China's Diversification Plans and QE2 See Gold Remain Robust

Commodities / Gold and Silver 2010 Nov 01, 2010 - 06:36 AM GMTBy: GoldCore

Gold and silver rose in all currencies as markets opened in Asia, prior to giving up those early gains. However, in trading in London this morning both precious metals have risen and are higher as the dollar has come under pressure again. Equity markets are mixed in Europe despite most Asian markets closing positively - except for the Nikkei which fell 0.52%.

Gold and silver rose in all currencies as markets opened in Asia, prior to giving up those early gains. However, in trading in London this morning both precious metals have risen and are higher as the dollar has come under pressure again. Equity markets are mixed in Europe despite most Asian markets closing positively - except for the Nikkei which fell 0.52%.

Gold is currently trading at $1,358.00/oz, €975.52/oz, £846.00/oz.

Despite growing concerns about the $89 trillion global bond market and the possibility of bubbles, prices on both two- and 10-year notes were generally higher across Europe, pushing yields lower. Prospects of quantitative easing, or QE2, from the Federal Reserve and other central banks may boost bonds in the short term, and lead to lower yields, but the long term ramifications of this experimental and unprecedented monetary policy may be currency wars, inflation and higher interest rates.

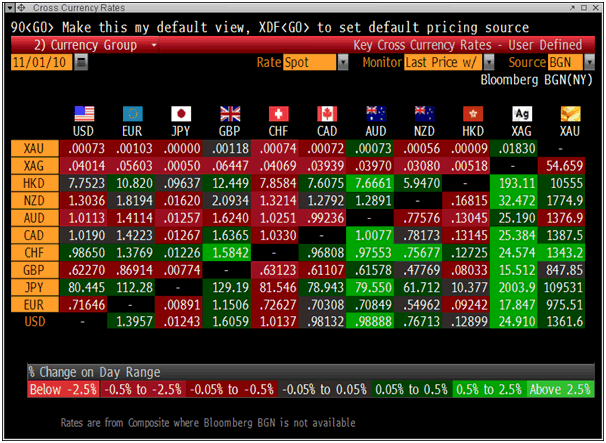

Cross Currency Rates.

China should buy strategic assets such as gold with foreign exchange reserves to avoid losses from a weakening dollar, Shao Fenggao, an official at China Construction Bank Corporation, the world's second-largest lender by market value, wrote in a commentary published in the influential China Business News today. China's foreign-exchange reserves, the world's largest, surged by a record to a new record $2.65 trillion at the end of September.

China's growing importance to the future price of precious metals and particularly gold was seen again this week. An influential newspaper affiliated with the Ministry of Commerce, International Business Daily, said China should buy gold to diversify its foreign-exchange reserves. The country should raise holdings of the metal if it wanted to "internationalise" its currency, the paper said. The comments may have been coordinated as they came after comments by the Chinese commerce minister that dollar issuance by the United States is "out of control," leading to an inflation assault on China.

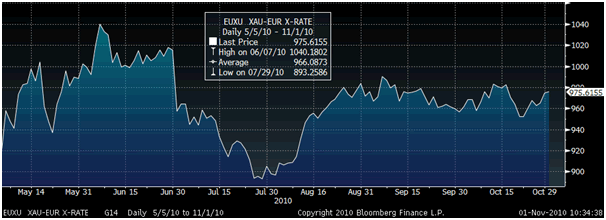

Gold in Euros - 180 Day (Daily).

China now has some $2,400 billion in foreign exchange reserves and yet its gold holdings a percentage of reserves are one of the lowest in the world at just 1.7 percent. A Chinese Chamber of International Commerce researcher that China should "eventually boost its gold reserves to a level equal to that held by the United States" on Tuesday. China's reported gold reserves total 1054 tonnes, a fraction of the 8133 tonnes held by the US.

Chinese dominance of rare earth supplies and trade in the high-tech ores are likely to come up in US President Barack Obama's or Secretary of State Hillary Clinton's upcoming meetings with Chinese leaders. President Obama and his advisers may also be concerned about the possibility that the Chinese will use their dollar reserves and increasing gold reserves as a geopolitical tool in order to further Chinese long term geopolitical and economic goals which include gradually positioning the Chinese yuan as the global reserve currency.

Iran has changed some 15 percent of its foreign-exchange reserves into gold and won't need to import the metal for the next 10 years, news agency Mehr reported Oct. 30, citing Central Bank Governor Mahmoud Bahmani.

Silver

Silver climbed 1.1 percent to $25.005 an ounce, the highest price since 1980 as the weakening dollar increased the appeal of precious metals as an alternative asset. The gold/silver ratio fell to 54 (one ounce of gold can buy 54 ounces of silver). It is the lowest level since the collapse of Lehman Brothers but a long way from the price seen when the Hunt Brothers tried to corner the silver market in 1980 when the ratio fell to 17 ($850 gold and $50 silver). A similar ratio today would see silver trading at some $80/oz ($1360/17).

Silver is currently trading at $24.79/oz, €17.80/oz and £15.44/oz.

Platinum Group Metals

Platinum is trading at $1,714.00/oz, palladium is at $649/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.