Natural Gas Has Better Days Ahead (in Two Years)

Commodities / Natural Gas Nov 22, 2010 - 05:52 AM GMTBy: Dian_L_Chu

Natural gas posted the first weekly increase this month in the week of Nov. 14, on forecasts of colder than normal temperatures in most of the eastern U.S. from Nov. 24 through Nov. 28, which could spur an average 20 percentage rise above the normal heating demand.

Natural gas posted the first weekly increase this month in the week of Nov. 14, on forecasts of colder than normal temperatures in most of the eastern U.S. from Nov. 24 through Nov. 28, which could spur an average 20 percentage rise above the normal heating demand.

Natural gas for December delivery—down 25 percent this year—gained 9.6 percent in one week to settle at $4.164 per Mmbtu on the NYMEX.

Temporary Seasonal Strength

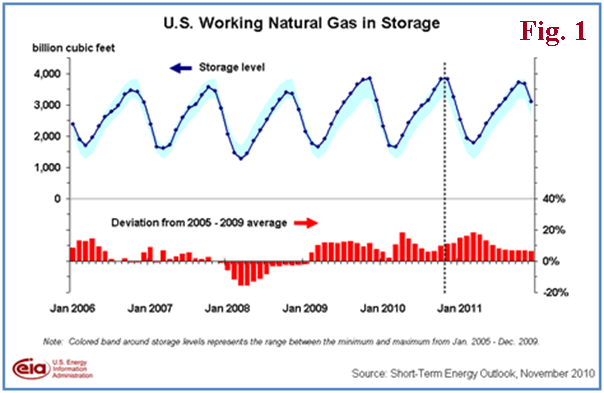

However, this temporary seasonal strength does not alter the fact that U.S. gas stockpiles climbed to an unprecedented 3.843 trillion cubic feet in the week ended Nov. 12—9.3 percent above the five-year average level and 0.3 percent above last year’s level. (Fig. 1)

This storage glut has pushed U.S. natural gas at Henry Hub to its cheapest level in 11 months relative to Canadian gas (at 5 cents below), according Bloomberg data. Henry hub benchmark has been traded at an average of 85 cents premium to the Canadian benchmark AECO for the past 10 years.

Drowning in Natgas?

As I said before that we are literally swimming in crude oil amid high inventory; but when it comes to natural gas, “drowning” would be a more appropriate description. While crude was hammered by China’s efforts to curb inflation, natural gas has an even bigger problem--nowhere to go--since it is region bound, and not as widely traded.

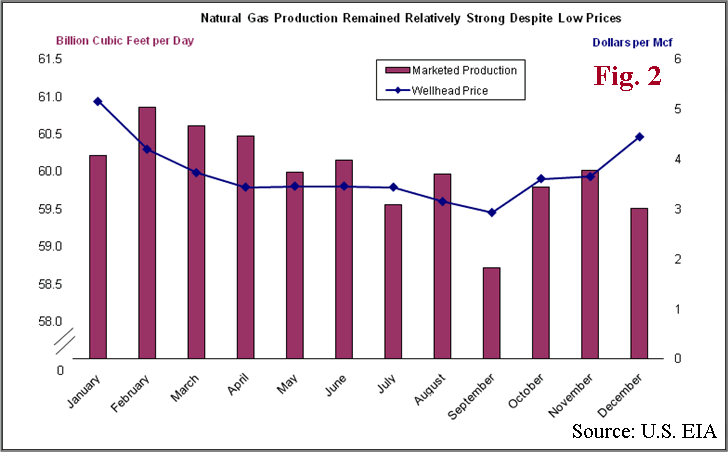

Worse yet, the latest short-term outlook published on Nov.9 by the Dept. of Energy estimates natural gas production will rise in 2010 to the highest level in 37 years. Marketed natural gas production is forecast to increase by 2.5 percent this year, and fall by 1.2 percent in 2011.

However, the drop in 2011 is not because of a decrease in shale gas production, but mostly a result of a 13.5-percent production decline in GOM production from the 2010 drilling moratorium.

Shale Surge

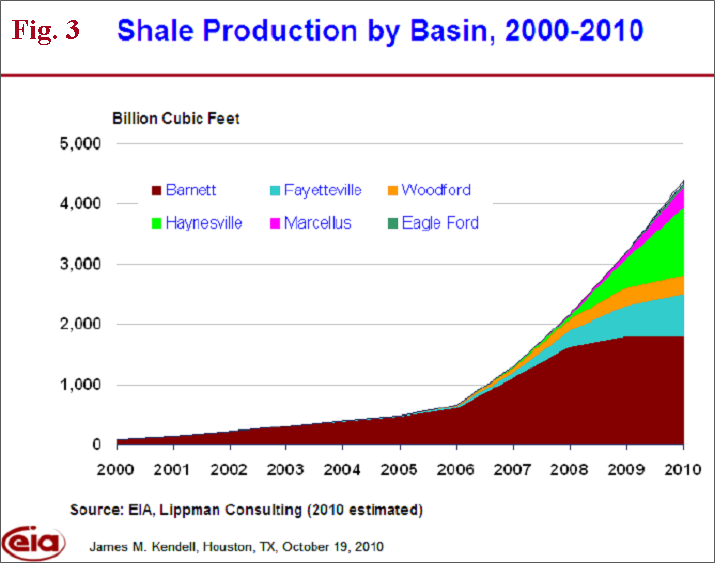

U.S. has seen a surge in natural gas output in the past two years (Fig. 2) with an increase in gas drilling from shale formations (Fig.3). During this time frame, the market equilibrium is distorted mostly by drilling activities supported through joint ventures with foreign oil majors and national oil companies (NOCs), held by production lease (drill or lose), and producers’ favorable hedging positions.

Gas Rig Count Has To Drop

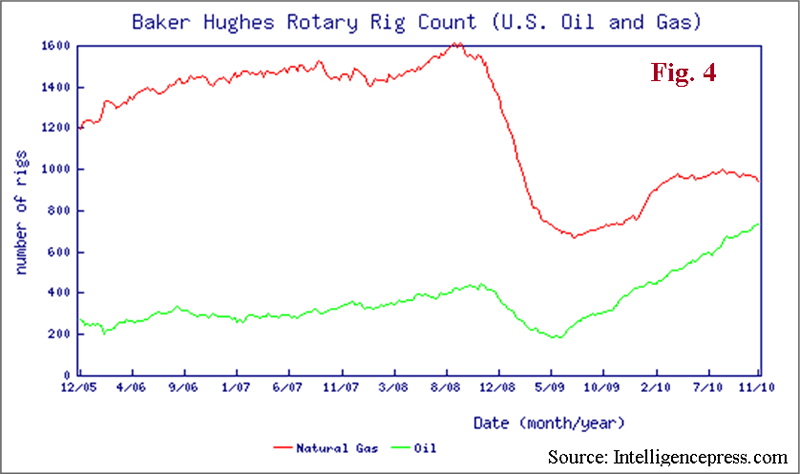

Some industry experts estimate that gas rig count needs see as much as 20% drop--to around 750—from the current 936 (as of Nov. 19) in the next 12 months just to keep production from growing.

The actual number of rigs required to hold production flat could even be lower due to the increased efficiency of new generation high tech rigs, and pad drilling.

Now, looking ahead, this rig count correction could actually start to take place by mid next year supported by the following factors:

- Operators are unlikely to find hedge support as favorable as that from the past.

- Easing of Held by Production – most will be held by mid 2011

- Some cost carries from joint venture are beginning to run out

- Drilling shifted from gas to oil and liquid rich plays due to more attractive oil prices (Fig. 4)

- Economics kicking in – since most shale gas wells need around $5 per mcf to meet returns

- Coal to gas switch from the power generation sector due to new EPA CO2 reduction rules and lower natual gas prices

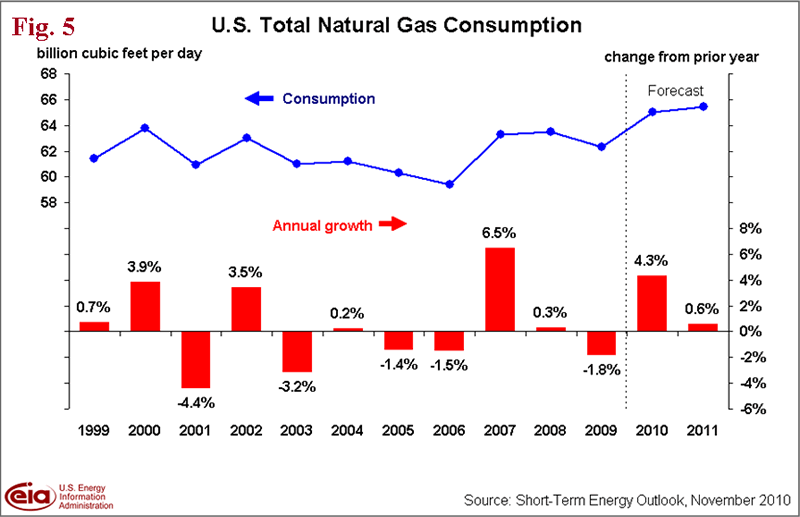

Unfortunately, the production boom for the last two years also means the price would remain sub-$5 for the next two years, amid the sub par GDP growth and demand outlook (Fig. 5)….unless several Katrina’s end up landing on the Gulf Coast.

Glut Set To Last 10 Years

Gas abundance is not limited to the U.S. The latest World Energy Outlook report by the International Energy Agency (IEA) released in early November basically threw the entire natural gas market under the bus by predicting the glut will worsen next year and last for 10 years, which will only fade gradually as demand rises strongly in China.

Future in LNG?

Nevertheless, news is coming out of China that the nation might see its natural gas supply fail to meet 35 percent of the demand in 2011, and the shortage could persist through 2021, according to China Business News.

Meanwhile, Platts reported that the significant arbitrage between UK ICE futures over U.S. prices--$3.357/MMBtu on November 8--has landed the first LNG cargo in 50 years from the U.S. Sabine Pass re-export terminal on UK's Isle of Grain import terminal.

While several import facilities were planned and built (before unconventional gas even came into the picture) in anticipation of high LNG imports in the coming decades, the U.S. has very limited LNG export capability. That could be about to change.

There are two LNG export facilities announced this year--Freeport LNG and Australia's Macquarie Bank have agreed to build one in Texas to export 1.4 billion cubic feet per day of gas, and Cheniere Energy's will be on the site of its Sabine Pass facility to export 16 million metric tons per year. Both plan to produce and export LNG by 2015.

So, while natural gas' green prospect is tied up in the legislative pipeline, it seems the more exciting aspect in the otherwise melancholy natural gas market could come from the LNG sector in the medium term.

Dian L. Chu, M.B.A., C.P.M. and Chartered Economist, is a market analyst and financial writer regularly contributing to Seeking Alpha, Zero Hedge, and other major investment websites. Ms. Chu has been syndicated to Reuters, USA Today, NPR, and BusinessWeek. She blogs at Economic Forecasts & Opinions.

© 2010 Copyright Dian L. Chu - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.