Is China's Renminbi Already The New World Reserve Currency?

Currencies / Fiat Currency Nov 10, 2010 - 04:00 AM GMTBy: Global_Research

Tyler Durden writes: With the dollar tumbling overnight, many were scratching their heads as to what caused the move in the dollar. Citi's Stephen Englander provides a useful explanation, which fits perfectly with the commentary from PBoC advisor Li's earlier that the dollar's position as a reserve currency is now "absurd": namely that more and more in the world are starting to look at the CNY as the new reserve currency. And as we pointed out earlier, its fixing surge of over 0.5% overnight caused many to blink. Is China finally pushing to aggressively force the dollar out?

Tyler Durden writes: With the dollar tumbling overnight, many were scratching their heads as to what caused the move in the dollar. Citi's Stephen Englander provides a useful explanation, which fits perfectly with the commentary from PBoC advisor Li's earlier that the dollar's position as a reserve currency is now "absurd": namely that more and more in the world are starting to look at the CNY as the new reserve currency. And as we pointed out earlier, its fixing surge of over 0.5% overnight caused many to blink. Is China finally pushing to aggressively force the dollar out?

From Steve Englander's note today:

Why CNY?

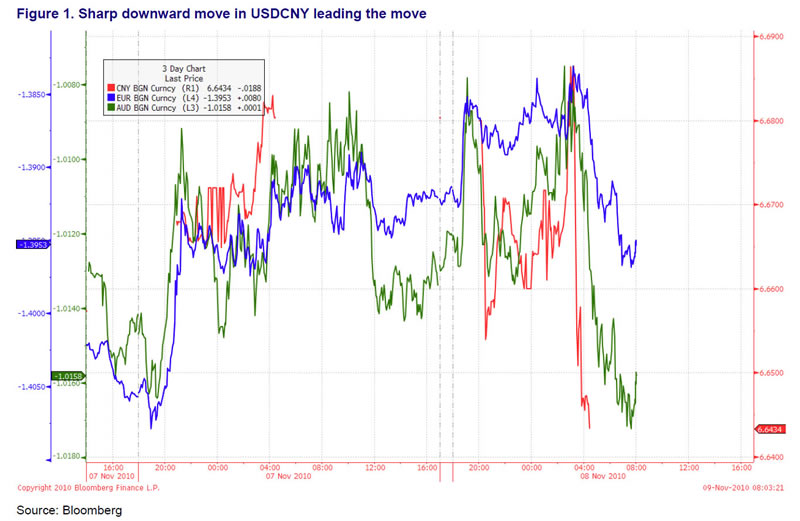

We have cited but not explained the phenomenon of CNY leading G10 currencies. That was very clear overnight with the sharp downward move in USDCNY very clearly leading the move in EUR and AUD (and equity markets for that matter.) Investors appear to be viewing CNY gains as broadly bearish USD and bullish risk. The response to CNY can be partially explained if we assume that investors see CNY as setting the effective limit for how much other currencies can appreciate. It is less clear why global risk should be driven by CNY, except if investors see more global cooperation as a positive signal.

To be sure, Englander has had it in for the dollar for a long-time. He follows up in his note that in his view the USD sell signal has been triggered. While we don't disagree, we ask - what will said reserve managers buy: EURs? GBPs? JPYs? After all, all of them are just as bad. Oh wait, gold?

Reserve Manager USD sell signal triggered

Last week we published our analysis of reserve manager behaviour and presented a trading rule based on the following conditions:

1) The USD fell in the prior calendar month;

2) The (currency valuation adjusted) increase in reserves in our subset of reserve managers is positive; and

3) Higher than in the previous month

Our subset of reserve managers consists of a sample of reserve managers who report reserves soon after month end. We adjust nominal reserve accumulation to remove currency valuation effects. For proprietary reasons, we do not disclose the reserve managers in our subset (all data is publicly available on Bloomberg) and we only use the subset aggregate in our analysis.

If conditions 1 through 3 are met, the rule says buy EUR/USD on the seventh business day of the month (by which time the early reporting central banks in our sample will have reported their reserve levels), and hold the short USD position through the seventh day of the next month.

These conditions were met in November with valuation adjusted reserves in our sub-sample growing by 1%, and the dollar having dropped sharply in October.

The intuition is that we think that reserve managers are a latent USD selling force because of the size of their portfolios and concentrated holdings of USD. The immediate response is likely to be aggressive efforts to avoid being left holding an ever expanding USD bag.

Global Research Articles by Tyler Durden

© Copyright Tyler Durden , Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.