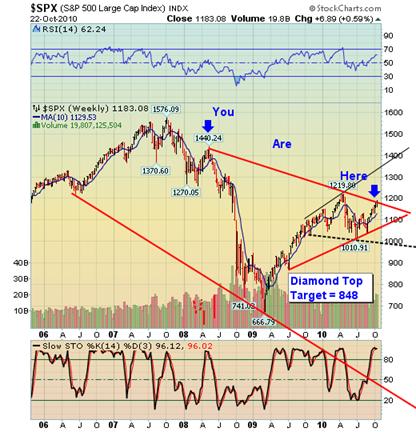

Stock Market Stalls at the Diamond Top

Stock-Markets / Stock Markets 2010 Oct 23, 2010 - 12:36 PM GMT FDIC’s Workload is Picking Up.

FDIC’s Workload is Picking Up.

The FDIC Failed Bank List announced seven new bank closures this week. Here we go - the rating agencies are now officially in the game. Next up - collateral calls and other nasty stuff: "Today, Fitch Ratings issued a number of separate press releases placing on Rating Watch Negative most U.S. bank and bank holding companies' Support Ratings, Support Floors and other ratings that are sovereign-support dependent. The two companies mostly impacted by this announcement are Bank of America Corporation and Citigroup, Inc." BBB+ coming up.

BLS Reports Jobs Losses By State In September More Than Double 95K Loss Reported In NFP Report

(ZeroHedge) In the latest amusing discrepancy to come out of the BLS, today's reported unemployment data by state indicated that at the end of September, there was a total of 129,699,600 people employed across the various states. Not very surprisingly, the biggest deterioration occurred in California which lost 63.5 K jobs, followed by New York at 37.6K (Wall Street layoffs?) and Massachusetts at 20.9K. The total change from August's 129,923,400 employed was a drop of 223,800. Well, this is a little confusing as the NFP number for September indicated that total jobs lost were 95,000, a slightly more than 50% improvement compared to the job losses at the state level. A rounding error, perhaps?

The Fed And Treasury's Actions Are Equivalent To Child Abuse(ZeroHedge) Kotlikoff says: "This massive Ponzi scheme is turning the American Dream into the American Nightmare" adding that what the Fed is doing now is equivalent to "child abuse" and adding "If things continue as we adults have planned, our nation’s debt, measured as a share of gross domestic product, will reach Greek levels just when the grandkids start heading to work.

The VIX retraced to the lower trendline.

--This week the VIX tested its 10-week moving average, then completed a deep retracement back to the lower trendline of its wedge. There is little question that the low is in. However, it appears to be waiting for something…like the G-20 meeting in Seoul? Clearly the VIX was sold going into this weekend, but one cannot expect peace and harmony in Seoul after the U.S. has beggared its currency.

--This week the VIX tested its 10-week moving average, then completed a deep retracement back to the lower trendline of its wedge. There is little question that the low is in. However, it appears to be waiting for something…like the G-20 meeting in Seoul? Clearly the VIX was sold going into this weekend, but one cannot expect peace and harmony in Seoul after the U.S. has beggared its currency.

I suggest that the next action may be an explosive move through its upper wedge boundary and above its 10-week moving average. This is the inverse of the crash scenario portrayed in the SPX and NDX.

SPX stalled at the Diamond Top.

The SPX extended its gains for another week as it bumps against the overhead resistance of the Diamond trendline. Equities had their pivot day on Thursday and virtually all the equities indexes stalled at the Thursday morning spike high. We now must see the follow-through. I have taken a look at all the permutations that the cycles can have at this point and a Trading Cycle low is expected in the first week of November. This leaves two weeks or less for the SPX to break down from the Diamond and reach its target.

The SPX extended its gains for another week as it bumps against the overhead resistance of the Diamond trendline. Equities had their pivot day on Thursday and virtually all the equities indexes stalled at the Thursday morning spike high. We now must see the follow-through. I have taken a look at all the permutations that the cycles can have at this point and a Trading Cycle low is expected in the first week of November. This leaves two weeks or less for the SPX to break down from the Diamond and reach its target.

The NDX now reveals a weekly 5-point reversal.

--What many analysts don’t realize is that a 5-point reversal (Broadening Formation) is a topping formation and not a continuation pattern. It seems that many analysts are now calling for a much higher advance instead of a downside reversal from the Orthodox Broadening Top.

--What many analysts don’t realize is that a 5-point reversal (Broadening Formation) is a topping formation and not a continuation pattern. It seems that many analysts are now calling for a much higher advance instead of a downside reversal from the Orthodox Broadening Top.

The pattern also suggests a Diamond Formation with an average downside target of 1480. That may not be the end of the decline. Once it violates the Broadening Top, the target may extend to 1300.

Gold reversed back into its Diagonal, the end of a trend.

-- Gold reversed back inside its diagonal this week. The fifth wave has taken almost exactly 2 years to complete.

-- Gold reversed back inside its diagonal this week. The fifth wave has taken almost exactly 2 years to complete.

I have been studying the cycles in gold from 1999 until today. Gold has unusually long trending cycles, followed by abrupt sell-offs. The initial decline from the March 17th peak in 2008 brought a 14.3% decline in two weeks. In 2006, the decline from that peak was 24% in a month. The pundits are nearly all saying that gold is in a much-needed correction. No one is saying that there is an important trend change going on here.

$WTIC spent another week at the top of its Diamond.

-- $WTIC appears to have completed a reversal pattern at all degrees of trend, but is hesitating to take the plunge. Using the same concept as the SPX, one may see a near-symmetrical Diamond Formation in $WTIC. Oil rallied on Monday, Wednesday and Friday, attesting to the effects of the POMOs on the price of energy.

-- $WTIC appears to have completed a reversal pattern at all degrees of trend, but is hesitating to take the plunge. Using the same concept as the SPX, one may see a near-symmetrical Diamond Formation in $WTIC. Oil rallied on Monday, Wednesday and Friday, attesting to the effects of the POMOs on the price of energy.

We can see the tug of war between world powers as the Chinese Government hiked interest rates on Monday night to cool down its economy. This led to an overnight drop of 4.55% in the price of oil. One of the heavy speculators in oil in this country is Goldman Sachs, one of the Primary Dealers that stands to gain from the POMOs and has large positions in oil. Goldman Sachs is a world power? Look at the influence they have over Washington.

The Bank Index fell below its 10-week Moving Average.

--The $BKX spent another week testing the lower Diamond trendline. This might be considered a complex Diamond Formation. A break of the Diamond yields a target of 34.65, but the Head & Shoulders pattern still remains with a deeper target of 26.57.

--The $BKX spent another week testing the lower Diamond trendline. This might be considered a complex Diamond Formation. A break of the Diamond yields a target of 34.65, but the Head & Shoulders pattern still remains with a deeper target of 26.57.

Karl Deninger, the editor of the Market Ticker, invited Reggie Middleton over for a half hour chat on his Blog Talk Radio show to discuss things such as foreclosure fraud, banks, derivative risk and the markets.

You may access the ZeroHedge recording here.

The Shanghai Index prepares for a pullback and a new bullish formation.

--The Shanghai Index has stalled after making what appears to be a completed impulsive rally. The short-term outlook is that is that it may be ready for a pullback. We now see what may be a neckline across the highs in the $SSEC. If its pullback can stay at some reasonable level above 2319.73, a new Head & Shoulders pattern will have formed.

--The Shanghai Index has stalled after making what appears to be a completed impulsive rally. The short-term outlook is that is that it may be ready for a pullback. We now see what may be a neckline across the highs in the $SSEC. If its pullback can stay at some reasonable level above 2319.73, a new Head & Shoulders pattern will have formed.

The People’s Bank of China increased its benchmark rate by 0.25 percentage points, so deposit rates will rise to 2.25 percent, and a crucial lending rate will climb to 5.56 percent. This is not a big move by most standards, except that the U.S. is attempting to lower rates. This could prompt a flight of capital to China and trigger the H&S pattern.

$USB appears to have found support.

-- $USB may have tested its previous week’s low at 130.94 and likely preparing for its next advance. It remained well above its Model support at 129.30. This blow-off may be tricky, but investors will respond by buying assets that are rising in a declining equities scenario.

-- $USB may have tested its previous week’s low at 130.94 and likely preparing for its next advance. It remained well above its Model support at 129.30. This blow-off may be tricky, but investors will respond by buying assets that are rising in a declining equities scenario.

$USB, $VIX and $USD have all reversed simultaneously from the Friday October 15th low. While $USB may be reversing from a 4th wave low, the others are reversing from a second wave low. It appears that the fifth wave in $USB may have some of the strength and proportion of a third wave as it piggybacks on its partners’ move.

$USD reversed from its lower trendline...DXZ Flash Crashed in after hours.

-- $USD reversed from its lower weekly trendline this week. This trendline is drawn across the recent lows in $USD. The cycles call for not just a spirited rally, but one that should astound the dollar bears.

-- $USD reversed from its lower weekly trendline this week. This trendline is drawn across the recent lows in $USD. The cycles call for not just a spirited rally, but one that should astound the dollar bears.

You may not be aware that the DXZ Flash Crashed nearly 4% about an hour after the market close on Friday. The dollar component quickly recovered, but the CHF and GBP remained down in after hours. This may be a signal of things to come on Monday morning.

I hope you all have a wonderful weekend!

Regards,

Traders alert: The Practical Investor is currently offering the daily Inner Circle Newsletter to new subscribers. Contact us at tpi@thepracticalinvestor.com for a free sample newsletter and subscription information.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.