Soybeans October Market Secret

Commodities / Agricultural Commodities Oct 02, 2007 - 12:10 AM GMTBy: George_Kleinman

Today I plan to share with you this market “secret”: Soybeans exhibit a very strong tendency to form a seasonal price bottom during the month of October. This bottoming tendency is the result of harvest selling pressure because many farmers sell their crop right out of the fields to generate cash.

Today I plan to share with you this market “secret”: Soybeans exhibit a very strong tendency to form a seasonal price bottom during the month of October. This bottoming tendency is the result of harvest selling pressure because many farmers sell their crop right out of the fields to generate cash.

This year, with soybean prices relatively high, this market behavior could be even more pronounced than usual. After the harvest selling pressure subsides, the soybean market usually exhibits a profitable post-harvest rally trading opportunity.

When I went back to quantify the probabilities for a soybean price rise post-harvest, what I discovered was actually quite exciting.

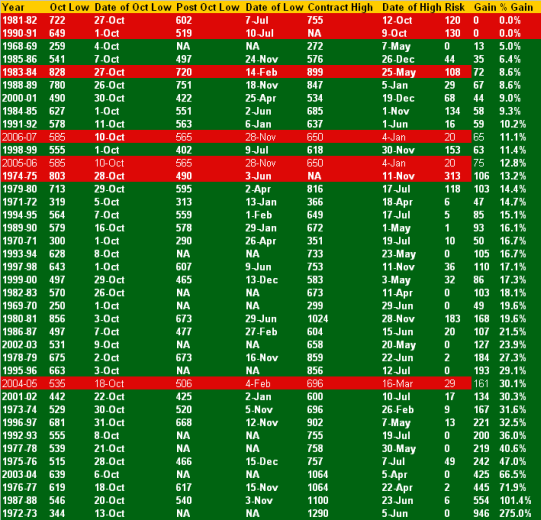

My database goes back to 1968. In the spreadsheet below, I sorted the data not by year but by the percentage gain the July (of the following year) soybean futures contract made from the October low price to the high for each year's July contract (last column).

The Risk column refers to the maximum price break (measured in cents per bushel) for that crop year under the October low price (post-October). The Gain column measures (in cents per bushel) the highest price achieved after the October low was registered through the following July.

July Soybeans

Source: Commodity.com

Let's analyze this data to develop a trading plan.

Looking at the last column first, note there were only two years with zero gain, meaning there were only two years when the month of October was a high-priced period for the July contract. For 37 of the 39 years, there was at least some price gain above the October lows. However, trading is never as easy as just buying in October and selling at a profit sometime later; we have to be realistic based on some risk-to-reward criteria.

Realistically, there were seven years (1974-75, 1981-82, 1983-84, 1990-91, 2004-05, 2005-06 and last year) where I make the assumption a trader who knew about this October market secret may not have profited because there was a measurable price drop from the October lows prior to any big gains. (These years are in red.)

For example, last year, even though the market eventually gained 11 percent from the October 2006 lows, I placed this year in the losing category because the market made a lower low in November. This lower low (below the October low) was only 20 cents per bushel, and it was followed by a big rally post-November, so it's very possible a trader actually would have profited last year on this seasonal tendency.

However, to be conservative, I placed years such as this one in the losing category. Still, even if we include years like this in the red category, there was an excellent chance to make a nice profit with minimal risk by buying in October in fully 32 of the 39 years; this is greater than 80 percent of the time or, in other words, excellent odds.

This year, although we're about a month away from definitively knowing what the October low for the July 2008 contract will be, the odds appear good; soybean prices will be higher next year. Too many farmers planted corn this past year at the expense of soybean acres, and the US Dept of Agriculture (USDA) projected ending supplies are only about 200 million bushels, a relatively tight supply. The reported yields to date have been inconsistent, and export demand remains at extremely high levels. The dollar is weak, and therefore, I look for exports to remain strong.

Conclusion

Our secret, plus market conditions, appear to be setting up a favorable reward-to-risk ratio for entering a long position in the soybean market sometime this month. I'll be looking for a good technical entry point for my Futures Market Forecaster subscribers.

What do you say? How about we keep our market secret just between us?

Good luck and good trading.

By George Kleinman

President

Commodity Resource Corp.

Lake Tahoe,

Nevada 89452-8700

http://www.commodity.com

George Kleinman is the President of the successful futures advisory and trading firm Commodity Resource Corp. (CRC). George founded CRC in 1983 while on the "floor" of the Minneapolis Grain Exchange to offer a more personalized level of service to traders. George has been an Exchange member for over 25 years. George entered the business with Merrill Lynch Commodities (1978 - 1983). At Merrill he attained the honor of 'Golden Circle' one of Merrill's top ten commodity brokers internationally. He is a graduate of The Ohio State University with an MBA from Hofstra University. George has developed his own proprietary trading techniques and is the author of three books on commodity futures trading published by the Financial Times.

He is Executive Editor of Futures Market Forecaster, a KCI Financial publication. In 1995, George relocated CRC to Nevada and today trades from an office overlooking beautiful Lake Tahoe. The firm assists individuals and corporate clients. CRC¹s exclusive clearing firm is R.J. O'Brien with all client funds held at RJO (assets in excess of $1.9 billion). Founded in 1914, R.J. O'Brien is a privately owned Futures Commission Merchant, and one of the most respected independent futures brokerage firms in the industry. RJO is a founding member of the Chicago Mercantile Exchange, a full clearing member of the Chicago Board of Trade, New York Mercantile Exchange, Commodity Exchange of New York and the New York Board of Trade. RJO offers the latest in order entry technology coupled with 24-hour execution and clearing on every major futures exchange worldwide. There is risk of loss when trading commodity futures and this asset class is not appropriate for all investors.

Risk Disclaimer

Futures and futures options can entail a high degree of risk and are not appropriate for all investors. Commodities Trends is strictly the opinion of its writer. Use it as a valuable tool, not the "Holy Grail." Any actions taken by readers are for their own account and risk. Information is obtained from sources believed reliable, but is in no way guaranteed. The author may have positions in the markets mentioned including at times positions contrary to the advice quoted herein. Opinions, market data and recommendations are subject to change at any time. Past Results Are Not Necessarily Indicative of Future Results.

Hypothetical Performance

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

George Kleinman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.