30 Trillion for Quantitative Easing (QE) 2? It's Time to Get Radical!

Politics / Quantitative Easing Sep 23, 2010 - 07:22 AM GMTBy: Chris_Kitze

Yes, it's time to get radical on the economy and no, I'm not talking about going full Karl Marx -- the politicians in Washington appear well down THAT road.. The next set of bailouts could run $30 trillion (as I'll explain in a bit) and that's probably not the end of it because all the future government entitlements are well over $100 trillion. This is not only unaffordable, any attempt to make good on even a small portion of this is a fool's errand. In addition to attempting an impossible task that is doomed to fail, we're bailing out the wrong people! Hopefully, this article will get you thinking -- feel free to leave a comment and help our discussion.

Yes, it's time to get radical on the economy and no, I'm not talking about going full Karl Marx -- the politicians in Washington appear well down THAT road.. The next set of bailouts could run $30 trillion (as I'll explain in a bit) and that's probably not the end of it because all the future government entitlements are well over $100 trillion. This is not only unaffordable, any attempt to make good on even a small portion of this is a fool's errand. In addition to attempting an impossible task that is doomed to fail, we're bailing out the wrong people! Hopefully, this article will get you thinking -- feel free to leave a comment and help our discussion.

I'm talking about taking a serious detour from the way things have been done and proposing a radical restructuring of the way government and money work, as well as, a massive clean up of the mess we've gotten into. What I am proposing will completely eliminate the Federal debt, change the way government does business and end the banking cartel that destroys countries, finances war and and causes excessive consumer spending. It will completely change the role of the Federal government and restore liberty. It could be replicated wherever fiat money systems are in force in almost any country.

The problem is one of debt and who gets debt relief. Today, the U.S. government now has a debt of $14 trillion and is adding another $2 trillion per year - states and consumers have a mountain of debt, as well. It has now reached the point where this debt can never be repaid, at least in anything resembling today's money or at any kind of real interest rate. Judgement Day is coming for the U.S. dollar. There will be a debt default, the only question is who will pay and what and how they will pay. This kind of thing never ends well for individuals or society. The problem is we've spent trillions of dollars to "fix" the problem in the past couple of years, but we've given the money to the people who created the problem in the first place and yet we still have even more debt now than we started with!

It's not very complicated, we just need to stop spending money we don't have, eliminate the debts, maintain sound and honest money and a have a rational government that doesn't take a big chunk of the economy or make major changes every time there is an election. This much smaller government will allow individuals and businesses to make investments, put people to work and plan ahead.

Because these most basic principles are being violated on a daily basis, there is no way the economy will get back on track until they are remedied. If they are not remedied and things continue down the present path, we could see a modern currency collapse similar to Germany in the 1920's (the Weimar), where money became worthless and the entire economy collapsed. This led to economic misery for millions and eventually WWII.

Children playing with stacks of worthless money in Germany,

The best way to start the stove...with stacks of freshly printed money!

The end result has always been the same, whether in the Weimar Republic or Zimbabwe. Debts must eventually be extinguished as they are today in Zimbabwe -- they didn't get that way by being repaid -- as everyone knows, the currency collapsed after a classic hyperinflation that resulted in the end of the Zimbabwe dollar as a currency and now all debts in that currency are null and void.

The final banknote issued by Robert Mugabe's socialist utopian government. Now a collectable on eBay, you can't spend it anymore. It used to buy local bus fare but is now worthless as currency.

Another key point; Germany at the time of the Weimar was a defeated power, but still was a world leader in patents, technology and industry. They were one of the most developed countries in the world at the time. If it can happen there, it can happen here.

The Mess We Are In

During the last election, people voted themselves money from the Treasury, at least they thought they did:

Peggy Joseph, who is probably going to be very disappointed with the way things will turn out.

The problem is, the Treasury was empty. There was no money because it's gone. The banks are insolvent, the government is completely insolvent and most people have too much debt they will never be able to pay back. As we saw from the Zimbabwe example, there's never a free lunch. There has to be massive failure and as we saw from the effects of the first round of bailouts and quantitative easing, printing more money and giving it to the people who caused the problem in the first place is an incredibly bad idea.

Stop the Foolishness NOW - or Spend Another $100 Trillion

To date trillions have been spent bailing out companies and banks that made foolish business decisions and now the taxpayer is responsible for the multi-trillion dollar mess. Leaving a large debt that can't ever be paid back to children and the unborn who can't even vote yet is immoral, besides being economic insanity. The problem has only gotten bigger.

According to an article in yesterday's UK Telegraph, the next set of QE2 bailouts could run $30 trillion with absolutely no guarantee it will work!!

As Ambrose Evans-Pritchard said:

Here is a back-of-an-envelope guess by David Greenlaw at Morgan Stanley on what the Fed can expect from a second blitz of bond purchases, or `Shock & Awe’ as he calls it.

If Ben Bernanke does a further $2 trillion (on top of the $1.7 trillion already in the bag) the yield on 10-year US Treasuries will drop 50 basis points to around 2.2pc.

GDP growth will be 0.3pc higher than otherwise in 2011 and 0.4pc higher in 2012.

The unemployment rate will be 0.3pc lower in 2011 and 0.5pc lower in 2012 — (in other words drop from 9.6pc to 9.1pc, ceteris paribus).

That looks like trivial returns for a collosal adventure into the unknown, with risks of dollar flight and mounting Chinese suspicions that the US intends to default on its external debts by debasement.

I had dinner recently with a former Goldman Sachs hedge fund guru, and while I can’t remember the exact details through a fog of Mersault Premier Cru, I am pretty sure he said it would take $30 trillion to do the job – given the scale of wealth destruction from the US property crash and ferocity of debt deleveraging still to come.

Ambrose is hoping the Premier Cru fog was thick and that he didn't remember the number correctly because that $30 trillion sum is 50% of the world's GDP! But I'm betting his memory, fog and all, was correct.

There is no guarantee they won't be back for QE3 and another $100 trillion or more to fatten their wallets. A word of advice to Ambrose; next time the Goldman hedgies are buying, grab the wine list and order the Montrachet -- it's a better wine and you might want to get a few of them for what I'm going to suggest next...

If they are seriously considering tossing around that kind of money, they should just fix things once and for all...

Abolish the Federal Reserve and restore the creation of money to its constitutionally mandated place without interest -- the U.S. Treasury. At the same time, the government will issue $14 trillion of new money to pay back all outstanding U.S. Treasury debt. In addition, Congress will need to pass a law banning future indebtedness by the federal government because the government will just issue the money directly from that point forward. There will never be another federal government debt and the government will never have to pay interest on debt because there won't be any debt. It's that simple.

Do an accounting of the gold in Fort Knox and other government depositories and revalue it to its true value (currently on the books at $42.22 per ounce), it will probably end up somewhere between $10,000 and $50,000 per ounce. Eliminate the legal tender laws that force citizens to accept funny money and allow full gold interchangeability with the currency (gold and silver would freely circulate alongside government issued paper money). This will finally keep the politicians honest about the money they are spending because there will be a competitive alternative -- gold and silver. As we all know, monopolies are never good for anyone but the monopolist. The politicians will be free to issue as much money as they would like, but the citizens are not compelled to accept their wampum.

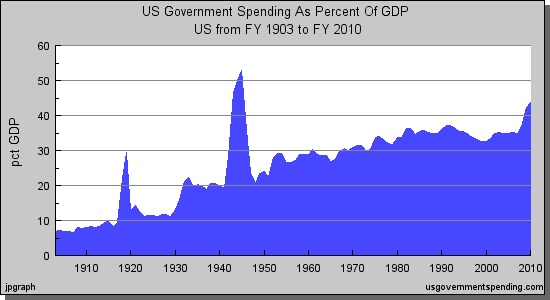

Government (federal, state and local) will need to slim down to less than 10% of the economy (it's currently 43% of GDP and growing) and government services will be cut except for traditional defense and food -- the government would still provide basic food to people who are hungry. Here's a coincidence (not); the last time it was that size, was 1917, around the time of the founding of the Federal Reserve (1913). Here's the chart:

The size of the U.S. Government continues to grow like an out of control biology experiment.

Welfare recipients will cease to exist because once a final lump sum payment (their final 90 day check) is made with the newly issued currency, there will be no more welfare checks. Same thing for Medicare. Cancel social security and issue a one time lump sum of newly printed money to everyone who paid into the system. Pay them back the amount they paid into the system plus a nominal interest rate. It's more money than they will ever see from this Ponzi scheme and it's certainly being honest with the citizen taxpayers.

Do the same for all government pension funds. Participants would be repaid what they paid into their pension. The government wouldn't pay another cent to anyone, as they could take their money and invest it themselves (or have their pension funds invest for them). Defined benefit would cease to exist.

Finally, the banks are mostly insolvent and we will make good on the government's promise of FDIC, even though it is completely out of money today, too. There are about $7 trillion worth of deposits and the government would issue that money to the savers that the banks aren't good for -- let's call that $2 trillion. The savers would be free to leave the money at their bank, convert it to gold or silver or move it somewhere else. They'd best pay attention to the condition of their bank because there won't be any more insurance on their deposit. The weakest banks will fold overnight.

People could use the money they receive from this program to pay off their debts and in one fell swoop, the debt problem is solved. These people would receive trillions in cash, enough to pay back the $1.2 trillion in outstanding credit card debt, and the bulk of the $15 trillion of mortgage debt.

Here's what it will cost:

Federal debt repayment: $14 trillion

Social security repayment: $ 2.6 trillion (per the U.S. ssa.gov website)

Welfare Final Payments: $2 trillion (I'm feeling generous to people like Peggy Joseph, above)

Medicare Final Payments: $2 trillion

FDIC Bailout: $2 trillion (this number is a SWAG, the total insured amount is $7 trillion)

Public Pension Bailout: $1 trillion (per Bloomberg)

Total: $23.6 trillion

About 20% less than the cost of the suggested QE2 bailout. If you include a 25% contingency, you will still be even with the banker's estimate of the cost of the next round of bailouts.

In this scenario, the people who lent the government money will be paid back, as will people who honestly worked and saved. People who did foolish things will have to pay for their mistakes. People who are dependent on the system will have 90 days to get their lives in order and they will need to figure out what to do for themselves. That won't be the government's problems anymore. Charity will have to make an immediate and large step up.

That's it. The government will be out of the debt business and people's lives, there will be plenty of money in circulation and after a few months, the economy will start to boom. Why? Taxes will be incredibly low, people (not banksters) will have money in their pockets and they will pay down their debts and start over. With fewer regulations, businesses will flourish.

Let's talk about what the government won't do. With a much reduced budget of only 10% of the economy, many things that have been going on for far too long will need to be tossed overboard:

- With the one time payments outlined above, there will be no more welfare, medicare, FDIC or social security

- No corporate welfare, no more agricultural support programs -- the government will simply purchase food from farmers for it's program to support the hungry. Farmers would be free to plant whatever they wanted to.

- The futile war on drugs. Eliminate all drug laws and apply an excise tax, just like alcohol and tobacco. Immediately release all non-violent drug offenders from prison. This should reduce the prison population by 40% over night. By the way, the modern "imprison people for putting things into their bodies" started about the same time as the Federal Reserve....1914!

- Immediately terminate all government unions. They are part of the problem.

- End the expensive foreign wars. Pull out of Iraq and Afghanistan immediately and close 80% of all U.S. bases in other countries.

- Eliminate laws and government agencies that don't strictly follow the constitution. Goodbye Department of Energy, Education, etc. and return these functions to the states where they belong. Eliminate the EPA. Eliminate at least 50% of the laws on the books -- there are so many that even the lawyers and judges can't keep up anymore. Eliminate the Department of Homeland Security, etc. etc.

- Eliminate the IRS and rely on a 10% national sales tax.

- Shut down all government medical programs by transitioning them to local charities.

- End welfare, the practice of giving people money for nothing. Your illegal immigration problem will go away automatically.

- Provide a minimal amount of government food, i.e. small box of rice, cans of beans, tea, etc. to keep people from starving.

What will replace all these things? Real charity will become a social responsibility again, not a growing government function. People will be responsible for their actions and not be able to shift responsibility. Banks and businesses will think twice about doing crazy things because they will go out of business, not get a bailout.

If you think this is impossible, you are correct. The system would never give $30 trillion to make the hard working people and savers whole, when it could go into the hands of bankers and the politically well connected. When the people have control of the money, the politicians can't reward them for their vote.

The politicians who could enact these changes will lose much of the power they presently enjoy and they would have to serve others, not themselves and unless there is a complete change in the way the universe works, this will never happen.

Let's not blame everything on our public servants. Moral values have slid down so far they have reached the low level of today. People still believe that things are always better when you spend money you don't have and it's even better when you get it from someone else without having to work for it yourself. Everybody would like to believe they can get something for nothing.

The risk of continuing the way we are is that we will end up with exactly the same situation that I just described with all the social unrest, riots, wars, etc. that entails. If we were to do this in a controlled fashion that puts the people who were ethical, hard working and honest in the position of running the future, things might turn out better.

It'll never happen. Why would greedy bankers and politicians not try to get their hands on another $30 trillion and continue their game of making everyone else their debt slave?

By Chris Kitze

A long career in digital media led to Before It's News, the People Powered News site that is quickly becoming a leading source for alternative news. We've got a great team of very bright and hardworking people with an incredible market opportunity that's been handed to us by a corrupt media and government. We're here to help you get your news out, that's why this site exists.

© 2010 Copyright Chris Kitze - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.