Republicans Take the House and QE Too!

Stock-Markets / Financial Markets 2010 Nov 03, 2010 - 03:41 PM GMTBy: PhilStockWorld

By Now, like many Americans, the Democrats know what it's like to lose their House.

By Now, like many Americans, the Democrats know what it's like to lose their House.

Back in the mid-1800's, the nation had another kind of Tea Party as the Whigs became a successful 3rd party, even going so far as to put two men in the White House - William Henry Harrison and Zachary Taylor plus Millard Fillmore, who succeeded "Old Rough and Ready" who died just after a year in office but that was a long term compared to Harrison, who caught pneumonia making a long inauguration speech in the freezing rain and died of it a month later despite attempts to cure him with opium, castor oil and leeches - treatments we are likely to see again as the Republicans vow to repeal Health Care legislation.

I don't have to talk about what happened last night, Barry Ritholtz did a great job of it in "The Tragedy of the Obama Administration" so let's just focus on the repercussions of the changeover and, of course, today's upcoming Fed decision. The Board of Governors were meeting all day yesterday and will meet again this morning to discuss their policy decision and one would think they can't be so deaf as to see that our citizens are not interested in additional deficit spending, which is exactly what QE2 is when the Fed writes checks to paper over the Treasury's profligate spending.

I don't have to talk about what happened last night, Barry Ritholtz did a great job of it in "The Tragedy of the Obama Administration" so let's just focus on the repercussions of the changeover and, of course, today's upcoming Fed decision. The Board of Governors were meeting all day yesterday and will meet again this morning to discuss their policy decision and one would think they can't be so deaf as to see that our citizens are not interested in additional deficit spending, which is exactly what QE2 is when the Fed writes checks to paper over the Treasury's profligate spending. Look for new and improved ways of not taxing corporations. Like GM, which will not have to pay taxes on its next $45.4Bn of earnings despite the fact that the Government paid for their losses already and allowed the company to bust union contracts and trash benefits for the millions of retired and fired workers as they shut down and sold brands - permanently shipping US manufacturing jobs overseas.

Of course, this tax break isn't about GM. GM just sets a good precedent for similar treatment of Banksters and others who received relief under TARP and, of course, whatever they decide to call the next emergency bailout of Big Business. If the market breaks our tops, we are going to be loving the XLF which already owns most of the people who got elected last night. With FAS at $22.44, we can sell the April $19 puts for $2.75 and buy the Jan $17/21.67 bull call spread for $3.10 and that's net .35 on the $4.67 spread that's starting out 100% in the money and makes 1,334% if FAS simply holds $21.67.

See, that's why we don't fear the upside. If the market is going to have a mindless rally, we can find dozens of trade ideas that can keep us ahead of inflation like that. This is why we can PATIENTLY wait for the market to PROVE it can move forward - our job is to preserve cash so we can participate in these mindless opportunities to make ridiculous returns while the life savings and futures of the bottom 95% is ground into dust.

See, that's why we don't fear the upside. If the market is going to have a mindless rally, we can find dozens of trade ideas that can keep us ahead of inflation like that. This is why we can PATIENTLY wait for the market to PROVE it can move forward - our job is to preserve cash so we can participate in these mindless opportunities to make ridiculous returns while the life savings and futures of the bottom 95% is ground into dust.

Do I feel bad about that? Not anymore, they are going to get the economy they just voted for and that's survival of the financially fittest and we'd better get serious about it because no prisoners will be taken in the next round of "Survivor, America." Already the commodities are flying in celebration of the return of control of the House to Republicans. There will be no legislation, there will be no investigation, there will be no restrictions at all and oil already jammed up to $85 in pre-market trading along with gold back over $1,360 and copper back at $3.85. Isn't that great? $5 more per barrel costs US consumers $100M a day and there's NOTHING they can do about it. They must spend it and that's more credit card transactions and more retail spending on gas, which we'll use as data to pretend the economy is improving - BRILLIANT!

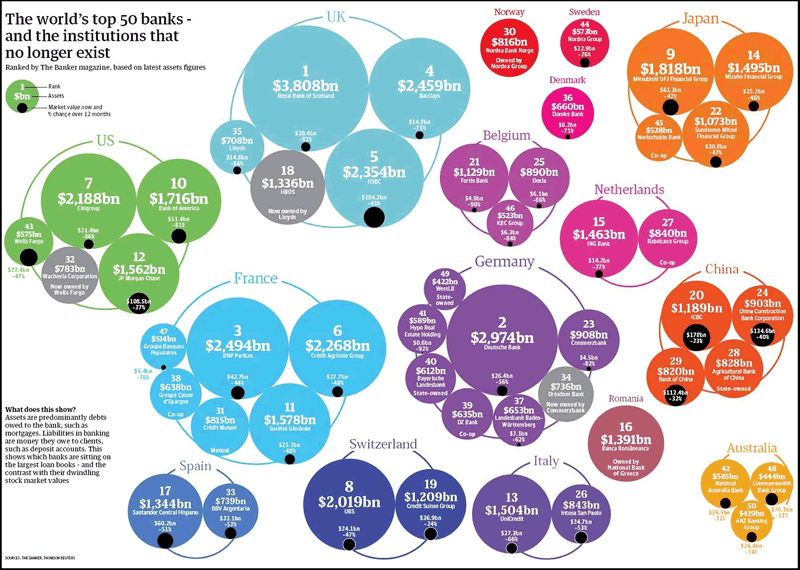

We have the MBA Mortgage Report this morning along with ADP Employment (+43,000 jobs - all service), Inventories and ISM manufacturing but nothing really matters other than the Fed, which has to ignore all the improvements in the underlying data and risk hyperinflation by jamming another Trillion dollars into the dead pool of the US Money Supply. We like XLF, UYG (see Member chat for our plays on them) as well as FAS to play the QE2 game because, eventually, all this money will flow through them at some point. Globally, the banking sector is just a shadow if it's former self, as illustrated in this chart (click to enlarge):

It's also interesting to note that just 4 of the World's top 50 banks are US banks - this probably does not fit into the average voters delusion of US economic superiority but we love our delusional voters because they are also delusional investors who pay us premiums, aren't they? Barry points out that the election means "Less Limits and Oversight of Banks." If we can't beat them, we may as well join them as we gear up for round 2 of "Grand Theft America."

It's all about the Fed today and then it will be all about Jobs on Friday. Despite intervention on the Yen this morning that took the dollar back to 81 this morning, the overall dollars has stayed below the 77 line since yesterday morning. My comment to Members near yesterday's close was that the market move was very unimpressive on the heels of a 0.7% drop in the dollar as they market should AT LEAST gain enough to offset the currency it's priced in and then you have the magnification as the commodity pushers move up on the weak dollar as well.

Not seeing good action makes us wonder, how low does the dollar have to go to get us back to April's highs, when the dollar was 7% stronger? All else being equal, we should be 7% ABOVE April's highs, not 7% below it and, if we can make 1,300% on a flat-line - imagine what we can do with a 14% pop!

Here's looking forward to a very exciting final two months...

- Phil

Addendum: Fed Statement

Release Date: November 3, 2010

For immediate release

Information received since the Federal Open Market Committee met in September confirms that the pace of recovery in output and employment continues to be slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising, though less rapidly than earlier in the year, while investment in nonresidential structures continues to be weak. Employers remain reluctant to add to payrolls. Housing starts continue to be depressed. Longer-term inflation expectations have remained stable, but measures of underlying inflation have trended lower in recent quarters.

Phil: After housing starts, it had said: "Bank lending has continued to contract, but at a reduced rate in recent months. The Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be modest in the near term." - So there is already more bank lending and they are mum on resource utilization and going ahead with QE anyway. VERY dangerous!

Consistent with its statutory mandate, the Committee seeks to foster maximum employment and price stability. Currently, the unemployment rate is elevated, and measures of underlying inflation are somewhat low, relative to levels that the Committee judges to be consistent, over the longer run, with its dual mandate. Although the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, progress toward its objectives has been disappointingly slow.

To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities. The Committee will maintain its existing policy of reinvesting principal payments from its securities holdings. In addition, the Committee intends to purchase a further $600 billion of longer-term Treasury securities by the end of the second quarter of 2011, a pace of about $75 billion per month. The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability.

Phil: That last bit is disappointing as the market doesn't want the Fed to have any reason to back of over 6 months. Also, $75Bn a month is disappointing but it is IN ADDITION to rolling other securities so probably adds up to $100Bn or more. Still, as we expected, it's not enough to support the insane expectations the market has built into this statement and down we go.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels for the federal funds rate for an extended period.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to support the economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate.

Phil: OH NO!!!! Look what they removed: "and is prepared to provide additional accommodation if needed" - Ththththis is all folks!

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Sandra Pianalto; Sarah Bloom Raskin; Eric S. Rosengren; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

Voting against the policy was Thomas M. Hoenig. Mr. Hoenig believed the risks of additional securities purchases outweighed the benefits. Mr. Hoenig also was concerned that this continued high level of monetary accommodation increased the risks of future financial imbalances and, over time, would cause an increase in long-term inflation expectations that could destabilize the economy.

Phil: Hoenig remains the sole voice of reason but he doesn't even get to vote next year! There's one more meeting on Dec 14th and then Jan 26th, March 15th...

So, I think this was not enough and forget the local reaction - how is the World going to feel about a possible bottom to the dollar, which is zooming back over 77 and look at TBT fly. Why is TBT flying? Because the Fed will only buy $75Bn of Tim's trash each month and we need to sell A LOT more than that.

Notice how this report was a disappointment and Bill Gross bolted from CNBC - when the statement goes his way he sits around pontificating for hours.

Tonight would be a great night for the BOJ to intervene on the dollar but we'll have to wait and see.

For a 20% discount for all PSW newsletter services, click here

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.