Stock Market Trade War Tuesday - China, Japan & U.S. at Odds

Stock-Markets / Stock Markets 2010 Sep 28, 2010 - 01:44 PM GMTBy: PhilStockWorld

War does not determine who is right, only who is left. - Bertrand Russell

War does not determine who is right, only who is left. - Bertrand Russell

Just when you thought it was safe to go back in the water, Japan and China are at it again. We discussed the "fishing’ incident last week and Japan has released the Chinese captain who rammed one of their Coast Guard vessels.

Now shippers in several Chinese cities said customs officers have stepped up spot inspections of goods being loaded onto ships bound for Japan and being imported from the country. Traders said officers in some cases were taking the highly unusual step of looking at every item in a container instead of following normal practice of examining a small sample. The heavy searches, which can add costly delays to shipments. For it’s part, Tokyo wants China to pay restitution and now China’s navy is moving into disputed waters.

China is fighting a trade war on two fronts as they are threatening to retaliate against US businesses operating in China if Congress passes legislation intended to force a revaluation of the Yuan. The House of Representatives is set to consider legislation this week that would let companies petition for higher duties on imports from China to compensate for the effects of a weak yuan. Forcing China to raise the value of its currency may create 500,000 jobs in the U.S., most in manufacturing at above-average wages, according to C. Fred Bergsten, director of the Peterson Institute for International Economics in Washington. China’s currency, which is undervalued by as much as 25 percent, is the most important trade issue facing the U.S., he said in testimony last week.

So we are pressuring China to strengthen their currency, which would make our currency relatively weaker. One would think the dollar couldn’t get much weaker than it is now (see Dave Fry’s chart). We’ve been shorting GLD (buying GLL) and TLT, expecting a dollar bounce off these levels but if we fail here - we’re going to have one very ugly chart.

So we are pressuring China to strengthen their currency, which would make our currency relatively weaker. One would think the dollar couldn’t get much weaker than it is now (see Dave Fry’s chart). We’ve been shorting GLD (buying GLL) and TLT, expecting a dollar bounce off these levels but if we fail here - we’re going to have one very ugly chart.

Of course a 10% drop on the dollar could be just the ticket for the markets - since our stocks are priced in dollars. That makes them look pretty good compared to cash that’s sitting on the sidelines (or tied up in notes) that’s lost over 10% of it’s buying power since June.

That’s right, JUNE! As people who travel to Europe are well aware, prices of things outside the US have gone up considerably in dollar terms. For our Multi-National Corporate Masters, who collect half their funds overseas, the dollar dive just represents another 10% pay cut for their American slaves, which is why the rich men are keeping the pressure on Congress, Treasury and the Fed to keep that dollar down. Americans aren’t buying anyway so who gives a crap about their worthless currency?

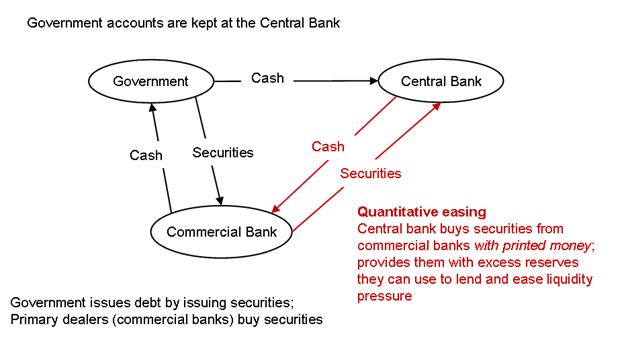

As The Market Oracle points out, the only people really buying Treasury Bonds, which finance our deficits are the "Primary Dealers," the too big to fail banks who get their money from the Fed and the Treasury through the wide-open "liquidity windows." Of course they don’t mind tying up their money in dollars as they borrowed dollars to buy the dollars and the Banksters make money on the rate spread. Banks borrow money at 0.25% FROM THE GOVERNMENT and they lend it back TO THE GOVERNMENT for 1-2.5% and THAT is how the US can give the banks over $4Tn of bailouts and stimulus WITHOUT CREATING A SINGLE JOB!

Look at what’s happening people: "They" (Banksters and their pet Government) have devalued 10% of your dollar-denominated assets in 3 months by printing 10% more money - all of which THEY kept. In fact, one of the parties in Congress wants to keep MORE of the money they are stealing and give LESS of it back to the people so they can make sure they have enough money to pay off the Banksters for all the loans they gave us with the money they stole from us. Man you guys are SUCKERS!!! Here is your market rally priced in Euros:

Look at what’s happening people: "They" (Banksters and their pet Government) have devalued 10% of your dollar-denominated assets in 3 months by printing 10% more money - all of which THEY kept. In fact, one of the parties in Congress wants to keep MORE of the money they are stealing and give LESS of it back to the people so they can make sure they have enough money to pay off the Banksters for all the loans they gave us with the money they stole from us. Man you guys are SUCKERS!!! Here is your market rally priced in Euros:

At PSW, we’ve been shorting Treasuries for a while now, expecting this bubble to pop and I warned members about this yesterday, saying (about where to keep your money):

At PSW, we’ve been shorting Treasuries for a while now, expecting this bubble to pop and I warned members about this yesterday, saying (about where to keep your money):

I don’t care if you don’t trust the market - trusting the government to pay you back at all in 10 years is dodgey and believing that the dollars they give you after they rack up another $15Tn in debt (not to mention after a decade of unfunded baby boomer obligations coming home to roost) will be worth anything like the dollars you gave them a decade before is not even in the realm of rational. I am not joking - it’s not… People buying long-term TBills are simply not thinking things through at all.

I don’t care if you don’t trust the market - trusting the government to pay you back at all in 10 years is dodgey and believing that the dollars they give you after they rack up another $15Tn in debt (not to mention after a decade of unfunded baby boomer obligations coming home to roost) will be worth anything like the dollars you gave them a decade before is not even in the realm of rational. I am not joking - it’s not… People buying long-term TBills are simply not thinking things through at all.

Our hedges to go along with this comment were well-timed entries into TZA ($26.70) and EDZ ($28.10) but, of course, we did our usual hedged option positions (see link). Earlier in the day I had sent out an Alert to Members with a put purchase on BIDU and so far, so bad but we planned on scaling in and $105 is our expected top so we’ll see how that plays out. We also picked up a long on FTR (see Oxen Group’s pick) a short on the DIA a short on NFLX (yes, we dare!), more TBT ($31.44) and longs on RIG, HOV and AAPL plus a ratio backspread on WAG, who had a nice upside surprise this morning.

So, on the whole, we had trades for every direction and we can only hope one of them turns out to be right. The nice thing about the disaster hedges is they pay us over 1,000% if we hit them and that really helps to balance out a little speculative bullish betting. Generally, we’re following the strategy of building long-term positions in solid stocks that are cheap and hedging by getting a little short on the ones that seem a little stretched in value at this point.

Our overriding concern (aside from the macro issues I mentioned in yesterday’s post) is that much of the recent rally, aside from the fact that it’s mainly the effect of a weak dollar - is nothing more than a fake, Fake, FAKE prop job put up by the same Primary Dealing Banksters as they try to razzle dazzle the sheeple with the up market trick while they reach into their pockets and rip away 10% of their lifetime savings in asset value.

So it should be no surprise that today’s Case-Shiller Home Price Index came in up 0.6% month/month and that’s up 3.2% for the year, which beat expectations of 3.1% by a rounding error (the full amount was 3.18%). Still the pre-markets are in "razzle dazzle" mode now and up close to 100 points off the 5am lows.

Very nice - home prices are up 3.2% and the really good news is you get to buy them WITH DOLLARS, and those are worth 10% less so the homes actually cost 6.8% LESS when calculated in real money (and don’t calculate your home’s declining value in gold or you will begin to cry). As fundamental traders we look at the Case-Shiller Report and we look at the Dollar and we look at the Markets and we RUN AWAY! I mean really - are you people crazy? Prove to me that these levels will hold up AFTER the quarter ends and I’ll be happy to get more bullish but, for now, CAUTION!!!

Asia had a cautious morning with a 1% pullback on the Nikkei and the Hang Seng while the Shanghai gave back 0.6% and India held firm at 20,104. Europe is pretty much flat ahead of our open but also the beneficiary of a massive 5am (EST) prop job initiated by much better-than-expected German Consumer Confidence data and improving UK GDP numbers. As we expected from our discussion on Ireland yesterday, Moody’s downgraded their debt THREE notches to Baa3. Portugal is also having serious problems and this week the EU banks have to roll over $400Bn in debt so this party ain’t gonna be over ’till it’s over, as the great Yogi said.

We get our own Consumer Confidence report at 10am but no other data with Thursday and especially Friday giving us our major data-points for the week. We played bearish yesterday as those 7.5% lines did not hold up (see yesterday’s post) and we’ll be watching them again but I expect another day of two-way trading as we don’t know how low that dollar can go but we do know that stocks are priced in dollars so a further breakdown in the buck should be able to give us yet another push higher - but it’s a Pyrrhic victory at best…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.