Gold And Silver Bull Market Breakouts

Commodities / Gold and Silver 2010 Sep 27, 2010 - 04:55 AM GMTBy: Howard_Katz

Above are the weekly basis charts for gold and silver for the past 3 years. Two weeks ago silver broke out of a symmetrical triangle and started to move aggressively to the upside.

Above are the weekly basis charts for gold and silver for the past 3 years. Two weeks ago silver broke out of a symmetrical triangle and started to move aggressively to the upside.

Typically, during the first major term bull market in the precious metals silver will lag behind gold. At that time, the traders are conservative; hence silver, which is the more volatile metal, lags. But there comes a point where silver is so under valued that it starts to play catch up. In the first major term bull market of the 1970s (1970-74), silver played catch up from 1972-1973. Then both of the precious metals declined from year-end 1974 to mid-1976. In the second major term bull market in the precious metals, silver lagged behind gold from mid-1976 to mid-1978. Then silver exploded in mid-1978 until early 1980 in what is known as the Hunt silver bubble (where Bunker Hunt lost most of his fortune by trying to manipulate the silver market).

The question we must ask ourselves is, is history repeating? Did the conservative phase of the precious metals bull move end on Sept. 3 and is the speculative phase just beginning. One of the reasons that it is important to answer this question is that the exploration stocks also come to life about the time that silver begins to move. The strategy here is to be in the conservative sector of the precious metals (gold versus silver and blue chip mines versus exploration mines) during the early phase and to be in the more speculative sector during the later phase.

As we have seen, both gold and silver hit important highs in March 2008. However, since that time gold has gone up almost 30%, and silver is flat. So we have just been through a substantial period when silver lagged. Similarly, the exploration stocks (as measured by the CDNX) lagged badly in 2008. Will they now start to play catch up?

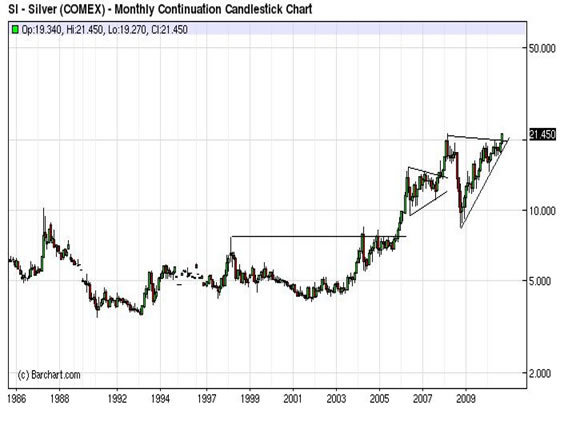

The 25 year chart of silver shows a long, slow base which lasted through more than the decade of the 1990s. The breakout came in 2004 in the form of a double bottom, and the 2008 decline took us back down to the breakout point of the double bottom. Here silver met support, and since that time has traced out two triangles, the first parallel to the 2006-07 triangle in gold, the second looking almost exactly like the 2008-09 ascending triangle in gold.

The key to success in the markets is to wait for a fundamental mis-evaluation (where the market price is far distant from true value). Such mis-evaluations usually lead to long term moves, either up or down. Because these moves are so long there is plenty of opportunity to take a position. Once the position is taken, you just ride things out. Remember that the vast majority of the people are up too close to events. They cannot see the forest for the trees. They make their decisions on the conditions of the moment.

For example, consider the 2008 decline in gold. I was bullish from early in the decade. When gold turned down in July 2008, I missed the decline and had to sit while the market went against me. But since the major trend in gold was still bullish, my decision to sit tight worked out nicely. I held through the Sept. Oct. decline and remained long through the October bottom and the ensuing rally back to $1,000 in Feb. 2009.

This was in contrast with those members of the establishment who had “put 10% of their portfolio into gold in case of a rainy day.” They panicked on the 2008 decline, believed the establishment line about deflation and sold their gold stocks near the bottom. They lost on their gold stocks, and they lost on their conventional stocks.

Meanwhile, what does the long term chart of gold show? It shows that gold has gone up since 1999 and is now (more than) 5 times its low of 11 years ago. There was nothing wrong with gold, but there was a great deal wrong with their timing. Gold is the play for our era, but no single economic good can bring you complete protection. The only complete protection lies in your wits. See reality as it is.

The above 25 year chart of gold gives us a good insight into this bull market. Notice the rounding bottom of 1998-2002, which broke out in Dec. 2002. Rounding bottoms are very slow to form. The advance which follows begins slowly. But it picks up steam as it goes along. Following the rounding bottom there are 2 triangles (that of 2006-07 and that of 2008-09). A triangle is a continuation formation. This means that after the triangle has completed the price will continue in the same direction it was going before the triangle formed.

Finally, the advance becomes more and more rapid. Whereas the bottom was a period of boredom with very small price changes, the final stages of the advance are almost straight up. In this period, the speculative end of the precious metals is moving rapidly, and there is great excitement. Right now we have none of these characteristics, and this tells us that the bull move has a long way to go.

The way to make money in the markets is to go with the long term trend. These trends persist and persist and persist. Go back to the rounding bottom in gold (above). It lasted 4 years, and the implications of the breakout will last much longer. The double bottom in silver lasted 16 years. The reason for this was that enormous numbers of people were selling at the bottom. Poor fools.

And you know that many of the gold mines themselves did worse than selling at the bottom. They sold short on their own product at the bottom. They are supposed to know gold like no one else. But they proved to be idiots. It sort of reminds me of the 1963 Los Angeles doctors’ “strike.” In 1963, the doctors of L.A. went on “strike” (withheld their services, thus violating the Hippocratic Oath). They were hoping that lots of people would die and the community would be forced to give them more money. But in fact, once the doctors of L.A. withheld their services, deaths declined. Once again the “experts” were wrong.

So the most important consideration for making money in the markets is to keep one’s perspective. Do not get caught up in short term events. Those who do are taken to the cleaners again and again. The proven path to profits in the financial markets is to remain focused on the long term.

I publish a fortnightly newsletter, The One-handed Economist, fortnightly (every 2 weeks). The letter costs $300 and is dated every other Friday (most recent issue 9-17-10). It is mailed the next day. You may subscribe by visiting our web site, www.thegoldspeculator.com, and clicking the Pay Pal button. Or you may subscribe by sending $290, ($10 cash discount) to: The One-handed Economist, 614 Nashua St. #122, Milford, N.H. 03055

At the present time, the main question for gold bugs is, have we moved into the speculative era of the precious metals bull market? If so, how should we position ourselves? How long will it last? And how will we know that it is over? These are some of the issues which are discussed in the OHE of 9-17-10.

Thank you for your consideration.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.