pimco’s Bill Gross Aligns with Warren Buffet in Bet against Deflation.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.