Huge Rise in U.S. Unemployment Expected After Mid-Term Elections

Economics / US Economy Oct 19, 2010 - 12:18 PM GMTBy: Mike_Shedlock

Earlier this month Gallup released a survey that showed unemployment rose .8% to 10.1%

Earlier this month Gallup released a survey that showed unemployment rose .8% to 10.1%

Unemployment, as measured by Gallup without seasonal adjustment, increased to 10.1% in September -- up sharply from 9.3% in August and 8.9% in July. Much of this increase came during the second half of the month -- the unemployment rate was 9.4% in mid-September -- and therefore is unlikely to be picked up in the government's unemployment report on Friday.

See Gallup Finds U.S. Unemployment at 10.1% in September for more details.

Gallup has since conducted a second survey that confirms the sharply rising unemployment of the first: Gallup Finds U.S. Unemployment at 10.0% in Mid-October

Unemployment, as measured by Gallup without seasonal adjustment, is at 10.0% in mid-October -- essentially the same as the 10.1% at the end of September but up sharply from 9.4% in mid-September and 9.3% at the end of August. This mid-month measurement confirms the late September surge in joblessness that should be reflected in the government's Nov. 5 unemployment report.

Certain groups continue to fare worse than the national average. For example, 14.2% of Americans aged 18 to 29 and 13.8% of those with no college education were unemployed in mid-October.

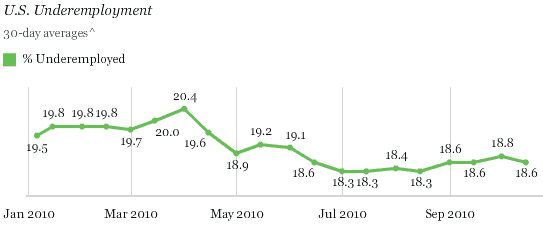

Fewer Working Part Time Looking for Full-Time Employment

The percentage of part-time workers who want full-time work is at 8.6% of the workforce, not much different from the 8.7% at the end of September, but well below the 9.2% reading in the middle of last month.

U.S. Unemployment Rate Should Increase on Nov. 5

Gallup modeling suggests the government's unemployment rate report for October will be in the 9.7% to 9.9% range when it is released Nov. 5. The government's last report showed the U.S. unemployment rate at 9.6% in September on a seasonally adjusted basis, as Gallup anticipated. In addition to seasonal adjustments, the official unemployment rate is likely to be held down by a continued exodus of people from the workforce. It is easy for potential workers to become discouraged when the unemployment rate is expected to remain above 9% through the end of 2011.

In this regard, the lack of increase in Gallup's underemployment measure when the unemployment rate is increasing would normally be a good sign for jobs and the economy. However, the current decline in the percentage of workers employed part time but looking for full-time work is not necessarily positive. It might be that some workers who are employed part time are losing their jobs -- becoming unemployed or dropping out of the workforce -- and are not being replaced, while new part-time workers are not being hired.

Something Amiss in BLS Data

Note that the BLS Jobs Report for September shows a whopping 612,000 increase of involuntary part-time workers from 8,860,000 to 9,472,000 while Gallup has the number declining substantially.

The BLS report is also inconsistent with recent ADP reports.

Please see Rosenberg says "ISM Flunks Sniff Test "; Cashin calls ISM "an Outlier"; ADP, Other Data Does Not Confirm for details regarding August discrepancies between BLS data and ADP.

Those discrepancies continued with the ADP September 2010 National Employment Report in which ADP reported "Private-sector employment decreased by 39,000 from August to September on a seasonally adjusted basis"

That was the second straight month of private sector contraction for ADP, consistent with what Gallup is saying. The odd man out is the BLS which shows private sector expansion.

Labor Pool Contraction

One of the things holding down the BLS unemployment rate is the huge number of people the BLS claims has dropped out of the labor pool.

Allegedly 175,000 dropped out of the labor pool in September. Moreover, 1,768,000 workers supposedly dropped out of the labor force in the past year.

While demographics suggest there will be a large number of boomers retiring, that fact is indicative of a labor pool that should be growing more slowly, not a labor pool massively contracting.

Even with the above astonishing numbers, the BLS reported unemployment rate is 9.6%.

I smell a huge rise in unemployment in the November 5th BLS jobs report, conveniently after the mid-term elections. I am sticking with my forecast that says new highs in the unemployment rate are yet to come.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.