Gold Up as Battered US Dollar Falls to New Low Against the Eur

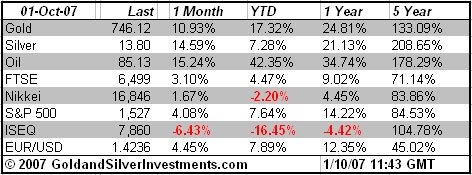

Commodities / Gold & Silver Oct 01, 2007 - 08:59 AM GMTBy: Gold_Investments

Gold

Gold

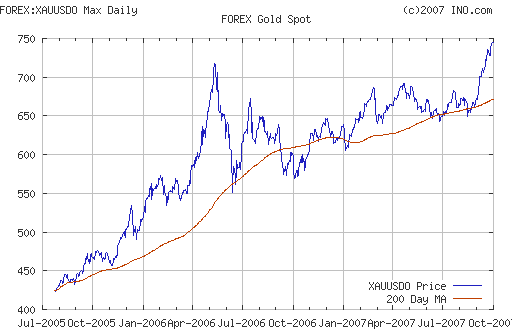

Gold made a new 28 year high close on the COMEX in New York Friday and again this morning. It closed at $743.10 on Friday and was up to $746.80 in early trading in Europe.

The yellow metal's strength is again in large part due to near record oil prices and the declining dollar which continues to sell off and has made another all time low against the EUR this morning at 1.4283.

Gold was up 10.9% in September and its close on Friday at $743.10 was the first time since 1980 that we have had a monthly close above $700. In January 1980 gold closed at $681.50. This is very significant and technicians and large hedge funds will see this as a strong technical buy signal. Gold has been up every one of the last 6 weeks and there may be a correction but it looks like we may surpass the inter day high over $850 before the end of the year. Gold was up 15% in the third quarter and this makes its performance in the third quarter the strongest since 1986.

The euro's new all time high against the battered dollar was the dollar's eight straight record daily low against the euro which is very unusual and highly supportive of the gold price (see Forex below).

Gold's bull market is built on very solid foundations with many strong fundamental factors. These include a possible dollar crisis, increasing food and energy prices and burgeoning inflation, falling U.S. property prices and global systemic issues.

The Daily Telegraph's Ambrose Evans-Pritchard wrote how what began as a credit crunch is developing into a dollar crunch and that "we are witnessing a run on the world's paramount reserve currency, an event that occurs twice a century or so, and never with a benign outcome." Pritchard quotes from Citigroup's latest report "Gold: Riding the Reflationary Rescue" written by Citigroup analysts John H. Hill and Graham Wark: "We believe that the policy resolution to the credit crunch will take the form of a massive, extended 'Reflationary Rescue', in a new cycle of global credit creation and competitive currency devaluations. This could take gold to $1,000 an ounce, or higher." The authors say the avalanche of central bank bullion sales earlier this year was "clearly timed to cap the gold price". They do not explain this explosive allegation, long promoted by the gold group GATA. But it would not surprise me if the European Central Bank's motive for selling 37 tonnes in April and May was to hold the euro price of gold below €500. Citigroup said the game was up once the Federal Reserve slashed rates half a point and opened the liquidity floodgates.

Evans-Pritchard says that the dollar crisis could degenerate into a wider currency crisis as other major currencies and economies also face serious challenges. This could lead to competitive currency devaluations going forward as countries and regions debase currencies in a 'beggar thy neighbour' attempt to maintain exports. He points out that the S&P 500 chart looks increasingly like its chart in September 1987 and concludes that "if Wall Street takes a beating this autumn, the safest play is pure metal."

Further fall out from the credit crisis was seen in UBS's huge losses and large financial losses in the City of London.

UBS SA , the largest Swiss bank, announced it had $3.4 billion in losses and announced a shake-up of management and job losses as it became one of the biggest casualties yet from the problems in credit markets. It posted a pretax loss of up to $690 million in the third quarter mainly because of losses linked to the U.S. subprime mortgage crisis. The loss will result in the shedding of 1,500 jobs from the bank's work force by the end of this year.

The FT reports that the City of London is losing millions of pounds in profits as the leading banks have failed to sell any loans in sophisticated asset-backed financial products in the wake of the credit squeeze. Europe's leading banks will lose £415m ($830m, €594m) in profits and £550m in revenue in the second half of the year, with London the biggest casualty as investors refuse to buy the securities in the aftermath of the U.S. subprime crisis, according to JPMorgan, the U.S. bank.

Forex and Gold

The trade weighted USD index traded to a new all time record low of 77.666. Considerably below its previous all-time low of 78.19 struck on its trade-weighted index in 1992. The dollar is now in uncharted territory both technically and literally and this new low could lead to further dollar selling and a sharper decline.

The sharply deteriorating U.S. housing market is beginning to affect the wider economy which may necessitate further interest rate cuts. However further interest rate cuts could lead to a run on the dollar and a currency crisis and thus the Federal Reserve has a massive dilemma with no easy solution. One path may lead to deflation and a more stable dollar the other to a declining dollar and stagflation.

Silver

Spot silver was trading at $13.79/13.81 (1130 GMT).

PGMs

Platinum was trading at $1380/1384 (1130 GMT) near last November's all time record high of $1,395.

Spot palladium was trading at $347/352 an ounce (1130 GMT).

Oil

Light, sweet crude for November delivery was flat and slipped 3 cents to $81.63 a barrel in Asian electronic trading on the New York Mercantile Exchange by midday in Singapore.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.