To Beat the Stock Market, Be in the Right Sector - Part 1

Stock-Markets / Learning to Invest Oct 09, 2007 - 09:58 AM GMTBy: Hans_Wagner

What stock market sector have you been in lately? The sectors that are beating the market or the ones that are trailing behind? Being in the right sectors will make a significant difference in the performance of your portfolio. However, finding the right sector can be a difficult proposition. First let's examine a couple of recent studies on sector rotation that help illuminate the opportunities and the problems for investors. In a follow up article we will then provide some guidelines for investors and traders on how to use sector rotation to achieve better investing results.

What stock market sector have you been in lately? The sectors that are beating the market or the ones that are trailing behind? Being in the right sectors will make a significant difference in the performance of your portfolio. However, finding the right sector can be a difficult proposition. First let's examine a couple of recent studies on sector rotation that help illuminate the opportunities and the problems for investors. In a follow up article we will then provide some guidelines for investors and traders on how to use sector rotation to achieve better investing results.

Sector Rotation

Sector rotation is an investing concept that believes that investors can produce better returns if they adjust the makeup of their portfolios to reflect the stage of the business cycle and the economy. In theory different sectors of the economy will perform better at different stages of the economic cycle. The National bureau of Economic Research ( NBER ) and especially Sam Stovell chief investment strategist for Standard & Poor's have been the leaders in helping to define the potential of following the economic cycle and rotate investments among various sectors.

The NBER is the organization that tells us when we have had a recession, usually well after the fact. They perform in depth analysis of many economic factors the help determine the status of the economy. Sam Stovell in one of his BusinessWeek columns titled “ Sector Watch ” stated “The National Bureau of Economic Research sets dates for peaks and troughs in economic activities, based on its assessment of such factors as gross domestic product and employment growth. Since 1945, the U.S. economy has experienced 11 recessions and 10 expansions (it's now in our 11th expansion). Growth periods have lasted an average of nearly five years (59 months, to be exact), with the shortest being 12 months from July, 1980, to July, 1981, and the longest at 120 months from March, 1991, to March, 2001.”

Stovell has published two books on the sector rotation titled Standard & Poor's Guide to Sector Investing 1995 ![]() and Sector Investing, 1996 . They provide a general idea of how the economy has influenced investing and especially flow of investors' money. While expensive these books offer an excellent review of the important concepts of sector rotation and how to use them to improve your portfolio's performance.

and Sector Investing, 1996 . They provide a general idea of how the economy has influenced investing and especially flow of investors' money. While expensive these books offer an excellent review of the important concepts of sector rotation and how to use them to improve your portfolio's performance.

The table below is derived from Stovell's book and describes the primary stages of the economy along with key characteristics that help define the stage. It provides some guidelines as to where the economy might be within the business cycle.

Stage: |

Full Recession |

Early Recovery |

Full Recovery |

Early Recession |

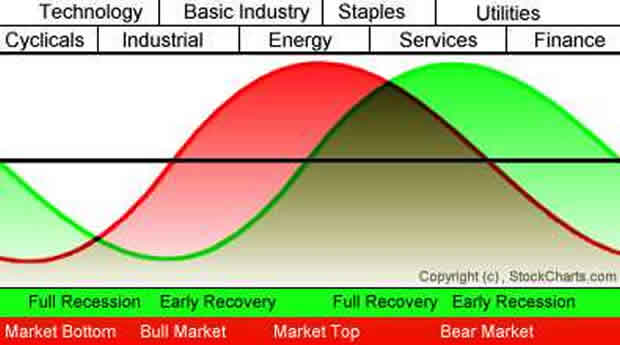

sing these stages the graph below, courtesy of StockCharts.com , shows these relationships and the order the key sectors respond to the economic cycle. The Stock Market Cycle precedes the Economic Cycle as investors try to anticipate how the market will react to the changes to the economy.

Sector Rotation Model:

Legend: Market Cycle

Economic Cycle

That seems pretty easy. Perform an analysis of the economy using the factors above and then invest in the sectors that will perform the best in the future based on the sector rotation model. So where are we now, October 2007? Consumer expectations have been falling recently with the concerns over the credit problems. So that places us in the Full Recovery stage. Industrial production overall seems to be rising though there are some areas of problems, especially in the homebuilding and auto sectors. So that probably puts us in the Full Recovery stage, maybe. Interest rates are falling as the Fed recently lowered the Fed Funds and Discount rate 0.50%. So that puts us in the Full Recession stage.

The yield curve was flat to inverted but is now more normal. So that puts us in the Full Recession stage. Assuming this analysis is correct (after it is brief and subjective) you can get the idea that it is more difficult to identify the stage of the economy we are experiencing. Adding to the problem is if the economy is experiencing just a slow down and not a recession, then it makes the analysis even more difficult.

As you can see the hard part in all this is identifying where the economy is in the business cycle. As you might realize this is no easy matter and many economists get it wrong. There are many indicators that get published on a regular basis that people use to monitor the economy. This is one of the reasons the NBER usually pronounces we are in a recession after the fact, and usually after it is over.

From an investment perspective, it is difficult to tell exactly what stage of the economy you are experiencing. Secondly, secular factors can overcome the normal cyclical pattern. Sound fiscal and monetary policy aimed at non-inflationary growth, the final impacts of automation on costs and margins, the restructuring of business for greater efficiency, and the global economy have created a far higher level of gross domestic product growth than we have experienced before without incurring substantial increases in inflation, interest rates, and risks of a bear market. These secular phenomena are important to understand if investors want to be able to take advantage of sector rotation to improve the performance of their portfolios.

Recent Studies

Fortunately, there have been a couple of recent studies that might help us to get a better understanding of how to use sector rotation more effectively. One is from a paper that builds on the work of Stovell and the NBER. In this study that covers nine complete business complete business cycles, they find that sector rotation does work though they apply some caveats that are important to understand. In another recently completed study, the authors show that Fed rate changes are associated with strong patterns in equity returns. The study, which will be published in a forthcoming issue of the Journal of Investing , indicates that a sector rotation strategy guided by Fed rate changes could have substantially improved portfolio performance over the past 33 years. I will review each of these studies in next weeks Point of Interest.

The Bottom Line

Sector rotation when applied correctly has the potential to improve investors' returns. The key to success is being able to identify where the economy is along the business cycle. As some studies have shown, when investors can identify where they are along the business cycle they can make better investment decisions and improve their results. However, the difficulty is to recognize where the economy is along this cycle. Fortunately there is some more recent research that helps to shed some light on this problem.

Next week I will review these studies to see how useful they might be to improve investor's ability to improve their investing prowess. Then on the following week I will provide guidelines on how to use sector rotation to improve your investing performance.

By Hans Wagner

tradingonlinemarkets.com

My Name is Hans Wagner and as a long time investor, I was fortunate to retire at 55. I believe you can employ simple investment principles to find and evaluate companies before committing one's hard earned money. Recently, after my children and their friends graduated from college, I found my self helping them to learn about the stock market and investing in stocks. As a result I created a website that provides a growing set of information on many investing topics along with sample portfolios that consistently beat the market at http://www.tradingonlinemarkets.com/

Hans Wagner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.