U.S. Dollar Current Account Woes

Currencies / US Dollar Oct 22, 2010 - 01:59 PM GMTBy: Andy_Sutton

Amid the recent rout of the USDollar, fears of an all-out trade war have been stoked globally. The G20 finance heads are currently struggling to find common ground on current account imbalances that will avert the inevitable. The point should not be lost on anyone that none of these leaders are really concerned about why these imbalances exist, but rather are only focusing on avoiding the negative consequences of poor fiscal behavior stacked up over the past several decades.

Amid the recent rout of the USDollar, fears of an all-out trade war have been stoked globally. The G20 finance heads are currently struggling to find common ground on current account imbalances that will avert the inevitable. The point should not be lost on anyone that none of these leaders are really concerned about why these imbalances exist, but rather are only focusing on avoiding the negative consequences of poor fiscal behavior stacked up over the past several decades.

It is for these reasons that any accords that are reached now will fail. The same forces that created the current dissatisfaction will create future dissatisfaction. As in many other arenas today, we appear content to kick the can down the road and try to keep the game going another month or year. This week we’ll take a look at the current account and some of the factors driving these imbalances.

Financial Responsibility DOES Matter

Using 2009 data, the United States ranked 181st out of 181 ranked nations in terms of current account at -$380.1 Billion. Anyone out there want to take a guess at some of the lowest ranking nations?

You guessed it. Spain, Italy, France, and Greece are right behind the US at the bottom of the heap. If anyone still thinks that debt doesn’t matter, this fact should provide a compelling argument to the contrary. The ongoing problems in Europe as a result of debt and the increasing violence in the French strikes portends a bad ending for those nations that insist on running massive debts to the rest of the world. This is particularly true when that borrowed money is used to prop up otherwise unsustainable social programs. People will not be quick to vote to end their own gravy train, and as such, these things usually end badly.

Taking a look at the Eurozone both in totality and by its worst offenders, it becomes rather obvious that Germany is carrying the entire EU. While this is no surprise or great revelation, it should underscore the inability of a few savers to make up for the gross negligence of the rest. Frankly, it should be a bigger surprise that Germany isn’t seeing the kind of civil unrest that France is. If nothing else, this should underscore an interesting characteristic of human nature. People who are having something (that for the most part unearned in this example) taken away react much more violently than those who are being forced to pay for it.

Why Support the Dollar?

Also by contrast, the same data that showed the US as being ranked 181/181 showed Germany as being ranked #3 behind only China (1) and Japan (2). It should be a curiosity then why Japan is stepping in to support the Dollar. This action started a few weeks ago, with rhetoric, and has been followed up by somewhat meaningful action. The obvious question is why would a nation who ranks #2 in a valid measure of economic strength step in to support a dying currency paradigm? Especially when doing so will only be to its own peril? It is pretty obvious that just on a current account basis that the US is leading the way down followed by the UK and most of Europe. There are other offenders as well.

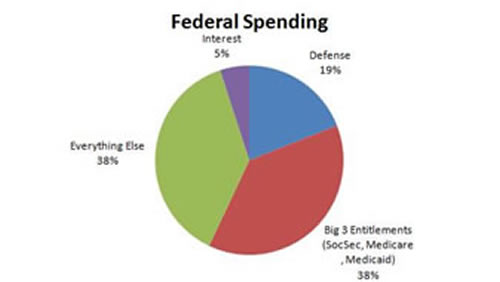

The answer is found in the most massive of imbalances, and the root of the current account and debt problem and that is the imbalance of manufacturing. Japan does a great deal of its business abroad and as such desires a ‘weaker’ currency to make its exports more competitive. It must compete with China, and the other Asian manufacturing hubs in foreign markets and therefore it is to Japan’s advantage to keep the Yen cheap just as it is to China’s to keep the Yuan suppressed. This is a direct result of globalization, and it is this author’s opinion that this reality was an intended consequence of the actions of the 1980s and 1990s. Economists, political analysts, and historians will undoubtedly argue about the causes of the eventual decline of the US/UK/Eurozone. Was it the nearly exponential explosion of social entitlement programs or was it the decay of manufacturing capability and production that triggered the demise? The two happened nearly simultaneously here in the US, so the debate is wide open or so it would seem.

What Came First?

I would opine that the diminished manufacturing activity and increase of ‘great society’ style entitlement programs go hand in hand. The transition from production to consumption creates a gap in the wealth function and that must be filled if societal paradigms are to be maintained. Governments, in their infinite wisdom, thought it wise to steal from tomorrow to create a paradoxical utopia in the present. First the national savings were spent and then when that was exhausted, the borrowing spree began. What used to be the third world was anxious to participate because those nations saw it as an opportunity for their own industrial revolutions and a means to create economic superpowers. The problem with superpowers is that not everyone can be one; otherwise there’d be nothing super about it.

In summary, Treasury Secretary Tim Geithner is currently meeting with other finance ministers from the G20 to figure out a way to keep this mess going another year. Geithner’s plan is to create current account targets as a way of pushing China towards a revaluation of its currency.

“Setting numerical targets would be unrealistic,” said Japanese Finance Minister Yoshihiko Noda, while German Economy Minister Rainer Bruederle rejected a “command economy” approach. Indian Finance Minister Pranab Mukherjee said caps would be hard to quantify. In interviews with Bloomberg Television, Canadian Finance Minister Jim Flaherty said the idea was a “step in the right direction” and Australian Treasurer Wayne Swan called it “constructive.”

It is pretty obvious that the biggest offenders want help and the countries in positions of superiority don’t have a large affinity for further handouts in the form of currency revaluations. What is odd is Canada’s position. Canada ranked #22 in 2009 with a reasonable current account surplus and as such ought to be averse to such forms of charity. However, Canada’s position is being formulated by the creator of the tax plan that killed the Canadian Energy Trusts so the common sense of his position could easily be called into question.

The central point of concern at this point is that the race to the bottom in the currency world is going to start a trade war. The race to the bottom in currencies is caused by current account imbalances, which were in turn caused by an avalanche of social programs and a deindustrialization of much of the First World. While there are certainly other factors, the causality here should be rather clear.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.