Fed Chairman Bernanke Presents a Case for QE2, CPI Remains Subdued

Economics / Quantitative Easing Oct 16, 2010 - 03:16 AM GMTBy: Asha_Bangalore

Chairman Bernanke's remarks, Friday morning, have confirmed expectations that a second round of quantitative easing (QE) will be put in place on November 3.

Chairman Bernanke's remarks, Friday morning, have confirmed expectations that a second round of quantitative easing (QE) will be put in place on November 3.

"Given the Committee's objectives, there would appear--all else being equal--to be a case for further action."

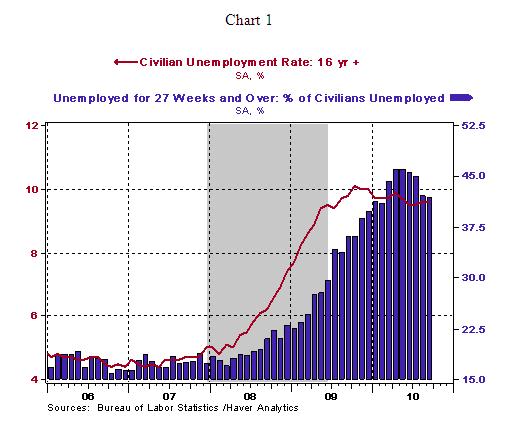

Bernanke's speech essentially noted that the current high unemployment and low inflation situation falls short of the Fed's dual mandate of full employment and price stability, which makes it imperative for the FOMC to act soon.

With respect to employment conditions, Bernanke indicated that the forecast of stronger growth in 2011, although close to trend, is inadequate to bring about a rapid drop in the jobless rate. In his words, an extended period of high unemployment poses a risk to the "sustainability of the recovery." Bernanke addressed the controversy about extent of structural unemployment in the United States as follows:

"Overall, my assessment is that the bulk of the increase in unemployment since the recession began is attributable to the sharp contraction in economic activity that occurred in the wake of the financial crisis and the continuing shortfall of aggregate demand since then, rather than to structural factors."

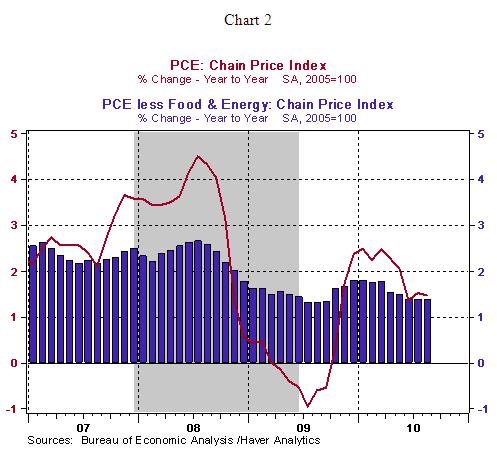

Inflation measures show a decelerating trend in recent months after moving up in the final months of 2009 and early part of this year (see chart 2). The Fed's preferred measures are the personal consumption expenditure (PCE) price index and the core personal consumption expenditure price index which excludes food and energy (The Consumer Price Index for September was published this morning, see discussion below.).

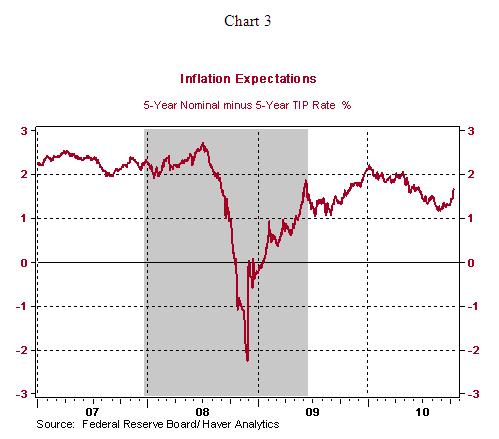

Inflation expectations continue to indicate that markets are confident of a contained inflationary situation in the next five years (see chart 3). To summarize Bernanke's stance, inflation expectations and the magnitude of slack suggest a subdued inflationary trend in the near term.

The FOMC considers a 2.0% inflation to be consistent with the mandate of price stability. The underlying inflation has been hovering in the neighborhood of 1.0% (see chart 2). Actual inflation is running below the level considered consistent with the Fed's dual mandate. The target federal funds rate is 0.0%-0.25%. The current combination of federal funds rate and inflation render a high short-term real interest rate, given the current state of the economy, which raises the probability of a deflationary situation in the months ahead. The conclusion in a single sentence is: The evidence pertaining to low inflation and high employment seals the Fed's case for QE2.

Details of QE2 were not mentioned in today's presentation. But, Bernanke indicated that additional purchases of longer-term securities would be the preferred path of QE2. Bernanke discussed the costs and benefits associated with this action. The Fed is a relative novice in using this tool and in Bernanke's opinion it should proceed with caution. He also added that additional purchases could reduce the public's confidence about the Fed's ability to execute a smooth exit strategy and raise inflation expectations. Translation: (1) The Fed will most likely not disclose the precise amount of purchases to allow for calibration tied to economic developments. (2). The FOMC will consider small purchases compared with the gigantic QE1 program which amounted to $1.725 trillion purchases of Treasuries, agency debt, and mortgage-backed securities.

September 2010 Consumer Price Index - Subdued Trend Remains in Place

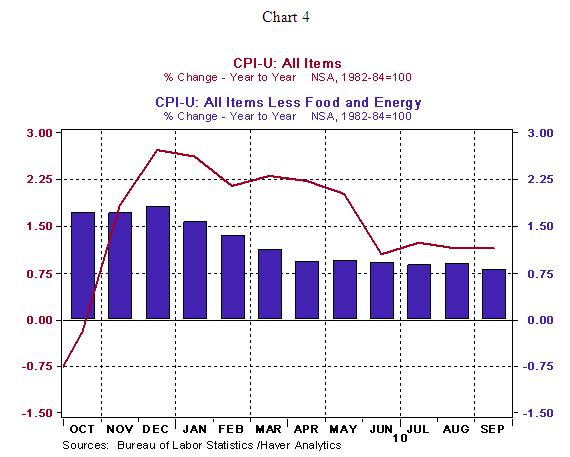

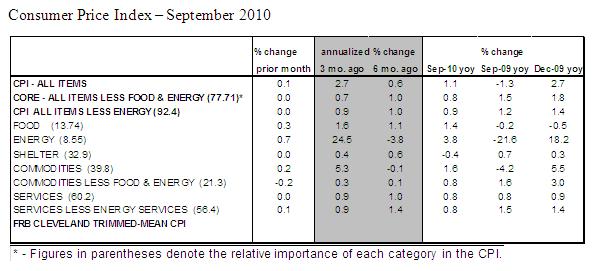

The Consumer Price Index (CPI) rose 0.1% in September, after gains of 0.3% in July and August. The CPI has moved up 1.1% from a year ago in September, which matches the reading of three out of the last four months. The energy price index rose 0.7% in September following a 2.3% gain in August. The higher gasoline price index (+1.6%) was the major culprit for the higher energy price index. The food price index rose 0.3% in September, putting the year-to0year gain at 1.4%; food prices show an escalating trend in the past six months.

Excluding food and energy, the core CPI, held steady for the second month in a row. The year-to-year change of the core CPI shows a significantly subdued trend, with the gain ranging between 0.8% and 0.9% for six straight months (see chart 4) and the lowest since February 1961. These benign inflationary trends were a big part of Bernanke's speech this morning.

In September, the shelter index was unchanged, the medical care index rose 0.6%, new car prices increased 0.1%, and airline fares rose 0.2%. Offsetting these gains were lower prices for clothes (-0.6%), recreation (-0.4%) and used cars (-0.7%).

Retail Sales Post Third Consecutive Monthly Gain, Q3 Consumer Spending Expected to Nearly Match Q2 Mark

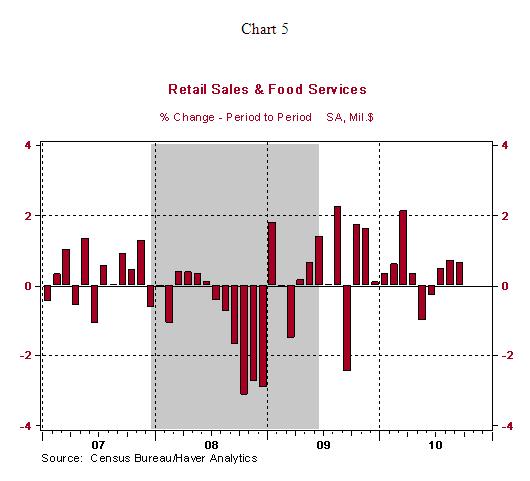

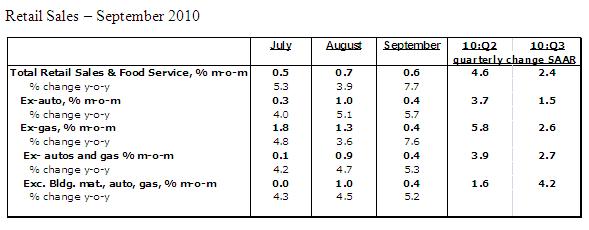

Retail sales increased 0.6% in September after an upwardly revised 0.7% increase in August (previously reported as +0.4%). The back-to-back monthly gains are impressive. In September, purchases of all major categories of retail sales - food, gas, autos, furniture, and building materials advanced. Apparel sales slipped 0.2% and general merchandise sales held steady. Based on the information from retails sales and unit auto sales, it appears that consumer spending in the third quarter will nearly match the 2.2% increase seen in the second quarter.

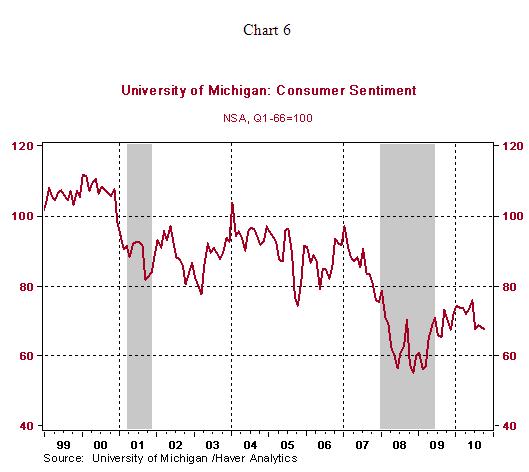

In other related news, the University of Michigan Consumer Sentiment Index slipped slightly to 67.9 in the preliminary survey, reflecting a drop in the Current Economic Conditions Index and an increase in the Expectations Index.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.