Brazil's Prominent Natural Resource Stocks Are Up 620%, 1,388% and 1,499% ...

Stock-Markets / Brazil Oct 15, 2007 - 10:19 AM GMT Martin Weiss writes: I'm in the interior of Brazil right now, and I don't have to travel too far to see, first-hand, the vast natural resources that are helping to make investors rich.

Martin Weiss writes: I'm in the interior of Brazil right now, and I don't have to travel too far to see, first-hand, the vast natural resources that are helping to make investors rich.

Brazil's sugar cane industry is soaring, propelled by surging demand for ethanol.

Its iron-ore, propelled by demand from Asia, is booming.

Brazil is forging ahead at breakneck speed with its vast reserves of gold, diamonds, bauxite, manganese, nickel, platinum and uranium.

It has signed landmark deals with China, India and virtually every resource-hungry nation on the planet.

Its currency, the real, is the fastest rising major currency in the world; and its stock market, one of the best performing.

But …

It Wasn't Always This Way

When Dad first brought me and my family to Brazil in 1952, it was still the "land of the future" — and, unfortunately, it would retain that ever-hopeful, oft-disappointing status for another half century.

Inflation was beginning to pick up speed, setting off wave after wave of currency devaluations.

And the remote regions that happened to have some of the best resources also suffered from some of the worst infrastructure: Air travel was spotty; highways, virtually non-existent.

|

|

To reach central Brazil, where we lived on a farm outside the town of Anápolis, we flew on a single-engine aircraft that, to me, seemed to be on its last legs.

Before one of our flights, I grabbed my small suitcase and walked under the body of the plane to take a closer look.

It wasn't exactly reassuring, and ever-cautious as usual, I warned my father of the danger.

But he said we had no choice.

Indeed, when we made the same trip by land, it was even worse. In the rainy season, it took us almost a week to get to São Paulo. And even in the dry season, with no mechanical repair shops for hundreds of miles, any breakdown in our Rural Willis that we couldn't repair ourselves could mean nights camped out in the woods.

For nearly all my life, Brazil has been the land of the future that never seemed to come. But now, its future is here.

Brazil's aircraft industry is the third largest in the world, providing most of the commuter jets flown in the U.S., Europe and Asia.

Paved two-lane highways reach into the Amazon, and super-highways crisscross the industrial south. The same road trip that took us a week in the 1950s now takes as little as half a day, assuming no traffic jams.

Moreover …

Brazil's Advances Are No Longer Just a Matter of Catching Up With The Rest of the World …

|

This is the only country that has ethanol pumps at every fuel station.

It's the only country that has flex-fuel engines in every new car rolling off its assembly lines.

And it's one of the few countries that now boasts three of the top-performing stocks on the New York Stock Exchange (more on these in a moment).

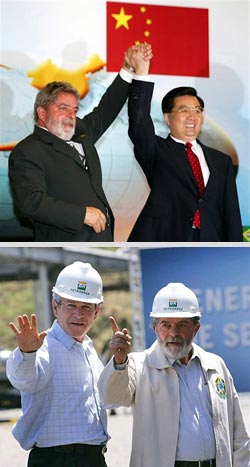

A key reason: Brazil and China are now joined at the hip in what is fast emerging as the broadest alliance for natural resources in the history of mankind — the former with massive, untapped supplies; the latter with equally massive, unquenchable demand.

Brazil and the United States are even closer:

Despite different political backgrounds, the countries' two presidents are staunch allies.

Capital flows between the two countries are the greatest in history.

And there are now more large Brazilian companies listed on U.S. stock exchanges than there were listed on the Rio and São Paulo stock exchanges when I first came here over a half century ago.

Since 2003 …

While the Dow Has Risen 42%, Brazil's Most Prominent Natural Resource Stocks Are Up 620%, 1,388% and 1,499%!

|

Shares in Petróleo Brasileiro (Petrobras) — Brazil's oil and energy giant — are up 620%. That's 14.7 times the rise in the Dow for the same period.

Brazil's Companhia Vale do Rio Doce (called "Vale"), the world's largest iron-ore producer, makes even Petrobras' gains seem small by comparison. Its shares are now up an astounding 1,388%, or 33 times the Dow's rise. And …

Brazil's Gerdau, Latin America's largest steel maker, has done even better. It's up a whopping 1,499%, or more than 36 times the Dow's rise.

All for good reason:

![]() Energy giant Petrobras (the company whose shares are up 620% since 2003) has jumped into the vanguard of the ethanol revolution. The company has just completed negotiations to sell 9 million liters of ethanol in the European market through Suape, a port in the northeast that it will use for ethanol exports for the first time. As soon as 2020, its worldwide ethanol sales will exceed its gasoline sales.

Energy giant Petrobras (the company whose shares are up 620% since 2003) has jumped into the vanguard of the ethanol revolution. The company has just completed negotiations to sell 9 million liters of ethanol in the European market through Suape, a port in the northeast that it will use for ethanol exports for the first time. As soon as 2020, its worldwide ethanol sales will exceed its gasoline sales.

![]() Iron-ore giant Vale (the one whose shares are up 1,388%) has just approved a 2008 global investment budget of $11 billion to boost output of the steel-making ingredient and other metals to meet soaring Chinese demand. And this huge budget is just the first part of its five-year, $59-billion program, which will be spent on more than 30 projects around the world.

Iron-ore giant Vale (the one whose shares are up 1,388%) has just approved a 2008 global investment budget of $11 billion to boost output of the steel-making ingredient and other metals to meet soaring Chinese demand. And this huge budget is just the first part of its five-year, $59-billion program, which will be spent on more than 30 projects around the world.

Last year, Vale produced 264 million metric tons of iron ore. By 2012, it plans to produce 450 million. Meanwhile, contract iron-ore prices, which have risen to a record for five straight years, are likely to gain another 30% next year, according to a Bloomberg survey. And …

![]() Monster steel maker Gerdau (the best performing among the three with a 1,499% share-price rise) is hotly pursuing partnerships with companies in China and India. The company bought a 45% stake in India's SJK Steel Plant Ltd. in June. Plus, it also has operations in the U.S., Canada and Spain.

Monster steel maker Gerdau (the best performing among the three with a 1,499% share-price rise) is hotly pursuing partnerships with companies in China and India. The company bought a 45% stake in India's SJK Steel Plant Ltd. in June. Plus, it also has operations in the U.S., Canada and Spain.

Your Strategy

When I first came to Brazil, investing in the country was risky and doing it without living here was virtually impossible.

But today, I feel it's precisely the opposite: Investors who do not diversify their portfolio internationally — in countries like Brazil, India, China and other emerging markets — are the ones taking the bigger risks.

You no longer have to deal with a foreign broker. You don't have to navigate foreign tax laws or exchange rates. You don't even have to pick the next big winners.

Instead, you can invest internationally simply by buying U.S.-based ETFs dedicated to overseas markets — the same kind of ETFs you're used to for domestic markets, with the same easy of buying and selling, with the same low commissions and with your regular brokerage account.

|

The Performance of International ETFs Since 2006 Underscores the Wisdom of This Strategy

While the Dow has risen 29% …

![]() The ETF dedicated to Hong Kong (EWH) is up 69% …

The ETF dedicated to Hong Kong (EWH) is up 69% …

![]() The Brazil ETF (EWZ) has surged 117%, while …

The Brazil ETF (EWZ) has surged 117%, while …

![]() The most widely traded China ETF (FXI) has surged by a whopping 207%.

The most widely traded China ETF (FXI) has surged by a whopping 207%.

And no guarantees, but we see nothing on the horizon that might prevent a continuation of this trend.

The Media Finally Wakes Up

Until recently, the U.S. media — and most American investors — generally ignored or underestimated emerging markets. But now that, too, is changing.

Floyd Norris, for example, writing in Saturday's New York Times, puts it this way:

"Of the 83 countries for which records of a major stock index were available, the American share price increase in the five years after Oct. 9, 2002, was better than those of only four …

"South America … produced three of the six best-performing markets during the period, in Peru, Brazil and Colombia.

"That all 83 markets around the world had an increase is emblematic of the strength of the global economy and the willingness of international investors to pour money into markets that many had never heard of — or that did not exist — 20 years ago."

Bottom line: We are at a critical threshold beyond which the rush to buy into emerging markets is likely to accelerate.

My recommendation: Don't wait until then.

Good luck and God bless!

Martin

P.S. Our International ETF Trader is getting ready to issue new historic ETF recommendations this week. Click here to read our latest report.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com .

Money and Markets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.