Can the U.S. Dollar Drop Fast Enough to Keep the Stock Market Up?

Stock-Markets / Stock Markets 2010 Oct 14, 2010 - 12:32 PM GMTBy: PhilStockWorld

Wheeee - this is fun!

Wheeee - this is fun!

The dollar dropped to 76.5 this morning and that gave us a nice pop in the futures which is fading now (8am) as we move towards our 8:30 Trade Report along with the PPI and, of course, the usual 450,000 weekly pink slips handed out to the few remaining US workers (135M and dropping almost as fast as the value of the dollar).

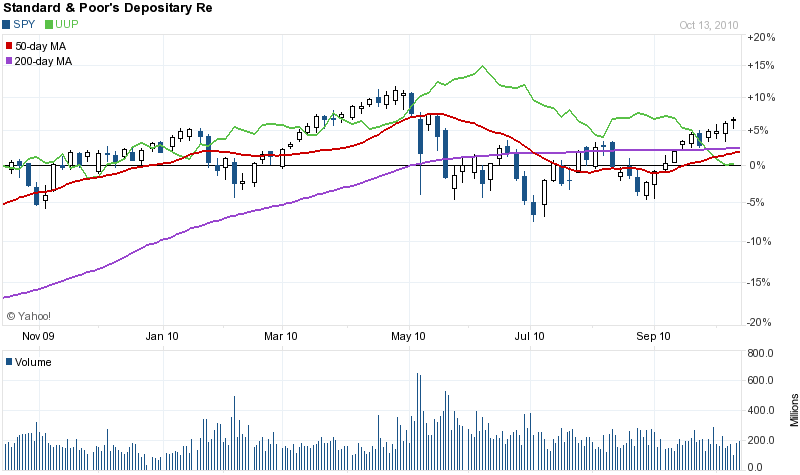

As you can see from Pharmboy’s excellent chart, our market "rally" is ALL about the declining dollar. We are not used to inflation in this country - it hasn’t been much of an issue for the past generation but that’s what we’re seeing here as we are experiencing lower wages, lower demand and flat prices - THAT IS INFLATION or, as we used to say in the 70s - STAGFLATION. A stagnant (or declining) economy plus inflation is a disaster for the people, even while it may be a boon for Big Business as they squeeze whatever dollars are left from the pockets of the consumers while paying their workforce less and, through the benefit of worthless currency, cleaning up on foreign sales as it’s much easier to sell an IPhone at $199 when $199 was 167 Euros in May and is 142 Euros in October - a nice 15% discount (for foreign buyers) heading into the holidays!

Since AAPL makes their IPhones in China - using the remaining FoxConn employees who haven’t killed themselves to escape their torturous working conditions (one improvement that’s been made is they now have bars on the windows to stop the workers from escaping by leaping to their deaths) and, since China’s currency is pegged to ours, their production costs stay flat and net profits (when priced in dollars) look pretty good.

Since AAPL makes their IPhones in China - using the remaining FoxConn employees who haven’t killed themselves to escape their torturous working conditions (one improvement that’s been made is they now have bars on the windows to stop the workers from escaping by leaping to their deaths) and, since China’s currency is pegged to ours, their production costs stay flat and net profits (when priced in dollars) look pretty good.

In fact, I had been getting bearish because I thought corporate profits weren’t going to be so good this quarter, what with the lack of sales and all, but I was wrong. I was wrong because corporate profits are priced in dollars and dollars are worth 10% less than they were the last time corporations reported.

So silly me - all profits are inflated by 10% and that 10% is the E that gets divided from the P and gives us a much better price/multiple to hang our hats on and that gets investors to BUYBUYBUY and, as I said yesterday - they may as well because Lord knows it’s utter foolishness to leave your money in a bank and just watch it lose 2.5% of its buying power EVERY MONTH.

Isn’t the declining dollar good for exports? That’s what they keep telling us, isn’t it? Well, it’s not. What do you think - that AAPL is making IPhones in China and then shipping them to Cupertino and then shipping them back to Hong Kong and Tokyo to sell? No, that would be silly. AAPL is a big multi-national corporation that has an office in Cupertino but manufactures almost everything overseas.

And why wouldn’t they? Despite a 20% pay raise at FoxConn (and it’s nice to have a 3rd party employ 100,000 workers for you so you can still claim your 34,000 person work-force is mainly American) Apple’s labor cost of producing an IPad only rose from 2.3% to 3% but that’s in Yuan, which have declined 12.5% with the dollar since May so even-Steven for AAPL!

Oh yes, exports (sorry, I went off track): So, exports were up just 0.2% as the dollar crashed. Why? Because we don’t make anything here - there’s nothing to export. As Michael Snyder points out in his excellent "24 Statistics about the US Economy that are Almost too Embarrassing to Admit," despite inventing the television in 1927 (Philo Farnsworth for you trivia buffs), NOT ONE (ZERO) of the 211 MILLION televisions sold in the World in 2009 was made in America. In fact, overall manufacturing is down 60% in the past 40 years and the US has lost over 30M factory jobs since Al Gore lost his.

Only 12M Americans, not even 10% of our workforce, now work in Manufacturing so EVEN IF a 10% decline in the dollar boosted manufacturing by 10% and EVEN IF making 10% more stuff got US Corporations to hire 10% more staff--that would add just 1.2M workers. That’s not very likely when FoxConn is happy to ramp up with workers who make less money per day than a US worker pays for lunch at a roach coach…

IMPORTS, on the other hand, were up 2.1% to $200.2Bn. That is a net deficit of $46.4Bn or a pace of well over $500Bn a year that we ship overseas. Adding insult to injury, we bought a lot less stuff this month - we just got charged more for it as our dollar depreciated. Getting less for more is something the middle class has gotten used to this decade and, as we’ve pointed out before - food inflation does not even take into account the shrinking size of almost everything you buy at the grocery store, yet another way we get less for more as our economy collapses in stealth mode.

Well, not entirely stealthy as 462,000 pink slips were handed out last week to US workers which was 20,000 more than expected so that’s knocking our futures back down a bit, as is the 0.4% increase in September Producers’ Prices (what inflation, right) which is 300% more than the 0.1% predicted by the same idiots who tell us how great the economy is and how we shouldn’t worry about inflation and how Quantitative Easing is a clever policy…

I will say this again. Devaluing the dollar by 12.5% costs US Citizens $3.75Tn of their Dollar-denominated assets in the past 5 months and even if we did hire 1.2M factory workers because it boosted exports (it didn’t and we didn’t), that would still be costing us over $3M per job! That’s a pretty hefty cost to pay to make sure the government doesn’t waste any money on additional stimulus, isn’t it?

The top 1% don’t care because they are hedging with commodities but the bottom 99% are getting raped repeatedly at the rate of 2.5% of their wealth removed each month, just to maintain unemployment at the current crisis levels. This is, as the Joker and I mentioned on Monday, a horrifying plan!

We are trying to get bullish, truly we are and I did send out three new high-return bullish trade ideas in yesterday’s morning Alert to Members but the one I liked best was the bearish play on the Russell, using TZA in a spread that pays 1,000% if we get back to our September lows. I am trying and trying and trying to get into party mode but I just cannot get my brain to switch off so I’ll be hitting the bars this weekend and seeing if I can get my judgment impaired enough to join in with all my bullish media colleagues.

"I am not judged by the number of times I fail, but by the number of times I succeed: and the number of times I succeed is in direct proportion to the number of times I fail and keep trying." - Tom Hopkins

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.