Urgent Lessons from Japan on Economy, Debt and Stocks Bear Market

Economics / US Debt Sep 20, 2010 - 08:55 AM GMTBy: Martin_D_Weiss

Imagine a world where the economy never emerges from recession.

Imagine a world where the economy never emerges from recession.

Imagine a time and place in which economists talk first of a double-dip recession, then about a triple-dip recession … and ultimately admit the dire reality of a long, multi-decade depression.

Imagine chronically high unemployment, overwhelming government indebtedness, shrinking population, spreading poverty — even growing rates of homelessness among college graduates.

Think about a 20-year period in which stock investors continually lose fortunes and retirees get nearly zero income on their savings, with no end in sight.

A future scenario? No! It’s the here-and-now scenario that I am personally witnessing — in Japan, where I am now.

And it’s the result of government policies that Washington is now also adopting — lock, stock and barrel.

I know because I can compare the Japan of today with the Japan of thirty years ago — when I worked here as an economic analyst. I can see clearly precisely how Japan has sunk into this abyss. And I can see how the U.S., despite its many differences with Japan, is heading down a very similar path.

|

Tokyo, 1978-1980

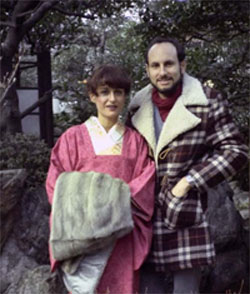

Elisabeth and I first went to live in Japan in 1978 so that I could complete fieldwork for my doctoral dissertation on the Japanese financial smarkets.

As part of the research plan, I was invited by a leading Japanese firm to join them full time. And I became the first U.S. analyst working inside the Japanese securities industry.

Meanwhile, however, our parents back home were bewildered. They had no personal experience with life in East Asia. They had difficulty staying in touch with us from the other side of the world. And they could never quite fathom why we chose to be so far away for so long.

Today, we’re getting a taste of our own medicine: Now, it’s our son Anthony who lives in Tokyo, and now WE are the parents living on the other side of the world.

Much like we did years ago, Anthony has adapted well to the language, culture, and tight spaces. He goes to a Japanese university, works for a Japanese company and plays on a Japanese sports team. And like we did years ago, he often gets so engrossed in his life here, he neglects to stay in touch as often as we’d like him to.

Fortunately, we have some advantages that our parents didn’t have when we used to live here. From our home in Florida, we can video-chat with our son via the Internet whenever we see him online. We can hop on a plane and join him within 24 hours. And whenever we’re here, we can relive old times — browsing our old neighborhood, visiting old friends, comparing then with now.

And it’s that comparison — between the Japan of 1980 and the Japan of 2010 — that offers some of the most urgent lessons for all Americans.

The Rise and Fall of a World Leader

Thirty years ago, Japan was on its way to becoming the world’s number one economy — not necessarily in terms of GDP, but in many other key aspects: It led the world in technology. Its massive trading companies and financial institutions were the largest in the world. Its trade surpluses and cash savings exceeded those of any other nation on the planet.

But today, Japan is number three in GDP, surpassed this year by China and slipping on nearly every single front where it was leading before — technology, trade and cash.

Thirty years ago, more than 99 percent of college graduates were employed during the critical April hiring season; if more than 1 percent failed to get work, it was considered shocking. Reason: Unlike their counterparts in the U.S., once they miss that window, most become unemployable. Companies view them as rejects, failures. In the next hiring season, it becomes almost impossible for them to get another interview.

|

Today, approximately 20 percent of college graduates are failing to get a job … crawling into a corner at their parents’ home, or worse, on the streets … and never re-entering the job market. In the Japanese context, this is TWENTY times more shocking than anything ever seen in prior generations.

When we lived here 30 years ago, homelessness was virtually non-existent. Today, although still small compared to homelessness in the U.S. and parts of Europe, you can see shanties along Tokyo’s river banks, people living under bridges, and the jobless college grads loitering around major train stations.

|

The crime rate, also still low by U.S. standards, is dramatically higher than it was back then. Prostitution among middle class teens, unheard of thirty years ago, is a real problem. Teenage suicide has soared. Health care, once among the best in the world, has deteriorated.

Casual observers rarely see this. All they typically see is a still-ultramodern, efficient, bustling society.

And indeed, Japan boasts a dazzling array of technology … the world’s most literate population … and even the world’s largest network of lost-and-found offices.

|

But most foreign observers don’t know the Japan of 1980 like we did.

Nor do they venture far beyond the hotels, guided tours or formal business meetings.

Moreover, it’s the hard financial facts that tell the true story of Japan today:

Fact #1. Permanent recession. Since 1990, Japan’s economy has been in a permanent catatonic state — wavering from subpar growth to mild recession. An old friend, formerly director of a major Japanese economic research institute, calls it “the 20-year recession that never really ended and the 20-year recovery that never really began — in other words, a depression.”

Fact #2. Banking dinosaurs. Every major bank that has collapsed in the past 20 years has been patched up with mega-mergers and government aid. In 1999, for example, we saw the massive three-way marriage of the Industrial Bank of Japan, Dai-Ichi Kangyo, and Fuji Banks — all weak institutions loaded with toxic assets. Since then, we’ve seen several more. All have failed to revive the banking sector.

|

Fact #3. 20-year bear market! Near the end of 1989, Japan’s benchmark Nikkei 225 Index reached an all-time peak of 38,957, promptly crashing by 47 percent in less than nine months … and ever since then, it has failed to recover those losses.

To the contrary …

• At its recent lows in 2009, the Nikkei was down to 7,021, a loss of 82 percent from its all-time high.

• Even after the global stock market recovery that began in March of last year, the Nikkei is at just 9,321, still down 76 percent from its highs!

• Since its first bust in late 1989, the Nikkei has enjoyed five major rallies. Each one raised investor hopes for an end to the 20-year bear market. And each one has given way to the dire economic realities — a new plunge, new all-time lows, plus big additional losses for investors.

Where Did Japan Go Wrong?

Japan was — and still is — a vibrant modern society of motivated, hard-working individuals. Its chronic malaise is not rooted in its culture or its people. It’s primarily caused by misguided government policy driven by political pressure to achieve the impossible.

Japan was the first major industrial nation to drop interest rates to practically zero and keep them there almost indefinitely.

Japan was the first to bail out so many large banks so consistently.

And Japan has also been the “leader” of fiscal stimulus. Japan launched a stimulus package of 10.7 trillion yen in August 1992 … another for 13.2 trillion in April 1993 … 6.2 trillion in September 1993 … 15.3 trillion in February 1994 … 14.2 trillion in September 1995 … 16.7 trillion in April 1998 … 23.9 trillion in November 1998 … and 18 trillion in November 1999 … plus many more such programs in the 2000s.

Yet after each government-engineered “recovery,” the economy fell back into recession; and after each government-inspired stock market rally, the Nikkei plunged again, falling to still lower lows.

At first, Japanese economists thought what they were witnessing was a “double-dip” recession just like the one we’re beginning to see in the U.S. today. But after subsequent rounds of stimulus also failed, it made little sense to call it a “triple-dip” or “quadruple-dip” recession. Ultimately, they were forced to admit that it was really one long, protracted depression.

Bottom line: Despite all the banking bailouts, stimulus programs, money printing and zero interest rates, all the emperor’s horses and all the emperor’s men could not put the Japanese miracle back together again.

The Japanese economy still suffered two lost decades of deflation, lackluster growth and declining stock prices.

Corporate earnings still fell. Consumers were still pinched.

Japan’s status as a world economic power continued to decline.

Investors lost fortunes and then lost still more fortunes — again and again.

The Wall Street Journal recently explained it this way:

“Keynesian ‘pump-priming’ in a recession has often been tried, and as an economic stimulus, it is overrated. The money that the government spends has to come from somewhere, which means from the private economy in higher taxes or borrowing. The public works are usually less productive than the foregone private investment.”

Several years ago, top Washington officials flew to Tokyo to lecture their Japanese counterparts about the futility and danger of their policies. Yet now, Treasury Secretary Geithner and Fed Chairman Bernanke are pursuing virtually the same policies:

They try to keep dying companies alive.

They want to outlaw the business cycle.

They chase an elusive dream of creating eternal prosperity and an unending bull market.

This Obviously Didn’t Work in Japan. It Won’t Work in the U.S. Either.

In the real world, companies are born and companies must die. The economy expands and it must also contract. Investors buy and they must also sell.

No government, no matter how powerful, can change this reality. No government can stop the march of time, fool Mother Nature or repeal the law of gravity.

Most people in Japan now see this clearly. They now know how much they’ve been lied to — over and over again.

That’s why Japan has had five prime ministers in the last four years and is going on a sixth. It’s why voters have permanently kicked the ruling party out of office for the first time in modern history. And it’s why they’re now equally mad at the new party in power.

Most Americans are also beginning to see the light: Despite $3.7 trillion in bailouts and money printing … despite a constant barrage of happy talk from Washington … and even after a series of feeble rally attempts on Wall Street … the average American knows that the economy is not passing even the most basic smell test.

Mike Larson has shown you how the housing market stinks to high heaven — a huge, new surge in foreclosures and repossessions … the most people ever on food stamps … the worst overall poverty rate in half a century. The entire concept of middle class is being challenged.

Like in Japan of recent years, this is having dramatic political consequences in America. Nearly anyone in office — whether Democratic or Republican — is vulnerable to severe attacks. A third party is emerging, with the potential to challenge our two-party system of democracy. The entire premise of monetary and fiscal policy — including the powers of Federal Reserve itself — is in its most precarious state since the Great Depression.

If you disagree — if you believe our government has the financial and political superpowers to achieve its Herculean goals — it would make sense to dramatically increase your exposure to financial risk.

But if you agree — if you can see as clearly as I do that the government’s recent adventures are doomed to failure — then you must …

1. Recognize that the latest stock market rally has no legs to stand on.

2. Use it as a SELLING opportunity — to dramatically reduce your exposure to vulnerable investments.

3. For investments that you keep, build a protective shield around your portfolio, including carefully selected hedge positions that are designed to appreciate as markets fall.

4. For money you can afford to play with, aim for large speculative profits from the decline.

Good luck and God bless!

Martin

This investment news is brought to you by Money and Markets. Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.