Bulls Still In Control, But the Stock Market Has QE Fatigue

Stock-Markets / Stock Markets 2010 Oct 29, 2010 - 02:11 PM GMTBy: Chris_Ciovacco

The quantitative easing (QE) talk on the street this week has been along the lines of (a) is quantitative easing baked into asset prices?, (b) will the Fed’s announcement on November 3rd trigger a “sell the news” event, (c) the perception of too much QE could spark inflation fears and push interest rates up, and (d) too little QE could result in a “disappointment sell-off” in stocks and commodities.

The quantitative easing (QE) talk on the street this week has been along the lines of (a) is quantitative easing baked into asset prices?, (b) will the Fed’s announcement on November 3rd trigger a “sell the news” event, (c) the perception of too much QE could spark inflation fears and push interest rates up, and (d) too little QE could result in a “disappointment sell-off” in stocks and commodities.

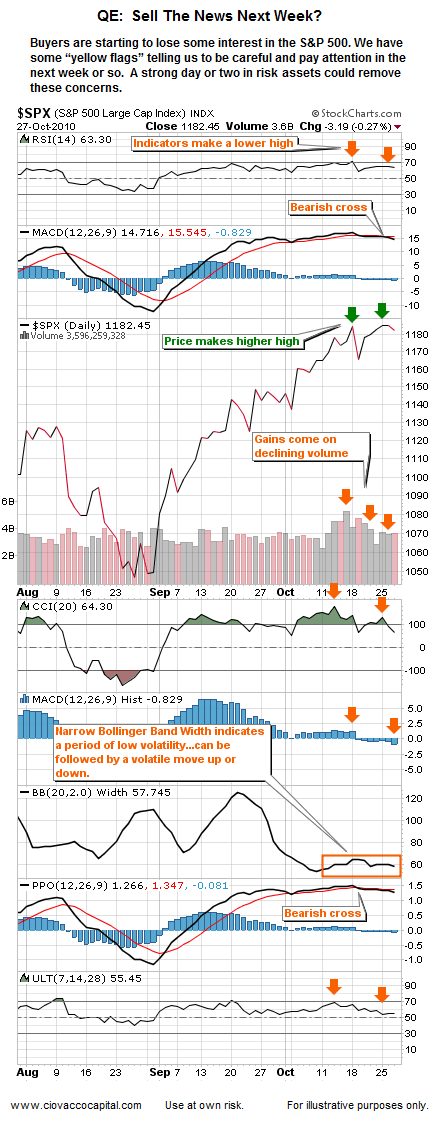

With the information we have in hand now, the market is set-up for a “sell the news” event next week. Prior to reviewing some concerns, we should note a convincing break above 1,185 on the S&P 500 (SPY), occurring on strong volume and positive market breadth could clear these “sell the news set-ups” below. Another bullish possibility, in the short-term, is a weak break above 1,185 that is retraced within a in week or two.

The take away here is we plan to proceed with caution relative to stocks and cyclical commodities until these yellow flags are displaced in some shape, form, or fashion. The comments below are also relevant to the NASDAQ (QQQQ) and the Dow (DIA). The NASDAQ is the clear leader at the moment, but it is unlikely the QQQQ’s would sidestep a market correction for more than a day or two.

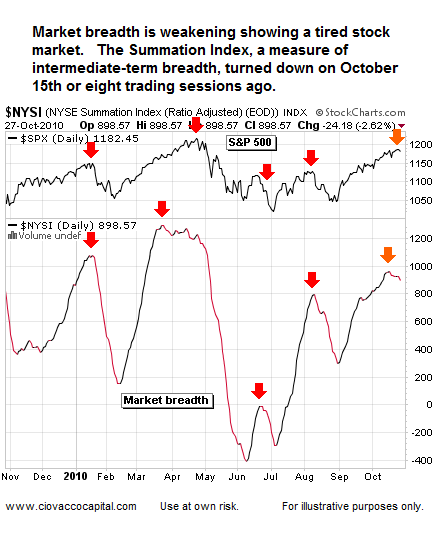

Market breadth refers to the number of advancing issues and the number of declining issues on a given market. Healthy markets have positive breadth or broad participation in rallies. The Summation Index, shown below, is an intermediate-term measure of market breadth. The S&P 500 is shown at the top of the chart. A strong market has a Summation Index line with conviction and a steep slope. Notice the lack of conviction in the Summation Index since roughly mid-September, over a month ago. Also see how the market can react after the Summation Index turns down. Markets can advance for a time with weak breadth, so this represents a yellow, not a red flag presently.

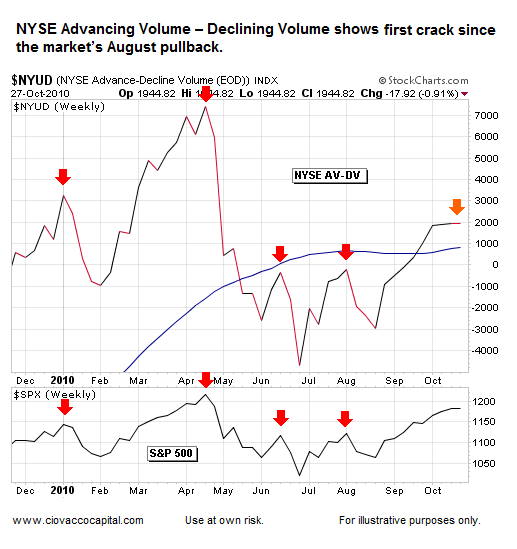

There is an expression on the street, “price follows volume”. Volume is a way to measure the conviction of buyers and sellers. $NYUD, below, shows the volume of advancing stocks less the volume of declining stocks; strong markets have rising lines – weak markets have falling $NYUD lines. The line below could easily turn back up, but notice it has been rising for roughly eight weeks as the market advanced. It is stalling out and turned negative recently, which is another yellow flag as long as the condition remains.

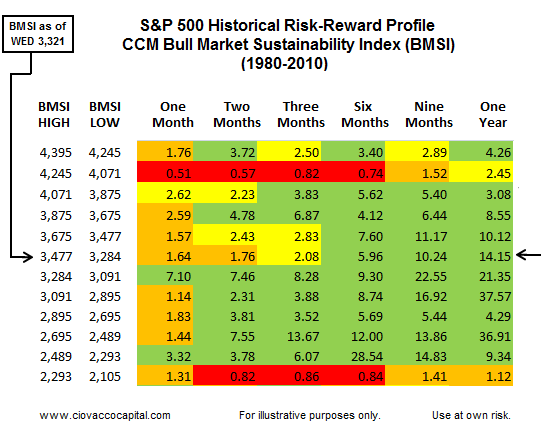

The CCM Bull Market Sustainability Index (BMSI) uses historical market profiles to better understand the current market’s risk-reward profile. The current reading on the BMSI is bullish for the longer-term, but also shows some concerns in the shorter-term (see orange and yellow boxes in one to three month outlook). The BMSI has been falling in recent days, also showing a tired market.

The CCM 80-20 Correction Index uses historical market profiles to better understand when the risks of a correction in the present day are elevated. The 80-20 Index is also flashing some “be careful” warning lights as the daily value has dropped from a high of 675 on October 8th down to yesterday’s close of 366.

We see additional concerns relative to a pullback occurring sometime in the next two weeks when we examine the S&P 500 Index. Technical charts can look intimidating, but the concepts are relatively simple. When healthy markets make new highs, technical indicators also make new highs showing the market’s momentum remains intact. Weaker markets, that are losing upside momentum, see price make a new high, but the indicators make a lower high. Compare the green arrows (price) to the orange arrows (indicators).

The third indicator from the bottom in the chart above is the Bollinger Band Width. Bollinger Bands deal with market volatility. The concept is when volatility contracts, markets are consolidating. Often periods of consolidation are followed by periods of volatility or big moves in price. The orange box shows a sleepy Bollinger Band Width, which almost like a coiled spring waiting to release its energy. The energy may be released with a move to the upside or downside. On the precious metals front, it has been two weeks since gold made a new high. Until some of these conditions described above are cleared, we are more concerned about either a false move to the upside (short-lived) or a break to the downside. This analysis speaks to risk and reward, meaning bullish outcomes are possible – they are just paired with increasing short-term risk.

You can access the next video in our six part series by clicking on the image below. The video gives some insight as to why the Fed is printing money. If we understand some of the Fed’s motives relative to QE, we can make more informed investment decisions.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.