The Chances of a Double Dip Economic Recession

Economics / Double Dip Recession Sep 18, 2010 - 10:58 AM GMTBy: John_Mauldin

I am on a plane (yet again) from Zurich to Mallorca, where I will meet with my European and South American partners, have some fun, and relax before heading to Denmark and London. With the mad rush to finish my book (more on that later) and a hectic schedule this week, I have not had time to write a letter. But never fear, I leave you in the best of hands. Dr. Gary Shilling graciously agreed to condense his September letter, where he looks at the risk of another recession in the US.

I am on a plane (yet again) from Zurich to Mallorca, where I will meet with my European and South American partners, have some fun, and relax before heading to Denmark and London. With the mad rush to finish my book (more on that later) and a hectic schedule this week, I have not had time to write a letter. But never fear, I leave you in the best of hands. Dr. Gary Shilling graciously agreed to condense his September letter, where he looks at the risk of another recession in the US.

I look forward at the beginning of each month to getting Gary's latest letter. I often print it out and walk away from my desk to spend some quality time reading his thoughts. He is one of my "must-read" analysts. I always learn something quite useful and insightful. I am grateful that he has let me share this with you.

If you are interested in getting his letter, his website is down being redesigned, but you can write for more information at insight@agaryshilling.com. If you want to subscribe (for $275), you can call 888-346-7444. Tell them that you read about it in Thoughts from the Frontline, and you will get an extra one month on your subscription. And now, let turn to Gary.

The Chances of a Double Dip

By Gary Shilling

Investor attitudes have reversed abruptly in recent months. As late as last March, most translated the year-long robust rise in stocks, foreign currencies, commodities and the weakness in Treasury bonds that had commenced a year earlier into robust economic growth - the "V" recovery.

As a result, investors early this year believed that rapid job creation and the restoration of consumer confidence would spur retail spending. They also saw the housing sector's evidence of stabilization giving way to revival, and strong export growth also propelling the economy. Capital spending, led by high tech, was another area of strength, many believed.

Not So Fast

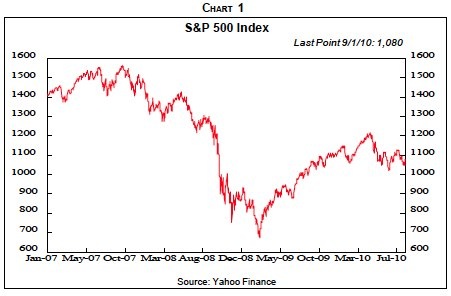

But a funny, or not so funny, thing happened on the way to super-charged, capacity-straining growth. In April, investors began to realize that the eurozone financial crisis, which had been heralded at the beginning of the year by the decline in the euro, was a serious threat to global growth. Stocks retreated (Chart 1 ), commodities fell and Treasury bonds rallied and the dollar rose. It is, after all, just one big trade among these four markets, so their correlated actions on the down as well as the up side aren't surprising.

Furthermore, investors began to worry about the health of the U.S. economy and the prospects for a second dip in the Great Recession that started in December 2007. The gigantic 2009 fiscal stimuli of close to $1 trillion was running out, threatening a relapse in an economy that was running on government life support. The $8,000 tax rebate for new home buyers was expiring April 30 and might be followed by a drop in house sales as had its predecessor that expired in November 2009 as the spike in activity early this year only borrowed from future sales. The outlook for exports had turned negative with the robust buck, sagging European economies and the current "stop" phase of China's "stop-go" monetary and fiscal policies. With unemployment remaining high last spring, investors began to fret that consumer spending would falter as fiscal stimuli was exhausted.

Deleveraging

Although investor views of the economy have reversed in the last five months, the reality probably hasn't. The good life and rapid growth that started in the early 1980s was fueled by massive financial leveraging and excessive debt, first in the global financial sector, starting in the 1970s and in the early 1980s among U.S. consumers. That leverage propelled the dot com stock bubble in the late 1990s and then the housing bubble. But now those two sectors are being forced to delever and in the process are transferring their debts to governments and central banks.

This deleveraging will probably take a decade or more - and that's the good news. The ground to cover is so great that if it were traversed in a year or two, major economies would experience depressions worse than in the 1930s. This deleveraging and other forces will result in slow economic growth and probably deflation for many years. And as Japan has shown, these are difficult conditions to offset with monetary and fiscal policies.

The deleveragings of the global financial sector and U.S. consumer arena are substantial and ongoing. Household debt is down $374 billion since the second quarter of 2008. The credit card and other revolving components as well as the non-revolving piece that includes auto and student loans are both declining. Total business debt is down, as witnessed by falling commercial and industrial loans.

Meanwhile, federal debt has exploded from $5.8 trillion on Sept. 30, 2008 to $8.8 trillion in late August. Many worry about the inflationary implications of this surge, but the reality is that public debt has simply replaced private debt. The federal deficit has leaped as consumers and business retrenched, which curtailed federal tax revenues, while fiscal stimulus, aimed at replacing private sector weakness, has mushroomed.

Four Cylinders

As discussed in our May 2010 Insight, in the typical post-World War II economic recovery, four cylinders fire to push the economic vehicle out of the recessionary mud and back out on to the highway of economic growth. At present, only one - the ending of inventory liquidation - is generating significant power. The other three - employment gains, consumer spending growth and a revival in residential construction - are sputtering at best.

The Inventory Cycle

Historically, the liquidation of excess inventories accounts for major shares of the decline in economic activity in recessions. Around business cycle peaks, the sales of manufacturers, wholesalers and retailers begin to weaken but their managers can't tell whether that's the beginning of a major drop in business or just a minor dip in an upward trend. So they delay cutting production and orders until the downward trend is firmly established. Meanwhile, inventory-sales ratios leap as the numerators, inventories, rise and the denominators, sales, fall. That makes cuts in production and orders imperative and propels the economic downward trend in the process.

That was also the case in the Great Recession. In our view, it really started in early 2007 with the collapse in subprime residential mortgages, and then spread to Wall Street that summer with the implosion of the two Bear Stearns hedge funds in June. But these were financial declines, and recessions are measured by production, employment and spending, which are dominated by the goods and nonfinancial services segments of the economy. So the recession didn't officially start until December 2007.

Consumers Go On Strike

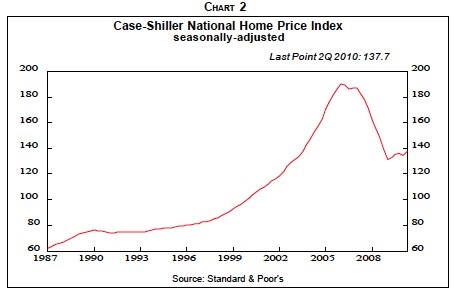

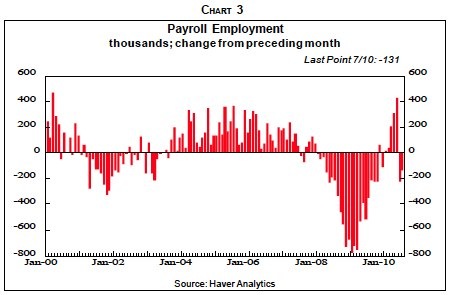

Furthermore, it wasn't until late 2008 that the collapse in home equity as house prices nosedived (Chart 2), rising layoffs (Chart 3) and the drying up of consumer lending drove consumers into retrenchment. But they suddenly went on a buyers strike in the last four months of 2008, and the results were leaps in inventory-sales ratios. Consequently, the cuts in inventories to get rid of unwanted stocks were far and away the biggest in the post-World War II era.

The reduction in inventory liquidation has been key to economic growth starting in the second half of 2009. In the third quarter of last year, it accounted for 66% of the 1.6% annual rate real GDP gain and 58% of the fourth quarter's 5.0% advance. The inventory-building in the first quarter of this year was responsible for 67% of the 3.7% annual rate rise in real GDP and 36% of the rise of 1.6% in the second quarter. In total, in the last four quarters, the inventory swing provided 58% of the 3.0% rise in real GDP.

Whether inventories will continue to hype the economy remains to be seen. As of June, the inventory-sales ratio for retailers had returned to its downtrend, but was still above trend for wholesalers and, especially, manufacturers. Furthermore, it's one thing to complete the liquidation of unwanted inventories but another to rebuild them significantly. The latter probably requires sales strength originating in other areas of the economy, and the other three cylinders of the economic engine aren't providing it in meaningful ways. Quite the opposite. It appears that recently disappointing retail sales have stuck merchants with unwanted goods that may be liquidated if consumers continue to retrench.

Employment Lags

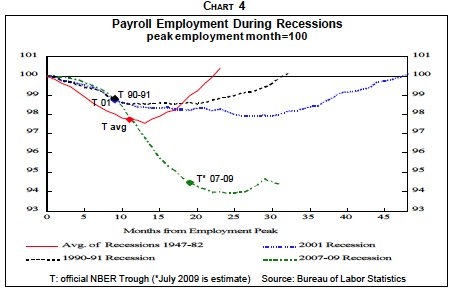

In post-World War II recessions before the 1990-1991 decline, payroll employment's bottom came close to the low point in the overall business decline and was followed by rapid rebounds (Chart 4 ). In the mild 1990-1991 and even shallower 2001 recessions, however, the job market remained weak for over a year into economic recovery. The same is true this time, assuming the economic decline ended in July 2009, as many believe. What's changed?

It isn't that a shallow recession results in weak job recovery because even though the 1990-1991 and 2001 downturns were mild, the Great Recession certainly wasn't in terms of jobs (Chart 4). A more likely explanation is that globalization, starting in the 1980s, forced American business to cut all costs vigorously, including labor costs, by outsourcing to domestic and foreign suppliers, promoting productivity and curtailing hiring. This has been especially prevalent in the last decade.

Jobs Lost Forever

Despite the huge employment losses since the end of 2007, many of those jobs are unlikely to return. Of the 7.7 million net nonfarm jobs eliminated between December 2007 and July of this year, 86% were in construction, manufacturing, wholesale and retail trade, finance and leisure and hospitality. These six sectors accounted for 44.5% of nonfarm payrolls in July, only about half as much as their losses. Furthermore, job losses in those industries spawned employment losses in service and other sectors that depend on them. Home building, for example, spurs employment in the production of appliances, furniture, home furnishings and homeowner insurance and provides revenues that support state and local employment.

Given the gigantic overhang of excess house inventories and resulting further price declines, it will be years before residential construction shows any meaningful revival, as we've explained in past Insights and will update next month. Similarly, financially troubled and massively vacant commercial real estate will inhibit new construction and jobs for many years.

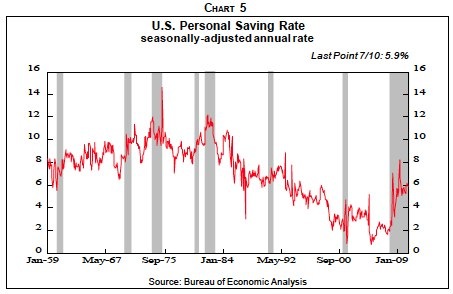

The inventory cycle did stabilize manufacturing employment in recent months, but that inventory-related bounce is over and the 2 million manufacturing jobs lost since December 2007, if anything, will probably become an even bigger number. Goods production continues to move offshore. job-reducing productivity gains continue in manufacturing, and consumer retrenchment and deflation will continue to curtail consumer durable goods consumption. Wholesale and especially retail trade will continue under pressure with the 25-year consumer borrowing and spending binge now replaced by a saving spree (Chart 5). That retrenchment as well as persistent business spending restraint will continue to retard jobs in leisure and hospitality.

Financial activities jobs stabilized with the March 2009-March 2010 revival of Wall Street, but the likely continuance of more recent weakness in many securities markets will lead to more layoffs and bonus cuts. The federal government, naturally, has added people, 262,000 since December 2007, as it expands in response to the weak economy. But state governments cut 6,000 on balance and local municipalities 128,000, largely in education.

Diligent Cost-Cutting

American business has been diligently cutting costs since the recession started in December 2007, especially labor costs. A recent survey shows that over half of adults have been affected by some combination of layoffs, wage and benefits cuts, involuntary furloughs and involuntary shifts to temporary jobs. Many may never be restored to their earlier statuses. Those layoffs lucky enough to find new jobs often are paid less than earlier.

About 20% of major employers with over 1,000 workers cut or eliminated their 401(k) plan contributions during the downturn but half have failed to restore them so far. Of those with 500 or fewer employees that cut contributions, only 36% have reinstated them or plan to in the next 12 months, according to a Fidelity Investments survey. Furthermore, 10% of all employers plan to reduce or eliminate matching 401(k) contributions in the next year.

Consumer Spending

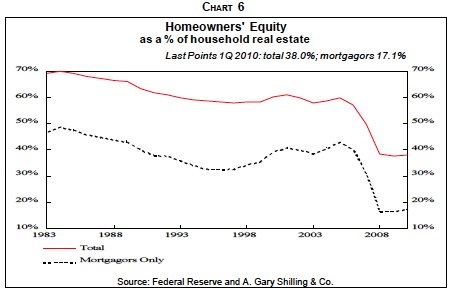

All the layoffs, involuntary furloughs, and temporary jobs and benefit and wage reductions have been instrumental in the rebound in corporate profits, but devastating to employee compensation. This spells weakness for consumer spending. Also, consumers are no longer saving less and borrowing more on credit card, home equity and other loans to bridge the gap between income and desired spending growth. Furthermore, home equity has evaporated (Chart 6 ) and tight lending standards on credit card and other loans prevail. So they're on a saving spree and debt reduction binge, further slashing the outlook for consumer spending, the third cylinder that normally fires to propel economic recovery from recessions.

In fact, without massive fiscal stimuli, subdued compensation and the recession would have pushed consumer outlays down substantially. Our calculations show that consumers saved 80% of the tax rebates they received in the summer of 2008. And they initially saved 100% of 2009's tax cuts and special payments of $250 for each Social Security beneficiary. Those actions resulted in the spikes in the saving rate shown in Chart 5. This is remarkable since the tax cuts did not go to highincome people, normally the only big savers. Also, those folks are relatively few in number so they received few of the extra Social Security checks. Consequently, middle- and lower-income households stepped out of character to save heavily.

Households are deleveraging their balance sheets with a vengeance. Since the end of the fourth quarter of 2007 when stocks began to collapse, personal sector assets have fallen $3.0 trillion. Some $1.8 trillion was in equities and $277 billion in mutual funds due to losses on balance and withdrawals from equity direct ownership and from mutual funds. Investors put money into mutual funds on balance in January, March and April, but cut their holdings, especially in stock funds, in May and June. Also, private pension reserves fell $754 billion from the end of 2007 to the end of March 2010 and government pension reserves in household accounts were down $290 billion. Increases of Treasury bond holdings of $533 only partially offset the decline in government agency and securities of $593 billion. Meanwhile, liabilities of the personal sector dropped $500 billion, largely due to the decline in mortgage and consumer debt as some debts were repaid while others were written off as hopeless.

Support By Government

Since the recession began in December 2007 through June 2010, personal income from wages and salaries, proprietors' income, rents, interest, dividends and transfers such as pension benefits, Social Security, Medicare and Medicaid payments and unemployment insurance increased $285 billion. It would have declined $247 billion without a $532 billion increase in government transfer payments. These increases in government transfers also flowed through to Disposable Personal Income (after-tax income), which further benefited by lower personal taxes that fell $382 billion due to tax cuts and the lower taxable income resulting from layoffs, wage declines and bonus cuts.

In total, DPI was enhanced by $532 billion from the increase in government transfers and $382 billion from the lower taxes. Without these significant boosts, DPI would have fallen $247 billion since December 2007 instead of rising $667 billion. Without question, and much more so than in any previous post-World War II recession, the consumer has been supported by massive government money in the form of increased transfers and tax cuts. And these numbers do not include wages from jobs created by federal spending on infrastructure or saved by federal transfers to state and local governments to curtail teacher layoffs and other employment reductions.

Where Did The Money Go?

What happened to that $667 billion increase in DPI and what does it tell us about the likelihood of a chronic consumer saving spree? About 43% of it was spent and 64% saved, so maybe some of the earlier tax cuts were spent, but with delays. Nevertheless, a 64% marginal saving rate does seem to support our chronic saving spree thesis.

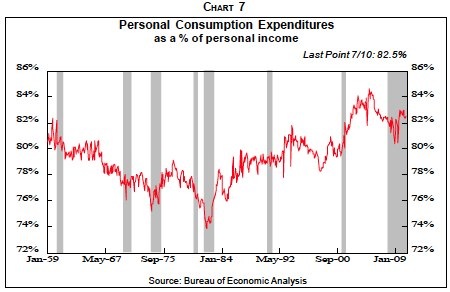

Also, in terms of spending and saving, note that whatever has been going on in the consumer arena has been supported by massive federal stimuli. Those stimuli may persist at near current levels in future years due to chronic high unemployment, as noted in earlier Insights, but seems unlikely to rise at the rates they did since the recession began due to their effects on the already massive federal deficits. Republicans and even some Democrats in Congress are so worried about the mushrooming deficit that current stimuli is unlikely to be renewed at least until unemployment leaps further. In that case, the resulting withdrawal of support for consumer outlays may push them down. So the leap in consumer spending as a share of personal income (Chart 7 ), which has been propelled by tax cuts that were only partially offset by saving increases, is highly unlikely to persist.

Evidence of recent consumer retrenchment is rampant. Consumer confidence has flattened as people worry about employment and income prospects as well as losses on their stocks and houses. Credit card loans outstanding fell 10% last year and promise to fall further as consumers repay debt, lending standards tighten and the new federal law cuts the profitability of credit card lending. Meanwhile, banks report that demand for consumer loans continues to drop, although at declining rates.

Increased saving is not only being used to repay debt but also to rebuild 401(k)s. Fidelity Investments found that in the second quarter, 5.3% of participants raised their contribution while 2.9% reduced them. That excess of increases over decreased has persisted for five quarters and follows three quarters of the reverse. Still, the numbers that tapped their accounts for loans or hardship withdrawals also rose.

Subdued Spending

On the spending side, vehicle sales in July were at an 11.5 million annual rate, up from the sub-10 million levels of 2008-2009, but well below the pre-recession levels. Consumer spending on TVs, computers, videos and telephone equipment rose 1.8% in the first half of 2010 compared with a year earlier while appliance purchases fell 3.6% and furniture outlays dropped 11%. Apparel sales also lost out to electronic gadgets. This shift reflects two forces. First, consumers are saving more and spending less on equipping their houses that are no longer appreciating but now depreciating assets. Second, they still want the satisfaction of buying iPads and other Small Luxuries, an investment theme we identified years ago and explained fully in our August Insight.

Housing Remains Depressed

The housing sector is an important generator of the normal economic recovery even though residential construction only accounts for 4.7% of GDP on average in the post-World War II years. It's the volatility that matters. Residential construction was 6.3% of GDP at its recent peak in the fourth quarter of 2005, but fell to 2.4% at its low in the first quarter of 2010. This 3.9 percentage point decline is very significant, considering that a 3% top to bottom decline in real GDP constitutes a major recession.

State and Local Government Spending

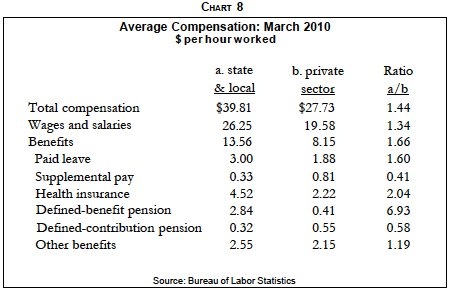

Spending by state and local governments is not one of the sources of economic revival after recessions end because it has been such a steady 12% to 13% share of GDP since the early 1970s. In the early post-World War II decades, it grew rapidly to finance the education of the postwar babies and the growth of mushrooming suburbs. Municipalities have also provided a steady source of jobs since, until recently, many fewer employees were laid off or fired than in the private sector and relatively few quit. Years ago, the "social contract" held that those employees received lower wages than private sector workers, so early retirement provisions and lush pensions allowed them to catch up in their later years. But since the early 1980s, the private sector has been globalized with very little growth in real incomes. Meanwhile, state and local government employees have continued to receive pay raises in excess of inflation and now have wages that are 34% higher than for private sector employees (Chart 8).

Federal Help

As part of its fiscal stimulus program, the federal government is transferring $246 billion to state governments to prevent more school teacher layoffs, help fund Medicaid cost increases and plug other holes in state budgets. Federal money is filling 30% to 40% of state budget gaps, but 46 states are projecting a collective deficit of $121 billion for the 2011 fiscal year that begins next July 1, equivalent to 19% of their budgets. And 39 states see gaps that total $102 billion for fiscal 2012. Unless federal assistance continues, these deficits will be much larger. All the states but Vermont are required to balance their budgets in one form or another, but most are honored in the breach as fiscal gimmicks and creative accounting get really creative.

Budget legerdemain no doubt is related to the rapid growth in state spending in recent years and leap in debt. State and local governments now use debt to fund investments that used to be done on a current budget basis, and some issue debt to cover up routine budget shortfalls. Total state and local bond debt outstanding leaped 93% between 2000 and 2009, from $1.2 trillion to $2.3 trillion.

It obviously takes a lot of gnashing of teeth in the outer darkness for state and local government to flatten, much less cut, their spending after a decade of 6% to 7% annual growth rates. Jumping municipal employment is the main reason for mushrooming spending in earlier years, and cutting often unionized state and local workforces is very difficult. Since the Great Recession started in December 2007 through April, private payroll employment has dropped 6.8%. Still, state and local jobs have declined but by much less, only 1.4%. In July, state and local governments, which employ 9.5 million, cut 48,000 jobs, 102,000 in the past three months and 169,000 so far this year.

Raise Taxes

In reaction to their financial woes, many state and local governments have attempted to raise taxes and fees. The usual suspects include higher sin taxes on tobacco and alcoholic beverages as well as taxes on companies based out of state but doing some business in the state. Attempts to raise taxes and cut spending have proved wholly inadequate to solving state and local government funding problems. And those woes appear chronic, especially if our forecast of slow economic growth and even deflation is valid. Rises in taxable personal and corporate incomes will be muted. Retail sales and taxes on them will be sluggish as consumers persist for the next decade in their saving spree, replacing the borrowing and spending binge of the last decade.

House prices are likely to fall further in the next year or so, under the weight of gigantic excess inventories. Even when those inventories are worked off, house prices will probably rise little, if at all, in a low inflation or deflationary climate. Historically, they've been flat after correcting for overall inflation and the growing size of houses over time. And now that house prices have fallen nationwide for the first time since the 1930s, home buyers no longer see their abodes as also great, leveraged investments, and want smaller, cheaper houses. That will also reduce assessments on property taxes.

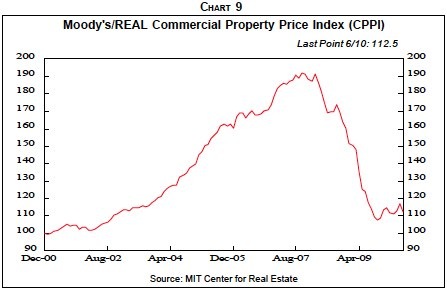

Meanwhile, commercial real estate high vacancies and severe financial problems will take years to resolve, keeping prices depressed for some time (Chart 9 ). So, all things considered, local government property taxes are likely to be curtailed for many years. Meanwhile, municipal expenses will be hard to cut. Chronic high unemployment will spawn high Medicaid enrollment and costs. Welfare and unemployment benefit costs will no doubt rise as well.

Deteriorating finances are raising the risks of defaults on state and local obligations and even municipal bankruptcies. Harrisburg, Pennsylvania's capital, will not make a $3.3 million municipal bond payment on $51.5 million debt that's due in two weeks, and earlier this year, city officials discussed bankruptcy. Harrisburg also lacks the funds to continue payments for the $288 million debt on an incinerator project. Earlier, Jefferson County, Ala., home of Birmingham, defaulted on $227 million due on its disastrous sewer upgrades.

Taxpayer Revolt?

People working in the private sector apparently were willing to accept the higher pay, more job security and better retirement benefits for state and local employees in past years. High employment in the private sector and robust economic growth at least held out the hope that their lots would improve tomorrow. But with slow economic growth, limited income expansion and high unemployment now expected by them for years, voter attitudes appear to be changing.

Americans still want basic municipal services like police and fire protection, good schools for their kids, clean streets and garbage collection. But they apparently are deciding they're paying too much for those services; that 34% higher wages for state and local employees compared to private sector workers isn't justified as pay cuts multiply in the private sector and those laid off earn much less if and when they can find another job; that 66% higher benefit costs is over the top, especially as private sector employees are paying more of their health care premiums and seeing their defined benefit pension plans replaced by much more uncertain 401(k)s.

As taxpayers revolt, there are plenty of things that can be done to reduce state and local government costs in an orderly way. Following in the footsteps of bankrupt GM, two-tier wage structures are being established with existing employees continuing at current salary levels, but new hires paid the much lower wages adequate to attract qualified people. And the new people are enrolled in defined contribution pension plans that require employee contributions, not defined benefit plans, while their retirement ages are increased.

Foreign Trade

Another economic sector that normally isn't a significant engine of economic recovery but is important at present is exports since the Administration hopes they will double in the next five years and provide meaningful economic growth. The President's zeal to achieve that goal rises as he realizes that massive fiscal stimuli have not revived the economy, and already-huge federal deficits impede further rounds of big spending.

But two significant problems are likely to retard export growth in future years - rising protectionism that clearly impedes foreign trade, and finding foreign countries that will buy this doubling of American exports. It's like the story of the stockbroker who calls his client during May's Flash Crash to tell him that stocks are collapsing. "Sell my entire portfolio!" yells the distressed client. "Sure," retorts the broker, "but to whom? There are no buyers."

Foreign Buyers?

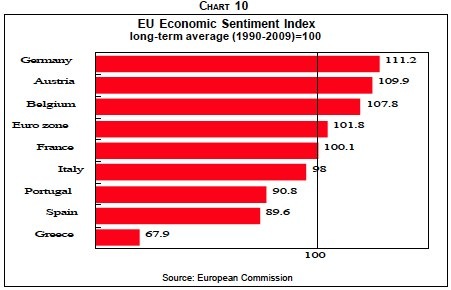

As far as foreign buyers of U.S. exports is concerned, the reality is that many of those markets that are showing robust growth and therefore might be able to absorb American products, lands like China and Germany, are major exporters themselves, not importers on balance. Indeed, it's no surprise that the EU's measures of both industry and household confidence shows that export-led Germany has the highest level while the economically weak Club Med net importers are at the bottom of the pile (Chart 10).

Currency changes have only limited effects on export or import prices. The volatility of U.S. import prices is only about one-fourth that of the dollar and a third in the case of American export prices. Why? Many products are sold under long-term contracts and immune from most currency fluctuations. Also, importers and exporters resist reflecting the full extent of exchange rate changes in their prices. If the yen is strong against the dollar, importers of Lexus cars shave their profit margins to offset some of the higher prices in dollars to avoid losing market share. Conversely, U.S. exporters to Japan don't pass on in lower yen prices the full extent of the dollar's decline in order to increase their profits.

The "processing trade" in which components are imported, assembled and then re-exported makes up about half of Chinese exports. This reduces the importance of the yuan's exchange rates. Furthermore, even goods with more domestic content aren't completely sensitive to exchange rates in a global world. About 50% of a Chinese manufacturer of children's clothes costs are fabric and around 50% of the fabric's costs are cotton, a globally-traded commodity priced in dollars. So, 25% of the total cost is not affected by yuan fluctuations. Also, another 25% might be in the combined profits of the clothing and the fabric producers, and could be adjusted to offset currency fluctuations - or production moved to lower-cost Vietnam or Bangladesh if the yuan leaped in value.

Double Dip Recession?

We've made our case for very slow U.S. economic growth in the quarters, indeed the years, ahead. The economic rebound due to the inventory cycle is over. Employment and consumer spending remain weak. Housing is too overburdened with excess inventory and the resulting price weakness to revive any time soon. State and local government spending and employment are retreating. And meaningful export gains are unlikely as economic growth abroad slips. Interestingly, the consensus forecast is moving toward our position as growth estimates have been reduced rapidly in recent months. In both April and June, the Wall Street Journal's poll of economists (not including us) expected 3% economic growth in the second half of this year. We wonder if they still do.

Will slow growth deteriorate into another recession, the so-called double dip scenario? Before exploring that question, let's define a double dip. It seems to mean a second period of economic decline following the 2007-2009 nosedive. That could imply that the recession that the accepted authority, the Business Cycle Dating Committee of the nonprofit National Bureau of Economic Research, pinpointed as commencing in December 2007, is still underway. Sure, real GDP grew in the last four quarters, but it's common to have quarters of gain within recessions. In the 11 post-World War II recessions so far, seven, including the 2007- 2009 decline, had at least one quarter of rising real GDP within the recession. In fact, two - the 1960-1961 and the 2001 declines - didn't even have two quarters of consecutive decline. Even in the 1929-1933 economic collapse, GDP rose in six quarters.

Still, to have a four-quarter interlude between the declining phases of the same recession would be unprecedentedly long, assuming that real GDP declines in the current quarter. So another period of economic weakness could be classified as a second recession, much as the 1981-1982 decline, which started in July 1981, only 12 months after the 1980 recession ended.

Slow Growth to Recession

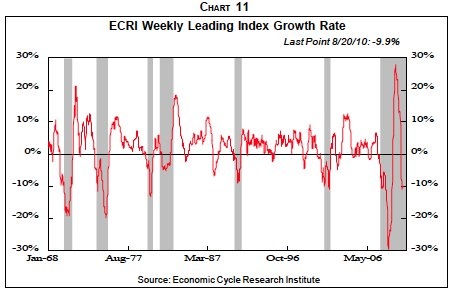

We're on record for a 50% or higher probability of a second dip or another recession, whatever it would be called. The composition of the ECRI Weekly Leading Index remains proprietary, but its growth rate has fallen to the level that in the past was always associated with recessions (Chart 11). Historically, however, recessions have been propelled by shocks. The post- World War II downturns prior to 2001 were caused by Fed tightening in response to threats of economic overheating and the resulting higher inflation. Since then, other shocks have been responsible. The 2001 recession resulted from the 2000 collapse of the dot com bubble augmented by the 9/11 shock. The 2007-2009 downturn resulted from the collapse in subprime residential mortgages that commenced early in 2007.

In the current economic and financial climate, it's highly unlikely that the Fed will tighten credit for years. In fact, the central bank has shifted from planning last spring to withdraw liquidity as the economy grew to renewing quantitative easing and worrying about deflation and subpar growth. It said after its August 10 policy meeting that household spending is being retarded by high unemployment, slow income growth, lower home equity and tight credit conditions while bank lending "has continued to contract."

Pushing On A String

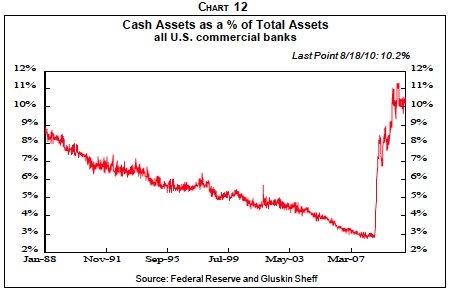

Conventional monetary ease is now impotent with the federal funds rate close to zero , the money multiplier collapsed and banks sitting on hoards of cash (Chart 12) and over $1 trillion in excess reserves. Sure, large banks report to the Fed that they are easing lending standards for small business, but after the intervening financial crisis, many fewer potential borrowers are deemed creditworthy than in the loose lending days. Furthermore, the small business trade group, the National Federation of Independent Business, reports that 91% of small business owners have had their credit needs met or business is so slow that they don't want to borrow. The Fed is pushing on the proverbial string.

The Fed also worries about deflation, which means that even zero interest rates are positive in real terms, as has been the case for years in deflationary Japan. Also, deflation encourages buyers to wait for still-lower prices in a self-feeding cycle, as is seen in Japan and as we have discussed often in conjunction with our forecast of 2% to 3% per year chronic deflation. In it s post- August 10 meeting statement, the Fed said that "measures of underlying inflation," already low, "have trended lower" lately and are "likely to be subdued for some time." James Bullard, President of the Federal Reserve Bank of St. Louis, recently warned of the risks of deflation.

Deflation is a scary phenomenon, but we can't resist noting that the Fed as well as many other forecasters are moving in the direction of our forecast. In contrast, an April 6 Wall Street Journal piece by Peter Eavis stated unequivocally, "No one in their right mind would bet on inflation remaining substantially below 4% for the next 10 years." Maybe we better have our head examined.

A Baby Step

So, with conventional monetary ease exhausted and further fiscal stimulus on hold because of the already-huge federal deficit, the Fed at its August 10 meeting took a baby step toward more quantitative ease by deciding to buy Treasury bonds to replace the maturing and refinanced Treasury and mortgage-backed securities in the $1.7 trillion hoard it finished buying earlier this year. With low mortgage rates, refinancings were projected to raise the Fed's portfolio contraction from an earlier estimate of $200 billion by the end of 2011 to $340 billion, with another $55 billion coming from retirement of Fannie Mae and Freddie Mac debt held by the Fed.

Furthermore, the Fed is open to further steps if the economy continues to slip. It could buy even more Treasurys or mortgage debt. But would the resulting lower interest rates encourage prospective home buyers who now know that house prices can and do fall? Would another $1 trillion in excess reserves induce more bank lending than the first $1 trillion? The Fed could also promise to keep short-term interest rates low, but it's already said it would for an "extended period."

It could cut out the 0.25% it pays the banks on their reserves, but would that induce reluctant banks to lend? Finally, the Fed could set an inflation target over its formal 1.5% to 2.0% range. That would be anathema for inflation-wary central bankers, and how could the Fed hit that target in a deflationary world where ample supply exceeds weak demand? Despite all the credit easing actions that Chairman Ben Bernanke, in his famous November 2002 speech, said the Fed could take if the federal funds target reached zero, the credit authorities are about out of ammo - except for dumping money out of helicopters. Remember the "Helicopter Ben" moniker?

Other Shocks

If the Fed is highly unlikely to shock slow growth into recession, what could? This brings us back to the series of seemingly isolated events that are occurring on the deleveraging road, such as further financial woes in Europe, a crisis in commercial real estate, a nosedive in the Chinese economy and a slow motion train wreck in Japan. They are all possibilities - as are other shocks here or abroad that we don't foresee. Maybe the exhausting of federal stimulus will be enough to trigger an economic downturn. Keep your eyes pealed, however, because it won't take much disruption to push the fragile global economy back into decline.

Houston, My Book, and New York

Tuesday was a very special day. My co-author, Jonathan Tepper of Variant Perception (based in London), and I spent the entire day reading the first complete rough draft of our forthcoming book, The End Game. We went cover to cover, making comments and notes. Of course, I had read the bits and pieces, but not in one sitting. I have to say that I am more than happy. It is a very good first draft, much better than I thought it would be. There is a lot of work ahead, of course, to try and make it a great book, but I can "feel" it. And I think we have managed to capture some very difficult topics and make them simple and maybe even a fun read. We are on target for a January 1 launch.

We make what I feel is an overwhelming case for a period of slow growth in the developed world, with more volatility as the base case. The research we review is very strong. But there are pockets of potential if you step back and take off your localized blinders.

I will be in Houston (along with Gary Shilling, David Rosenberg, Bill King, and Jon Sundt) at the one-day X-Factor Conference on October 1. Quite the lineup. You can learn more by going to www.streettalklive.com. Then I will be in New York in late October, speaking at the BCA conference and a few media events.

It has been interesting talking with investment types in Europe. They are very curious about the US and what they perceive as our lack of seriousness about the deficit. It appears that Greece has focused their attention. And of course, I get off the plane from Malta yesterday and the headline in the Financial Times says, "Greece rules out possibility of default." I know that made me feel better. And gave us all a laugh. If you have not, read the piece from Michael Lewis in Vanity Fair on Greece. And then share my amusement about the chances of no default.

It is time to hit the send button. I feel a nap coming on. Jet lag has been worse than normal this trip. And maybe another glass of Prosecco to ease me into slumberland.

Your excited about almost finishing this book analyst,

John F. Mauldin

johnmauldin@investorsinsight.com

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2010 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.