A Fingerprint of Instability in Biology and Finance, Time Series and Fractals Analysis

InvestorEducation / Financial Markets Oct 28, 2010 - 12:48 PM GMT Recently, there has been much research into the chaotic dynamics of complex systems in many different fields. Complexity theory provides great analytical insights into the structures of "hard" sciences such as biology and also social sciences such as economics. It can even reveal dyamic properties that will serve as predictive indicators across both of the two fields (and perhaps many others). It should be noted that "predictive" doesn't necessarily mean a specific result will always follow, but that it becomes significantly more likely to occur. The following article will explore a relatively simple indicator which identifies high probabilities of instability in both the human circulatory system (specifically cardiac) and financial markets. Let's start this discussion with a short quiz. Take a look at the following four graphs of heartbeats per minute over a 30-minute interval, and see if you can guess which one(s) belongs to a healthy patient and which one belongs to a patient facing sudden cardiac death:

Recently, there has been much research into the chaotic dynamics of complex systems in many different fields. Complexity theory provides great analytical insights into the structures of "hard" sciences such as biology and also social sciences such as economics. It can even reveal dyamic properties that will serve as predictive indicators across both of the two fields (and perhaps many others). It should be noted that "predictive" doesn't necessarily mean a specific result will always follow, but that it becomes significantly more likely to occur. The following article will explore a relatively simple indicator which identifies high probabilities of instability in both the human circulatory system (specifically cardiac) and financial markets. Let's start this discussion with a short quiz. Take a look at the following four graphs of heartbeats per minute over a 30-minute interval, and see if you can guess which one(s) belongs to a healthy patient and which one belongs to a patient facing sudden cardiac death:

|

| Link |

|

| Fractal Coastline |

Fractal Blood Vessels |

|

| Fractal Tree |

The reason why variability of time horizons is so important for market stability can be explained with a simple example. Let's compare an average day trader with a five-minute time horizon to an institutional investor (such as a pension fund) with a weekly time horizon from 1992-2002. The average five-minute price change in 1992 was -0.000284% (an overall "bear market"), with a standard deviation of 0.05976 per cent. A six standard deviation drop (-.359%) in price during that time period could easily wipe out the day trader's investment if it continues. The institutional investor, on the other hand, would consider that drop a buying opportunity since weekly returns over the ten-year period averaged 0.22% with a standard deviation of 2.39%. The relatively large drop for the day trader is basically a non-event for the weekly trader's technical/fundamental outlook, so the latter can buy the dip and provide stabilizing liquidity to the market. [Slides 38-39]

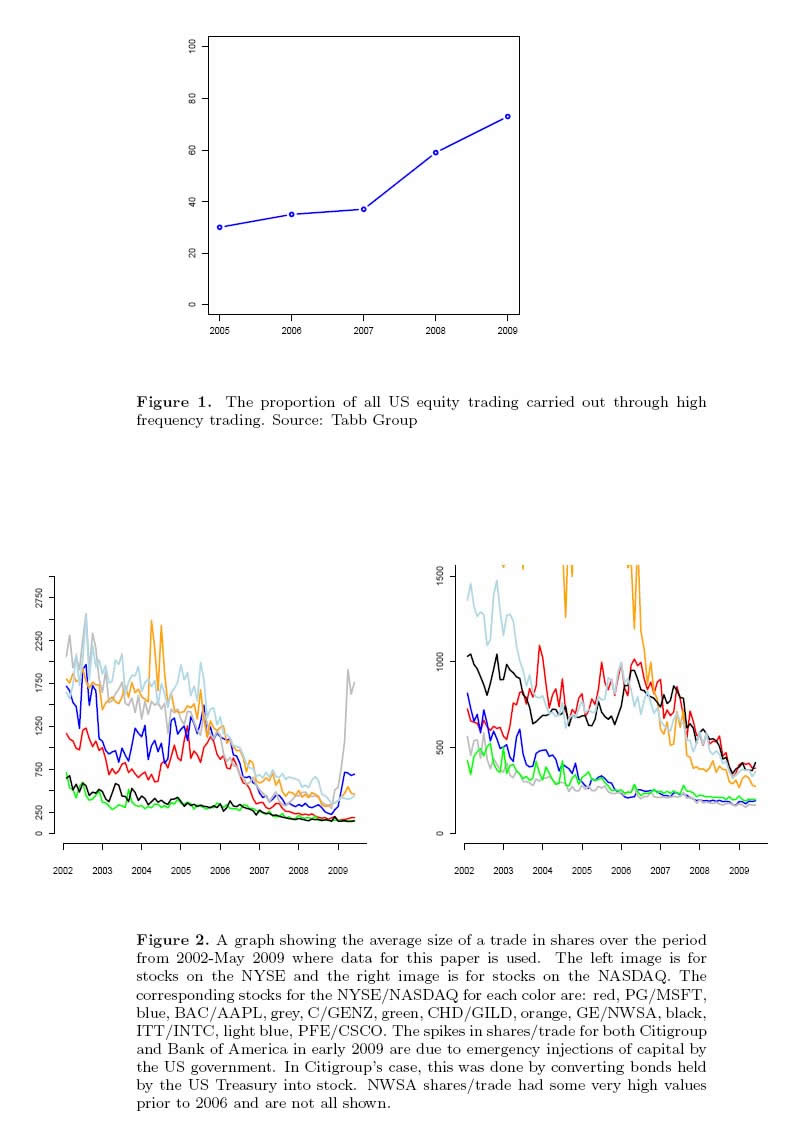

As most people in the world of finance know by now, every week in the stock market is characterized by increasingly few actors trading on an increasingly short time scale. Retail investors with relatively long-term time horizons and variable trading preferences have been exiting the market in droves (~$80B equity outflows from domestic mutual funds YTD) [9], while computer-based high frequency traders have dominated the market and buy/sell to each other in time scales best measured by seconds (one of the largest HFT firms, Tradebot, holds stocks for an average of 11 seconds). [10]. A paper by Reginald Smith, from the Bouchet Frankline Institute of Rochester, has confirmed this trend by showing that high frequency trading (HFT) "is having an increasingly large impact on the microstructure of equity trading dynamics". Currently, more than 70% of U.S. equity trading comes in the the high frequency variety. Smith also states that "traded value, and by extension trading volume, fluctuations are starting to show self-similarity at increasingly shorter timescales". [11]. In essence, the robot traders are dominating the market and destroying the natural fluctuations between stocks traded, shares traded, trading volume and time horizons that characterize a "healthy" market.

|

| Top Graph - HFT % of U.S. Equity Market Bottom Left - Average Trade Size in NYSE Bottom Right - Average Trade Size in NASDAQ |

Given the above information, one may conclude that we are currently on the verge of the stock market equivalent of "sudden cardiac death", but that's not entirely accurate. Although the dominance of HFT in the market has helped destroy healthy variability, it is not the root cause of systemic instability. That designation is more appropriately reserved for the decades-long credit (complexity) bubble which has ensued all around the world, but especially in the United States. The reality is that the "critical point" for U.S. financial markets was already reached in 2008, and as most Americans are aware, the markets almost died back then. Cue the federal government and federal reserve, which provided trillions in "liquidity" to artificially create the variability that had been lost. The politicians and central bankers would like to think of themselves as the defibrilator that has sparked the financial "heart" back into a healthy rhythm. However, that analogy is simply not accurate, as evidenced by the current equity market's painfully boring microstructure. They are more like the artificial respirator that is keeping the brain-dead markets "technically" alive. Their tireless efforts are simply masking the terminal reality that lies underneath, and now we're all just waiting for someone or something to finally pull the plug.

Ashvin Pandurangi, third year law student at George Mason University

Website: "Simple Planet" - peakcomplexity.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2010 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.