Regarding Gold and Silver - Meet Mr. Consistency

Commodities / Gold and Silver 2010 Nov 08, 2010 - 12:15 PM GMTBy: Peter_Degraaf

During the past 10 trading days gold has risen 5%, while silver rose 15%. During the past 72 trading days (going back to July 27/10), gold rose 20%, while silver added on 53%.

During the past 10 trading days gold has risen 5%, while silver rose 15%. During the past 72 trading days (going back to July 27/10), gold rose 20%, while silver added on 53%.

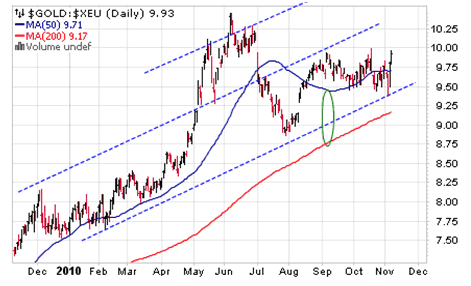

On July 30th I wrote an article titled: "Meet someone who is 90% invested in gold and silver." Gold was trading at $1181 on that day along with silver at 17.98. My advice to my subscribers was: "Hold onto core positions and add on during pullbacks." The blue arrow points to the day the article was published.

On Aug 23rd I wrote an article: "Trading gold using Kitco traffic as a guide." Gold had risen to $1227 by then but silver was virtually unchanged at 17.99. Silver was still being suppressed by the cartel (consisting of a number of bullion banks with large short positions). My advice to subscribers remained the same: "Hold onto core positions and add on during pullbacks." The green arrow points to the day the article appeared.

On Oct 4th I wrote: "Gold and silver, it could well be a whole new ball game!" Gold had risen to $1319 and silver advanced to 21.95. My advice to subscribers was changed slightly to: "Traders with heavy exposure might consider taking partial profits in overbought positions, but long-time investors should simply hold on to core positions." The black arrow points to the day the article made its appearance.

Note: All three of these articles are available in the archives.

From the time I wrote that article on July 30th and throughout those 72 trading days, (17 calendar weeks), I encouraged my subscribers to hold onto their core positions and add on during pullbacks. I did that because a number of analysts were calling for gold and silver to suffer serious setbacks, and I did not want my subscribers to fall for that erroneous advice. My personal investment portfolio remained at 84% or higher throughout this period. The Stock Pick of the Week, updated weekly on my website, is in its 62nd week and the success ratio there is 52 to 9. I have received many thank you letters as a result and some of them have been posted on my website under: "Testimonials." Several subscribers have called me "Mr. Consistency", - hence the title for this essay.

You're probably wondering what advice I'm giving my subscribers now that gold is trading at all-time high prices in US dollars, while silver is trading at its highest level since the 1980's.

Featured is the index that compares gold to the long bond, (stuff compared to fluff). Since the gold bull market began in 2001 - 2002, gold has outperformed the bond sector and the trend is now beginning to pick up steam. Price is in fact turning exponential, and the RSI and MCD are suggesting the trend has room to move higher. The 50WMA is in positive alignment to the 200WMA (green oval), and both are rising. The higher this index moves, the more we will see people sell their bonds and buy gold.

Gold is rising not only in US dollars (which would mean a lack of confidence in the US dollar), but rising against virtually all of the major currencies (indicating a lack of confidence in 'paper money' - actually fiat money). The rise of gold in Euros shown here, is a good example. The trend is up and the 50DMA is in positive alignment to the 200DMA (green oval), while both are rising.

Why then, is gold the unmentionable, four letter word of economics? ... The answer is threefold: A misunderstanding of the role of money; a misreading of history; and finally, visceral revulsion to the notion that a metal can do a better job of guiding monetary policy than a gaggle of finance ministers, central bankers and well-degreed economists." ...... ~ Malcom Forbes.

Featured is the weekly silver chart. When silver broke out at the blue arrow, it set its sights on a target at 32.00. This past week as part of this move, silver produced the best result in several years. The RSI and MACD are positive and the 50WMA is in positive alignment to the 200WMA while both are rising. That is bullish action. Along the way to the target, we will no doubt see a few pullbacks. These are buying opportunities for those with the foresight and resources to take advantage of them.

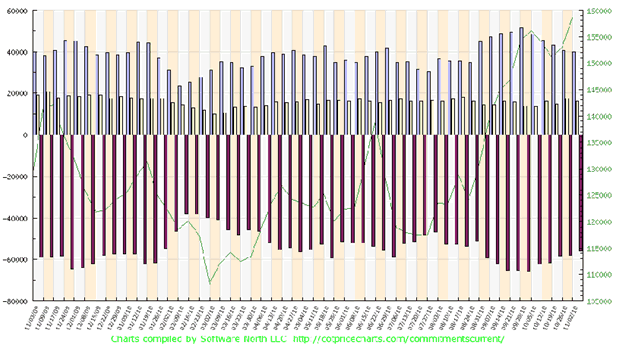

This chart courtesy Cotpricecharts.com shows a steady decline in the number of 'net short' positions held by commercial traders (purple bars). From 65,000 contracts on Oct 1st down to the most recent 56,000 'net short' contracts. The fact that this decline is taking place while price is rising is very bullish for silver. Whereas commercial traders usually increase their short positions during a steady price rise, this time they are backing off. They sense that it will hurt financially to short this bull market. At the same time the large speculators and hedge funds (grey bars), have been taking profits, thereby reducing their overall 'net long' position. This is also bullish because it takes away supply that the commercials count on to cover their short positions.

As part of my consistent behaviour where gold and silver are concerned, I have given away silver ever since I became interested in these markets (over 50 years ago). I still make it a habit, whenever I give someone a gift, to make sure it is silver. Quite often I run into a bank teller or a secretary in a doctor's office, who I have not seen for years and he or she will say to me: "I still have that nice silver Christmas bar you gave me. "Silver is truly a 'gift that will last a lifetime." In a small way, every ounce you give away is an ounce that is unlikely to be returned to the market. Another habit I'd like to pass along is to convert a portion of the profits you make in silver stocks, options and ETFs, into physical silver. By doing this you help guarantee that your trading vehicles will continue to rise over time and you will guarantee there is a supply of silver when silver becomes scarce.

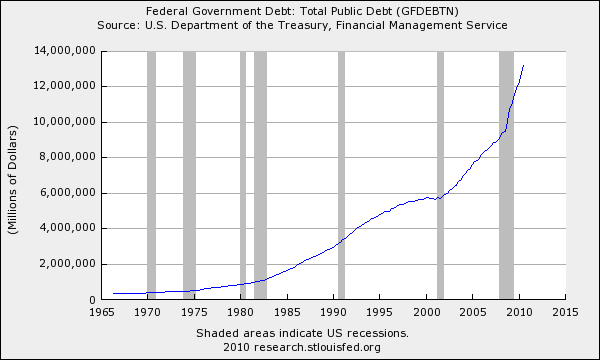

This chart courtesy Federal Reserve Bank of St. Louis shows the 'admitted to' public debt of the US Federal Government. The actual debt which includes government employee pensions, Medicare and Medicaid is over 100 trillion dollars. The amount reflected in this chart is scary enough and will never be repaid. It is covered over as good as possible, by additions to the money supply and by borrowing, but it will never be repaid. History teaches that once a government uses monetary inflation as a method to cover its deficit spending, the outcome is always THE DESTRUCTION OF THE CURRENCY!

FOSTER: Ralph T.: "Over the course of 600 years, five dynasties in China had implemented paper money and all five had made frequent use of the printing press in an attempt to solve problems. Economic catastrophe and political chaos inevitably followed. Time and time again officials looked to paper money for instant liquidity and the immediate transfer of wealth. But its ostensible virtues could not withstand its tragic legacy; those who held it as a store of value found that in time all they held were worthless pieces of paper." Ralph T. Foster, (Author of Fiat Paper Money - the History and Evolution of our Currency - P 29).

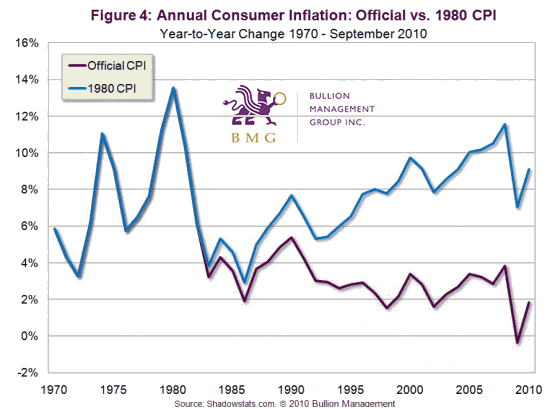

This chart courtesy Bullion Management Group Inc. (BMGbullion.com), compares the official CPI numbers to the numbers compiled at Shadowstats.com. Clearly the trend in the 'real' numbers is rising, and small wonder. Corn has risen from 3.12 to the current 5.62 a bushel. Wheat is 7.00; Beans are at 10.00, Sugar at 24c, Cotton near 1.00, Pork bellies at 1.50 a pound. Copper is nearing 4.00 a pound. Coffee, cattle, Barley, Oranges, Pork, Salmon, Sugar Wool, Palm Oil, Rubber and Iron Ore are all rising in price. These prices reflect increases that range from 23% to 103%. When people become aware of price inflation, they flock to gold and silver.

"When the people find out that they can vote themselves money, it will herald the end of the republic"...... ~ Benjamin Franklin.

Summary: To find out what Mr. Consistency is currently advising his subscribers, all you need do is become a subscriber. A sample copy of a recent report is available for the asking. Quotes used in this essay are part of a 60 page collection of quotes found at my website.

Happy trading!

By Peter Degraaf

Peter Degraaf is an on-line stock trader with over 50 years of investing experience. He issues a weekend report on the markets for his many subscribers. For a sample issue send him an E-mail at itiswell@cogeco.net , or visit his website at www.pdegraaf.com where you will find many long-term charts, as well as an interesting collection of Worthwhile Quotes that make for fascinating reading.

© 2010 Copyright Peter Degraaf - All Rights Reserved

DISCLAIMER: Please do your own due diligence. I am NOT responsible for your trading decisions.

Peter Degraaf Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.