Stock Markets Downside Risk Mitigated By Fed, Economy, and Technicals

Stock-Markets / Stock Markets 2010 Oct 07, 2010 - 08:56 AM GMTBy: Chris_Ciovacco

From current levels, the downside risk in stocks, and risk assets in general, is probably not as significant as many believe. Three factors mitigate the risks relative to a gut-wrenching correction in risk assets: (1) the Fed, (2) the economy, and (3) a significant band of support in the S&P 500.

From current levels, the downside risk in stocks, and risk assets in general, is probably not as significant as many believe. Three factors mitigate the risks relative to a gut-wrenching correction in risk assets: (1) the Fed, (2) the economy, and (3) a significant band of support in the S&P 500.

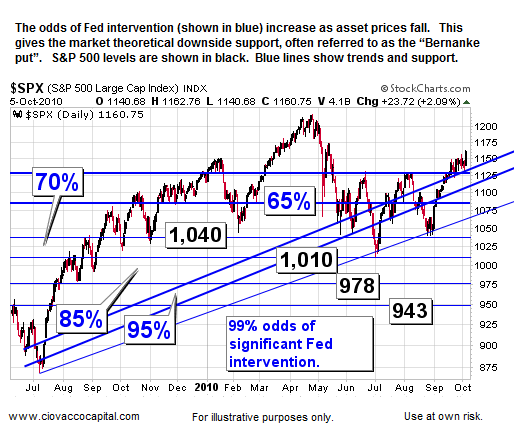

Since global balance sheets from the consumer to the U.S. government remain impaired, one of the objectives of the Fed’s policies is to create conditions which can stabilize, and possibly inflate asset prices (houses, stocks, commercial real estate). As markets drop and prices fall, the asset side of the balance sheet is impaired even further. Therefore, the odds of significant intervention from the Fed increase as markets and asset prices fall. We believe Fed intervention would be radical and significant if the S&P 500 dropped below 943.

While there is no question the current recovery is weak, the odds of a GDP double-dip remain relatively low. Bob Doll, chief equity strategist for fundamental equities at BlackRock puts the odds of double-dip between 10-20%. In its latest global outlook, Barclays Capital said there is little chance for a double-dip recession and the recent economic slowdown is typical four-to-six quarters into a recovery. Pimco’s El Erian sees a 25% chance the US slips into a double dip recession. Morgan Stanley sees the odds being below 25%. Warren Buffet has also expressed his views on the lows odds of a double-dip recession. From TheStreet:

Warren Buffett, CEO of Berkshire Hathaway and head public relations executive for the U.S. economy, found himself in the headlines again last week when he proclaimed that there won’t be any double dip recession. Buffett was unequivocal in his words, saying that it was “night and day” for the U.S economy now versus a year or year and a half ago. What’s more, Buffett didn’t just say he didn’t think a double dip recession is coming; he said it isn’t coming, end of story. There was no mincing of words or hedging of bets from the Oracle of Omaha. (Full Story).

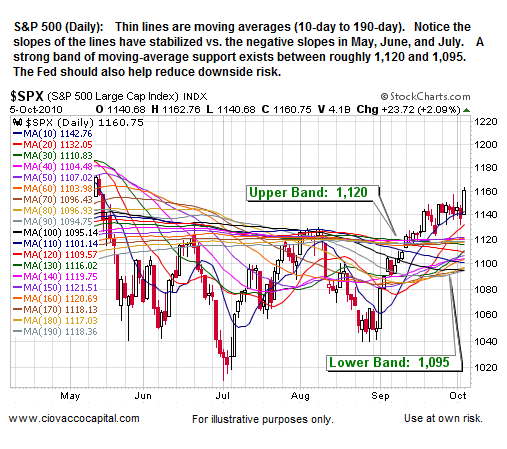

The third mitigating factor to downside risk relates to the S&P 500’s recent move above 1,131. While the chart below is busy, the concepts presented are simple. Given the relatively low odds of a double-dip, and the “Bernanke put”, we believe buyers would become interested should the S&P 500 revisit 1,095 to 1,120.

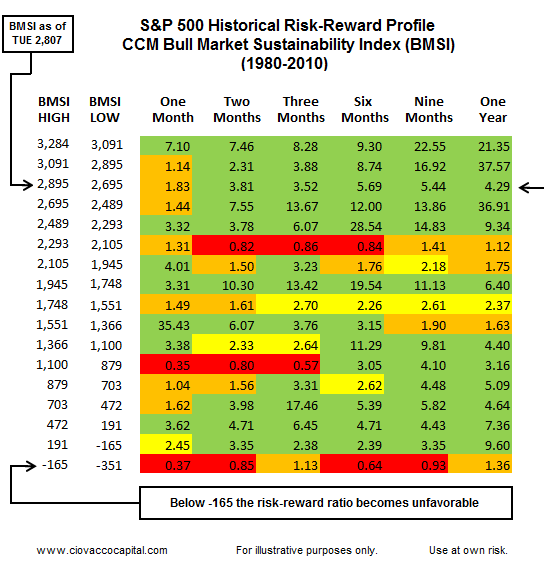

The CCM Bull Market Sustainability Index (BMSI) is based on an overall technical composite of the U.S. stock market. The market’s current profile has produced attractive risk-reward profiles in the past, especially over the two-month to twelve-month time horizon (see green area in upper-right portion of the table below).

The CCM 80-20 Correction Index is based on studies of significant market corrections. The current daily 80-20 value of 567 tells us roughly 80% of significant corrections began from more extended market conditions, or 80-20 Index values higher than 567.

The Fed’s strong hints at another round of quantitative easing are a significant factor in many markets, including copper, silver, gold, and oil. You may or may not agree with the Fed’s approach, but the reality of the situation is more QE is probably on the way. Our task is understand the Fed’s possible impact on asset prices.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.