QE2 And Corporate Earnings Are The Key This Week

Stock-Markets / Stock Markets 2010 Oct 11, 2010 - 09:19 AM GMTBy: PaddyPowerTrader

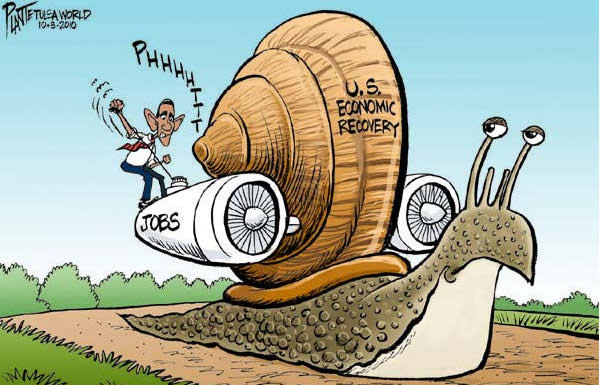

U.S. stocks gained Friday, sending the Dow Jones Industrial Average above 11,000 for the first time since before the May 6 crash, as worse than estimated jobs data raised speculation the Federal Reserve will enact stimulus measures. When the much awaited macro hit the tape, confusion reigned and persisted for the rest of the afternoon. The headline number was weaker (-95k v -5k cons) and initially sent markets lower, but wait, surely a worse number makes QE more likely? Up we went. The underlying NFP detail was mixed; the private payroll gain in September was close to expectations (+64,000), and there were upward revisions to July/Aug (+36,000 net), but, there was a very sharp 84,000 drop in state and local government jobs (primarily teachers).

U.S. stocks gained Friday, sending the Dow Jones Industrial Average above 11,000 for the first time since before the May 6 crash, as worse than estimated jobs data raised speculation the Federal Reserve will enact stimulus measures. When the much awaited macro hit the tape, confusion reigned and persisted for the rest of the afternoon. The headline number was weaker (-95k v -5k cons) and initially sent markets lower, but wait, surely a worse number makes QE more likely? Up we went. The underlying NFP detail was mixed; the private payroll gain in September was close to expectations (+64,000), and there were upward revisions to July/Aug (+36,000 net), but, there was a very sharp 84,000 drop in state and local government jobs (primarily teachers).

Stocks wise Alcoa rose 5.7% after beating brokers profit estimates, CF Industries Holdings, Deere & Co. and Monsanto all surged more than 4.1% as the U.S. government cut crop supply forecasts. But in contrast Tyson Foods Inc. and Smithfield Foods both dropped at least 6.7% on concern feed costs will rise. Elsewhere J.C. Penney and Fortune Brands rallied more than 2.6% after Pershing Square Capital Management disclosed stakes.

A holiday in Japan (health sports day) and in the US (Columbus Day) will limit activity and volumes today, though the US stock market is actually open.

There are no earnings Stateside today but Tuesday kicks off with Intel, while Weds brings forth the first of the big banks JP Morgan. We get Goole on Thursday and GE to end the week.

In Europe a subdued opening has seen Smiths Group, the world’s biggest maker of airport security scanners, gaining 1.3% after its price estimate was raised 11% by UBS, while Inmarsat, the world’s biggest provider of satellite services, climbed 1.4% after Goldman Sachs recommended the shares. But BT has shed 1.8% today after its recommendation was cut at Sanford C. Bernstein & Co.

And Yara, the largest publicly traded nitrogen-fertilizer maker has rallied 4% and Syngenta, the world’s biggest maker of agricultural chemicals, has risen 2.5% after news that Corn futures rose the 45 cent daily limit, or 8.5%, to $5.7325 a bushel on the Chicago Board of Trade. Corn harvests will fall 3.4% from a year earlier after floods in June and dry weather in August cut yields, the USDA said. Soybean futures gained as much as 4.4 percent to $11.8475 a bushel, the highest since June 5 last year. Separately, the Telegraph newspaper said Yara could be a potential buyer of Potash Corp. of Saskatchewan Inc.’s non-potash units.

Elsewhere in Europe Gamesa Corporacion Tecnologica has slumped 5.2% after UBS downgraded its recommendation on the Spanish maker of wind turbines to “sell” from “neutral” and Exane BNP Paribas cut its price estimate on the shares by 43% to 4 euros. “We continue to see market fundamentals as particularly tough,” Exane analyst Arnaud Brossard wrote in a report today. “Demand is modest and overcapacity is still high.”

Today’s Market Moving Stories

•Massive USD shorts accumulated in CME futures. Shorts haven’t been this big since Nov 2004. We’re almost at record levels. And of course, numbers released by CFTC on Friday were based on a positioning snapshot taken on Tuesday. A lot has happened since then and it’s all been USD negative. ‘Current’ short positioning at this very moment must surely be at record levels, we’re at an extreme so clearly risk of a USD rebound now rising. Seems massive amounts of QE now built into the price. So despite the damp squib at the G7 the market is very vulnerable to a big disappointment when FOMC decision comes on Nov 3 and a Dollar rebound. But we don’t have to wait until then Bernanke’s speech on Friday night will be crucial,.any hint from him that the next round of QE will be small and inoffensive should see the USD bounce strongly on short covering. Even before then, on Tuesday, we get the eagerly awaited FOMC minutes from the fateful Sept 21 policy meeting if these confirm that “shock and awe” QE is off the agenda, then USD should benefit, catching lots of shorts “offside”.

•Japan’s Govt Pension Fund to buy emerging markets Stocks. Why? Because the fund desperately needs to improve return on investment, as aging population means big payouts expected from 2012. The Nikkei newspaper says it’s not going to happen until next Summer though. But when it does, we should notice. The Fund is worth about $1.2trn, only 9% of this currently held in overseas equities (but all of these are in developed market economies). Most of the rest is heavily invested in JGBs (domestic Govt bonds), where the yields are miserable. Diversification will start small. Surprisingly, JGB holdings will not be touched initially. Instead there will be some switching from developed market equities into EM equities. So USD/JPY unlikely to be affected as JGB yields should not be disturbed. The plan is to target BRIC economies, Africa, Mexico and others. That won’t please lawmakers, policymakers, and regulators in these economies who are already concerned about capital inflows.

•Greek bonds are on fire again today i.e. their spread over Germany is contracting on news that theIMF is prepared to lengthen Greece’s bailout loans with longer term loans if European nations decide to do so. Mr Strauss Kahn said Greece is doing “exactly what they need to do” to comply with the loan conditions but need additional time. An IMF spokeswoman said recent improvements in investor sentiment toward Greece due to strong implementation of reforms “suggest that Greece will be able to fully cover its external financing need from the markets from 2012″.

G7/IMF/World Bank Meetings

Usual case of much ado about nothing after all the “currency wars” hype. As expected, meetings ended without agreement on anything. Summarising, the FT comments that global economic cooperation is “in disarray”. US and China traded words: Geithner saying China needs to do more, China complaining that ultra loose US monetary policy is encouraging destabilising capital flows into emerging markets. There was no specific public criticism of Japan’s unilateral FX intervention policy either, although ECB’s Draghi took a swipe on the sidelines of the meeting. Referring to Japan’s intervention said: “Not only is it against the spirit we ought to have it also doesn’t yield results”. Noda seemed pretty pleased though with how the G7 received his explanation for the intervention: “we did not discuss anything about the future, but I believe we’ve gained understanding on our basic stance”. Geithner and Noda even had a bilateral meeting where, according to Noda, no specific mention of Japan’s intervention policy was made. All looks like a green light for Japan to come in again. Attention now shifts to G20 meeting of Finance Ministers and central bankers on Oct 22-24. S Korea President Lee on wires o/n saying G20 must reach FX accord by Nov Summit, and failure to do so would put world economy in big trouble.

Company / Equity News

•Travis Perkins’ reports that its performance during Q3 was inline with its expectations with like for like sales +10.3% in merchanting and +0.6% in retail (Wickes). The outcome for merchanting sales shows that the +10% rate previously reported for July has been sustained, however the group states it is seeing some signs of this rate moderating in recent weeks. Merchanting gross margins in Q3 were inline with H1.Wickes like for like sales of +0.6% represents a turnaround on the -1.5% seen for the month of July and -0.5% outcome in H1. There is no change to Travis Perkins full year outlook as provided with its H1 results, which included modest growth in the trade market in 2010.

•Vivendi and Vodafone, the world’s largest mobile phone company may put talks over the U.K. company’s 44% stake in French mobile operator SFR on their agenda in the coming months, the French weekly Journal des Finances said, citing Vivendi Chief Executive Officer Jean- Bernard Levy.

•Bloomberg reports that the search for higher yields is driving the biggest rally in seven years for telephone stocks, as investors ignore some of the lowest profit forecasts in the MSCI World Index. Verizon Communications Inc. and PCCW Ltd. are leading a 21% gain in MSCI’s gauge of 52 telecommunications companies since the end of the second quarter even as analysts estimate that the group’s earnings will grow at less than half the pace of the MSCI World measure of stocks in 24 developed nations, data compiled by Bloomberg show. U.S. phone shares are the most expensive industry in the Standard & Poor’s 500 Index relative to forecast profits, the data show. With the MSCI World rising less than 4%in 2010 and corporate debt offering the lowest yields on record, investors are sacrificing the prospect of faster earnings growth for the current income of telecommunications stocks. Artemis Investment Management LLP, BlackRock Inc. and Fifth Third Asset Management Inc. are buying phone shares as dividends of companies from Royal KPN NV to AT&T Inc. yield more than their bonds amid signs that the U.S. economy is slowing.

•Cnooc Ltd. will pay $1.08 billion for a one third stake in Chesapeake Energy Corp.’s Eagle Ford shale project in Texas, in the biggest acquisition of a U.S. oil and gas asset by a Chinese company. Hong Kong-listed Cnooc plans to buy 33.3%of Chesapeake’s 600,000 oil and gas leasehold acres in Eagle Ford, the companies said in separate statements. Cnooc will also pay $1.08 billion of Chesapeake’s drilling costs in the basin, Chief Executive Officer Aubrey McClendon said in an interview.

•Potash Corp. of Saskatchewan Inc. is considering selling its nitrogen and phosphorous assets and paying shareholders a dividend of up to $70 a share, the Sunday Telegraph reported, without saying where it got the information. Potash Corp. may try to use the asset sale, and add at least another $4 billion to its $3 billion in debt, to repel a hostile bid from BHP Billiton Ltd., the newspaper said. Potash spokesman Bill Johnson in Saskatoon, Saskatchewan declined to comment on the report when contacted by Bloomberg News today.

•Separately, the Ontario Teachers’ Pension Plan is in talks with Temasek Holdings Pte about a possible rival bid to BHP Billiton Ltd.’s hostile offer for Potash Corp. of Saskatchewan Inc., the Sunday Times reported, without saying where it got the information. The two funds, together with Teck Resources Ltd., are considering an outright takeover offer for the fertilizer company or buying a minority stake at a higher price than BHP’s offer of $130 per share, the newspaper said. Jeffrey Fang, a spokesman for Temasek, Singapore’s state owned investment company, declined to comment on the report to Bloomberg News today. Ontario Teachers’ spokeswoman Deborah Allan also declined to comment.

•And it seems everyone wants a piece of Chinese action these days. Siemens AG wants to boost its share of the wind turbine market and surpass market leaders General Electric Co. and Vestas Wind Systems A/S, Handelsblatt reported. Siemens is counting on expanding turbine sales in China and the U.S. to help the German company increase its 5.9% share of the global market, the newspaper said, citing Rene Umlauf, who heads Siemens wind business.

•ArcelorMittal is in talks with China Oriental Group Co. to set up a joint venture to produce steel sheet piling in China with ArcelorMittal’s technology, the China Business News reported, citing Michel Wurth, a board member of the company.

•And Ford Motor Co. plans to focus its expansion efforts in China to help catch up with competitors General Motors Co. and Volkswagen AG, Handelsblatt reported, citing Chief Executive Officer Alan Mulally. Ford is “aggressively” expanding production capacity and a distribution network with two local partners in China, the newspaper said.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.