Is Quantitative Easing (QE2) the Road to Zimbabwe Style Hyperinflation?

Economics / HyperInflation Dec 02, 2010 - 09:54 AM GMTBy: Ellen_Brown

Unlike Zimbabwe, the U.S. can easily get the currency it needs without being beholden to anyone. But wouldn't that dilute the value of the currency? No.

Unlike Zimbabwe, the U.S. can easily get the currency it needs without being beholden to anyone. But wouldn't that dilute the value of the currency? No.

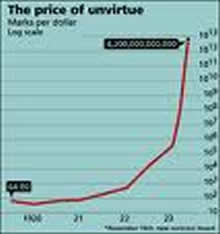

A month ago, the bond vigilantes were screaming that the Fed’s QE2 would be the first step on the road to Zimbabwe-style hundred trillion dollar notes. Zimbabwe (the former Southern Rhodesia) is the poster example of what can go wrong when a government pays its bills by printing money. Zimbabwe’s economy collapsed in 2008, when its currency hyperinflated to the point that it was trading with the U.S. dollar at an exchange rate of 10 trillion to 1. On November 29, Cullen Roche wrote in the Pragmatic Capitalist:

Back in October the economic buzzwords had become “money printing” and “debt monetization”. . . . [T]he Fed was initiating their policy of QE2 and you’d have been hard pressed to find someone in this country (and around the world for that matter) who wasn’t entirely convinced that the USA was about to send the dollar into some sort of death spiral. QE2 was about to set off a round of inflation that would make Zimbabwe look like a cakewalk. And then something odd happened – the dollar rallied as QE2 set sail and hasn’t looked back since.

Back in October the economic buzzwords had become “money printing” and “debt monetization”. . . . [T]he Fed was initiating their policy of QE2 and you’d have been hard pressed to find someone in this country (and around the world for that matter) who wasn’t entirely convinced that the USA was about to send the dollar into some sort of death spiral. QE2 was about to set off a round of inflation that would make Zimbabwe look like a cakewalk. And then something odd happened – the dollar rallied as QE2 set sail and hasn’t looked back since.

What really happened in Zimbabwe? And why does QE2 seem to be making the dollar stronger rather than weaker, as the inflationistas predicted?

Anatomy of a Hyperinflation

Professor Michael Hudson has studied hyperinflation extensively. He maintains that “every hyperinflation in history stems from the foreign exchange markets. It stems from governments trying to throw enough of their currency on the market to pay their foreign debts.”

It is in the foreign exchange markets that a national currency becomes vulnerable to manipulation by speculators.

The Zimbabwe economic crisis dated back to 2001, when the government defaulted on its loans and the IMF refused to make the usual accommodations, including refinancing and loan forgiveness. Zimbabwe’s credit was ruined and it could not get loans elsewhere, so the government resorted to issuing its own national currency and using the money to buy U.S. dollars on the foreign exchange market. These dollars were then used to pay the IMF and regain the country’s credit rating. According to a statement by the Zimbabwe central bank, the hyperinflation was caused by speculators who charged exorbitant rates for U.S. dollars, causing a drastic devaluation of the Zimbabwe currency.

But something darker seems also to have been going on. Timothy Kalyegira, a columnist with the Daily Monitor of Uganda, wrote in a 2007 article:

Most observers and the general public believe Zimbabwe’s economic crisis was brought about by Mugabe’s decision to seize white-owned commercial farms in 2000. That might well be true. But how about another, much more sinister element . . . sabotage?

Kalyegira asked how a government “with the same tyrant called Mugabe as president, the same corruption, and same mismanagement, kept inflation down to single digit figures [before 2000], but after 2000, the same leader, government, and fiscal policies suddenly become so hopelessly incompetent that inflation is at the latest reported to be over 500,000 percent?”

Canadian commentator Stephen Gowans calls it “warfare by other means.” Devaluing the enemy’s currency has been used as a war tactic historically. It was used by Napoleon against the Russians and by the British against the American colonists.

In 1992, financier George Soros showed how it was done, when his hedge fund virtually single-handedly brought down the British pound. His fund sold short more than $10 billion worth of pounds, forcing the Bank of England to devalue the currency, earning Soros an estimated $1.1 billion and the title "the man who broke the Bank of England." In 1997, the UK Treasury estimated the cost at 3.4 billion pounds.

War by Other Means

The push for regime change in Zimbabwe was detailed by Stephen Gowans in a March 2007 article posted on Global Research. He wrote:

Before 1980 Zimbabwe was a white-supremacist British colony named after the British financier Cecil Rhodes, whose company, the British South Africa Company, stole the land from the indigenous Matabele and Mashona people in the 1890s. . . .

Ever since veterans of the guerrilla war against apartheid Rhodesia violently seized white-owned farms in Zimbabwe, the country’s president, Robert Mugabe, has been demonized by politicians, human rights organizations and the media in the West. . . .

I’m going to argue that the basis for Mugabe’s demonization is the desire of Western powers to change the economic and land redistribution policies Mugabe’s government has pursued; . . . and that the ultimate aim of regime change is to replace Mugabe with someone who can be counted on to reliably look after Western interests, and particularly British investments, in Zimbabwe.

Timothy Kalyegira concurred in this theory, observing:

A former undercover operative John Perkins recalled events that are strikingly familiar to what we see in Zimbabwe today: “[In] 1951…Iran rebelled against a British oil company that was exploiting Iranian natural resources and its people…An outraged England sought the help of her…ally, the United States…Washington dispatched CIA agent Kermit Roosevelt…to organize a series of …violent demonstrations, which created the impression that [Iranian Prime Minister] Mossadegh was both unpopular and inept. (Confessions Of An Economic Hit Man, Ebury Press, 2005, page 18) Clearly, Mugabe’s capital crime was to displace White privilege in Zimbabwe and personally stand up to the White establishment in London and Washington.

This is not to condone any atrocities of which the Mugabe government stands accused, or to overlook the fact that breaking up the white-owned farms and delivering them to unskilled workers was a disaster for the economy. The original black workforce did have the necessary skills, and if the farms had been transferred to cooperatives owned by them, little harm would have been done to the economy.

The narrow issue considered here is whether the Zimbabwe hyperinflation was the result of the government printing money to fund its budget. In fact, the government was printing money to buy the foreign currency needed to pay debts owed in a foreign currency, something that subjected it to the whims of speculators.

The U.S. Is Not Zimbabwe

Even if Zimbabwe’s hyperinflation was the result of currency manipulation rather than exploitation by corrupt politicians, couldn’t the same thing happen to the U.S. dollar?

The answer is, not likely. The U.S. does not owe debts in a foreign currency over which it has no control. It can issue bonds payable in its own currency.

Today that currency is issued by the Federal Reserve, which is privately owned by a consortium of banks; but the Fed has been at least semi-captive ever since the 1960s, disgorging its profits to the Treasury. Its website states, “Federal Reserve Banks are not . . . operated for a profit, and each year they return to the U.S. Treasury all earnings in excess of Federal Reserve operating and other expenses.” The Federal Reserve Act provides that it can be modified or rescinded at any time, so Congress retains ultimate control.

Randall Wray, Professor of Economics at the University of Missouri-Kansas City, writes that “involuntary default is, literally, impossible for a sovereign government.”

The U.S. does not have to rely on foreign investors even to buy its bonds. If the investors are not interested, the central bank can buy the bonds. That is, in fact, what the Fed’s second round of quantitative easing is all about: issuing $600 billion for the purchase of long-term government bonds.

Unlike Zimbabwe, which had to have U.S. dollars to pay its debt to the IMF, the U.S. can easily get the currency it needs without being beholden to anyone. It can print the dollars, or borrow from the Fed which prints them.

But wouldn’t that dilute the value of the currency?

No, says Cullen Roche, because swapping dollars for bonds does not change the size of the money supply. A dollar bill and a dollar bond are essentially the same thing. One bears interest and is a little less liquid than the other, but both are obligations good for a dollar’s worth of goods or services in the economy. If the bondholders had wanted cash, they could have cashed out the bonds themselves. They don’t have any more money to spend, or any more incentive to spend it, when they’ve been cashed out by the government than when they were holding bonds.

Moreover, adding money to the money supply cannot hurt the economy when the money supply is shrinking, as it is now. Most money today consists simply of bank credit, and bank credit is shrinking because banks are deleveraging. Bad debts are wiping out capital, which wipes out lending capacity. QE2 is just an attempt to fill the empty liquidity pitcher back up -- and a rather feeble attempt at that. Financial commentator Charles Hugh Smith estimates that the economy now faces $15 trillion in writedowns in collateral and credit, based on projections from the latest Fed Flow of Funds (September 17, 2010). Based on his projections, it might be argued that the Fed could print enough money to refinance the entire federal debt without creating price inflation. (The current inflation in commodity prices is due to other factors, as was discussed in an earlier article, here.)

Dean Baker, co-director of the Center for Economic and Policy Research in Washington, wrote recently concerning the federal deficit:

There is no reason that the Fed can’t just buy this debt (as it is largely doing) and hold it indefinitely. If the Fed holds the debt, there is no interest burden for future taxpayers. The Fed refunds its interest earnings to the Treasury every year. Last year the Fed refunded almost $80 billion in interest to the Treasury, nearly 40 percent of the country’s net interest burden. And the Fed has other tools to ensure that the expansion of the monetary base required to purchase the debt does not lead to inflation.

This means that the country really has no near-term or even mid-term deficit problem. The current deficit is a positive. In fact, if it were larger we would have more jobs and growth. Furthermore, there is no reason that the debt being accumulated at present should pose any interest burden on future generations. In this vein, it is worth noting that Japan’s central bank holds debt amounting to almost 100 percent of that country’s GDP. As a result, Japan’s interest burden is considerably smaller than the United States’s, even though Japan’s debt is almost four times as large relative to the size of its economy. [Emphasis added.]

Although Japan’s relative debt is almost four times as large as ours and its central bank holds enough to equal nearly 100% of its GDP, investors are not fleeing the yen or driving the economy into hyperinflation. In fact Japan still can’t pull itself out of DEFLATION, despite massive quantitative easing. The country still has willing trading partners and is still the third largest economy in the world, an impressive feat for a small island.

If the Fed were to follow the lead of Japan and hold federal debt equal to the country’s gross domestic product, the Fed would be holding $14.75 trillion in federal securities, enough to refinance the ENTIRE U.S. federal debt of $13.8 trillion virtually interest-free.

The federal debt hasn’t been paid off since the 1830s under President Andrew Jackson. It is just rolled over from year to year. An interest-free debt rolled over indefinitely is the functional equivalent of the government issuing money itself.

Andrew Jackson would have said the government SHOULD be issuing the money itself, rather than borrowing from banks that issue it. If Congress gave itself the right under the Constitution to issue money, he said, “it was conferred to be exercised by themselves, and not to be transferred to a corporation.”

Indeed, that may be why the U.S. dollar has been going UP since QE2 was initiated, while the Euro has been going DOWN. EU governments are doing what the inflation hawks want them to do: cut back on services, privatize their pension money, and otherwise engage in austerity measures to balance their budgets. The effect has been to depress their economies and throw them deeper and deeper into debt, with nowhere to get the extra cash needed to pay the expanding debt and interest burden.

The U.S. and Japan are exploring another model: allowing their currencies to expand to meet the needs of their economies. This was, in fact, the original money system of the American colonists. It was revived by Abraham Lincoln to avoid a crippling war debt, after which it was dubbed the “Greenback solution.”

Ellen Brown developed her research skills as an attorney practicing civil litigation in Los Angeles. In Web of Debt, her latest book, she turns those skills to an analysis of the Federal Reserve and “the money trust.” She shows how this private cartel has usurped the power to create money from the people themselves, and how we the people can get it back. Her earlier books focused on the pharmaceutical cartel that gets its power from “the money trust.” Her eleven books include Forbidden Medicine, Nature’s Pharmacy (co-authored with Dr. Lynne Walker), and The Key to Ultimate Health (co-authored with Dr. Richard Hansen). Her websites are www.webofdebt.com and www.ellenbrown.com.

Ellen Brown is a frequent contributor to Global Research. Global Research Articles by Ellen Brown

© Copyright Ellen Brown , Global Research, 2010

Disclaimer: The views expressed in this article are the sole responsibility of the author and do not necessarily reflect those of the Centre for Research on Globalization. The contents of this article are of sole responsibility of the author(s). The Centre for Research on Globalization will not be responsible or liable for any inaccurate or incorrect statements contained in this article.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.