SPX Cyclical Bull Looks Like Resuming its Uptrend

Stock-Markets / Stock Markets 2010 Sep 26, 2010 - 05:55 PM GMTBy: Andre_Gratian

Current Position of the Market

Current Position of the Market

Very Long-term trend - Down! The very-long-term cycles are down and if they make their lows when expected, the bear market which started in October 2007 should continue until about 2014-2015.

SPX: Intermediate trend.The has closed outside of its downtrend line. The move signals a new intermediate uptrend, or the continuation of an intermediate sideways consolidation.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview:

It is possible that a cyclical bull market, within a secular bear market, began in March 2009. Some uncertainty will remain until the SPX has surpassed its 1219.80 high of late April 2010, but the action of the past few weeks is telling us that the decline from that level may only have been an intermediate correction and not a resumption of the 2007-2008 bear market. Whether or not it was and how long it will last are questions that cannot be answered at this time.

The market action is clarifying another area of uncertainty: the 4-yr cycle may have bottomed in July 2010, along with the 2-yr cycle, just as it did four years ago in 2006. An even greater possibility is that it did so in late August. Whichever date it was, the current market strength is telling us that it is likely behind us. If it were still expected in October, we would be experiencing much more weakness. Any decline which takes place into the middle of next month will be caused by the combined action of the 9-mo and 17-wk cycles making their lows.

The index is currently trying to form a short-term top, but it is having some difficulty doing it. You'd think that after filling the Point & Figure count at 1148 it would have started to decline -- and it did, but after a paltry 2- day pull-back of 16 points, it recouped it all plus a little more on Friday.

Once again, we have been shown the value of P&F projections. I had determined that the base formation just above 1040 had a count to 1148 with a possible extension to 1168. The high last Tuesday was 1148.59. The fact that the base has a potential for 20 more points may be the reason why the index is having trouble getting something going to the downside. Another reason may be that the Bradley date of 9/30 is acting as a magnet, and that the reversal will not take place until next Thursday. You'd think that the poor breath statistics of the past week would have led to a sharp pull-back. But instead, it made a new high Friday, if only by a fraction -- and the NDX is even stronger and almost ready to challenge its April high.

Let's look at the charts!

Analysis

Chart Pattern and Momentum

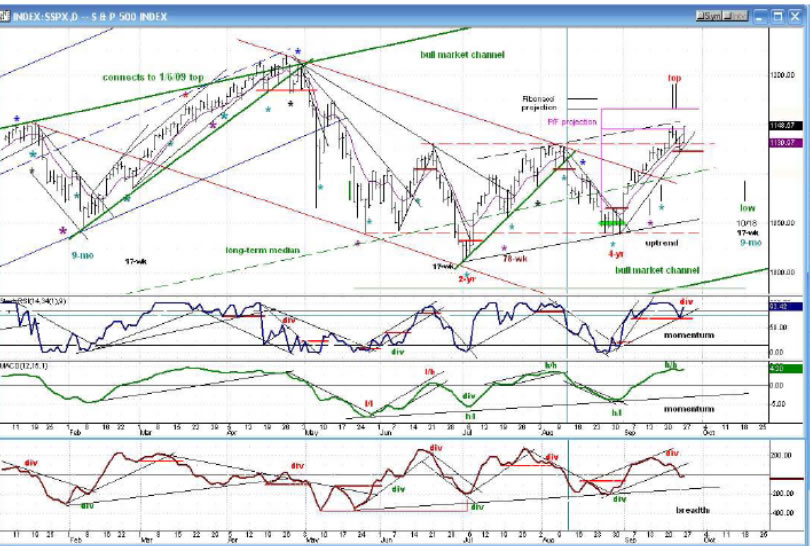

We'll start by analyzing the Daily Chart of the SPX. The picture it provides is very clear, except for the very near-term. The intermediate correction from 1220 came to an end when the index broke out of its red channel and subsequently rose above its last high of 1129.24. Since its low of 1011 in early July, it has started to make a pattern of higher highs and higher lows, and this has brought it to an area of resistance at the top of the black channel which I have drawn on the chart.

Furthermore, when it reached 1148, the index filled its minimum P&F projection, which normally leads to profit-taking and a pull-back. These two factors combined should produce some sort of a top. In addition, there was a potential projection into this time frame. This is marked on the chart by two vertical line with the red "top" written above.

You will also notice that the brown breadth indicator (at the bottom) has been showing significant negative divergence to the price pattern for the past week. So why didn't the market continue down on Friday instead of rallying to a slightly new high? If you look at the top (blue) momentum indicator you will see that, until last Tuesday, it was overbought but did not sport any negative divergence. After Friday's rally, the negative divergence which has begun to appear is minimal. But the green momentum indicator has none! That tells us that we may spend a couple more days building this top, or the index could decide to go and fill its 1168 base projection extension before reversing. As mentioned in Overview, the market could also be under the influence of the 9/30 Bradley date and continue to rise until then. In other words, it's too soon to draw a definite conclusion about the near term market position. The next couple of days will tell us exactly where we stand.

By rising to a new high on Friday, the index has created a new short-term uptrend line. This trend line will have to be broken on the downside, and confirmation that a downtrend has started will not come until the SPX has closed on an hourly basis below Friday's low of 1122.79.

The drop to 1123 was the result of a small area of distribution which had built up at the first top on the P&F chart.

Let's move on to the Hourly Chart and get a more detailed view. You can see how close the index is to the top of the black channel. I have also drawn a brown channel which delineates the parameters of the phase which started at 1041. The index is still trading in the top half of that channel, which is an indication of strength. However, on Friday it could not rise to the top. If it still cannot do so by Monday or Tuesday and starts to retrace, it will be the first sign of deceleration in the trend, and a sign of weakness.

Earlier, when we analyzed the daily indicators, we saw that those which track momentum were the strongest, and breadth was the weakest. On the hourly chart, we have the exact opposite, with breadth being the strongest on Friday. Until all indicators are in agreement, we are probably not ready for a reversal. It is not easy to come up with a valid P&F projection from the 1123 reversal point, but I can make out a potential 1151 and 1156.

Cycles

As discussed earlier, there is some strong evidence that the 4-yr cycle has already made its low.

The 9-mo and the 17-wk cycles should both make their lows near 10/18.

Projections

The base projection of 1148 was reached last Tuesday. There is still a potential P&F projection to 1168 and a Fibonacci projection to 1175.

The very near term could carry to 1151 and perhaps 1156.

Breadth

The NYSE Summation index (courtesy of StockCharts.com) continues to show strength. This bodes well for the intermediate uptrend.

On the other hand, my daily A/D indicator has reflected a lack of support for price over the past week.

Market Leaders and Sentiment

The SentimenTrader (courtesy of same) has slowly been moving away from its former bullish condition, and has begun to show some negativity. But it is not yet close to giving us readings that are associated with an important market top. Any such warning would have to be accompanied by similar signals from other indicators. At this time, there are none. In fact, as you can see by the next indicator, it's quite the opposite.

The NDX/SPX ratio (courtesy of StockCharts.com) has improved sharply over the past two weeks. This is a positive for the market.

Gold

By touching 127 last week, GLD is now close to its original projection of 128. A confirming count of 128/130 can be established from the re-accumulation pattern around 116/117. This makes a reversal from the projection area highly probable.

Bulls should be aware that GLD has a tendency to reverse suddenly and with little warning once it reaches its target, especially when it makes this kind of topping pattern. The move into early December 2009 is a good example of what could happen. A break of the short-term trend line from 113.21 may be the only warning.

Summary

It now looks as if the SPX started a cyclical bull market in March 2009 and that it completed an intermediate correction at 1011 before resuming its uptrend.

The first phase of the new uptrend ended at 1130, and a short-term correction down to 1041 ensued -- probably as a result of the 4-year cycle making its low.

Since then, an initial target to 1148 has been met, and the index appears to be deliberating whether it should move up to its next projection of 1168 before correcting into the 9-mo/17-wk cycle lows due around 10/18.

There is a Bradley date due on 9/30 which may hold up prices before any short-term reversal.

Andre

If precision in market timing is something which is important to you, you should consider a trial subscription to my service. It is free, and you will have four weeks to evaluate the claims made by the following subscribers:

Thanks for all your help. You have done a superb job in what is obviously a difficult market to gauge. J.D.

Unbelievable call. U nailed it, and never backed off. C.S.

I hope you can teach me about the market and the cycles. I want to be like you and be the best at it. F.J.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.