Gold Sell-off from 28year Highs Expected to be Short-lived

Commodities / Gold & Silver Oct 02, 2007 - 12:09 PM GMTBy: Mike_Clark

Gold

Gold

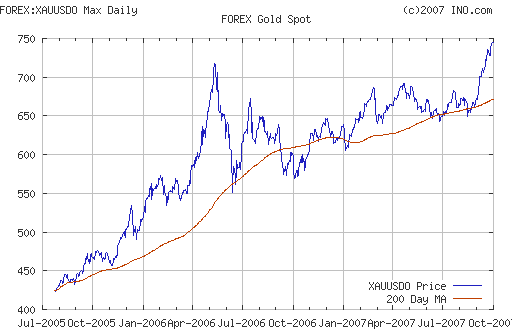

Gold made a new 28 year high close on the COMEX in New York yesterday. It closed at $746.90 and has sold off in Asian and early European trading.

The dollar has rallied and oil sold off which may be leading to profit taking in gold. Gold was due a breather after the large run up in recent weeks and profit taking and consolidation is to be expected.

There is support for gold at $726 and stronger support at previous resistance at $690 to $700 and the 50 day moving average at $693. Gold was up by nearly 11% in September alone and given the size of the run up a consolidation is to be expected.

However, the importance of gold's monthly close above $700 for the first time since 1980 (in January 1980 gold closed at $681.50) is not fully appreciated and will likely lead to gold surpassing its interday high of $850 in the coming months. The importance of this has not been realised but it will have been noted by chartists and technicians and will likely lead to further allocations into gold by retail investors, hedge funds, high net worth individuals and institutions.

Also any sell off is likely to be brief due to robust physical demand being seen even above $700. In a tight supply-demand environment any sort of industrial unrest and 'resource nationalism' in Latin America, Russia or elsewhere internationally will be supportive of the gold price. Another example of this was seen in Peru with the news yesterday that a national strike is planned for November 5 at Newmont Mining Corp.'s Yanacocha mine, reportedly the largest gold mine last year.

The FT reports that European investment banks on Monday were forced to reveal the heavy damage inflicted on their profitability by the recent turmoil in financial markets. Credit Suisse followed UBS with a profit warning. But the announcements prompted a sector share price rally on investor hopes that the disappointing trading statements could signal the worst might be over for the banks by quantifying the extent of fallout from the turmoil.

The ramifications of the credit crisis and Northern Rock run on the bank in the UK continue to be digested. The Telegraph reports that the banking industry has given a lukewarm welcome to the Chancellor's plans to raise the guarantee on savers' deposits to £35,000 but cautioned him against increasing the limit further. The British Bankers' Association said it had not yet been consulted on the reforms to the deposit guarantee scheme, and urged Alistair Darling to commission a full review into the way the financial system and the money markets stumbled amid the Northern Rock crisis.

CBI director-general Richard Lambert said: "The CBI is in favour of protecting 100% of savings up to £35,000 but we need plenty of consultation on any move beyond that. We must make sure that any new scheme will not provide perverse incentives to savers to invest in inappropriate areas and that the changes are affordable for the system." Liberal Democrat Treasury spokesman Vince Cable said: "The Government's chopping and changing commitment to deposit guarantees is so confusing that it seems likely it will undermine stability rather than reinforce it. "Ministers must beware the depositor protection scheme becoming a 'crook's charter' in which dodgy banks attract deposits which are fully protected, lend money recklessly, knowing the Government will always provide a copper-bottomed guarantee."

Forex and Gold

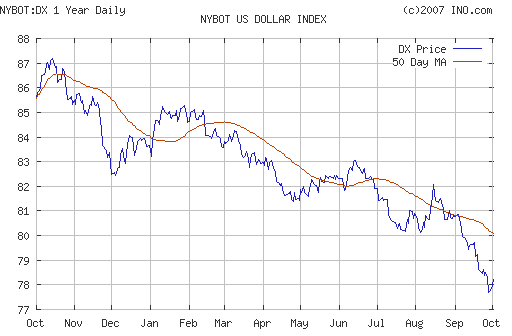

The trade weighted USD index has recovered from yesterday's new all time record low of 77.666. This low was below it's previous all-time low of 78.19 struck on its trade-weighted index in 1992.

The sharply deteriorating US housing market is beginning to affect the wider economy which may necessitate further interest rate cuts. However further interest rate cuts could lead to a run on the dollar and a currency crisis and thus the Federal Reserve has a massive dilemma with no easy solution. One path may lead to deflation and a more stable dollar the other to a declining dollar and stagflation.

However, the dollar does look oversold in the short term and a rally back to previous support at 80 may happen. But the the likelihood of further weakening of the U.S. economy and interest cuts will likely make any reprieve for the dollar brief.

The increasing trend away from the petrodollar and towards a petroeuro or 'petro basket of currencies' (including GBP and JPY) will lead to further pressure on the dollar in the coming months.

Iran has slashed the use of the dollar in payment for its oil exports to 15 percent, an official said this morning, amid growing pressure from the United States on its financial system. The vast majority of transactions for oil from OPEC's number two producer are now being carried out in euro, said Mohammad-Ali Khatibi, deputy head of the National Iranian Oil Company in charge of marketing.

Silver

Spot silver was trading at $13.27/13.29 (1200 GMT).

Silver continues to trade in unison with gold. It outperformed gold to the upside in recent days and is now again outperforming to the downside with its higher beta resulting in another sharp correction.

PGMs

Platinum was trading at $1348/1356 (1130 GMT).

Spot palladium was trading at $348/354 an ounce (1200 GMT).

Oil

Oil prices slipped below $80 a barrel as investors stayed on the sidelines ahead of the U.S. Energy Department's weekly report due Wednesday. Light, sweet crude for November delivery slipped 34 cents to $79.90 a barrel in Asian electronic trading on the New York Mercantile Exchange by mid afternoon in Singapore.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.